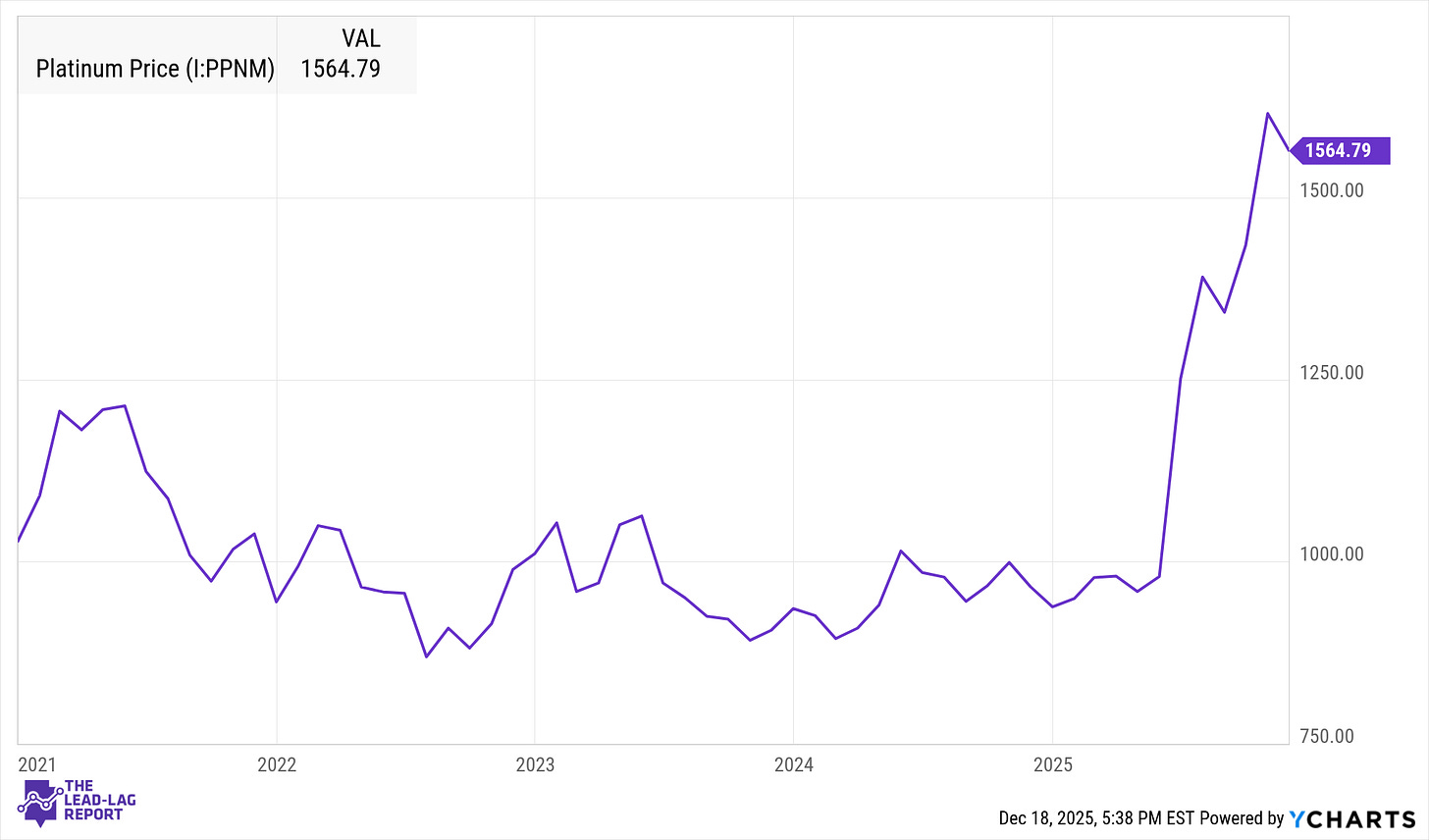

After spending much of the past decade in relative obscurity, platinum has re-emerged as one of the strongest performers in the precious-metals complex. Since late 2024, prices have risen sharply, outpacing both gold and broader equity markets as investors return to hard assets amid persistent inflation and rising geopolitical risk.¹ This move is not the result of speculative enthusiasm alone. Instead, it reflects a convergence of structural supply constraints, renewed industrial demand, and a macroeconomic backdrop that increasingly favors scarce real assets.

At the center of platinum’s resurgence is a market that remains structurally undersupplied. The World Platinum Investment Council estimates that global platinum supply will fall short of demand by nearly one million ounces in 2025, extending a deficit that has now persisted for several consecutive years.² With roughly four-fifths of global production concentrated in South Africa, chronic power shortages, labor disruptions, and underinvestment in new capacity have left supply fragile and highly sensitive to disruption.³

At the same time, demand dynamics have quietly shifted in platinum’s favor. Automotive catalysts remain the largest end market, and recent policy and economic developments have slowed the pace of electric-vehicle adoption in key regions. Each incremental reduction in EV penetration translates into incremental demand for platinum group metals, as internal-combustion engines continue to rely on catalytic converters.⁴ Beyond autos, platinum demand is expanding in electronics, chemical processing, and hydrogen-related technologies, while jewelry demand, particularly in China, has rebounded as consumers seek alternatives to elevated gold prices.⁵

Together, these forces have created a market in which inventories are thin, substitution is limited, and marginal supply is increasingly expensive. For miners, that combination can be powerful.

A Valuation Gap Still Intact

Despite its recent price gains, platinum remains historically undervalued relative to gold. On a long-term basis, platinum has typically traded at a premium to gold. Today, it trades at a steep discount, with the platinum-to-gold ratio well below its historical average.⁶ This gap reflects years of investor neglect rather than an absence of fundamental support.

Equities tied to platinum production mirror this disconnect. Many platinum group metal producers continue to trade at single-digit EV-to-EBITDA multiples, discounted net asset values, and depressed enterprise-value-per-ounce metrics. In several cases, balance sheets have improved meaningfully since the last cycle, yet valuations still reflect skepticism shaped by the metal’s long period of underperformance.

Macro conditions add another layer of support. Inflation remains above target in much of the developed world, while fiscal deficits continue to widen. Central banks, constrained by debt dynamics and economic fragility, appear increasingly tolerant of elevated inflation. This environment has historically favored scarce, real assets, and platinum has begun to reassert itself alongside gold and silver as part of that trade.⁷

Established Producers with Leverage to the Cycle

Among large and mid-cap producers, several companies stand out for their scale, balance-sheet strength, and direct exposure to platinum pricing.