Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: ARE WE ABOUT TO GET INTRO TROUBLE BECASE OF NVIDIA?

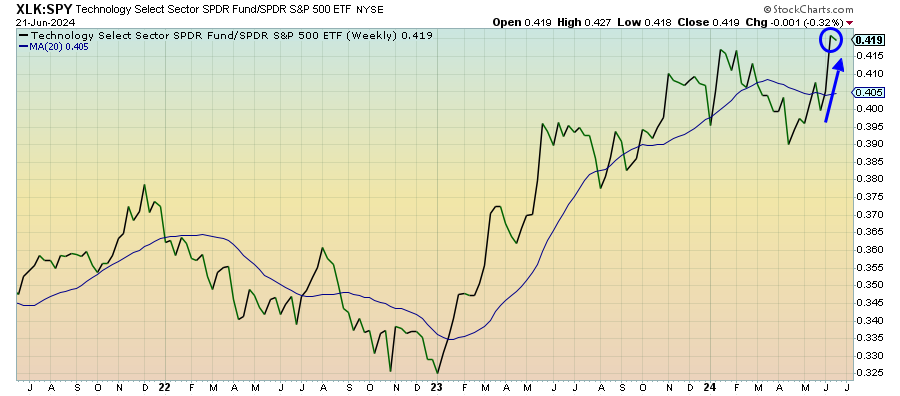

Technology (XLK) – A Big Test

Tech finally took a breather last week following one of its most powerful two week rallies in some time. The dynamic featuring NVIDIA, however, could prove interesting moving forward. If that stock breaks down here, as it has been over the past three trading days, is it enough to sink investor sentiment? The top-heaviness of the major averages could finally be a real risk to the markets here.

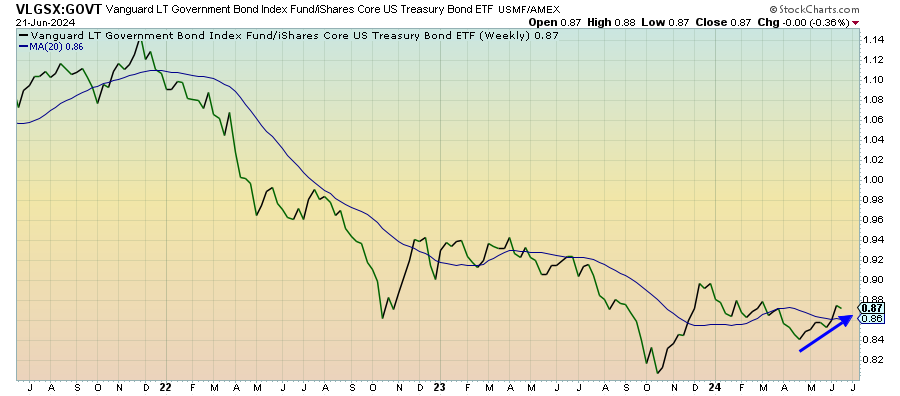

Long Bonds (VLGSX) – Competing Forces

Treasury yields are holding pretty firm here despite forces potentially pulling them in either direction. On one hand is the Fed dynamic, which is currently tilting towards pricing in more cuts prior to year-end. On the other hand is inflation and Japan. The latter appears ready to dump billions of dollars in sovereign debt holdings in order to prop up the financial system and that excess supply could force rates higher.

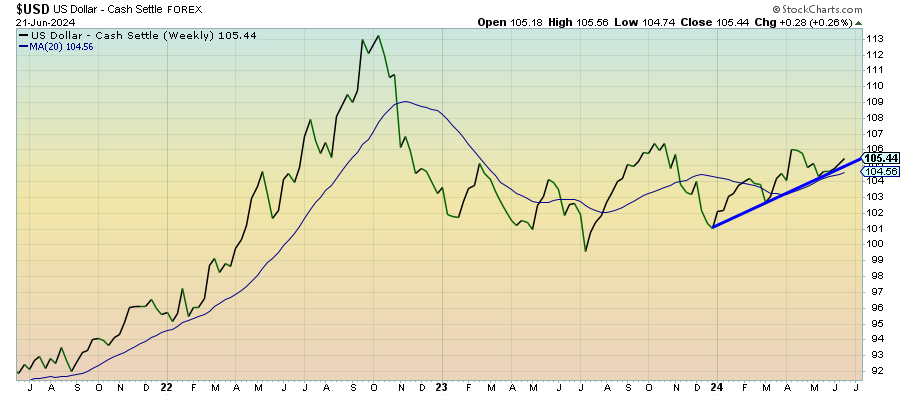

U.S Dollar ($USD) – Another Yen Intervention Looms

After a rough start to the 2nd quarter, the dollar is picking up strength again. The yen/dollar rate nearly broke through the 160 level over the past few days and puts it in prime position for another BoJ intervention. European currencies have also backed off a bit following a significant deceleration in expansion in June. Barring some major yen support in the short-term, momentum is firmly in the dollar’s favor at the moment.

LAGGARDS: IS IT INVESTMENT-GRADE CREDIT SPREADS WE SHOULD BE WORRYING ABOUT?

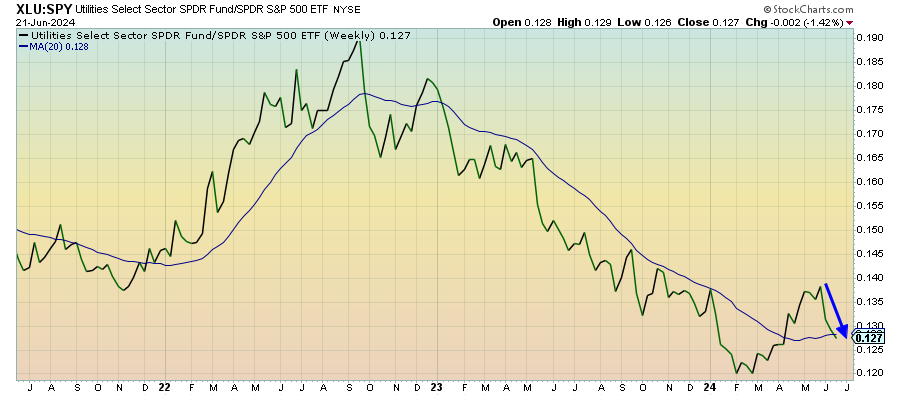

Utilities (XLU) – Is The Risk-Off Pulse Still Beating?

With utilities reversing course and confirming the short-term strength of the tech trade, it’s going to be important to watch where the sector moves from here. Overall market breadth, or the lack thereof, would suggest there’s still a risk-off pulse here, but like almost everything it’s being drowned out by the mega-cap growth rally. Now that the mag 7 is softening again, the re-emergence of utilities would suggest the risk-off pulse is still beating.

Industrials (XLI) – An Oversold Bounce