Not A Traditional Muni Bond Fund

But The Quality & Yield Make It Worth A Strong Look

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The fixed income market has gotten jostled around in 2024. Earlier in the year, the yield curve moved lower as the start of the Fed’s interest rate cutting cycle became imminent. Yields dropped further when the inflation numbers suggested that prices may be dropping too fast, reflecting a potential lack of consumer demand and rising recession risk. Over the past month, long end yields have been back on the rise as the latest economic data appears to be fairly healthy and the markets begin phasing out some expectation for outsized rate cuts. What looked like a potential flight to safety trade not too long ago has shifted into a more short-term neutral position on rates.

Those positions pertain to the muni market as well, although investors also need to consider the potential direction of tax rates. If the federal debt spirals higher and the government is forced to raise tax rates to pay for that debt, munis suddenly look a whole lot more attractive. The Guggenheim Taxable Municipal Bond & Investment-Grade Debt Trust (GBAB) may raise some questions based on its name alone, but it’s got a solid long-term track record of navigating the credit markets. Volatility, however, is high and the fund should be risk-managed within a broader portfolio, but it could be an intriguing vehicle for playing potential conditions.

Fund Background

GBAB’s primary investment objective is to provide current income with a secondary objective of long-term capital appreciation. It seeks to achieve its investment objectives by investing primarily in a diversified portfolio of taxable municipal securities and other investment grade, income-generating debt securities, including debt instruments issued by non-profit entities, municipal conduits, project finance corporations, and tax-exempt municipal securities. The fund also utilizes leverage in order to enhance yield and total return potential.

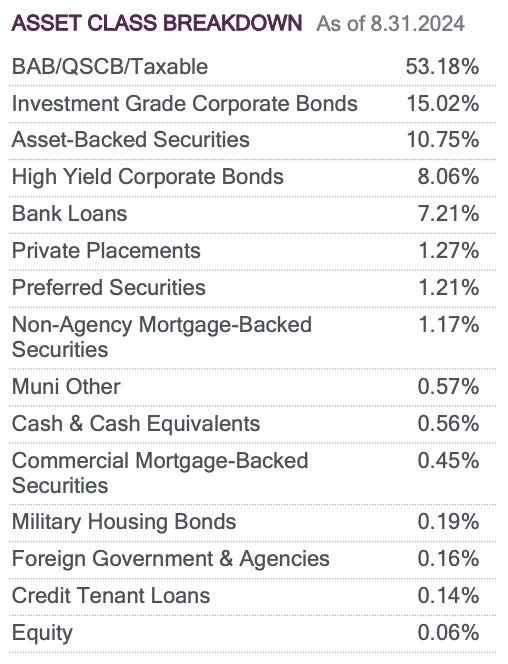

For the record, the word “taxable” in the fund’s name may frighten some people off. As we’ll see in a moment, a big chunk of the portfolio’s assets are currently dedicated to Build America Bonds, a program that was launched coming out of the financial crisis that was designed to provide local governments a more cost-effective means of funding projects, such as school improvements and building development. These bonds were designed to deliver taxable interest even though it was issued by a municipality.

With the ability to also invest in traditional corporate bonds, this shouldn’t be considered a muni bond fund that will exclusively produce federally tax-exempt interest.

From a security selection perspective, there’s nothing terribly fancy or unusual about the fund itself. It places some limits on itself to avoid concentration risk, but other than that it’s constructed as a true “all-credit quality” portfolio. The degree of leverage could be the biggest determinant in whether investors may want to consider this fund. The 20% leverage overlay doesn’t look excessive on the surface, but it really ratchets up the risk, making it potentially unattractive from a risk-adjusted perspective.

As mentioned, a full half of the portfolio’s assets are currently dedicated to Build America Bonds. With the vast majority of the remainder of the fund’s assets going towards corporate bonds, bank loans and asset-backed securities, there’s relatively little here that’s producing tax-exempt income. There will be some tax benefit (approximately 56% of 2023 income was categorized as ordinary dividends), but it won’t provide the tax savings of a traditional muni fund.