After more than a decade in the shadows, nuclear energy is reasserting itself as a strategic pillar of the global energy system. What has changed is not just sentiment, but necessity. Explosive growth in electricity demand from AI data centers, renewed energy-security priorities, and an increasingly supportive policy environment have converged to revive interest in nuclear power—and in the uranium and nuclear equities that support it. Uranium-focused stocks have responded forcefully, outperforming many broader market benchmarks and re-entering leadership after years of neglect.¹

This revival is not a short-term trade. Nuclear operates on multi-decade timelines, and the policy, infrastructure, and capital commitments now underway suggest the current cycle may have more durability than prior rebounds.

Uranium Fundamentals Are Tightening

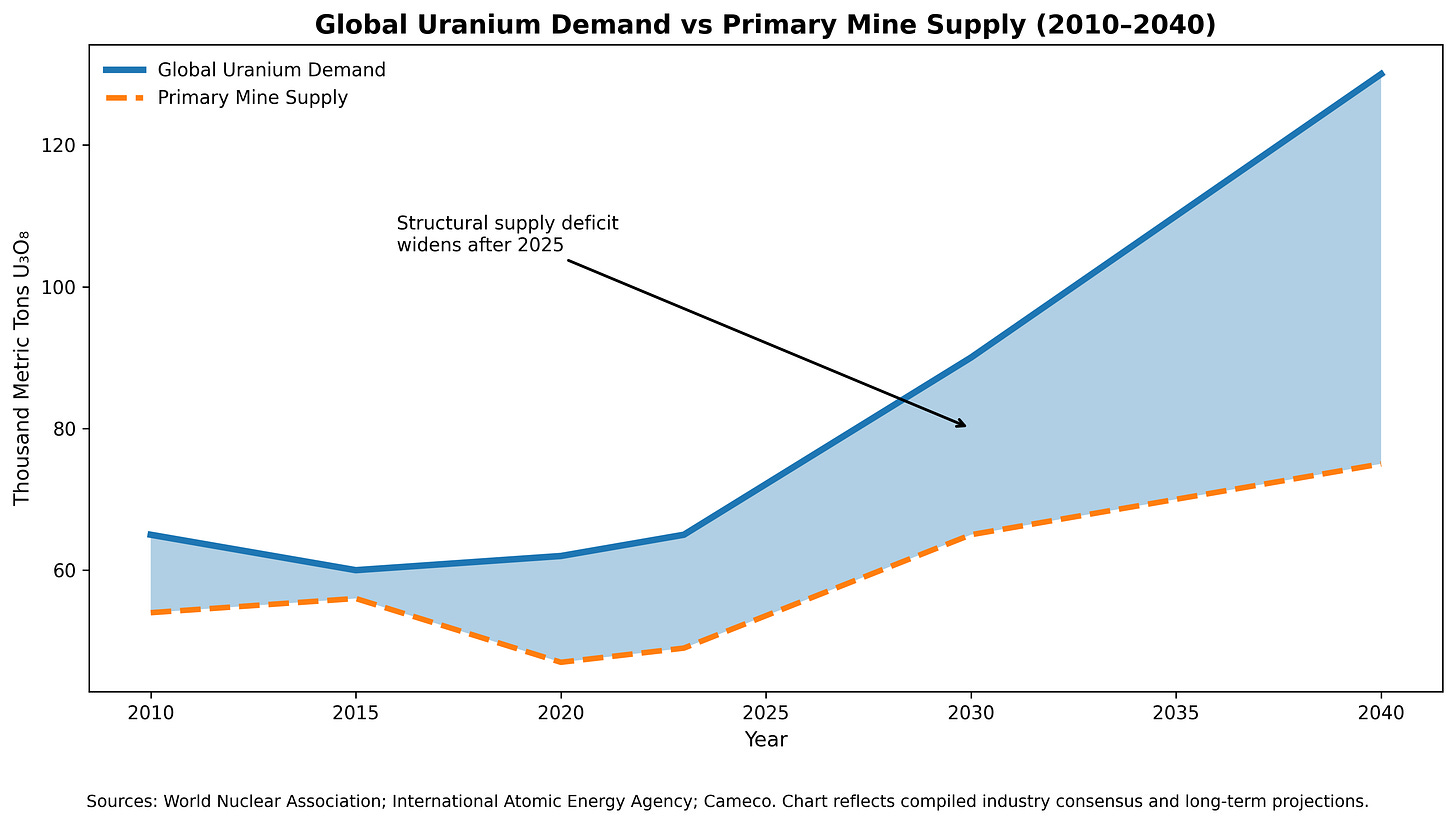

Uranium prices are hovering near their highest levels since 2011, while long-term contract prices have moved even higher as utilities prioritize supply security over spot market exposure.² This reflects a structural imbalance. Global reactor requirements are expected to rise steadily over the coming decades as new reactors are built in China, India, and the Middle East, and as Western countries extend the life of existing fleets.³

Supply, however, remains constrained. A decade of underinvestment following Fukushima left little excess capacity, and production remains geographically concentrated. The United States consumes tens of millions of pounds of uranium annually while producing only a negligible share domestically.⁴ This mismatch has elevated uranium from a cyclical commodity to a strategic resource.

Policy and Energy Security as Structural Tailwinds

Policy support has become one of the most important pillars of the current nuclear cycle. Uranium’s reclassification as a critical mineral in the United States has unlocked federal funding, accelerated permitting timelines, and increased support for domestic production and fuel-cycle infrastructure.⁵ The Inflation Reduction Act reinforced incentives for existing nuclear plants, while subsequent executive actions outlined ambitious long-term goals for expanding nuclear capacity.⁶

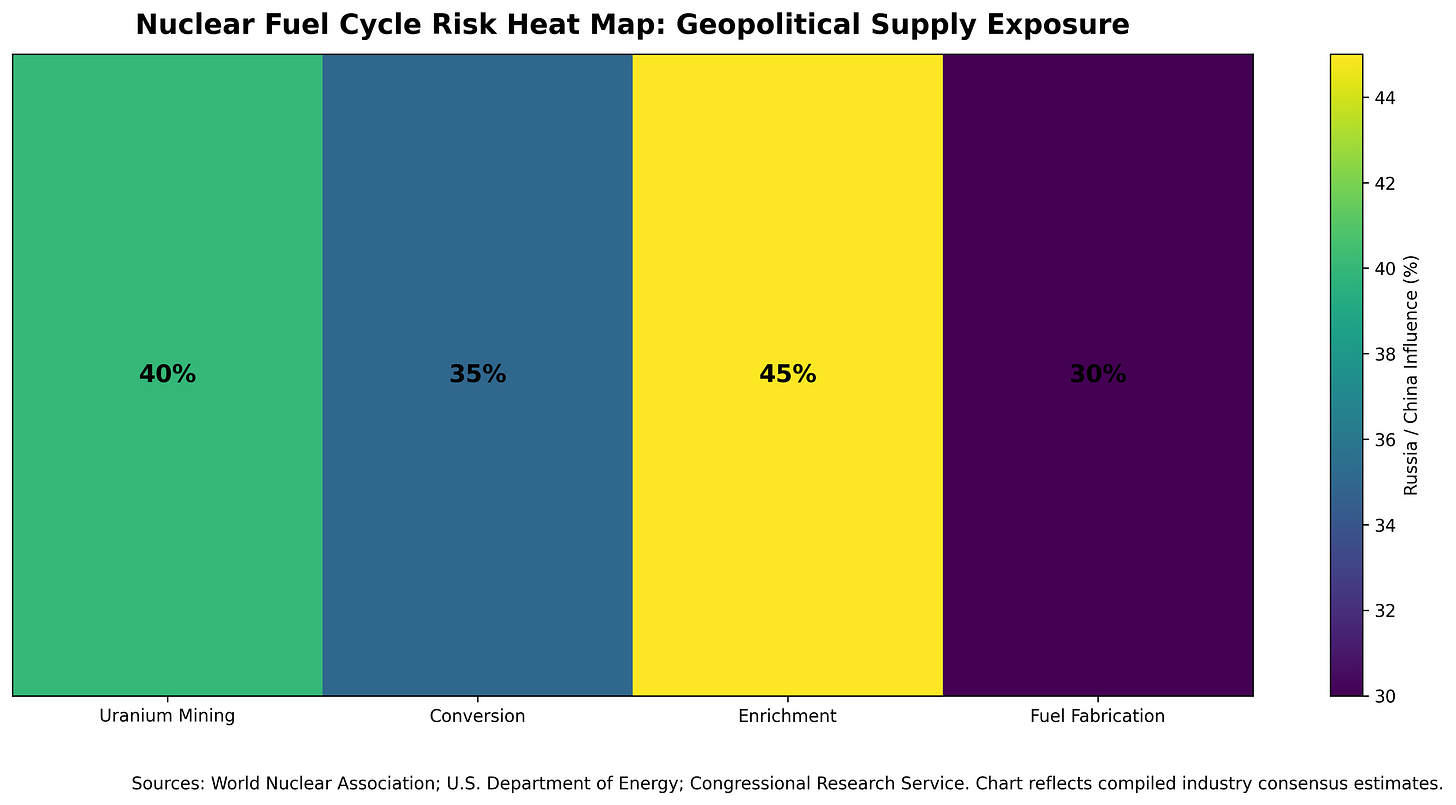

Energy security has further strengthened the case. Western governments are actively reducing reliance on Russian nuclear fuel services, accelerating investment in domestic enrichment and advanced fuel capabilities.⁷ Nuclear is increasingly viewed not as a transitional technology, but as a cornerstone of long-term grid reliability and decarbonization.⁸

Valuations Require Selectivity

The rally in uranium equities has lifted valuations, particularly among early-stage producers. On traditional metrics, some stocks appear expensive, reflecting expectations for sustained high prices and future production growth.⁹ That said, improving earnings have begun to justify these valuations, with sector-wide multiples compressing as revenues catch up to prices.¹⁰

Selectivity is now essential. Balance-sheet strength, asset quality, jurisdictional stability, and execution capability matter far more than thematic exposure alone.

Stock Ideas Across the Nuclear Value Chain

Cameco Corp. (CCJ) remains the cornerstone large-cap uranium exposure. As one of the world’s largest producers with tier-one assets in Canada and a deep book of long-term contracts, Cameco offers leverage to higher uranium prices with comparatively lower operational risk. Its strategic ownership stake in Westinghouse Electric adds exposure to reactor construction and nuclear services, broadening its earnings profile beyond mining alone.¹¹