Summary

Utilities have been up and down relative to the S&P 500, but there is a gentle uptrend slowly developing.

Consumer staples is displaying a little more conviction than utilities, which would follow the outperformance we’ve seen in the mega-cap names in recent weeks.

Equity investors appear satisfied that bank liquidity issues are largely resolved (although they are still drawing from government facilities) and are willing to test the waters again.

Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: RISK-OFF SENTIMENT CONTINUES TO BUILD, BUT SLOWLY

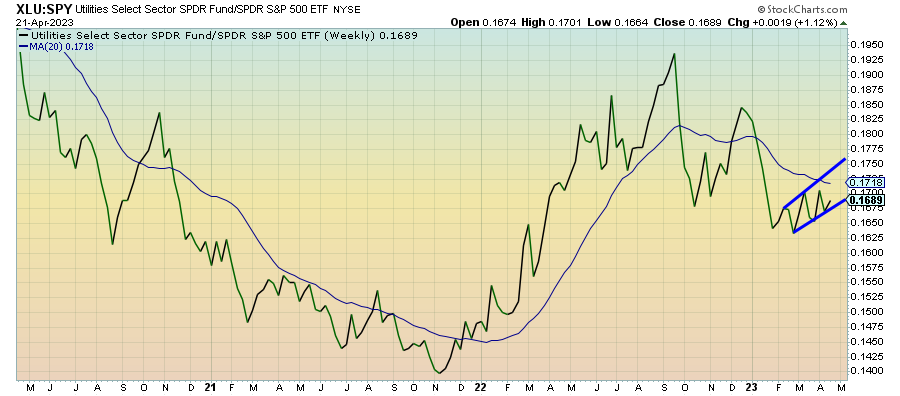

Utilities (XLU) – Slow & Gentle Signal

Utilities have been up and down relative to the S&P 500, but there is a gentle uptrend slowly developing. This sector has done a pretty good job of accurately assessing the current sentiment, which is to say that investors are flip-flopping back and forth based on the latest economic data. I’d like to see a little more conviction out of this signal before getting more comfortable saying this is a trend, but it has been tilting in that direction.

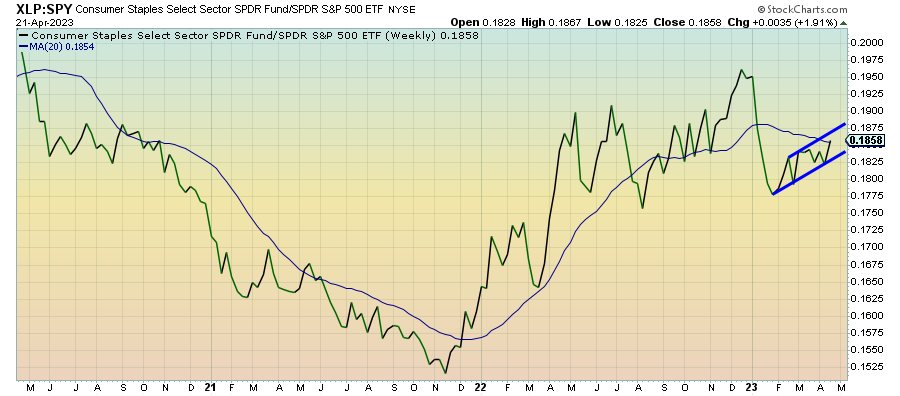

Consumer Staples (XLP) – Opportunity To Continue Leading

Consumer staples is displaying a little more conviction than utilities, which would follow the outperformance we’ve seen in the mega-cap names in recent weeks. With growth sectors fading sharply and cyclicals typically performing better during economic bottoms, I think there’s room here for this trend to continue.

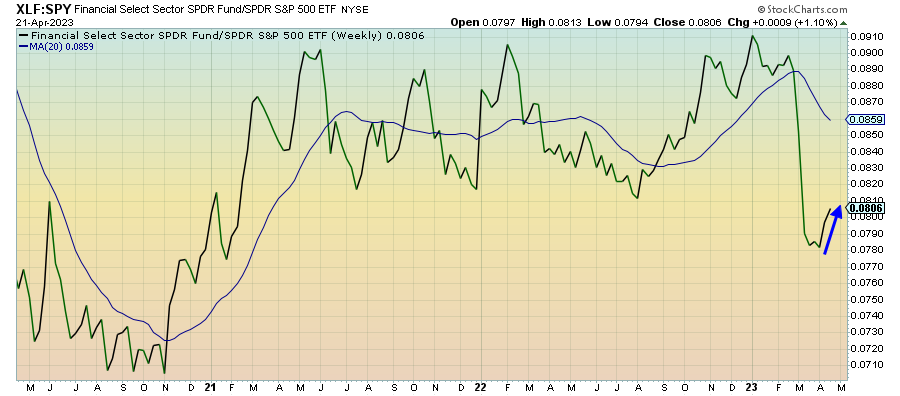

Financials (XLF) – The Worst Is Behind Us

Equity investors appear satisfied that bank liquidity issues are largely resolved (although they are still drawing from government facilities) and are willing to test the waters again. While there were a few trouble spots (M&A and investment banking revenue, in particular), earnings results from the big banks indicate they’re still in a good position. This could be an opportunity based on valuations alone.

Industrials (XLI) – Conditions Don’t Support This Rebound

An uptrend in cyclicals is generally a sign of a bottom in the economy. I’m not sure that conditions support that notion, but we are seeing a bit of a rotation out of growth and back into these sectors. Financials and materials have been leading for a few weeks and now industrials are moving higher again. I don’t suspect this trend has longer-term legs, especially with continued deterioration in both manufacturing and housing.

Materials (XLB) – A Weak Move Higher