For more than two years, the traditional financial media focused nonstop on what kind of “landing” the US economy would go through as higher interest rates worked their way through the system. What few people thought about, however, is that it may not land at all. The “no landing” situation — of growth that stays robust while inflation hovers above target — is beginning be to a serious topic of conversation among strategists.

Resilient Growth Defies Expectations

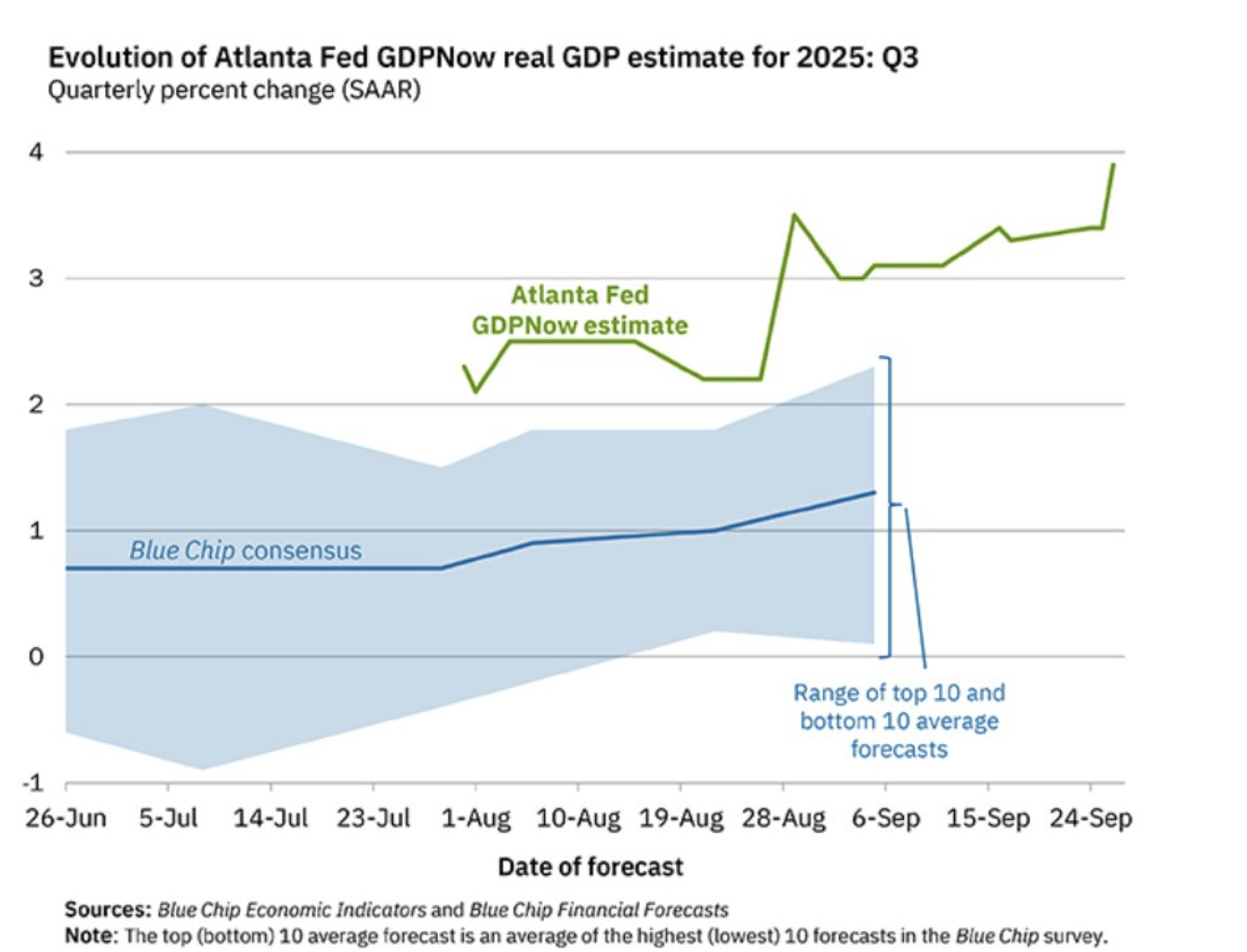

After a relatively mild slowdown in early 2025, U.S. G.D.P. is growing by an annualized rate of 3.8 percent in the second quarter and seems likely to post another good gain for the third quarter, according to the Atlanta Fed’s GDPNow model.

The biggest driver? Consumers. Personal spending increased 0.6 percent in August after gaining 0.5 percent in July, even as borrowing costs were elevated. Wealth effects from buoyant stock markets and solid home values have helped keep upper-income consumers in a spending mood. Household net worth totaled a record $176 trillion in the second quarter as stocks and housing continued to gain. Although lower-income families are more stretched, the overall dynamic is one of stable demand.

The Labor Market: Cooling, But Far From Cracking

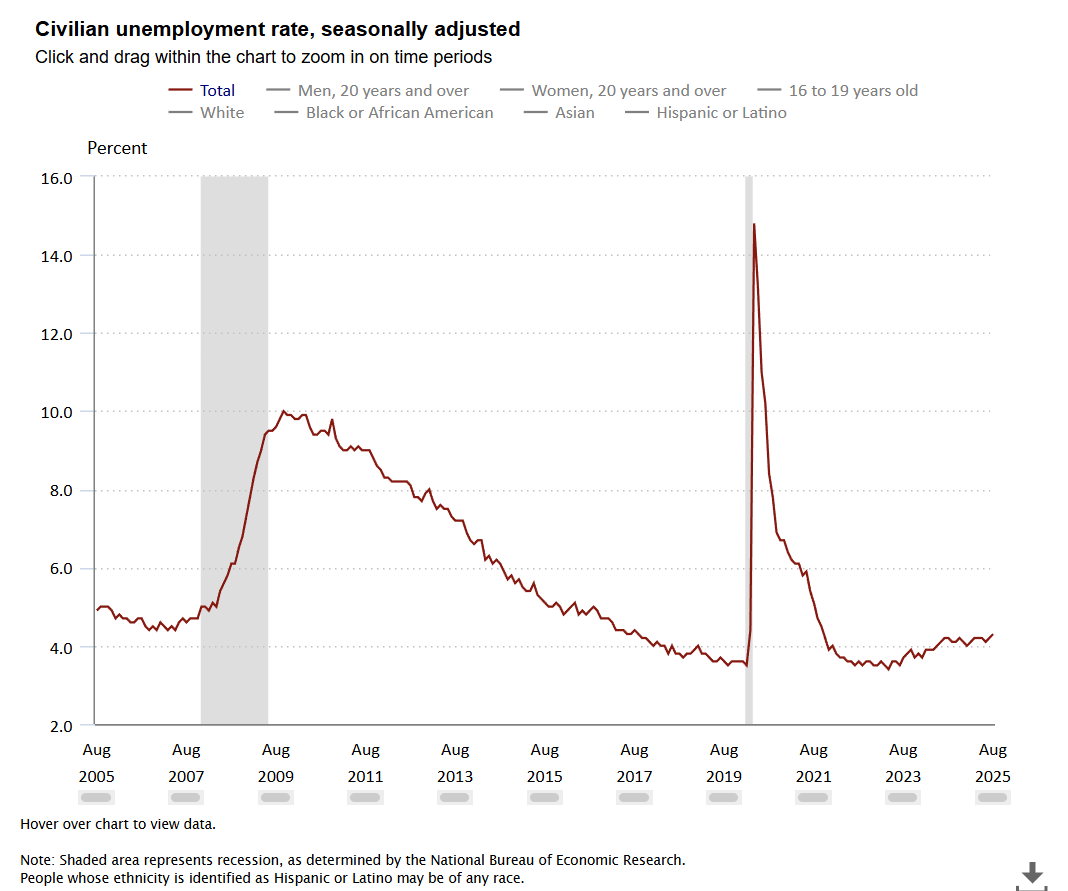

A defining feature of this expansion is the resilience of the nation’s labor market. Nonfarm payroll growth has slowed, though not enough to produce layoffs. The unemployment rate edged up slightly to 4.3 percent — a historically low level — as more workers returned to the job market. Employers appear to be hesitant to lay off workers after having difficulties with rehiring during this post-pandemic recovery.

Wage growth has moderated but is still strong enough to cushion real incomes and keep spending afloat. The job market has effectively made a U-turn into “slow hire, low fire” — not so tight as to stoke demand yet so tight that it caused overheating.

Inflation: Cooling but Sticky

Headline and core inflation have dropped sharply from the 2022 peaks, but decelerated progress. The Fed’s preferred measure — core PCE — went down to an annual 2.9% in August 2025, the lowest level in over two years but still above its 2% target.

There has recently been a renewed upward pressure on prices in services and energy, while new tariffs introduced incremental cost-push inflation. Policymakers confront a familiar dilemma: robust growth is preventing inflation from properly normalizing, pushing back the timing of how deeply Fed will need to cut interest rates (is at all any further).

Markets in a No-Landing World

As long as the economy continues to grow, corporate profits should hold up — though leadership could change. The high-valuation growth stocks that flourished in the era of falling-rate expectations may underperform, while cyclicals, industrials and financials take over the baton.

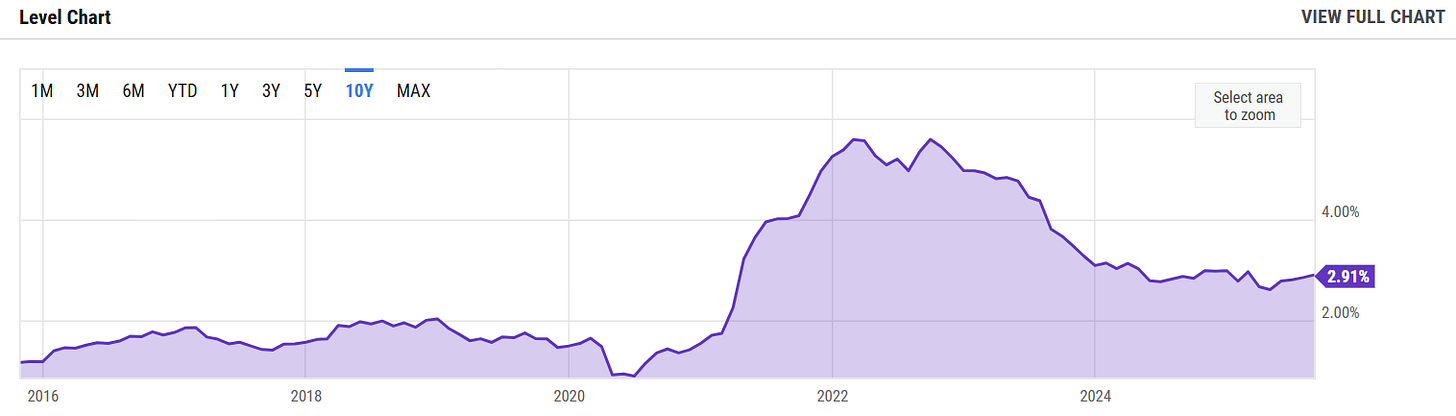

No place to land is likely bad news for bonds. Strong growth and persistent inflation will mean that central banks are slower to ease, keeping a lid on yields at higher levels. The 10‐year T- bill yield should hover in the vicinity of 4.0– 4.5%, and there would be little downside unless growth breaks down.

Longer-duration Treasuries and investment-grade bonds are still exposed, while shorter-term assets and floating-rate securities present better risk-reward. Active managers can also take advantage of opportunities in credit — healthy fundamentals keep default risk low, even though corporate refinancing costs are increasing it requires careful selection.

Commodities and Real Assets

Maintaining solid demand for energy and industrial metals, a persistent expansion bodes well for commodities as both return generators and hedges against inflation. Gold could tread water: persistent inflation supports it, but higher real yields are a headwind. Property and infrastructure are potential beneficiaries from this sustained level of economic activity, but higher funding costs will limit the upside.

Currencies

If American growth surpasses peers, you would expect the dollar to remain strong. Higher relative yields and lofty capital flows keep the greenback a magnet, especially as Europe and Japan struggle. Pro-growth currencies such as the Canadian dollar and some emerging-market FX could stand to gain but, for a no-landing world, dollar strength is the baseline.

Global Context: Diverging Growth Paths

Europe remains the counterpoint. After a close call with recession, the Eurozone economy is growing only weakly in part because manufacturing has sagged but that weakness is being offset by services. A U.S.-led global recovery might boost European exporters, though inflation and tight credit still drag on domestic demand. The European Central Bank is out of room for interest rate cuts, and financial conditions remain tight.

China, however, is exhibiting questionable stabilization. Stimulus measures and better sentiment are both supporting consumption, and growth of close to 5% looks attainable. This is good for global trade and commodity demand — especially for other emerging markets that are plugged into China’s supply chains and resource imports.

But emerging markets have a classic challenge: A thriving U.S. just serves to keep the dollar at elevated levels, in turn pulling down on financial conditions for dollar borrowers. (This could leave countries that export commodities — think Brazil, Chile or Indonesia — better off than economies reliant on imports.

At bottom, the U.S. looks exceptional again — its might props up global growth while buttressing financial hegemony, compelling flimsier regions to stretch beyond their means.

Portfolio Positioning: Staying Nimble

For both retail and institutional investors, the no landing field reality requires adaptability:

Stay invested but rotate smartly. Keep equity exposure but pivot into cyclical and value names benefiting from economic strength. Mid-cap and financial stocks appear more reasonably valued than overpopulated large-cap growth.

Shorten duration in bonds. Prefer short-term Treasuries, credit and TIPS to long-duration government debt. And the high end of the yield curve provides income without too much rate risk.

Add real assets. Commodities, infrastructure and certain real estate offer some inflation protection and non-correlated returns.

Maintain liquidity and diversification. No landing was ever to be forever — or suddenly over. Maintaining some dry powder will enable investors to react quickly if growth ultimately fades into either a soft or hard landing.

For retail investors, that could involve a combination of broad stock ETFs with short-term bond funds and small allocations to commodity ETFs. For institutions, it is about re-weighting strategic allocations in favor of equities and private real assets while pulling back on aggregate bond exposure.

Conclusion: The Growth That Will Not Die

Investors have to walk a line between participating in growth and hedging themselves against a potential tail event that is always looming. Healthy G.D.P., strong employment and robust spending do not point to any slowdown — yet history teaches that every flight lands. The trick is to stay in flight on this even keel — riding the momentum of growth and expansion while also preparing oneself for its eventual reversal.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.