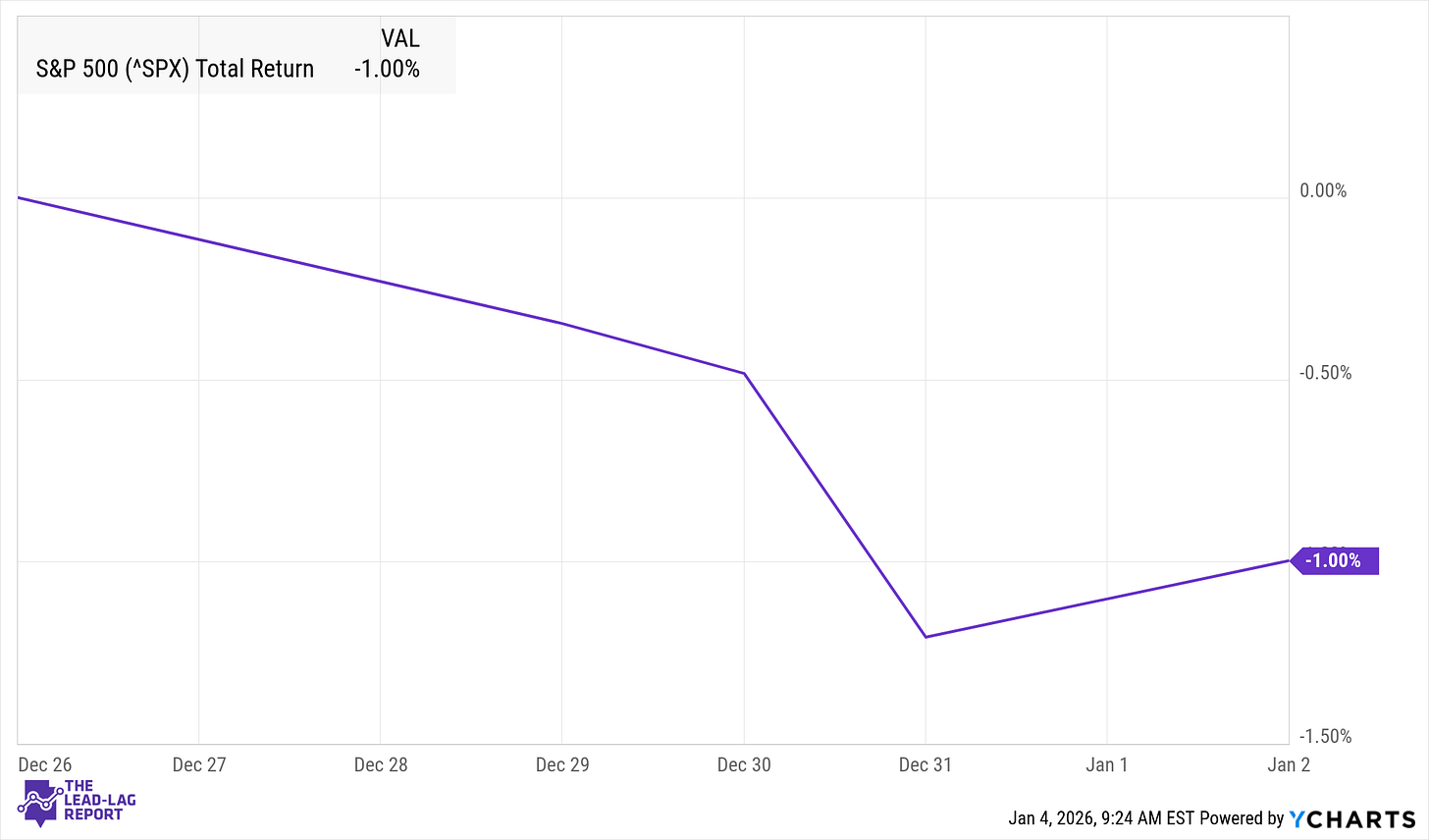

Major markets closed the year on an uneasy note as a thinly traded, holiday-shortened week delivered a reality check to 2025’s late-cycle rally. The S&P 500 slipped roughly 1% for the week, its first weekly decline in five weeks, while the Nasdaq fell closer to 1.5% amid renewed profit-taking in the year’s biggest winners.¹ A four-day equity losing streak was only interrupted by a modest bounce on Friday, the first trading session of 2026, as investors attempted to reconcile conflicting macro signals. At the center of that tension sat the Federal Reserve. Minutes from the December FOMC meeting revealed deeper divisions than markets had anticipated and hinted that rate cuts in 2026 may be far more limited than bullish investors had hoped.² Bond yields drifted higher, the U.S. dollar remained firm near recent highs, and even gold, one of 2025’s standout performers, retreated from record levels as the year drew to a close.³ The final trading week of the year served as a reminder that monetary policy, not sentiment alone, continues to anchor asset prices.

Fed Caution Returns to the Forefront

The tone of the Fed minutes stood in sharp contrast to the optimism that fueled markets into year-end. While policymakers did approve a third consecutive rate cut in December, lowering the benchmark rate to the 3.5–3.75% range, the decision was far from unanimous. Several officials expressed concern that inflation’s progress had stalled and acknowledged they could have supported holding rates steady.² The updated projections reinforced that caution, with the Fed signaling only one additional rate cut in 2026, a clear departure from market expectations earlier in the quarter.²

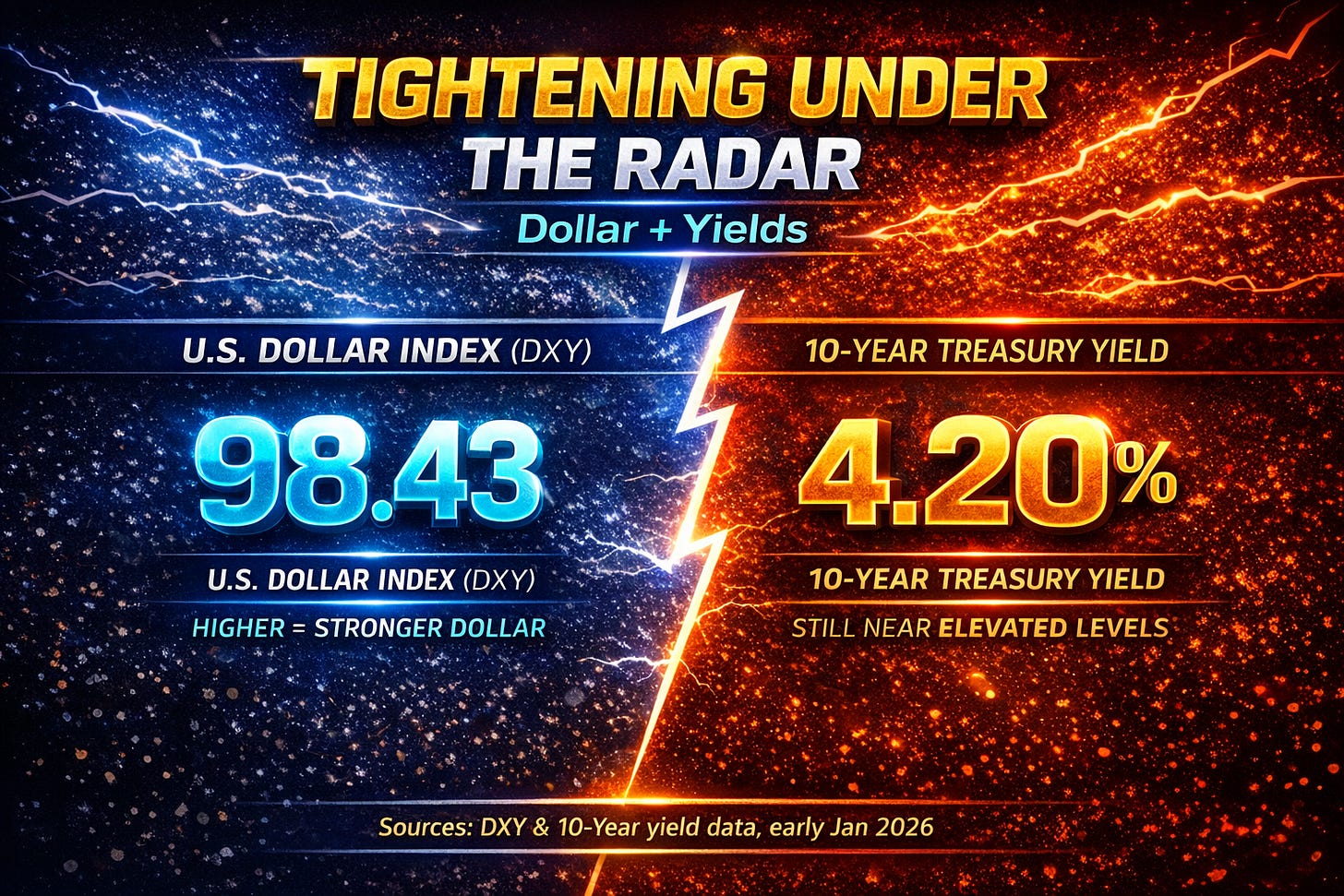

That restraint collided with economic data that continue to show surprising resilience. Weekly jobless claims came in at just 199,000, underscoring a labor market that remains tight despite higher borrowing costs.⁴ Housing data offered a similar mixed message, with home prices surprising to the upside late in the year even as affordability remains strained.³ These dynamics kept the U.S. dollar elevated near the 98 level and nudged the 10-year Treasury yield back toward 4.2%, tightening financial conditions at the margin.³ Equity investors took notice. High-valuation technology stocks, which led much of 2025’s rally, wavered into year-end, with the Nasdaq briefly logging a five-session losing streak before stabilizing.¹ The message from markets was subtle but clear: the Fed may be easing, but it is not rushing toward an aggressive accommodation cycle.

Global Signals: Flickers of Hope, Persistent Friction

Outside the United States, global data offered a mix of cautious optimism and lingering concern. China delivered one of the week’s brighter data points, with the official manufacturing PMI ticking back into expansion territory at 50.1 in December, snapping an eight-month contraction streak.⁵ While economists were quick to caution against reading too much into a single data point, the improvement suggested that stimulus measures may be gaining traction at the margin.⁵ Investor enthusiasm was especially visible in China’s technology sector, where Baidu shares surged after the company announced plans to spin off its AI chip unit via a Hong Kong listing.¹ The move highlighted a recurring theme of late 2025: even as macro indicators struggle to gain momentum, investors remain willing to pay for long-term growth narratives tied to artificial intelligence.