We focus a lot on the potential impact of consumers running out of gas and dialing back spending. U.S. retail sales demonstrated resilience once again in July with a 1% month-over-month gain, but credit card “serious” delinquencies hit their highest level in more than 10 years.

While the consumer is usually the driver of economic activity and is likely to again this time around, there’s one area of the market that looks like it could be particularly vulnerable to a major credit event - the private credit market.

What is Private Credit?

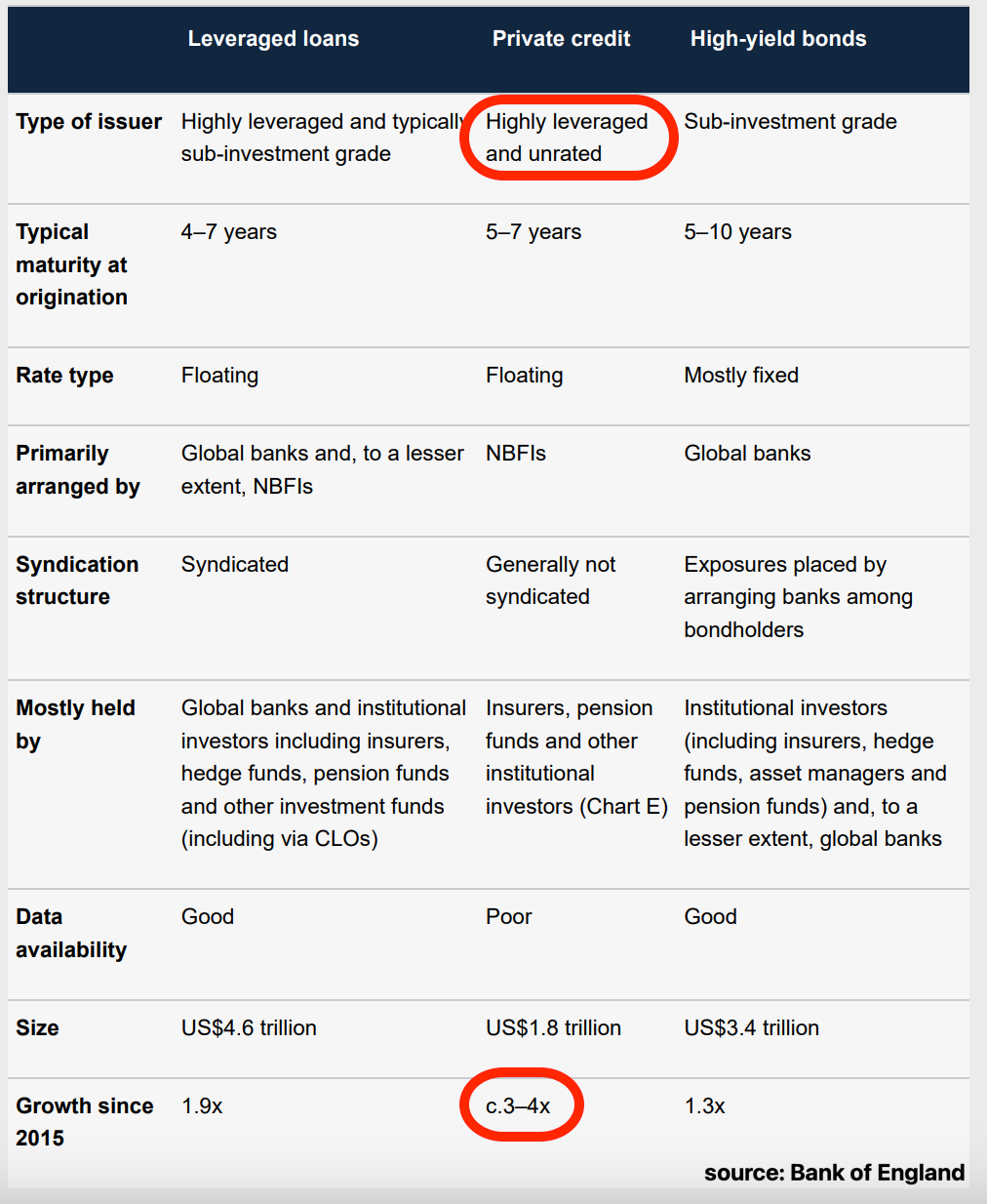

Private credit has become synonymous with non-bank lending. Companies typically look to access the private credit markets when they’re either too small or too risky to utilize the public debt markets. Senior loans and leveraged loans generally fall under the umbrella of private credit, but private credit can include other types of debt beyond just those two categories.

The risk profile of private credit tends to also look very similar to that of leveraged loans and publicly traded junk bonds.

There are a couple of factors in this graphic that directly relate to how potentially dangerous the private credit market is.