After months of data showing that inflation in the U.S. was sticky and elevated, this week saw an about face. Core & headline CPI as well as core & headline PPI all came in below expectations in May. Core inflation, which was up 0.2% for the month, was the lowest reading since June 2023. Headline inflation came in at 0% flat, the first non-positive reading since July 2022. Producer prices actually dropped by 0.2%, the biggest single month decline since October 2023, while core PPI was flat.

All of this, of course, investors’ belief that the Fed still might have the ammo to cut multiple times yet in 2024 (as evidenced by the fact that they immediately priced in two rate cuts this year after Powell said the Fed’s new forecast called for one). Predictably, long-term Treasury yields have turned volatile over the past week after a series of new reports sending conflicting signals.

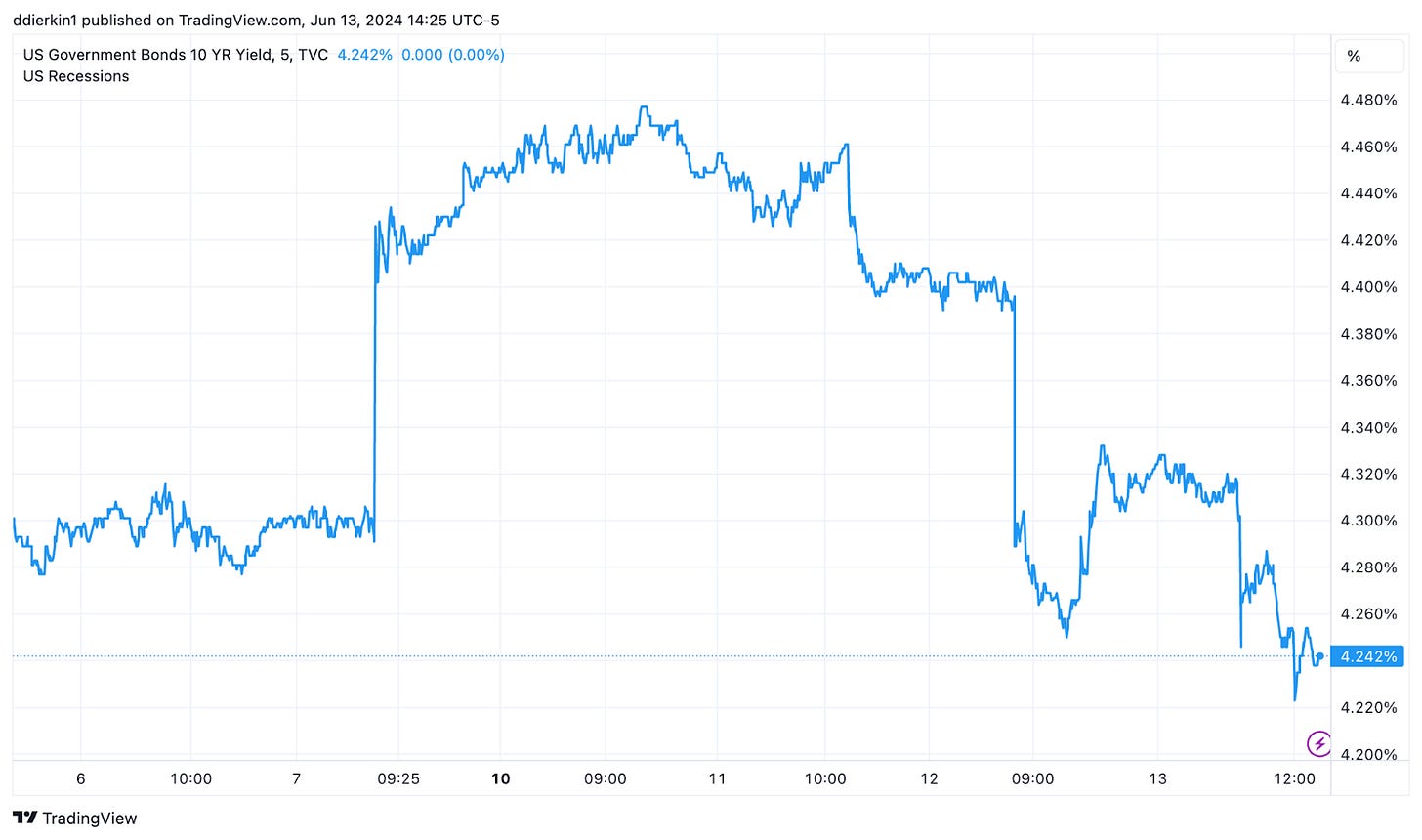

The 10-year yield shot higher on Friday following a much above expectations NFP number. It dropped again Wednesday after the CPI report before reversing higher during Powell’s testimony. Thursday’s lower PPI report sent yields to their lowest level since early April.

The real question now is are these numbers a signal that the disinflationary trend is resuming or are they a one-off aberration?