Navigating Murky Waters: How Mega-Cap Tech Earnings Mask Underlying Market Uncertainties

Sell in May?

Summary

Mega-cap tech earnings last week may have given investors a sense of optimism, but several corners of the market are suggesting otherwise.

Small-caps underperformed again.

Low volatility has been beating high beta since February.

There are no changes to the signals this week, which continue to indicate that conditions still aren’t terribly positive. Mega-cap tech earnings last week may have given investors a sense of optimism, but several corners of the market are suggesting otherwise. Small-caps underperformed again. Low volatility has been beating high beta since February. Long-term Treasuries have had a good couple of weeks. Risk asset prices still don’t seem to want to broadly move higher here even though the data still looks pretty good.

How To Interpret the Signals: Within each strategy, there is a risk-on and risk-off investment recommendation, with the risk-off option being the more conservative of the two. When a particular signal indicates that investors should be risk-off, for example, subscribers should consider investing in the risk-off option and avoiding the risk-on option. The opposite, therefore, would be true when the signal flips to risk-on. In each strategy, you’d always be invested in one option or the other.

Here’s how to read the scorecard for each strategy:

Some of the strategies will be more aggressive than others. The “Leverage For The Long Run” strategy, for example, uses the S&P 500 and 2x-leveraged S&P 500. The more conservative “Lumber/Gold Bond” strategy, however, uses intermediate-term Treasuries and the S&P 500. In every case, a risk-off signal indicates that you should be invested in the more conservative of the two options, while a risk-on signal indicates you should be invested in the more aggressive one.

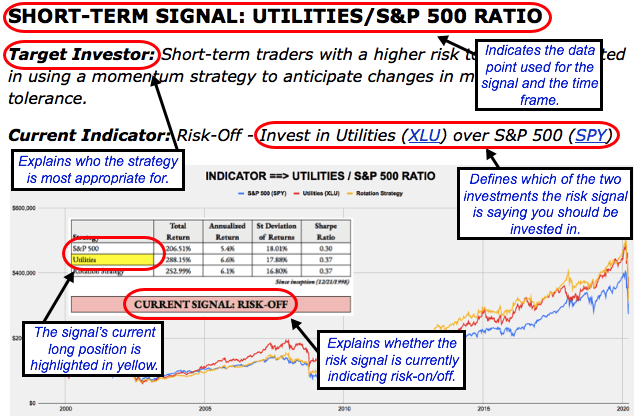

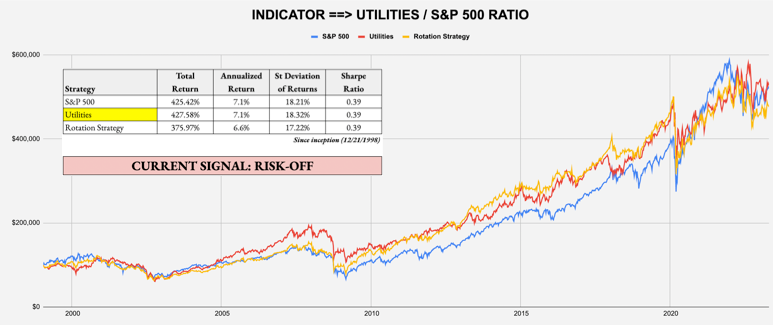

SHORT-TERM SIGNAL: UTILITIES/S&P 500 RATIO

Target Investor: Short-term traders with a higher risk tolerance interested in using an equity momentum strategy to anticipate changes in market risk tolerance.

Current Indicator: Risk-Off

Strategy: Beta Rotation - Example: Invest in Utilities (XLU) over S&P 500 (SPY)

SHORT-TERM SIGNAL: LONG DURATION/INTERMEDIATE DURATION TREASURIES RATIO

Target Investor: Short-term traders with a higher risk tolerance who want to use the activity in the U.S. Treasury market to judge overall risk levels.

Current Indicator: Risk-Off

Strategy: Tactical Risk Rotation - Example: Invest in Long-Duration Treasuries (VLGSX) over S&P 500 (SPY)

INTERMEDIATE-TERM SIGNAL: LUMBER/GOLD RATIO