A year-end rally is gaining momentum as investors respond to cooler bond yields and a growing belief that the Federal Reserve is prepared to ease policy soon. Equity benchmarks have climbed toward record highs, helped by strong technology earnings and a broad pullback in Treasury yields. Nvidia’s latest results underscored how dominant the AI cycle remains, with revenue and profit topping expectations and lifting the broader tech complex.³

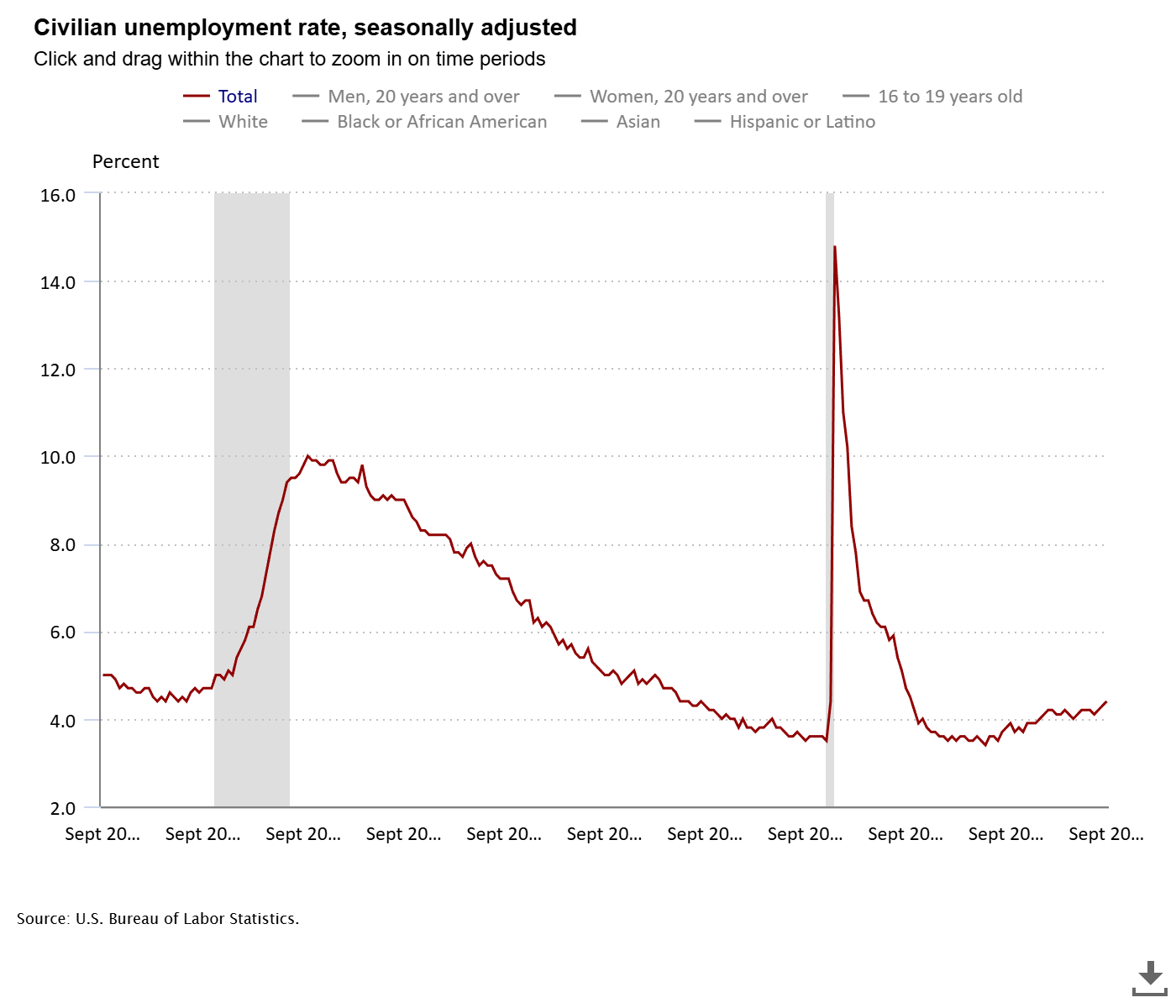

Beneath the optimism, the macro picture looks less convincing. Unemployment has drifted higher, layoffs have accelerated, and retail indicators point to consumer fatigue.⁵ Recent Fed minutes reflected a divide: some officials questioned moving too quickly, while others argued that a weakening labor market justified further easing.¹ Futures markets now largely expect a December cut as disinflation continues and growth slows.

This tension—rising asset prices amid deteriorating fundamentals—has produced a striking split: heavy inflows into equities alongside record cash balances. Money market funds now hold more than $7.5 trillion,⁴ suggesting many investors are participating in the rally while still hedging against downside risks. Volatility remains subdued, but the fragility beneath the surface keeps an undercurrent of caution alive.

Rotation Signals a Preference for Stability

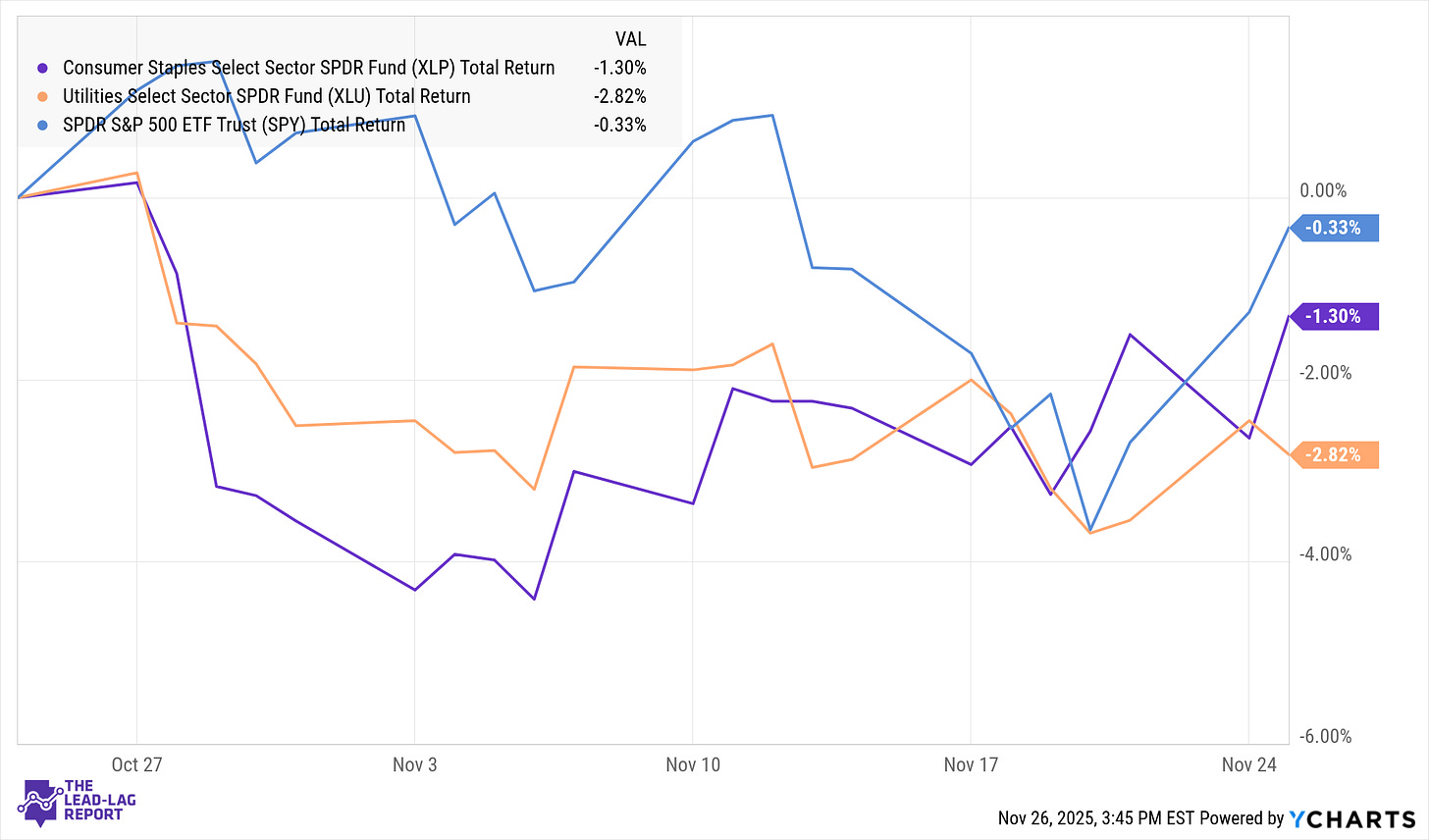

Equity leadership remains concentrated in mega-cap technology and communication services, while smaller companies have narrowed the gap only modestly. Growth stocks continue to outperform as falling yields boost longer-duration assets. Defensive sectors have also shown signs of life. Utilities and consumer staples—two groups that lagged for much of the year—have attracted renewed interest as investors quietly probe for safety.⁵

Factor behavior suggests a similar tone. Low-volatility and high-dividend stocks have outperformed high-beta names in recent weeks,⁵ even as headline indices press higher. The pattern is consistent with late-cycle positioning: stay invested, but maintain ballast.

Europe Sees Stability, but Only in Moderation

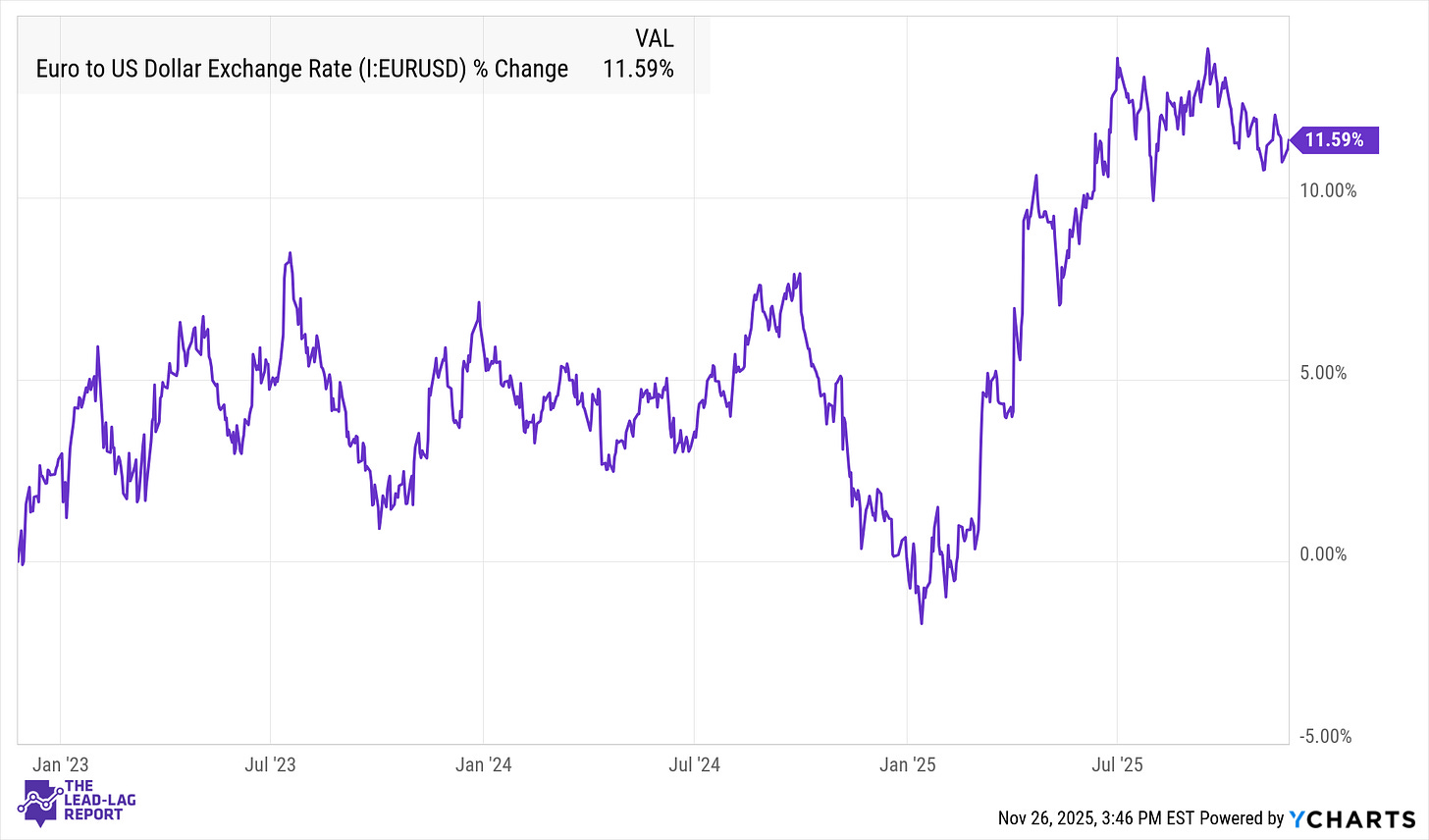

Across the eurozone, the macro environment is slowly improving. Recent PMI data shows modest expansion, led by the services sector, while inflation has cooled back toward the ECB’s 2% target.⁷ With this progress, the central bank has held policy steady and signaled that the tightening cycle is likely finished.⁸

A stronger euro has reinforced the sense of stability. EUR/USD recently touched multi-month highs,¹⁶ supported by fading recession fears and a weaker U.S. dollar. Equity markets have responded positively, helped by lower energy prices and reduced concerns about a deep downturn. Still, expectations for 2026 growth remain modest.

The UK Leans on Fiscal Tightening for Credibility

Britain’s latest budget took center stage as officials attempted to restore fiscal credibility after a turbulent period in U.K. markets. The plan emphasized tax increases and deficit reduction, helping to steady gilt yields and lifting sterling above $1.32.² Investors had braced for a more disruptive outcome, so the relief was immediate.