Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE DECEMBER SURPRISE: EXTRA VOLATILITY FOR THE HOLIDAYS TO SET UP 2025

Consumer Discretionary (XLY) – Winners Pull Back To Finish The Year

A bit of extra volatility last week has begun pulling some previous winners back down to finish off the year. Even though consumer spending still seems to be growing at a reasonable rate, it’s impossible to ignore the underlying credit challenges that still exist. Holiday sales will probably take over the consumer narrative in the near-term, but I imagine that with the re-emergence of inflation, consumer behavior starts to show signs of weakness.

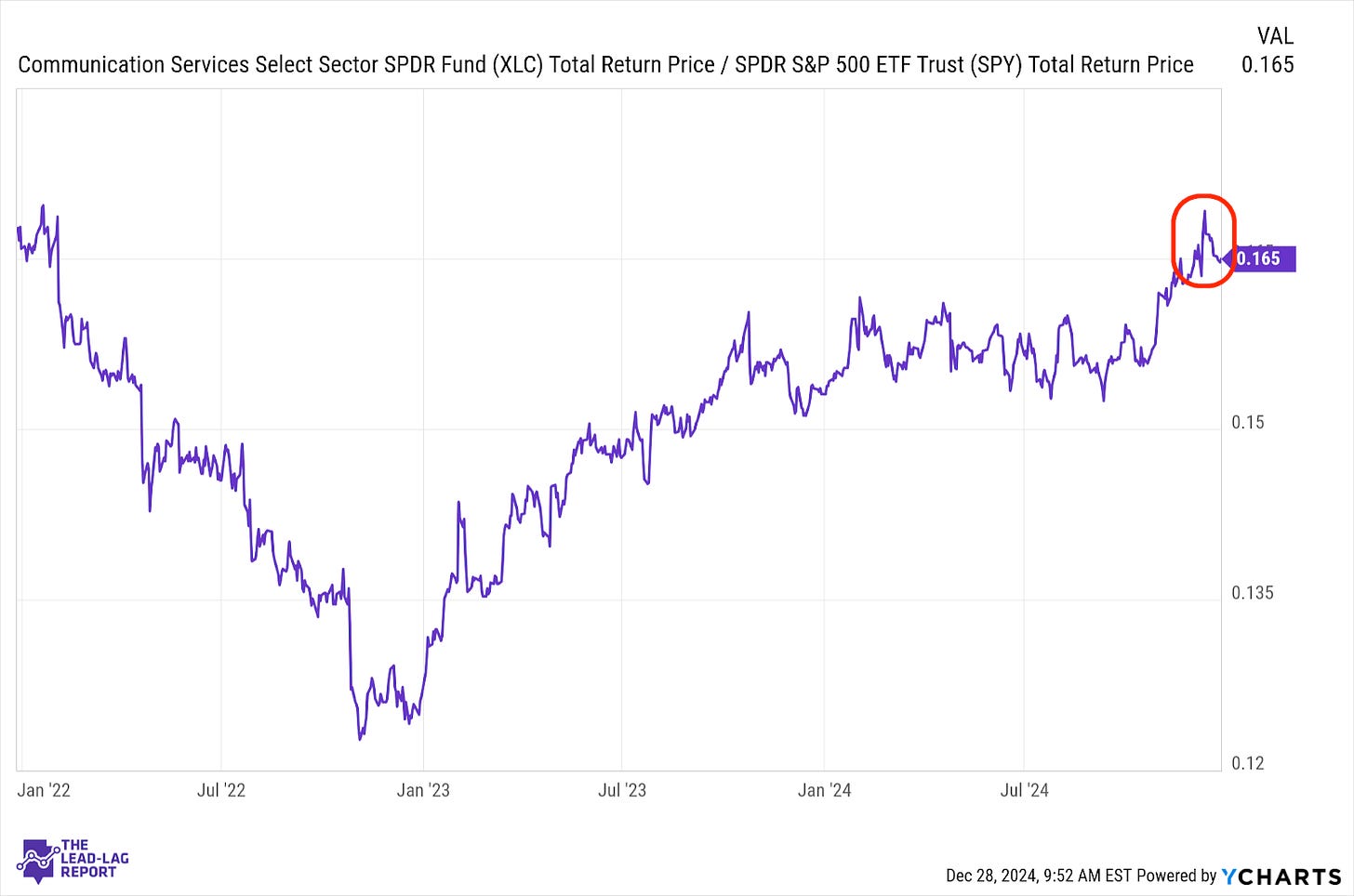

Communication Services (XLC) – Top Heaviness Masks Some Weakness

This sector is positioned to finish 2024 as the best performer, although narrow leadership is masking some underlying weakness. The equal weight version of this sector trailed the cap-weighted version by 17%, thanks to a big year for Facebook and modest outperformance by Alphabet. The traditionally more defensive telecoms were certainly a drag in a year that didn’t favor conservative equities.

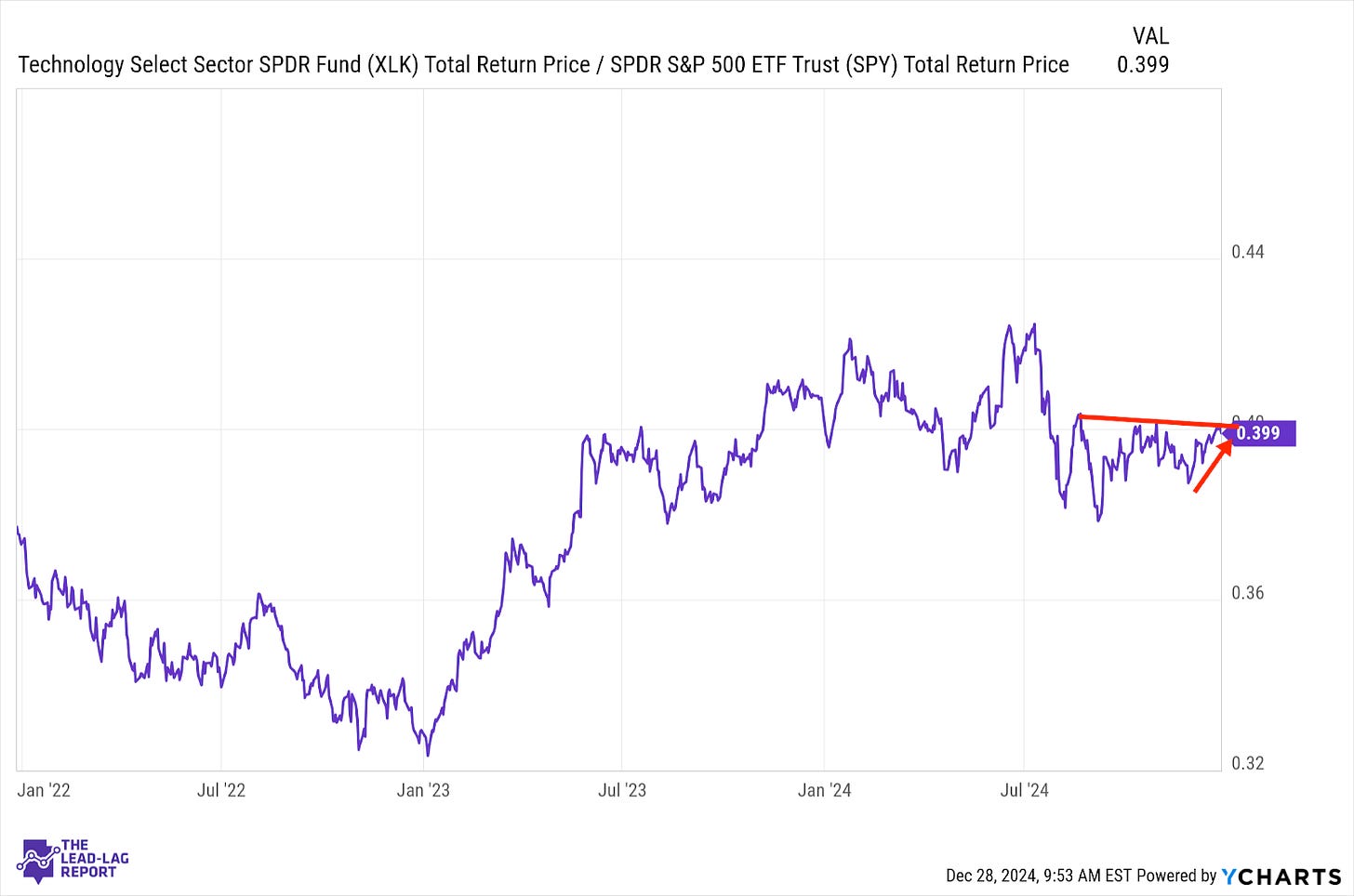

Technology (XLK) – The AI Revolution Could Extend Mega-Cap Gains

Tech has managed to outperform the S&P 500 in recent weeks, but it’s been struggling to recapture its previous leadership for nearly two years. The AI revolution could produce continued strength from the mag 7 stocks, but valuations are starting to get stretched. All of that infrastructure spending will need to pay off or we could see an unwind of some of those gains tied to AI potential.

Junk Debt (JNK) – Conditions Ready To Get Priced In

Junk bonds are approaching a potential inflection point. The rally in relation to Treasuries has progressed virtually non-stop (save for the pullback around the yen carry trade unwind) for nearly two years. Now, junk bonds may be topping as credit spreads begin moving higher. There’s a fairly easy argument to be made that conditions for lower-grade credit are already challenged, but high inflation and few, if any, Fed rate cuts could finally see that getting priced in.

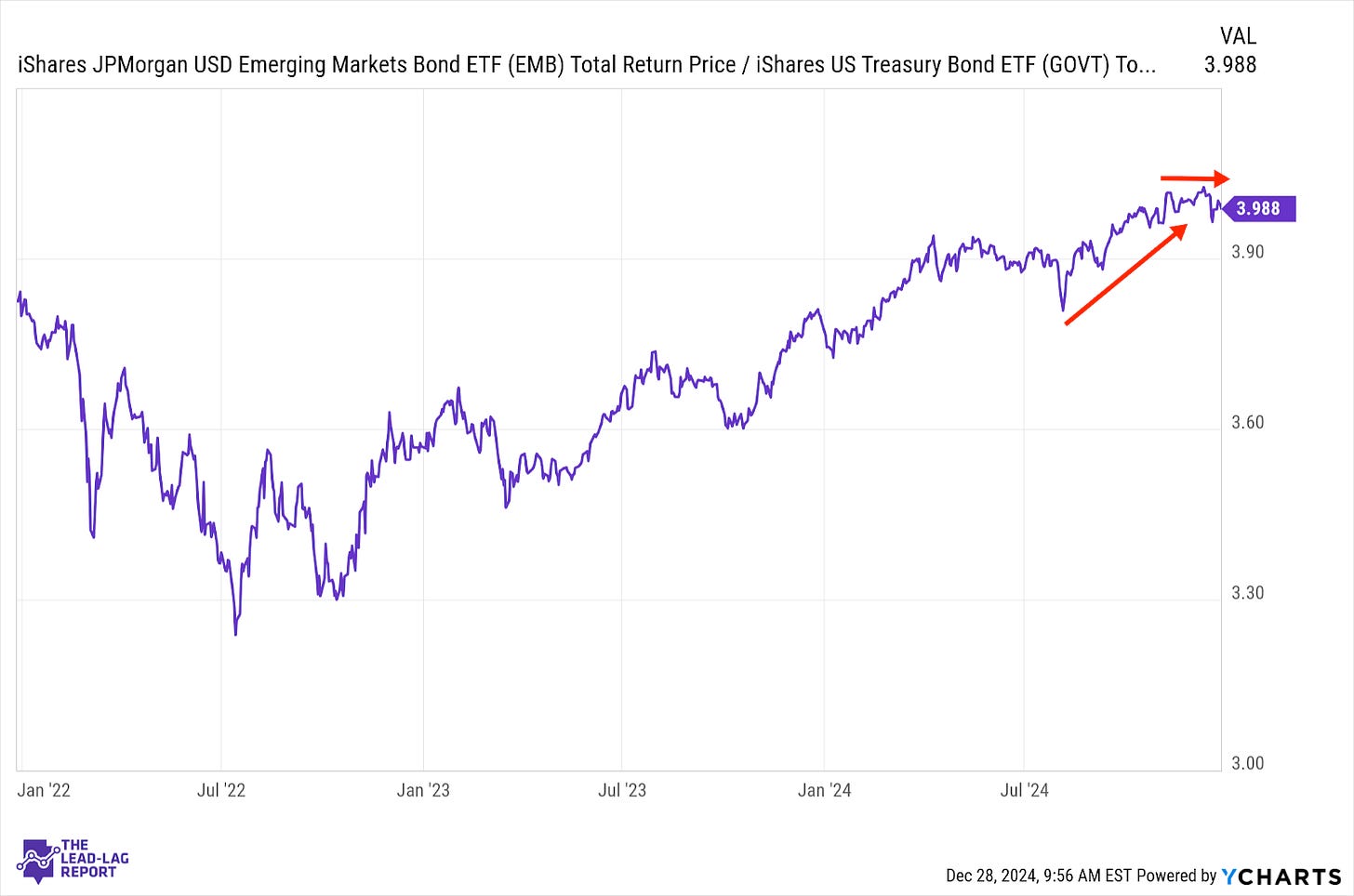

Emerging Markets Debt (EMB) – Depends On U.S. Policy

After a banner 2024, EM debt might be losing a bit of steam. Thanks to an overall improvement in credit quality, general outperformance from lower quality bonds and some central bank assistance, emerging markets bonds delivered one of the better performances in the fixed income space. This coming year could depend heavily on U.S. foreign policy and whether tariffs and other measures begin to hinder overseas economic growth.

U.S Dollar ($USD) – Further Gains Ahead