Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: UTILITIES JUST WON’T BACK DOWN

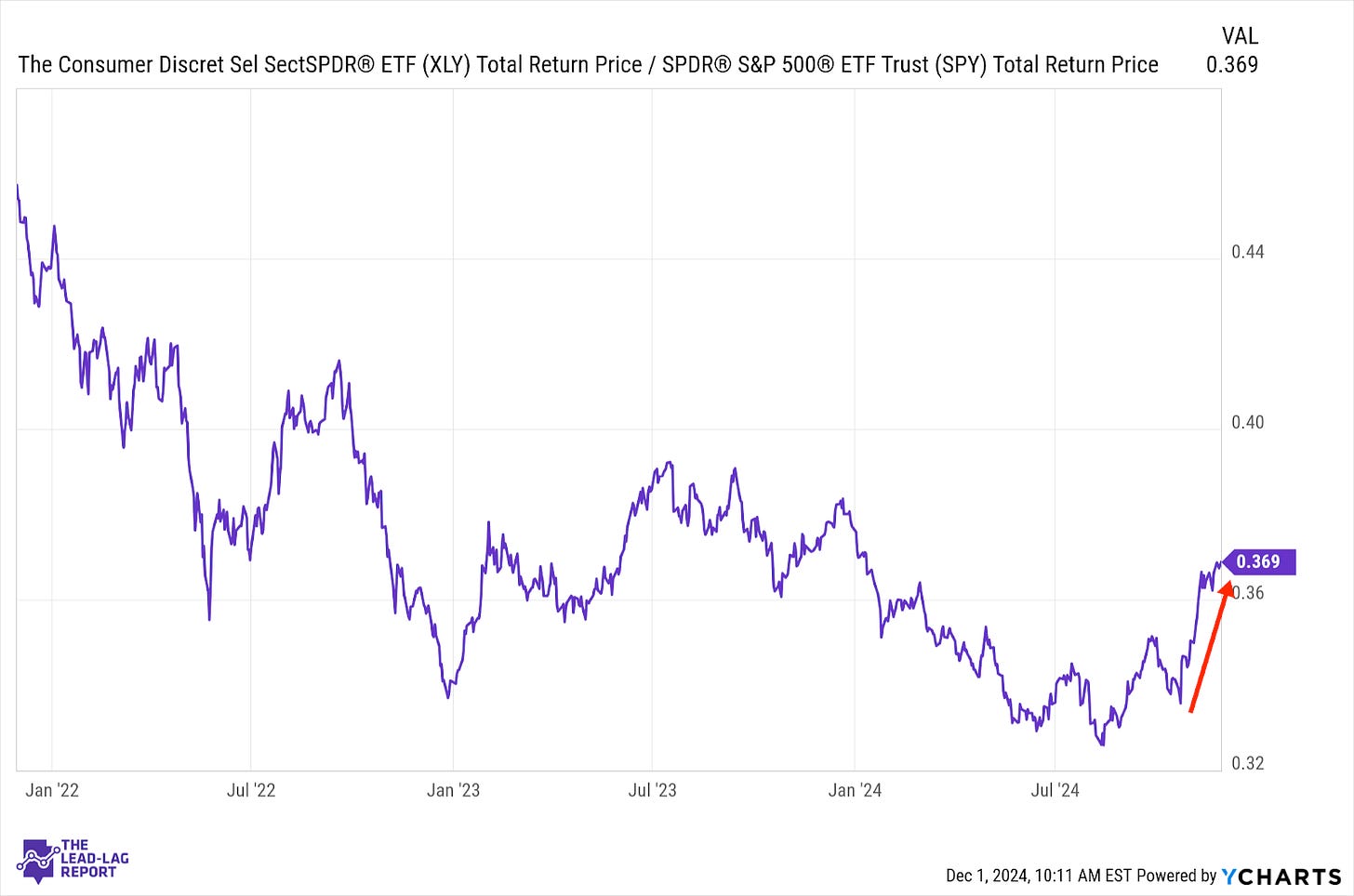

Consumer Discretionary (XLY) – Separating Itself From The Pack

Even though tech is continuing to lag here, the same can’t be said for some of its growth sector counterparts. We’ve consistently seen consumer spending remain resilient even in the face of inflation concerns and high debt loads. The Fed is, as of now, likely to only make a couple rate cuts by the end of 2025. That could start to slow the momentum of this group, but it’s unquestionably been a strong month.

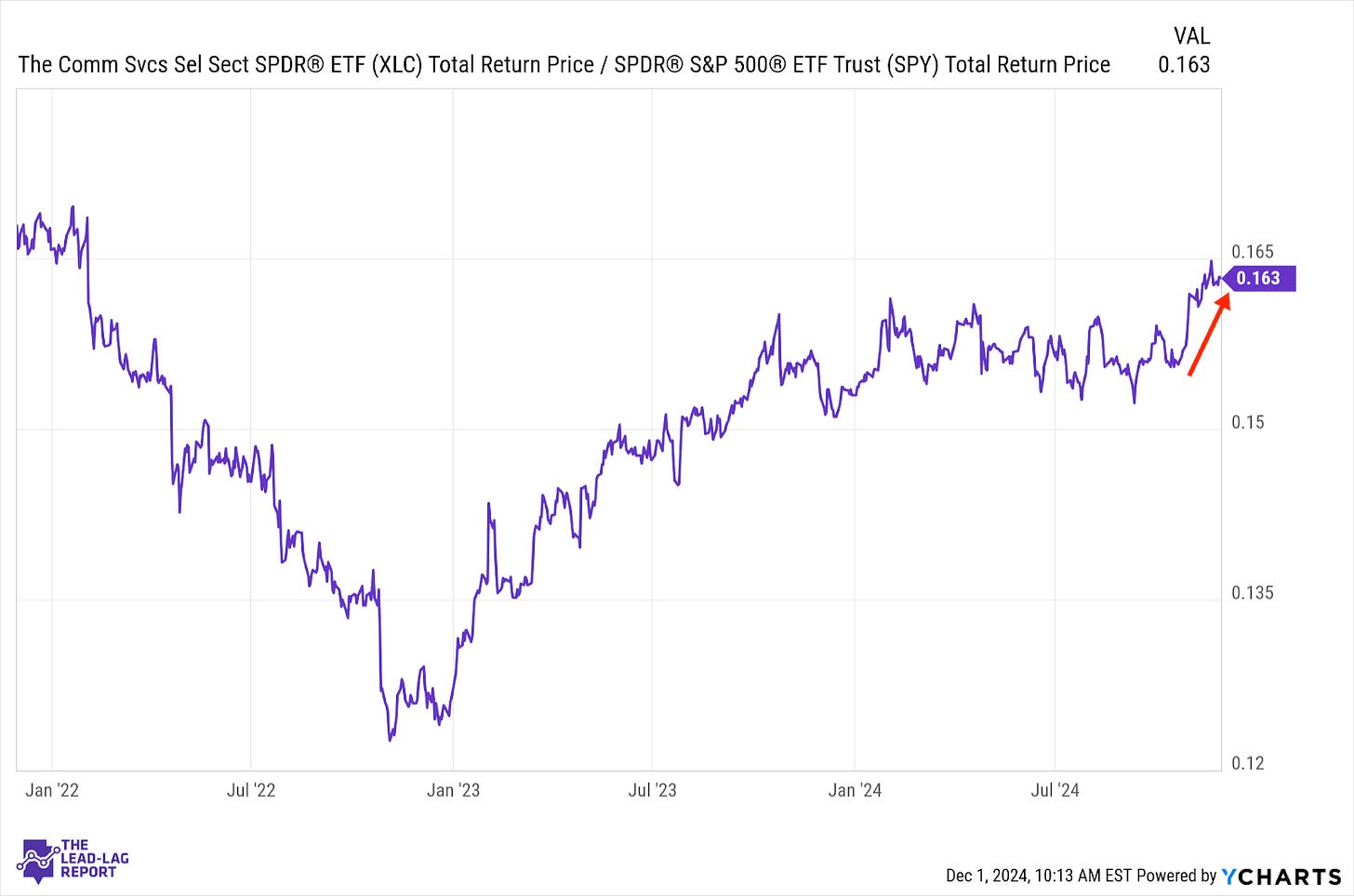

Communication Services (XLC) – Ability To Sustain

The post-election rally for this group is holding on to gains, but it could be interesting to see how it performs in the current defensive market turn. It’s been positioned well enough to rally over the past few weeks, but the broadening of gains within this sector have allowed it to sustain. Facebook and Alphabet will always be the drivers of this sector, but it’s the telecoms and more traditional media names that could help it hold up in a downturn.

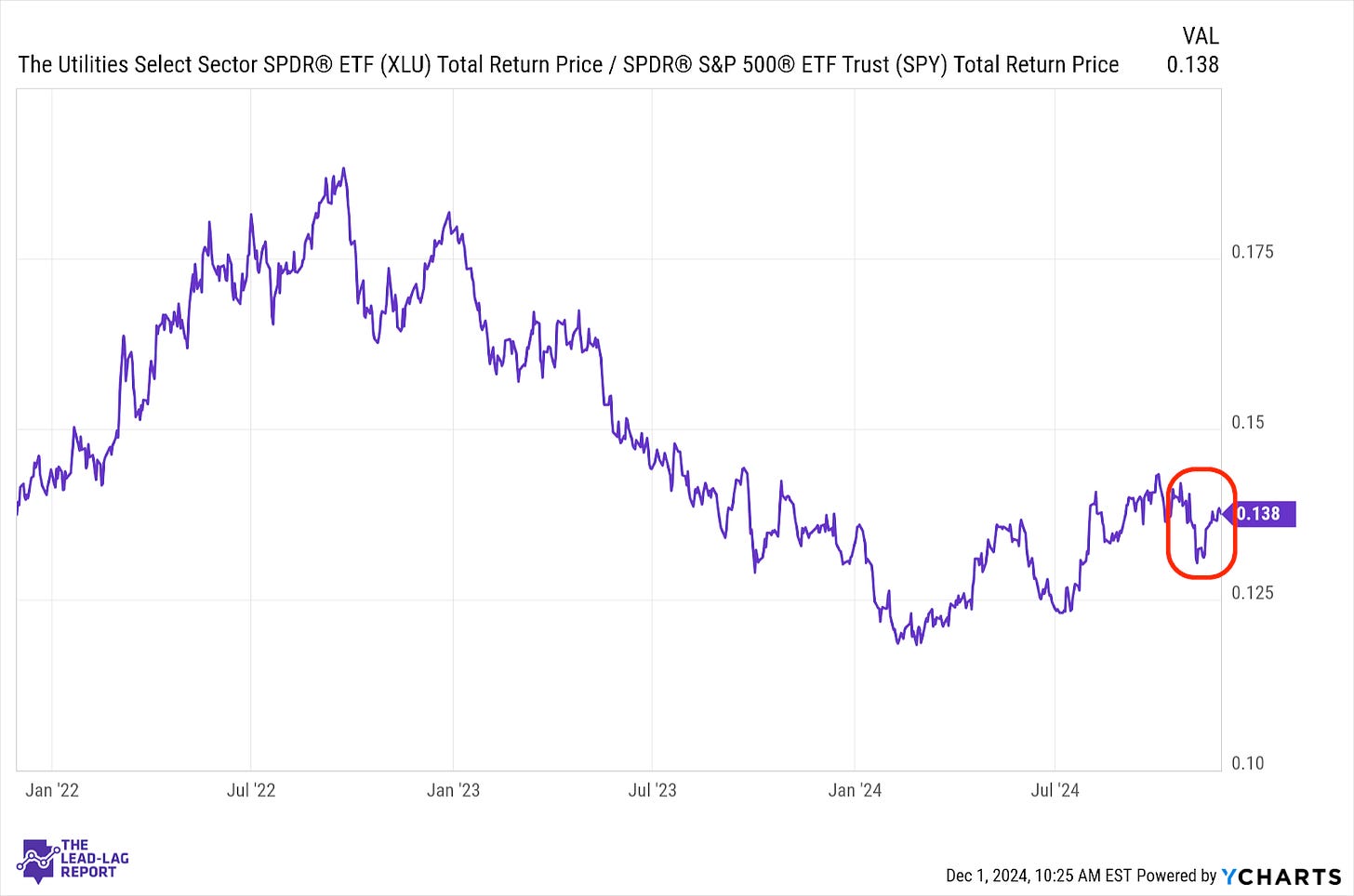

Utilities (XLU) – Unusual Durability

Utilities stocks have been turning more volatile in recent weeks, lagging since election day, but since rebounding in the nascent defensive shift. This sector has displayed a durability that is unusual in what’s supposed to be a roaring bull market. Now that other defensive sectors look like they’re starting to wake up, we could be getting a more decisive risk-off signal.

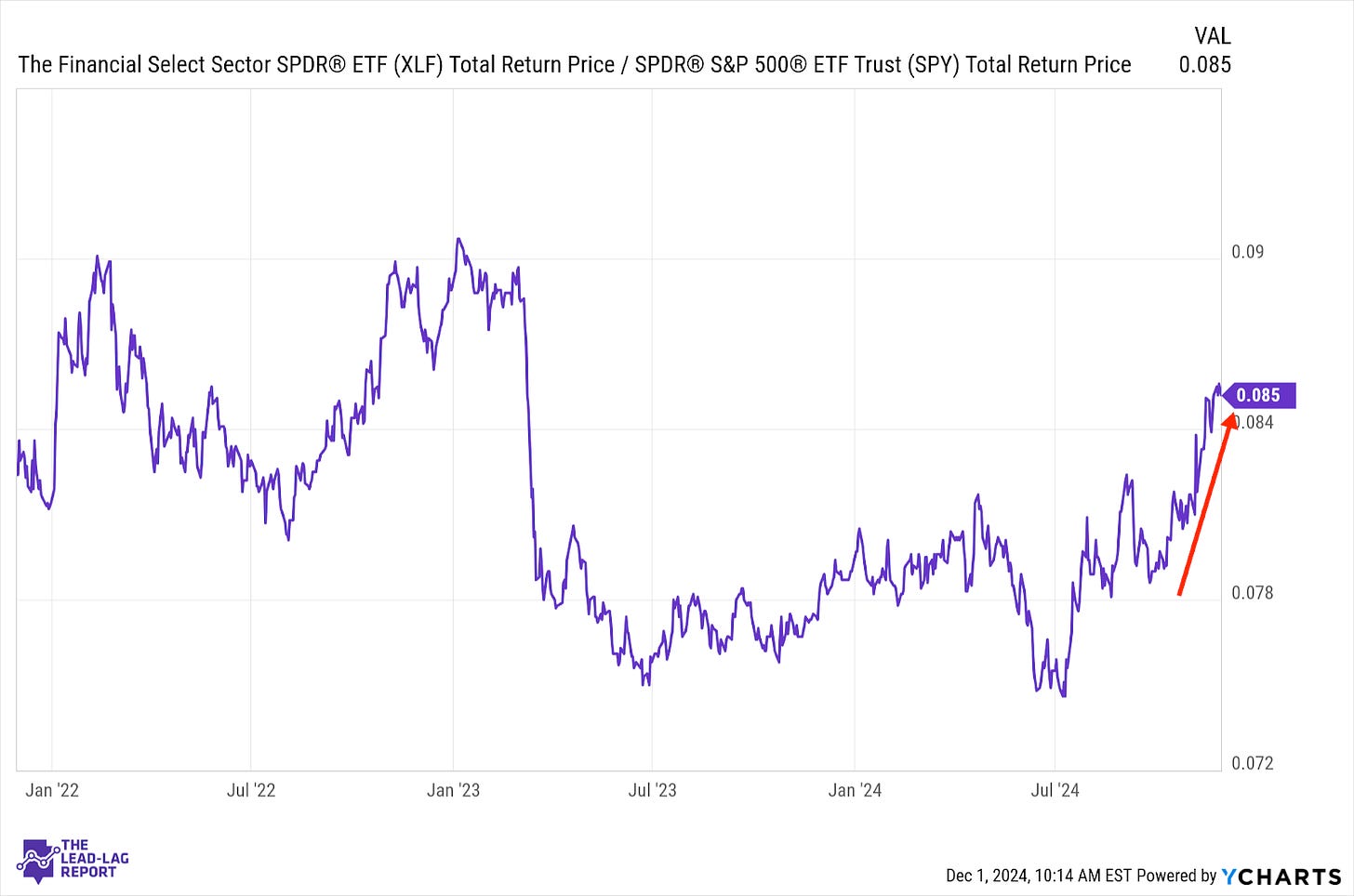

Financials (XLF) – Due For A Breather

This sector has been the one Trump trade that’s been able to consistently lead the market throughout. Deregulation and the push for higher interest rates have been the driving themes thus far, but the rally could probably use a breather. The former catalyst will likely remain in place throughout 2025, but we’ve already seen rates declining in the wake of the yen rally. Inflation should add support for rates, but the current flight to safety move can’t be discounted.

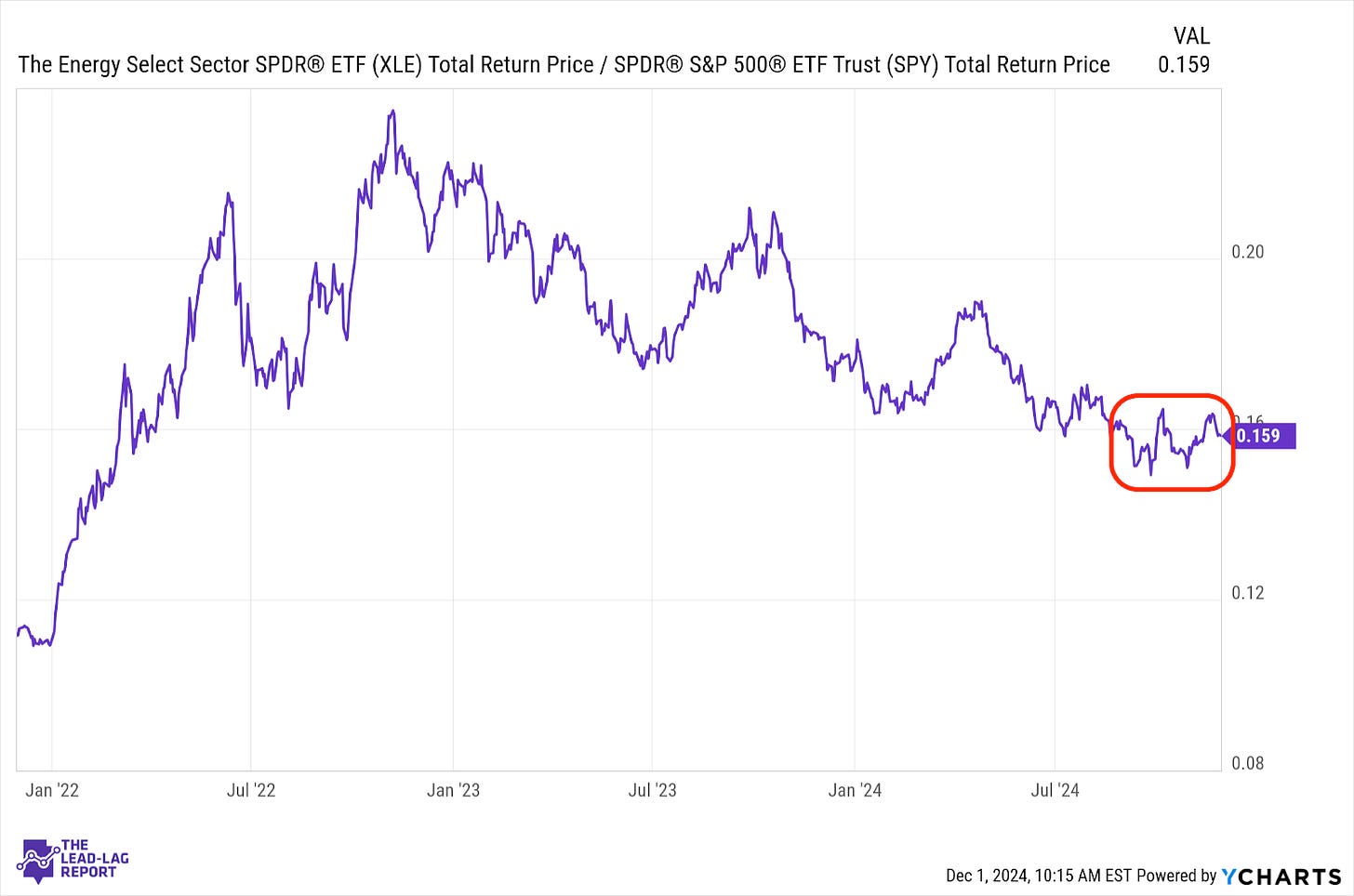

Energy (XLE) – Slowing Global Demand vs. Geopolitical Risk

Energy stocks seem to be stuck in a range relative to the S&P 500. Slowing global energy demand has been offset somewhat by geopolitical risks that have threatened oil supplies and sent prices higher. The recent ceasefire agreement has mitigated some of that risk and energy stock prices have dropped accordingly. If the global demand theme overshadows the geopolitical backdrop, there’s a strong case that this ratio could move lower.

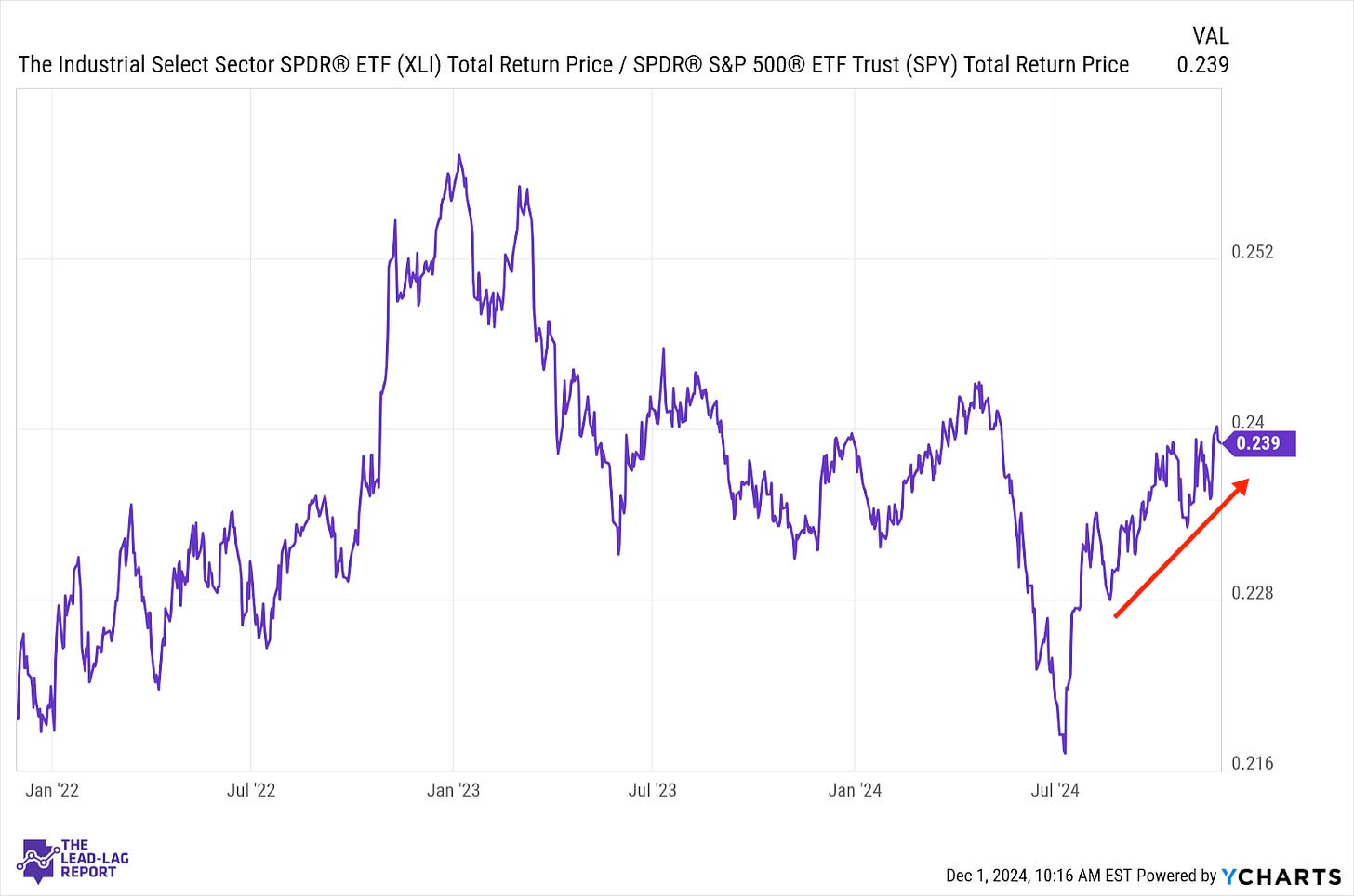

Industrials (XLI) – Uptrend Intact, But The Path Is Getting Choppy

Industrials have continued to outperform the market since the end of last summer, but the ride has gotten choppy over the past several weeks. Cyclicals are still generally in favor here, but it’s the Trump trade beneficiaries that have done better. Industrials have behaved as a general proxy for the U.S. economic outlook for a while and right now it’s telling us that the expectation for continued growth is there.

Small-Caps (VSMAX) – Picking Up A Head Of Steam