Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: UTILITIES QUIETLY START TO LEAD

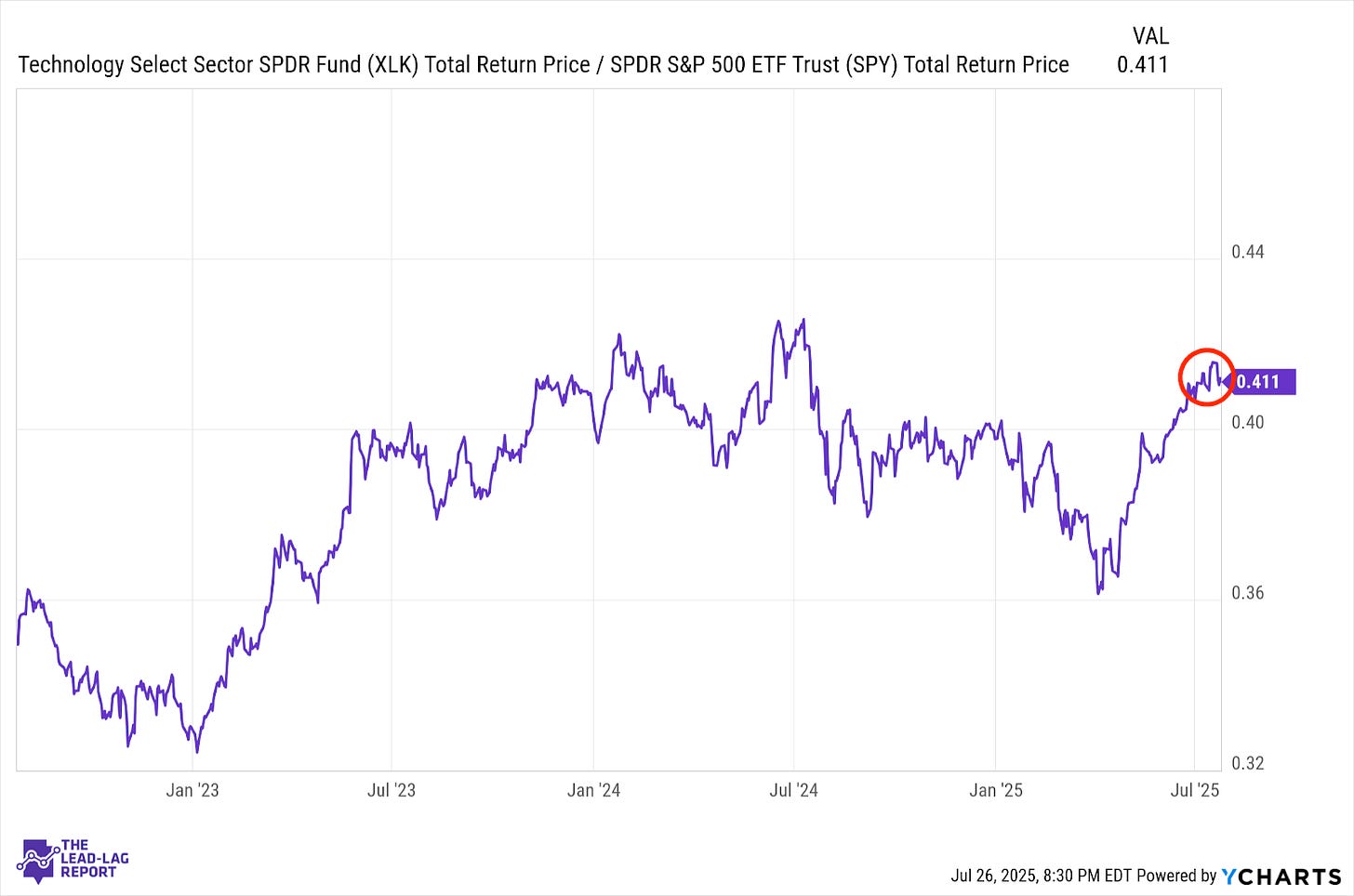

Technology (XLK) – Here Come The Mag 7 Earnings

Tech’s relative strength has started to cool a bit after a months-long run at the front of the market. Earnings have been mostly solid, but the mag 7 names will be coming this week. Overall, we’re seeing a quiet rotation into more balanced or value-heavy parts of the market. That said, there’s still no obvious sign of a broad breakdown here, but this week’s earnings could provide the next direction.

Industrials (XLI) – A Rebound In The Data

Industrials have quietly started to regain some footing after a shaky stretch, helped by a slight rebound in the June ISM manufacturing index and a strong recovery in factory orders. The recovery could be influenced by a modest shift in tone as investors start to reconsider the sector’s role if the economy keeps progressing without falling into recession.

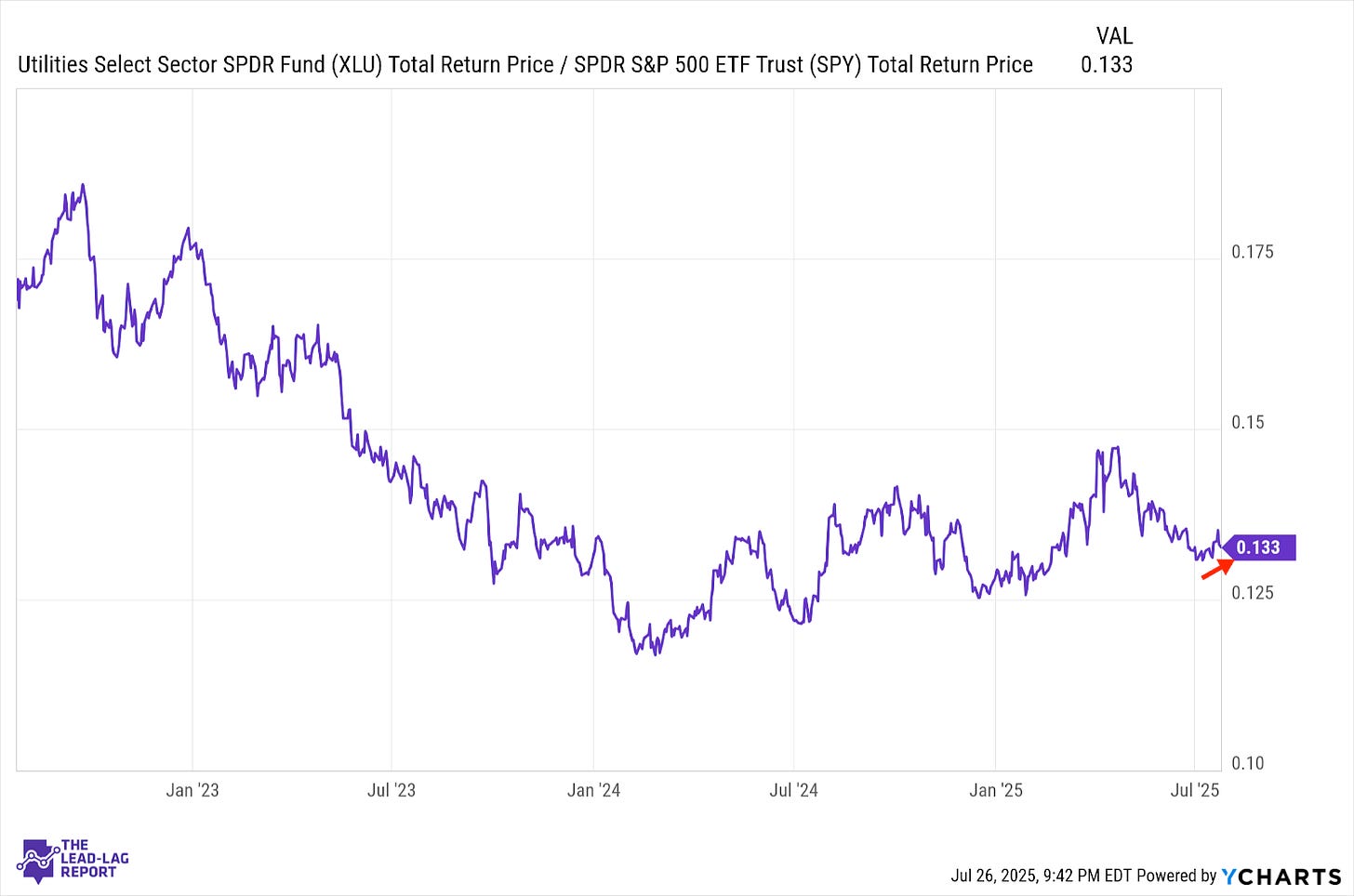

Utilities (XLU) – Quietly Signaling A Risk-Off Shift

The utilities signal flipped to risk-off this week, a move that probably slipped under the radar given the string of new highs being set by the S&P 500. The move hasn’t been dramatic, but the ratio is starting to tick modestly higher, hinting at a shift in tone as the market gets a little more cautious. We’ve been seeing this across a lot of the major risk-off themes, so following through this week could be an interesting development.

Treasury Inflation Protected Securities (SPIP) – Trade Deals Ease Concerns

Inflation concerns increased as the Trump administration’s August 1st tariff deadline approached. Now that we’ve seen some form of trade deal with both Japan and the European Union, those inflation bets appear to be getting walked back. The latest CPI data shows overall inflation on the rise, but the upside may be capped now that there’s clarity in place for some of the world’s larger regions.

Junk Debt (JNK) – Credit Risk Getting Minimized Again

The bond market, save for a few isolated periods, hasn’t really been pricing in credit risk for a while. With tariff risk, one of the market’s biggest wildcards over the past six months, now looking like it could be on the downswing, there may be new support for investors’ belief that credit risk still isn’t an issue.

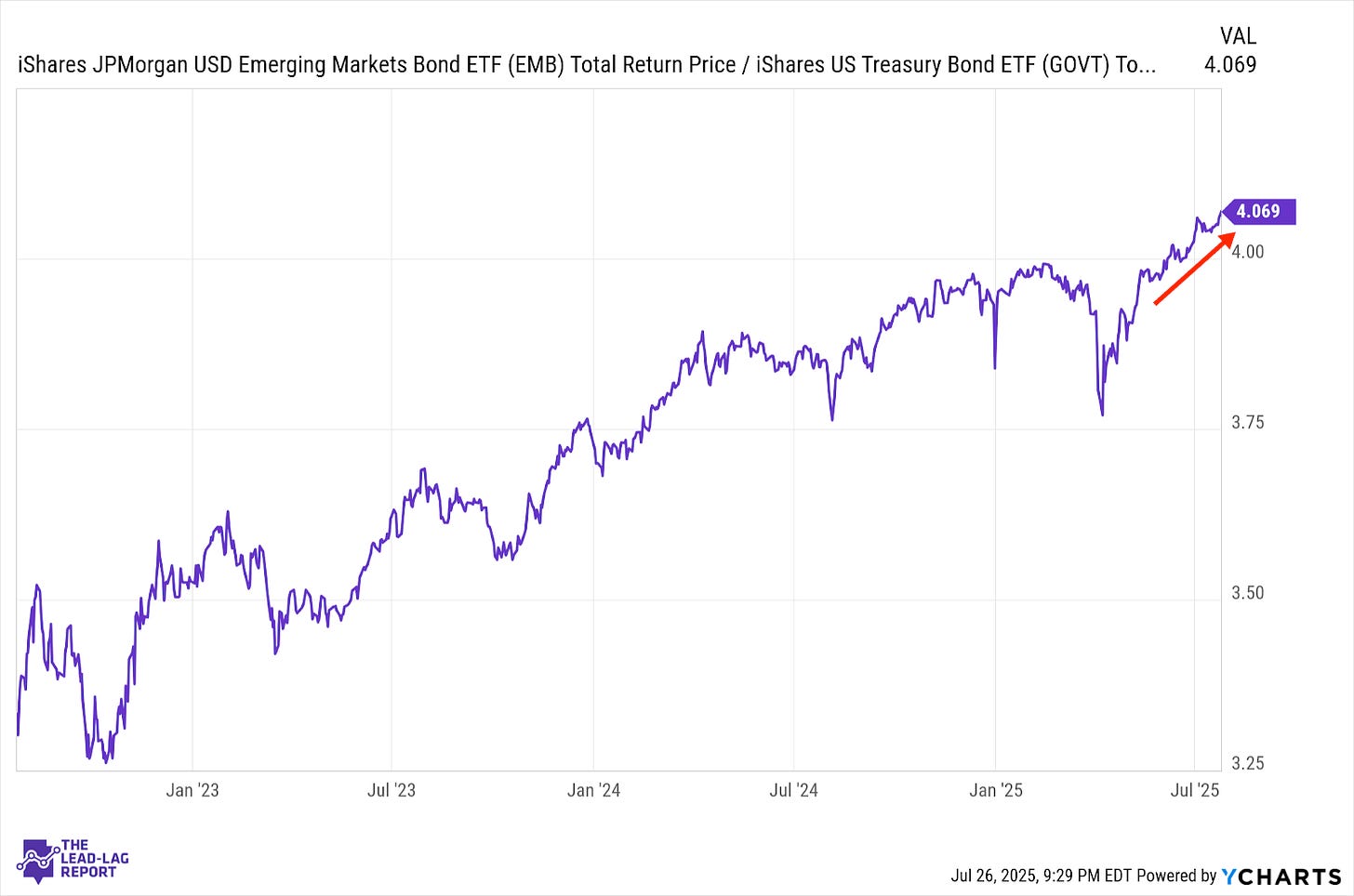

Emerging Markets Debt (EMB) – Positive Sentiment In Place

Emerging markets debt has pretty steadily outperformed Treasuries, even though there’s been short-term volatility with the dollar. With trade tensions looking like they could begin easing further here and the U.S. & China looking for their own trade agreement (or at least an extension of the current delay), it appears that positive sentiment is pretty firmly in place.

European Banks (EUFN) – ECB Pause Could Be A Turning Point