The U.S. equity markets remain volatile more than anything. Daily moves of at least 1% up or down have become the norm and are indicative of a market that’s searching for trend and direction without much success. The tariff drama has at least subsided for the time being without any new major threats in the past week or so. Still, the VIX is hovering around 30, a traditionally higher risk area, and showing little sign of returning to a more historically normal range.

The risk-off rotation from stocks into gold has been one of the biggest market themes. With Treasury yields looking disconnected from current conditions, investors have bypassed the traditional safe haven and moved into precious metals. I hear a lot of people arguing that investors are searching for non-correlated assets in this market. That may be true for some, but I think it’s mostly performance chasing for others (flow data is confirming this). Gold is up more than 30% year-to-date through Monday’s close and judging by the action over the past several days, there’s a sense of FOMO gripping this market. As I’ve mentioned previously, this actually makes gold more vulnerable to a pullback here.

As I see the yen sitting at 140, this is around the range where it could trigger another wave of margin calls and/or unwinding short yen trades. With mega-cap tech (and U.S. stocks in general) no longer serving as the “higher yielding asset” in this trade, traders may soon become more compelled to deleverage and take risk off the table. We can see clearly through the behavior of the dollar that there’s a wave of sentiment against U.S. stocks & Treasuries at the moment and that could add more fuel to a potential second reverse yen carry trade.

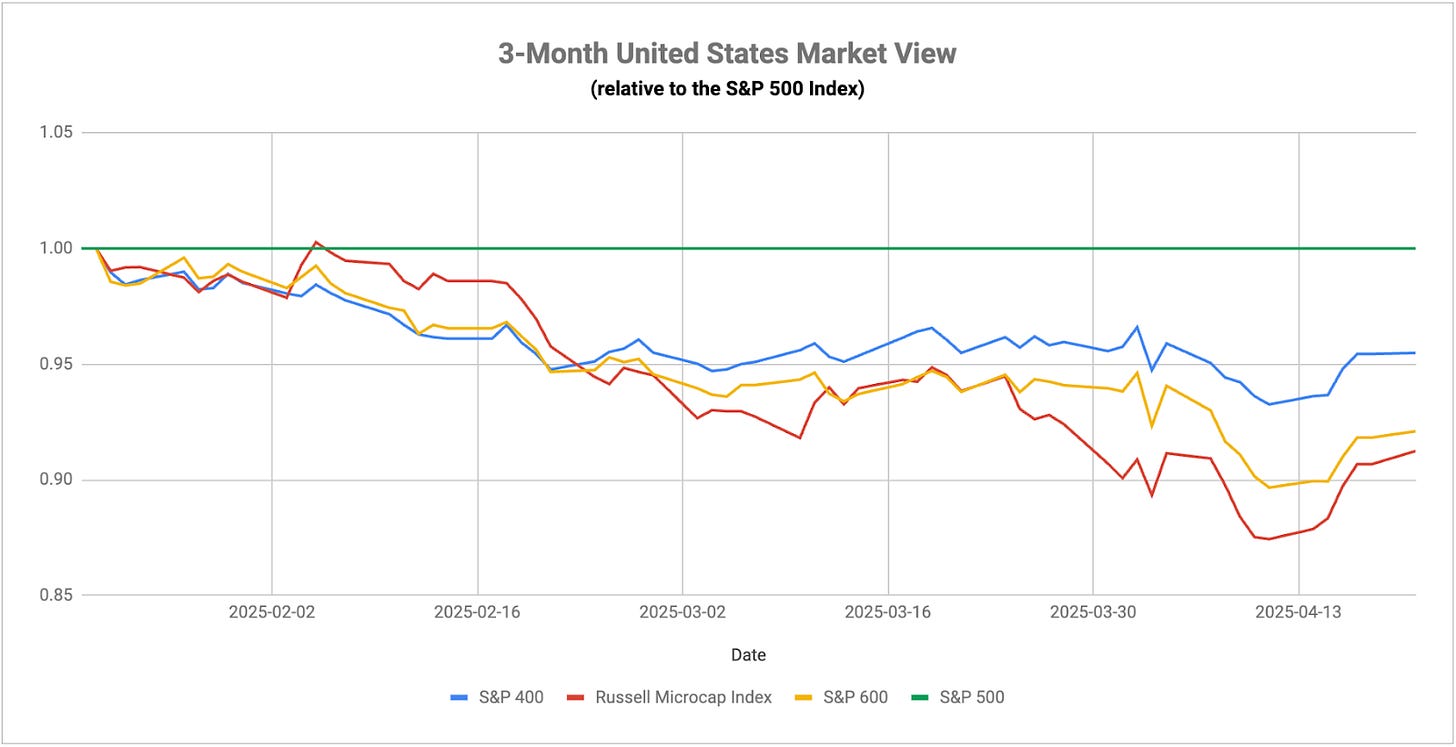

Over the past couple of weeks, we’ve seen utilities, low volatility, value and dividend stocks outperforming the major averages, but also small-caps. In terms of pure outperformance potential, there is an opportunity here for small-caps despite their outsized exposure to Trump’s trade war. There’s a value aspect to this group that’s certainly getting a lift, but this is also likely a function of the heavy overweight to mega-caps and the magnificent 7 stocks in many portfolios. That group has gotten hammered in recent months and U.S. tech stocks have been lagging the S&P 500 steadily throughout 2025. As those positions get unwound in a high volatility environment, small-caps could outperform on a relative basis in the short-term.