Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: TRADITIONAL RISK-OFF IS BACK!

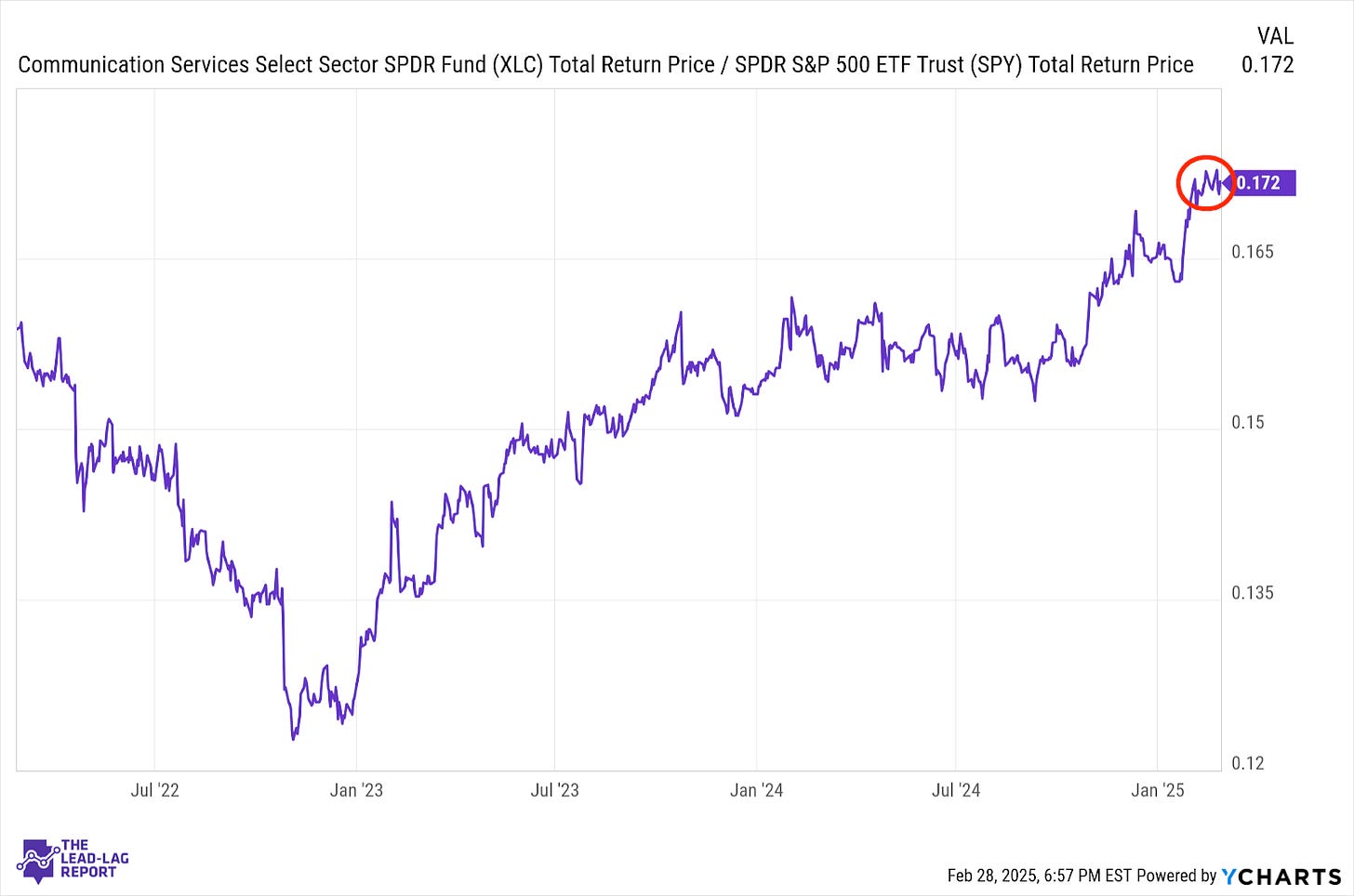

Communication Services (XLC) – A Growth/Value Combo

Growth stocks are broadly underperforming here, but this is the one sector that’s still hanging on. Facebook has corrected by 10%, which is to be expected after a 20-day winning streak, but it’s the telecom sleeve that’s really been picking up the slack lately. If you’re looking for a balance of growth & value within a single group in the market, communication services has emerged as a real option.

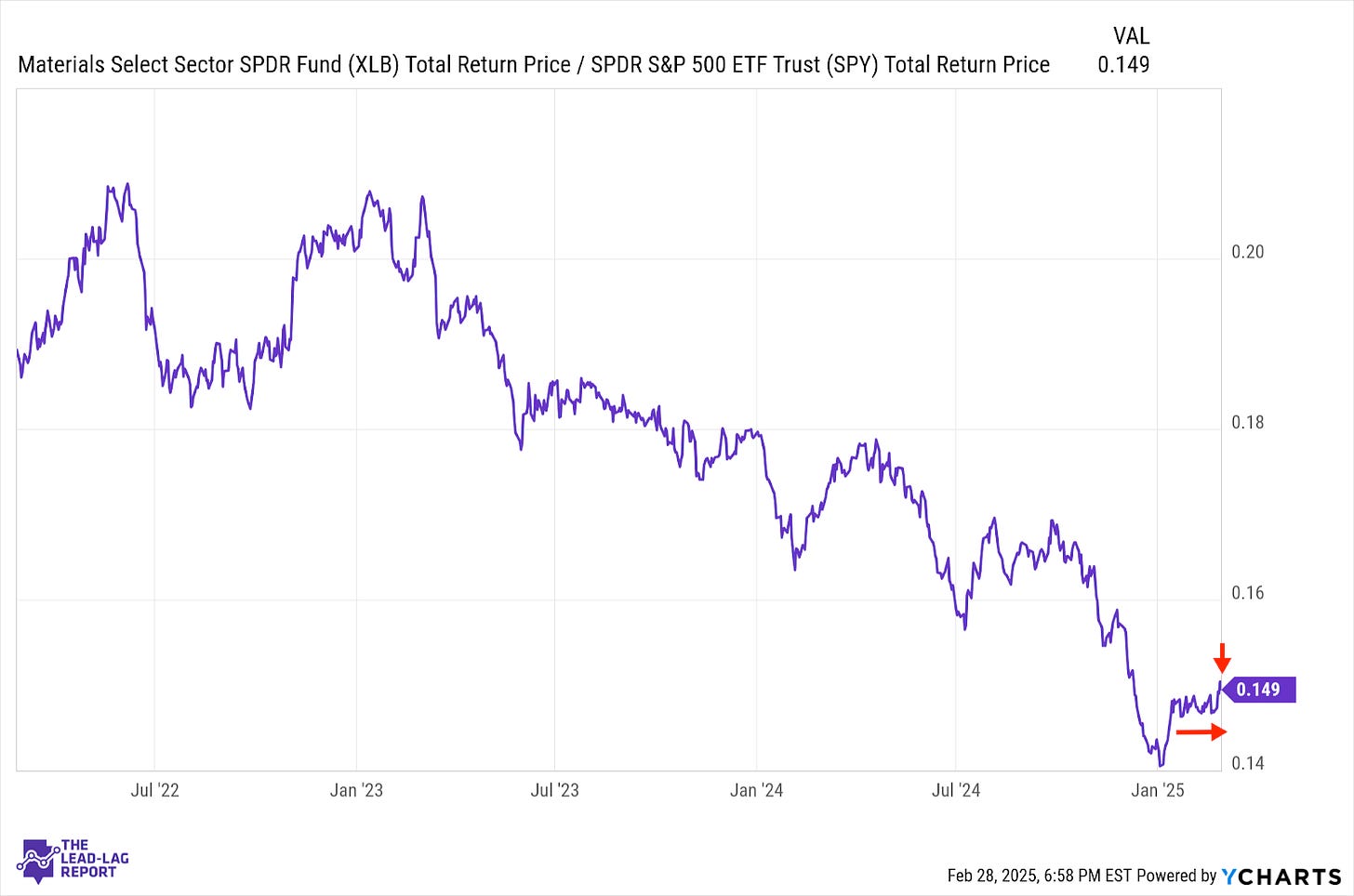

Materials (XLB) – Relative Value Is Paying Off

The news hasn’t necessarily been good for cyclicals, but we are seeing the relative value in some of these sectors paying off. The environment may quickly get worse here, but the manufacturing sector is actually holding up and China might actually be in the very early stages of turning the corner. If the U.S. continues to slow, I don’t know how far I’d go in saying that there’s opportunity here, but there’s a very reasonable chance of this sector outperforming the S&P 500.

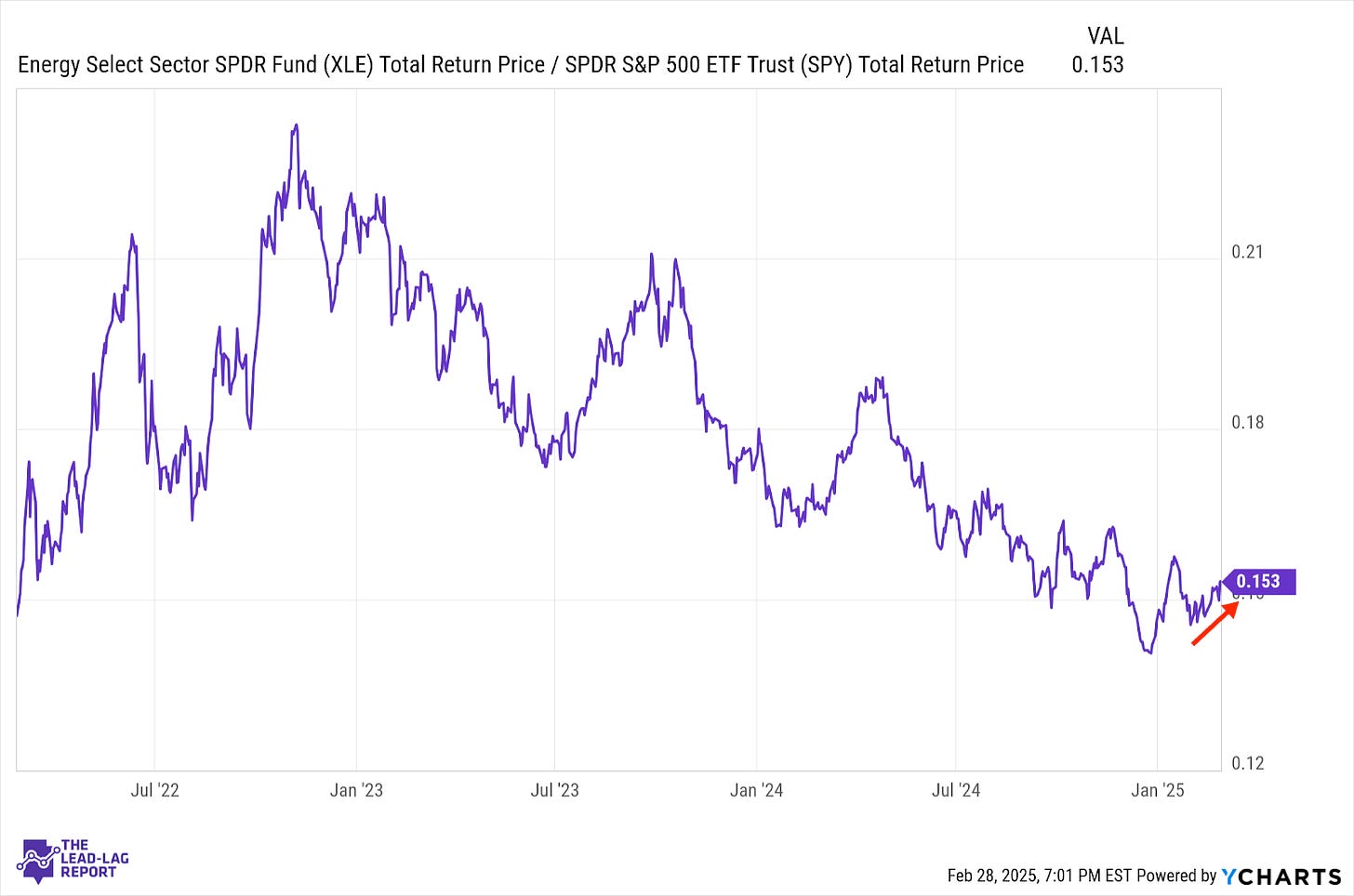

Energy (XLE) – Still Working On The Bull Case

Energy has been a solid outperformer over the past month as crude oil and natural gas demand is expected to pick up and manufacturing shows some signs of life. Geopolitics is playing a part in the overall outlook and that’s likely to result in some extra volatility, but there’s some reason for short-term optimism even if there still isn’t an outright bull case.

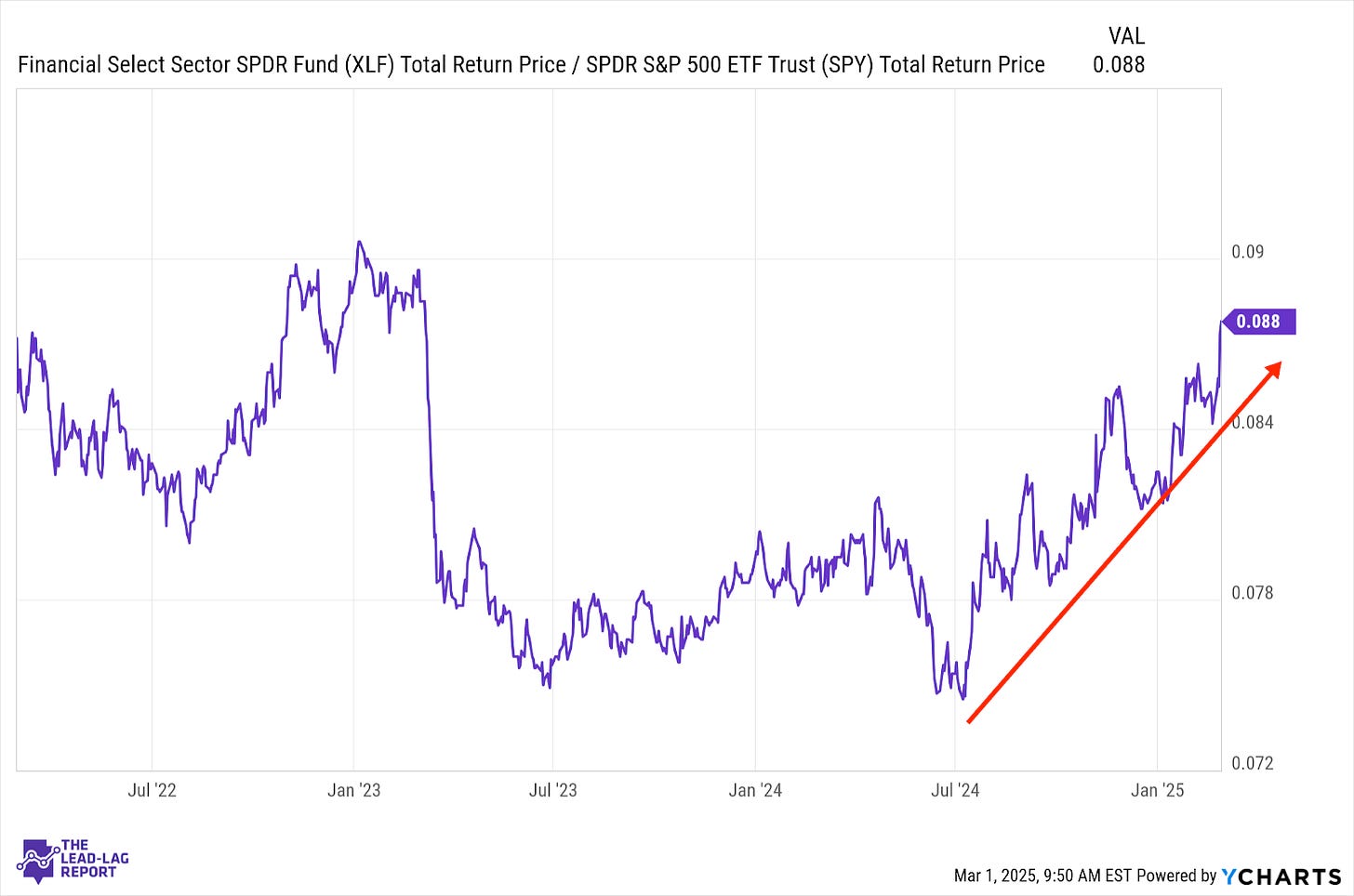

Financials (XLF) – Dereg Tailwind

There have been ups and downs, but financials overall have been in an 8-month long uptrend. Plus, this ratio is now virtually all the way back to its pre-regional banking crisis highs. I think there’s definitely a deregulation tailwind helping out this sector, but the macro obstacles are starting to pile up.

Utilities (XLU) – Pushing Higher For Longer

Utilities have pretty consistently been signaling risk-off throughout 2025 and that trend appears to remain firmly in place. This sector has had periods of leadership over the past year, but it’s often had to go it alone. Now that it’s getting the support of other defensive sectors, value, low volatility and Treasuries, there’s a good chance that this trend has an opportunity to push higher for longer.

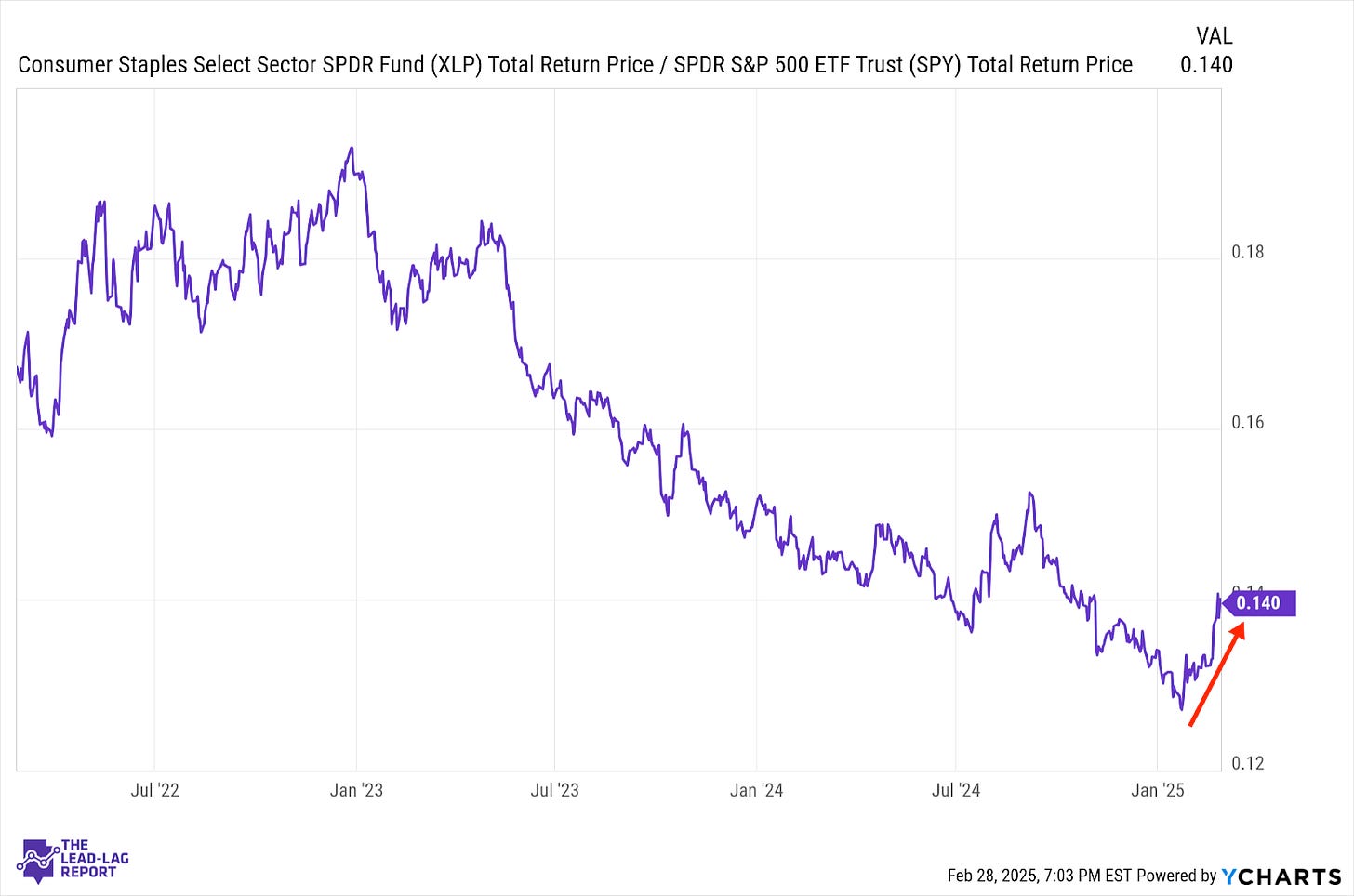

Consumer Staples (XLP) – Plenty Of Room To Run

Consumer staples had been a steady laggard throughout the past couple years, but those days are clearly gone. Given that this is perhaps the most traditionally defensive looking sector of the market, the sharp uptrend is confirming the overall negative sentiment surrounding this market. We’re still only at the base of the reverse yen carry trade bounce from the 2nd half of last year, so I think there’s plenty more room for this group to run.

Health Care (XLV) – Something Larger Brewing