Powell Under Fire: How the DOJ’s Criminal Inquiry Could Shake the Fed’s Independence—and Ignite a Gold Super Spike

Key Highlights

The DOJ’s criminal inquiry into Fed Chair Jerome Powell marks an unprecedented challenge to Federal Reserve independence.¹

Powell argues the investigation is a political pretext tied to pressure for interest-rate cuts rather than genuine misconduct.²

Market confidence in U.S. monetary institutions is central to dollar stability and orderly financial conditions.

Perceived erosion of Fed autonomy introduces a new category of political-monetary risk for investors.

Gold has emerged as a primary hedge against declining institutional trust and policy credibility.³

An Unprecedented Challenge to the Federal Reserve

Late Sunday evening, financial markets were confronted with a headline few observers ever expected to see: the U.S. Department of Justice had opened a criminal inquiry into Federal Reserve Chair Jerome Powell.¹ The investigation places the nation’s top central banker under legal scrutiny at a moment when political tensions surrounding monetary policy are already elevated. While the details may appear technical, the implications are anything but abstract. This episode cuts to the core of how U.S. monetary policy is governed and how insulated it remains from political pressure.

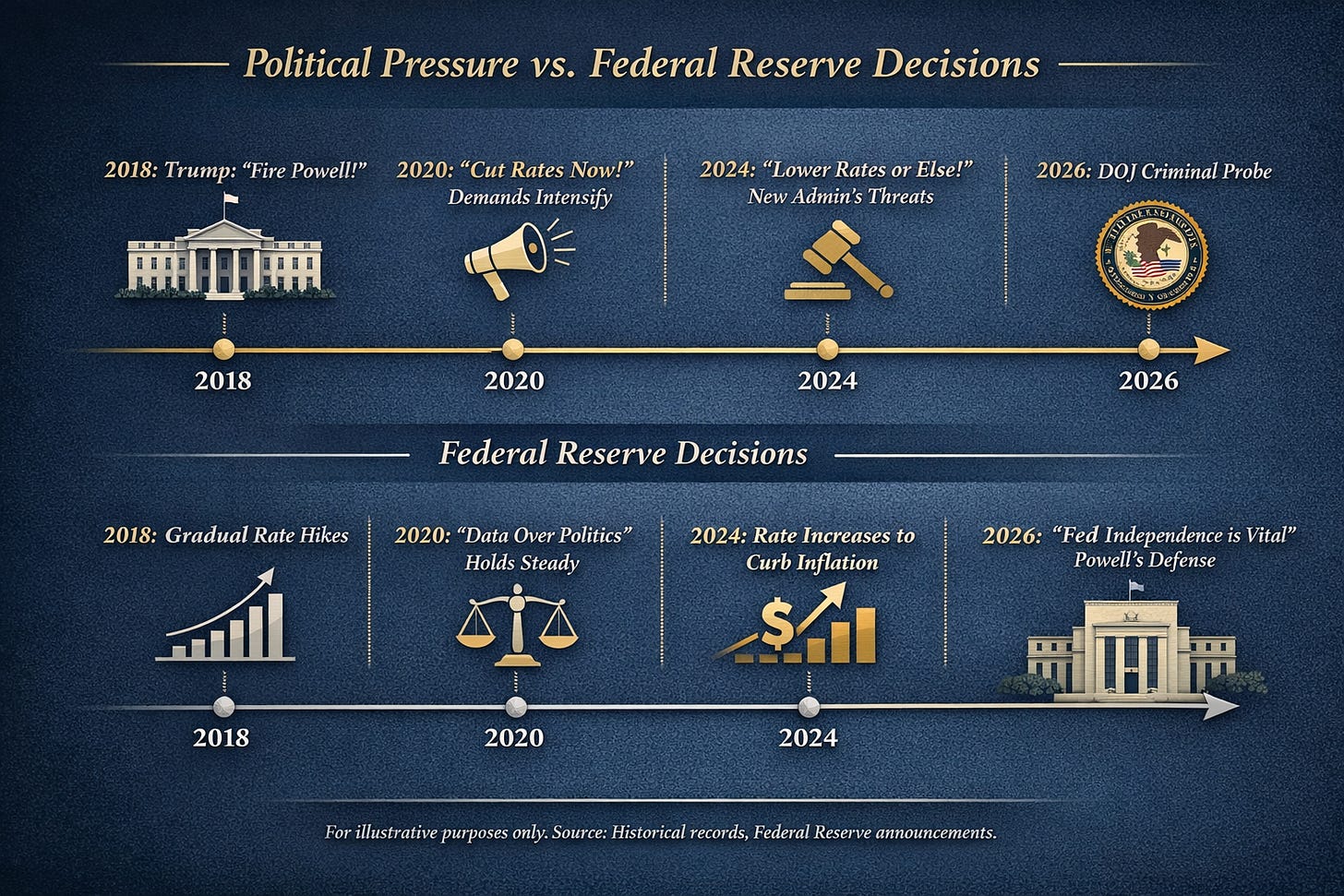

Powell has spent much of his tenure navigating criticism from elected officials while maintaining the Fed’s posture as a data-driven institution. That balancing act has grown more precarious with renewed public attacks on the central bank for resisting rapid interest-rate cuts. The current inquiry, announced as Powell’s term approaches its conclusion, raises fundamental questions about whether the traditional boundaries separating fiscal power, prosecutorial authority, and monetary independence are beginning to blur.¹

The DOJ Investigation and Its Political Context

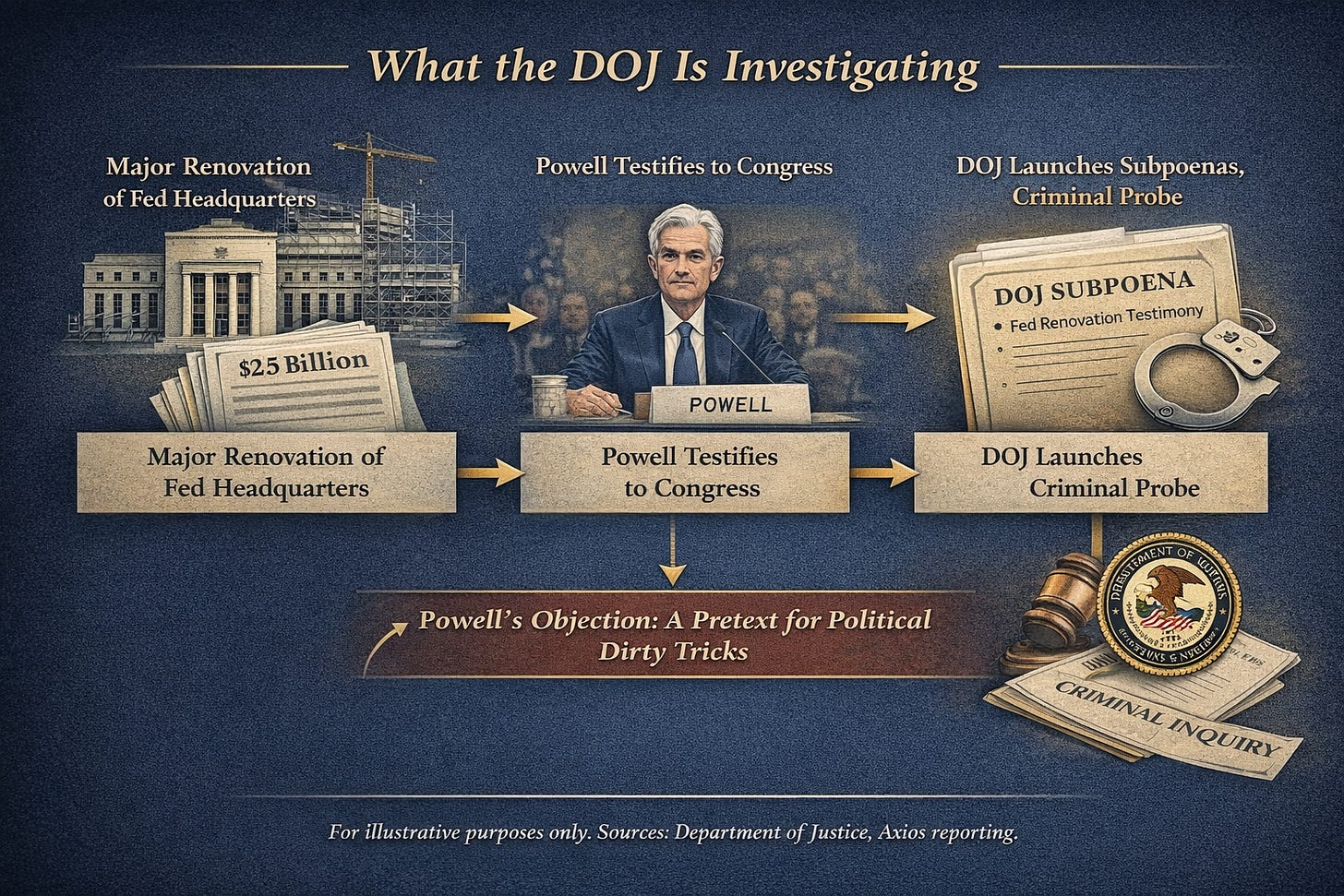

At the center of the inquiry is a costly renovation of the Federal Reserve’s historic Washington headquarters. Prosecutors are examining whether Powell misled Congress regarding the scope and cost of the project during prior testimony.² While cost overruns have drawn bipartisan scrutiny, the investigation’s timing has unsettled markets. The Department of Justice has reportedly issued subpoenas related to Powell’s statements, escalating the matter beyond routine oversight.⁴

Powell has not denied that the renovation exceeded initial estimates. Instead, he has publicly challenged the motivation behind the probe. In a rare and unusually direct statement, Powell argued that the inquiry represents an effort to intimidate the central bank following policy decisions that were politically unpopular.² He characterized the renovation issue as a pretext, asserting that the real dispute centers on the Fed’s refusal to adjust policy in response to political demands rather than economic conditions.²

The administration has rejected claims of political interference, maintaining that the investigation reflects a broader mandate to enforce accountability across federal institutions.¹ Yet concern has spread beyond partisan lines. Some lawmakers have warned that using prosecutorial pressure against the Fed risks undermining one of the most important institutional safeguards in the U.S. financial system.¹

Why Federal Reserve Independence Matters

The Federal Reserve’s credibility rests on its perceived ability to act independently of short-term political interests. Monetary policy affects inflation expectations, currency stability, borrowing costs, and financial market confidence. When markets believe that policy decisions are insulated from electoral cycles, long-term planning becomes easier and volatility tends to remain contained.

History offers cautionary lessons. Periods in which political pressure constrained central banks have often coincided with persistent inflation, distorted capital allocation, and currency instability. These outcomes are not theoretical concerns. Global investors closely monitor institutional integrity, particularly in reserve-currency economies. The dollar’s role in the global financial system depends not only on economic scale but also on confidence in policy discipline.³

If market participants begin to question whether U.S. monetary policy can be influenced through political or legal pressure, risk premiums can rise across asset classes. That erosion of confidence does not require a formal policy shift to have consequences. Uncertainty alone can reshape investor behavior.

Market Implications of Institutional Risk

The investigation into Powell introduces a new variable into financial markets: perceived political-monetary risk. While markets have weathered political disputes before, direct legal action involving a sitting Fed Chair is without modern precedent. The concern is less about the outcome of any single case and more about the precedent it may establish.

Should investors conclude that future Fed officials could face legal consequences for policy decisions that conflict with political priorities, the incentive structure governing monetary policy could change. Such a shift would likely increase inflation risk premiums and weaken confidence in long-duration financial assets tied to stable policy expectations.³

This dynamic helps explain why markets have reacted not only through traditional risk channels but also through renewed interest in assets viewed as independent of institutional credibility. Currency markets, sovereign debt, and alternative stores of value all reflect sensitivity to changes in trust rather than changes in economic data alone.

Gold as a Hedge Against Policy Credibility Risk

Gold’s recent strength reflects more than cyclical factors. It has increasingly functioned as a hedge against institutional uncertainty. Unlike financial assets that depend on confidence in government policy or legal frameworks, gold derives value from scarcity and global acceptance. That characteristic becomes especially relevant when concerns emerge about monetary governance.