Lumber’s price swings have long served as an early read on the economy’s health. Because it’s central to homebuilding, lumber demand often rises and falls before broader economic shifts appear in GDP or employment data. As economist Edward Leamer once wrote, housing is “the most important sector in our economic recessions”—the first to slow when the economy weakens and the first to rebound when recovery begins¹.

That’s why traders have long treated lumber as a macro signal. I somewhat popularized this approach through my award-winning paper “Lumber: Worth Its Weight in Gold,” which compares lumber’s behavior to gold’s. When lumber outperforms gold, it tends to reflect optimism and risk-taking. When gold leads, it often signals fear and market stress. Recently, however, that once-reliable signal has turned fuzzy: gold and stocks have been rising together, leaving lumber’s warning light blinking but hard to interpret.

Lumber Prices Cool After the Pandemic Rollercoaster

Lumber’s pandemic boom and bust remains one of the most dramatic commodity cycles in memory. In 2021, prices soared above $1,500 per thousand board feet—triple the pre-COVID record—before crashing more than 70% in months². Since then, the market has calmed but not fully normalized.

Through 2024 and 2025, lumber prices have drifted modestly lower. As of September 2025, softwood prices were roughly 5–6% below last year’s levels according to the National Association of Home Builders³. The NAHB’s framing lumber composite reached its lowest level in over a year, reflecting cooling builder demand.

Volatility, though milder than the pandemic chaos, remains part of lumber’s DNA. Month-to-month moves of 10% or more are still common as weather, interest rates, and speculative trading all play roles. The commodity currently trades in the low $600 per thousand board feet range—well below its 2021 peaks, yet still higher than the pre-COVID norm. The market has steadied, but not yet settled.

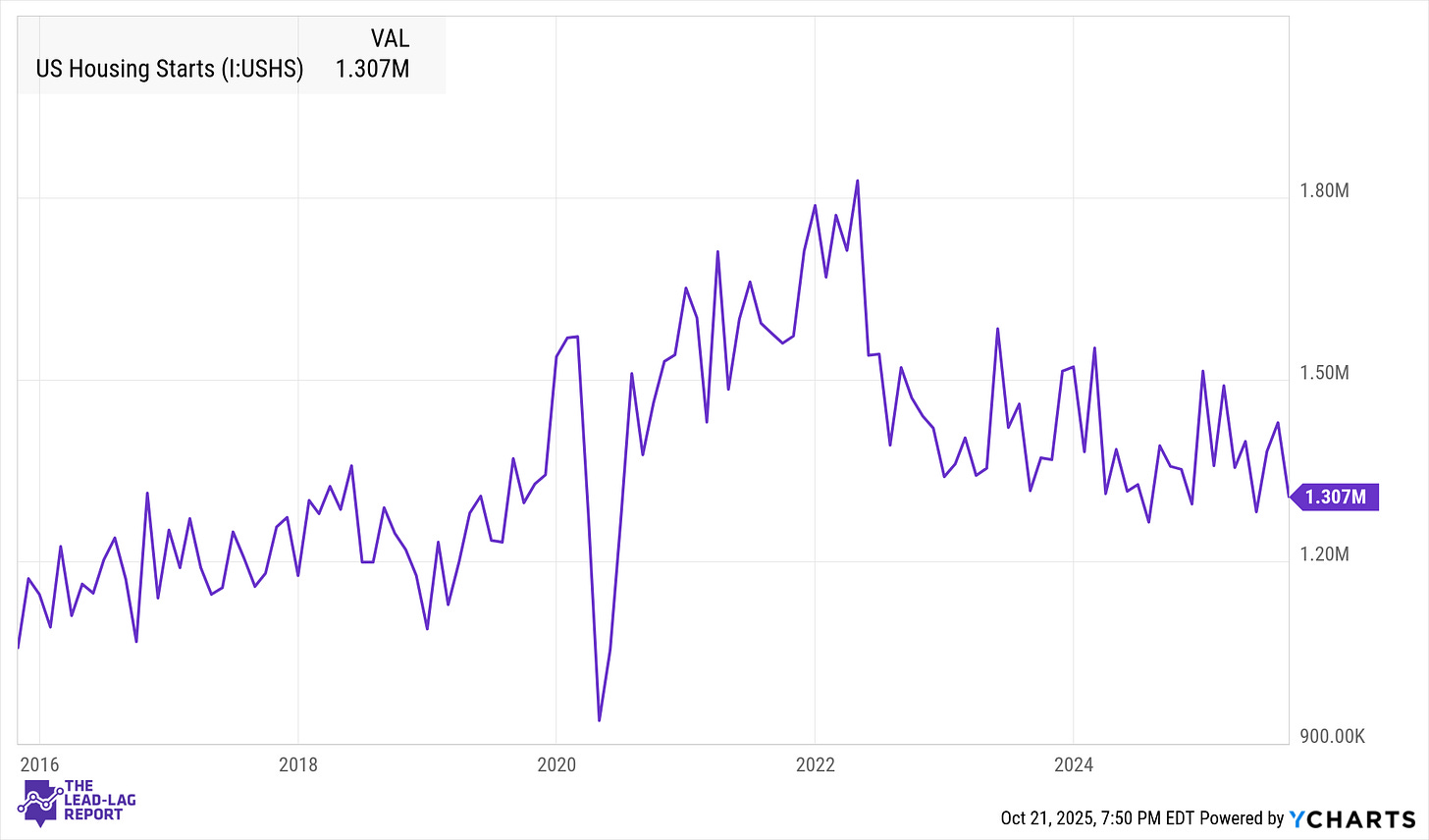

Housing Starts Slow Under Higher Rates

If lumber is the thermometer, housing is the fever. Construction has slowed as mortgage rates hover near two-decade highs. U.S. housing starts stood at about 1.31 million annualized units in August 2025, roughly 6% below the prior year⁹. Single-family starts fell to under 0.9 million, while building permits—a leading indicator—declined by 11%¹¹.

Builders remain cautious as affordability challenges weigh on demand. The Federal Reserve’s aggressive tightening cooled the pandemic housing boom, though the broader economy has so far avoided recession. Historically, that’s unusual. Leamer’s research found residential investment typically rolls over before recessions and rebounds before recoveries¹.

For investors, lumber’s softening mirrors these dynamics. Each new single-family home requires over 14,000 board feet of lumber⁷. When builders slow down, demand drops fast. The correlation between housing starts and lumber prices remains one of the tightest in the commodity world—and both are flashing “cooling,” not “collapse.”

The Lumber-to-Gold Ratio: A Signal of Risk Appetite

The logic is simple but powerful: lumber represents growth and risk-taking; gold represents fear and defense¹³.

When lumber outperforms gold over a 13-week stretch, markets tend to be calm, cyclical sectors outperform, and volatility subsides¹⁹. When gold leads lumber, risk aversion often rises and equities stumble.

For years, the ratio worked beautifully. Lumber’s weakness signaled trouble before the 2008 crisis; its rebound flagged recovery ahead of the bull market. Rotating between offense (stocks) and defense (bonds) based on this ratio historically boosted risk-adjusted returns and reduced drawdowns²³.

Why the Signal Is Blurry Now

In the post-COVID market, the lumber-gold compass seems off-kilter. Over the past year, gold has handily outperformed lumber—a traditional “risk-off” warning—yet equities have rallied. The reason lies in gold’s changing role.