Macro Crosscurrents: Resilience, Repricing, and a Rising Yen

Firm U.S. labor data met softer inflation, duration caught a bid, and Japan’s tightening impulse reshaped global FX dynamics.

Key Highlights

January payrolls rose 130,000 and unemployment dipped to 4.3%, reinforcing a resilient labor floor.¹

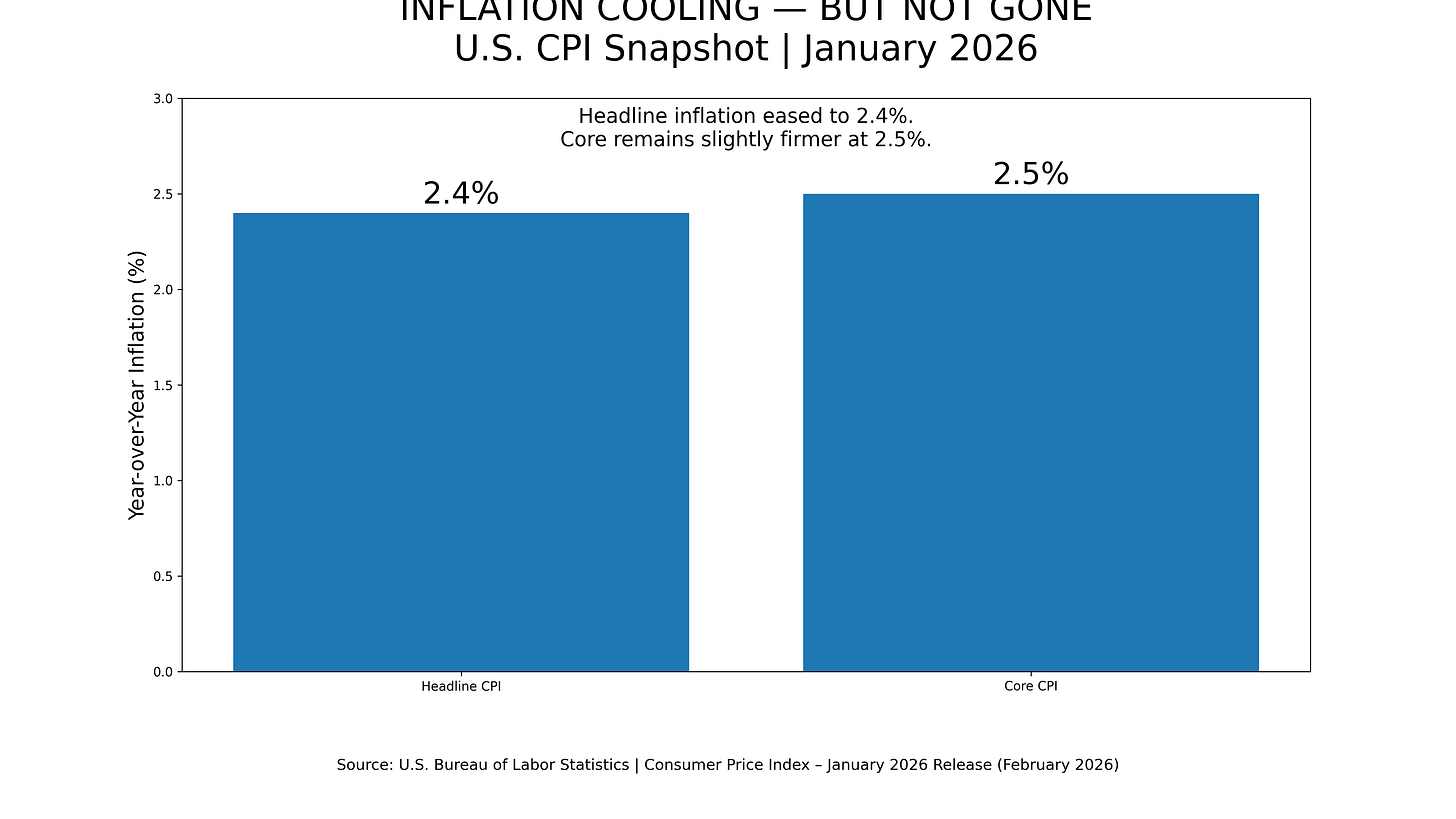

CPI cooled to 2.4% year over year, reopening the path to mid-year easing.²

The 10-year Treasury yield fell from 4.22% to 4.09% over the week, with curve flattening at the margin.³

High-yield spreads widened only slightly, signaling repricing rather than systemic stress.⁴

The dollar declined on the week, while the yen posted its strongest weekly gain in roughly a year.⁵

United States: Resilient Labor, Softer Inflation

The week’s macro sequence mattered more than the individual releases. January nonfarm payrolls increased by 130,000, and the unemployment rate edged down to 4.3%.¹ Wage growth remained firm at 0.4% month over month and 4.2% year over year, while the average workweek ticked up to 34.5 hours.¹ That combination does not describe an economy sliding toward recession. It describes an expansion that is cooling without cracking.

Weekly jobless claims reinforced that narrative. Initial claims fell to 227,000 in the week ended February 7, consistent with stabilization rather than deterioration.⁶ Retail sales, however, hinted at marginal cooling. December sales were unchanged from November, with official characterization describing activity as “virtually unchanged,” though still positive year over year.⁷

Inflation provided the pivot. January CPI rose 0.2% month over month, bringing the year-over-year rate to 2.4%.² Core CPI increased 0.3% on the month and 2.5% year over year.² Energy softness helped the headline, while services categories reflected early-year price resets.⁸ The sequencing is critical. A firm labor print tightened the market’s tolerance for immediate cuts. A softer inflation reading reopened the debate around mid-year easing.

Rate markets translated that balance into a duration bid. The 10-year Treasury yield fell from 4.22% on February 6 to 4.09% on February 12, while the 30-year declined from 4.85% to 4.72%.³ The 10-year minus 2-year spread narrowed modestly, reflecting flattening pressure.³ By Friday, the 10-year traded near 4.067% following the CPI release.⁹

Term premia remain an underappreciated driver. The San Francisco Fed’s yield premium estimates show the 10-year term premium above one percentage point, underscoring that long-end yields reflect compensation for duration risk beyond expected policy rates alone.¹⁰

Operational liquidity also mattered. The New York Fed signaled that elevated reserve-management purchases of Treasury bills and short-dated government bonds would continue into mid-April, framed as technical rather than stimulus-oriented.¹¹ The Treasury General Account remained elevated, keeping near-term liquidity impulses dependent on bill supply and tax flows.¹²

Equities absorbed the macro mix unevenly. A sharp growth-led drawdown tied to AI-related positioning pressure drove major index declines midweek.¹³ Friday’s softer CPI stabilized sentiment, though dispersion remained elevated. Commentary highlighted that internal breadth was healthier than index-level performance suggested, pointing to fragile leadership and rotation beneath the surface.¹⁴

Credit markets did not flash systemic stress. The ICE BofA U.S. High Yield option-adjusted spread widened from 2.87% to 2.92% over the week.⁴ That magnitude aligns with equity volatility and modest risk repricing rather than a funding shock.

In FX, the dollar weakened on the week as rate futures increased the implied probability of a June cut following CPI.¹⁵ U.S. policy commentary also reflected tolerance for a weaker dollar, with the Commerce Secretary describing the currency as closer to a “more natural” level for trade.¹⁶

International Developed Markets: Divergence Re-Emerges

Europe’s story centered less on data and more on narrative. An ECB policymaker argued that Europe should prepare for a larger global safe-haven role, emphasizing stronger liquidity backstops.¹⁷ The euro traded near $1.1863 into Friday, modestly higher on the week.⁵ The implication is structural rather than cyclical. A stronger institutional bid for euro assets alters funding dynamics over time.