Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: U.S.-IRAN CONFLICT LOOKS LIKE NOTHING MORE THAN 2-DAY DISRUPTION

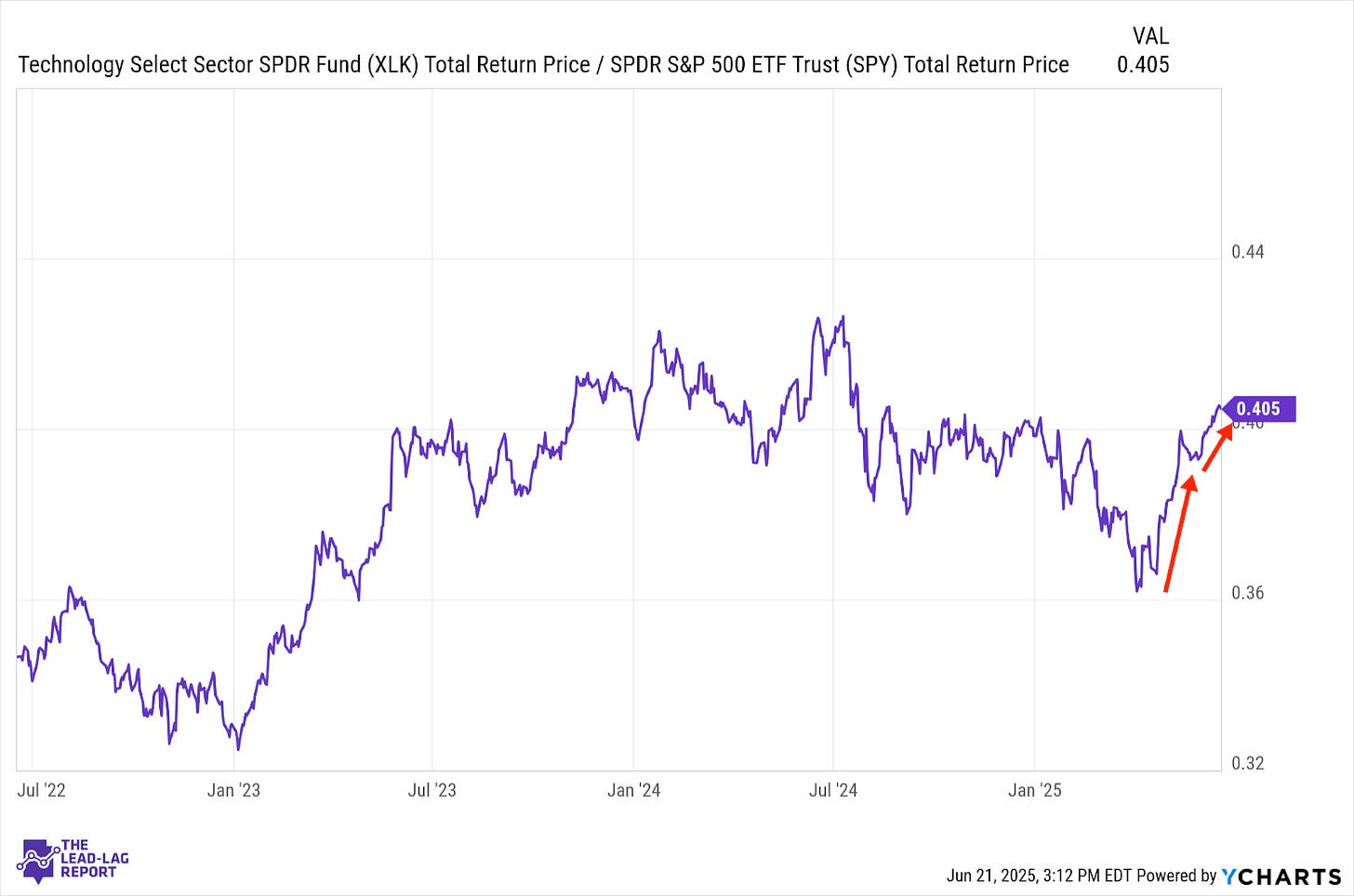

Technology (XLK) – Short-Term Direction Depends On Iran

Even with geopolitical risks on the rise, tech stock leadership shows that risk-on behavior might still be in control here. This is just one of the many trends that have been in place for several weeks now. The U.S. strikes in Iran could lead to a longer-term shift in the other direction depending on how Iran responds and whether supply chains get disrupted in the Strait of Hormuz.

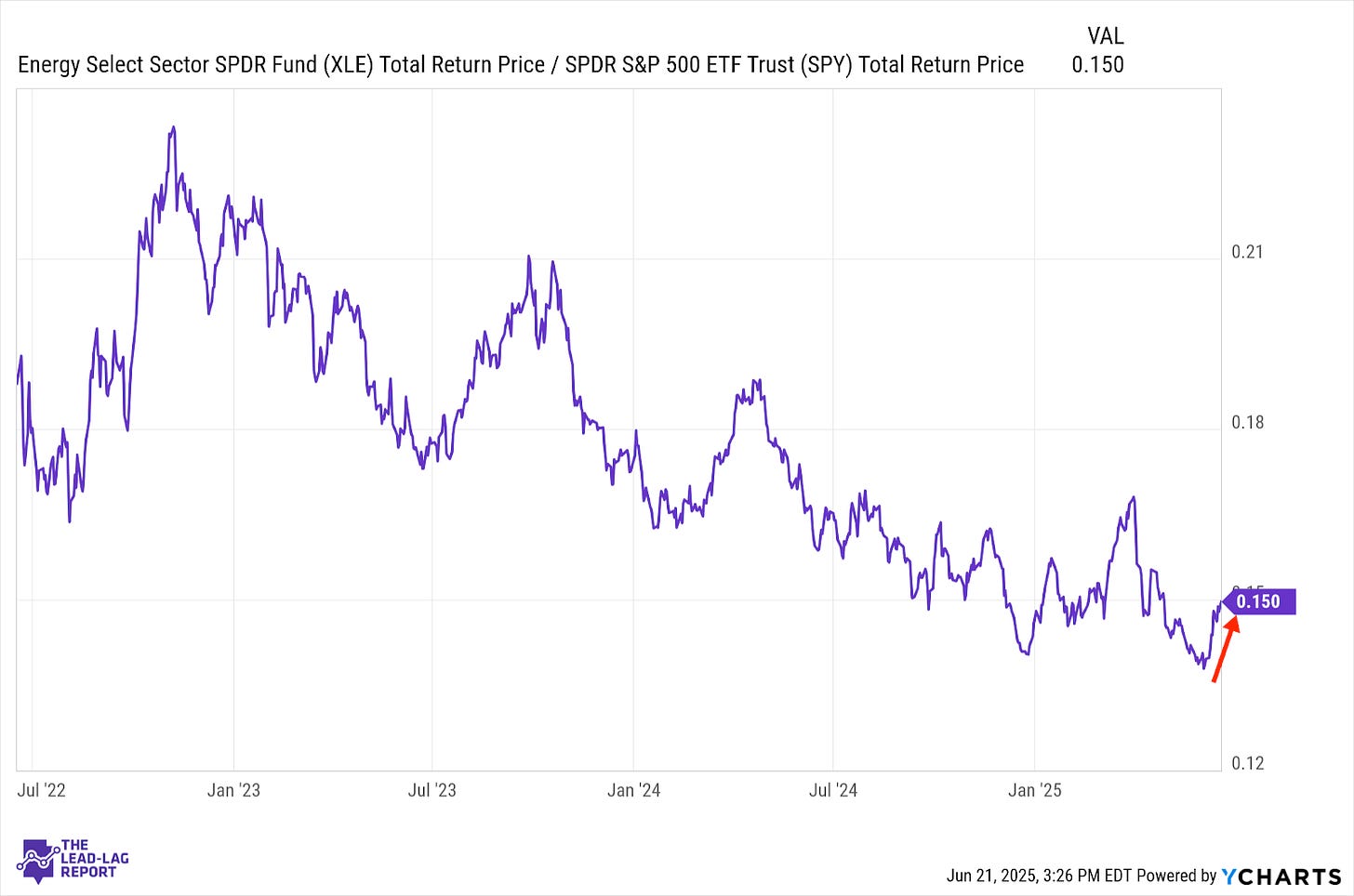

Energy (XLE) – Investors Don’t Seem Concerned

Over the weekend, it was looking like energy stocks would be the big winner in a U.S. strike on Iran. By Monday, risk had dissipated and the anticipated spike in energy prices fizzled out. There’s the possibility that Iran retaliation reignites risk and acts as an upside catalyst for energy stocks in the short-term, but Monday’s reaction suggests investors don’t seem too concerned.

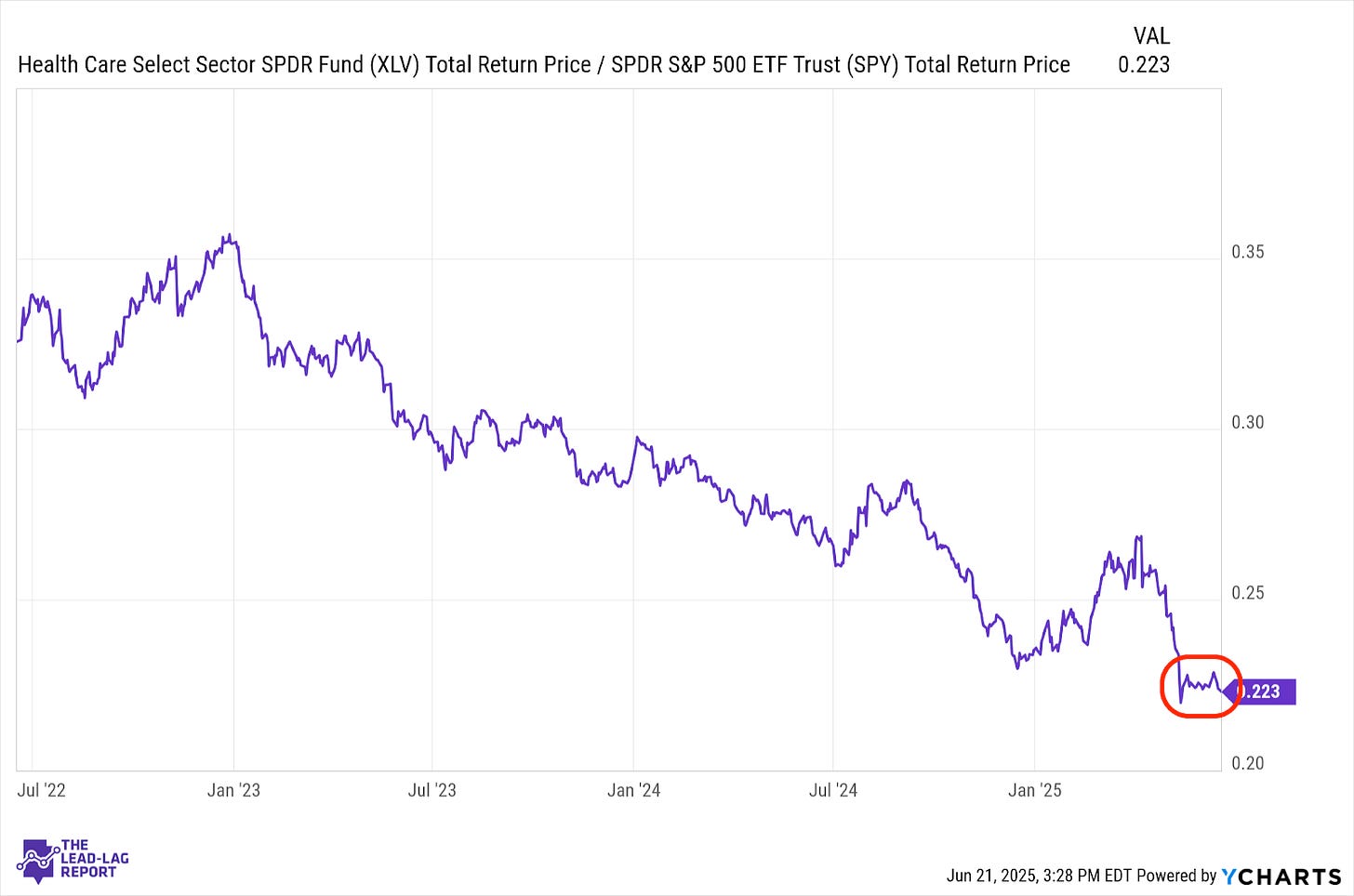

Health Care (XLV) – Deregulation Buzz

Healthcare stocks are kind of in a holding pattern here. They’re falling short as tech & growth remain the leaders, but performing noticeably better than some of their more defensive counterparts. Healthcare is a very headline-driven sector and we’ve heard some buzz related to drug pricing and deregulation. The best opportunity, however, for outperformance is usually a good old fashioned risk-off pivot.

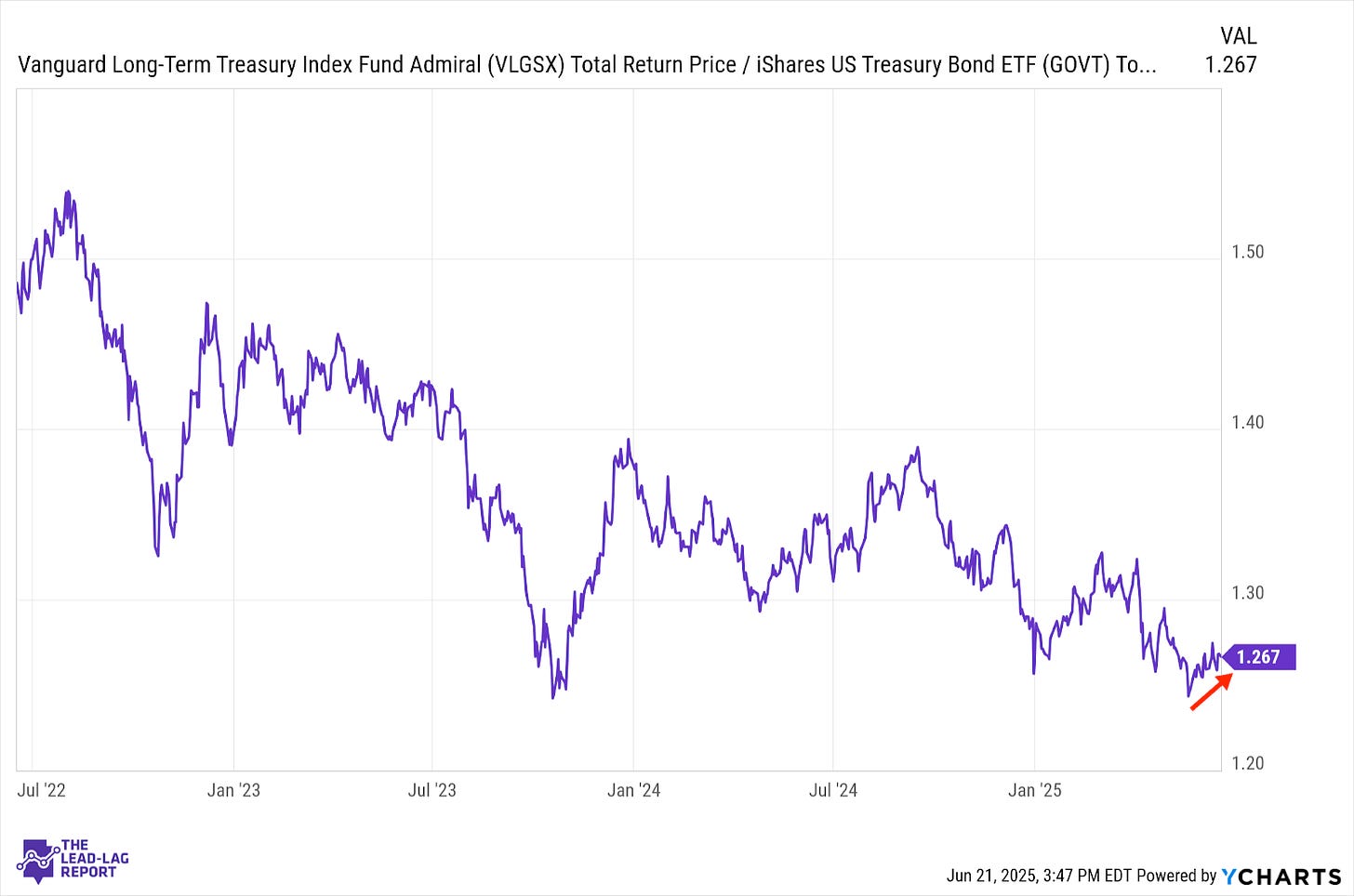

Long Bonds (VLGSX) – An Opportunity Emerges

Whether it’s a sign of underlying cautiousness or just a normalization of persistently high yields, the Treasury market is beginning to move higher. I suspect it might be the latter as long bond yields have broken below their recent range. The anticipated path of the Fed hasn’t really led to Treasury bonds being able to sustain any upward momentum. If the Middle East conflict turns out to just be a short-term event and trade war risks remain mitigated, I think there’s an opportunity for Treasuries.