Key Highlights

Markets are pricing in aggressive rate cuts despite persistent inflation risks.

Federal Reserve officials continue to warn against easing policy prematurely.

Commodities and precious metals are signaling renewed cost-push inflation pressures.

Investors may be underprepared for an environment where inflation re-accelerates rather than fades.

Overconfident Markets, Cautious Central Banks

Financial markets have become increasingly confident that interest rate cuts are imminent and inevitable. The prevailing narrative suggests inflation has been subdued enough to allow central banks, particularly the Federal Reserve, to pivot decisively toward easier policy. Equity rallies, declining bond yields, and risk-on positioning all reflect this assumption. Yet beneath the surface, that confidence appears increasingly detached from the underlying economic reality.¹

Federal Reserve communication over recent months has been notably restrained. Policymakers have emphasized that progress on inflation has slowed and that declaring victory would be premature. At the Federal Reserve’s December meeting, dissent among officials underscored this concern. Several policymakers argued that inflation’s descent had stalled and that cutting rates risked reigniting price pressures.² The central bank ultimately reduced rates, but its forward guidance signaled only limited additional easing, a stark contrast to market expectations of a rapid and sustained cutting cycle.²

Core inflation remains stubborn, running above the Fed’s stated target. While headline inflation has cooled from its post-pandemic peak, services inflation and wage growth continue to pose challenges. Atlanta Federal Reserve President Raphael Bostic has been particularly explicit, warning that easing policy too aggressively could destabilize inflation expectations and undermine the Fed’s credibility.³ His message was clear: the costs of acting too soon may outweigh the benefits.

Despite these warnings, markets have largely chosen optimism over caution. Investors appear willing to dismiss inflation risks as transitory or already resolved. According to surveys of global asset managers, many professionals believe inflation risk is being materially underpriced heading into 2026.¹ Strong fiscal spending, resilient consumer demand, and accelerating investment in artificial intelligence infrastructure all threaten to keep price pressures alive longer than markets anticipate.¹

What the Commodities Market Is Signaling

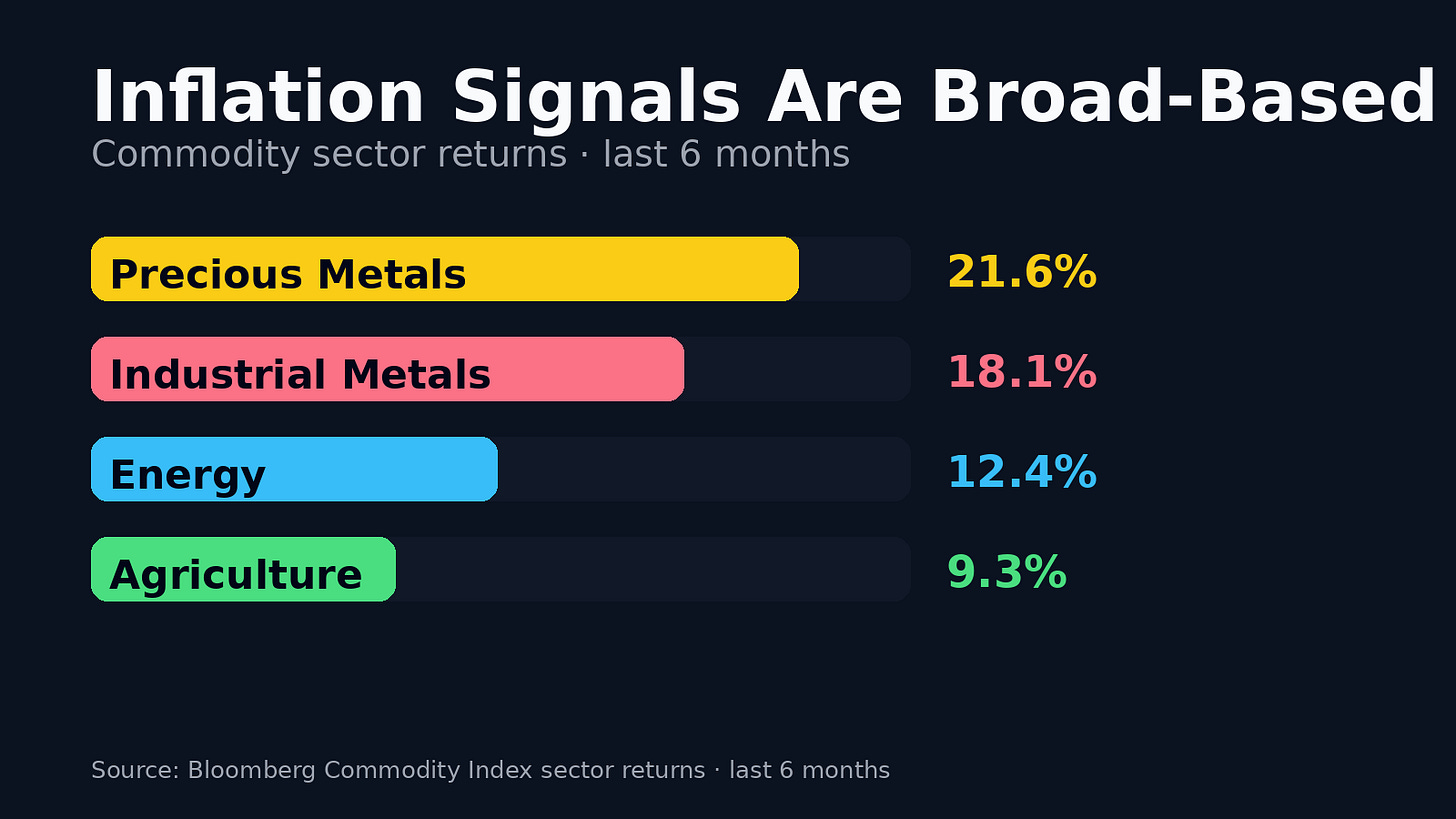

If inflation risk were truly behind us, commodity markets would likely reflect that calm. Instead, they are flashing warning signs. Precious metals, industrial metals, and energy prices have all shown renewed strength, suggesting investors are hedging against future inflation rather than celebrating its defeat.

Gold has surged to record highs, while silver and platinum have posted outsized gains of their own.⁴⁻⁶ These moves are rarely coincidental. Historically, sustained rallies in precious metals often reflect concerns about currency debasement and declining real purchasing power. The breadth of the rally matters as much as its magnitude. When gold, silver, copper, and tin rise simultaneously, it points to macro forces rather than isolated supply disruptions.⁵

Silver’s performance has been particularly notable. Strong industrial demand combined with constrained supply has fueled sharp price increases, reinforcing silver’s dual role as both a monetary and industrial asset.⁶ Platinum has followed a similar path, benefiting from supply tightness and renewed investor interest in real assets.⁶ Such coordinated moves suggest that inflation hedging behavior is returning to portfolios.