Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: INFLATION RISK RE-ENTERS THE DISCUSSION

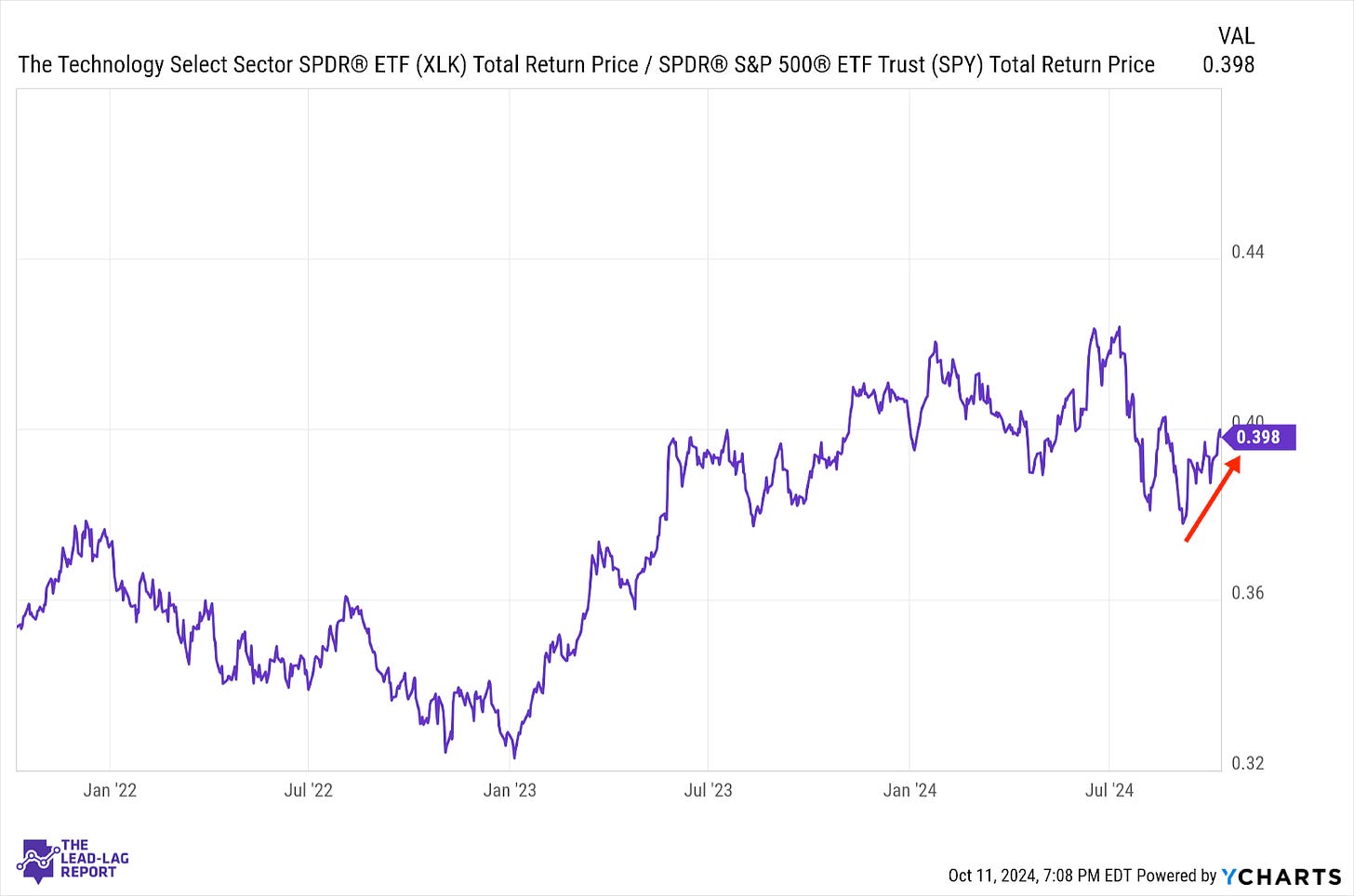

Technology (XLK) – Looking For Breadth Of Earnings Growth

Tech is finally starting to build some momentum again after getting a bit lost in the shuffle of a cyclical rebound. This upcoming quarterly earnings season could be especially important for this sector since so much of the growth of 2024 has been concentrated in just the mega-cap names. Those hyper-growth rates will inevitably begin slowing and the markets will want to see a broadening of earnings strength in order for this sector to be an outperformer.

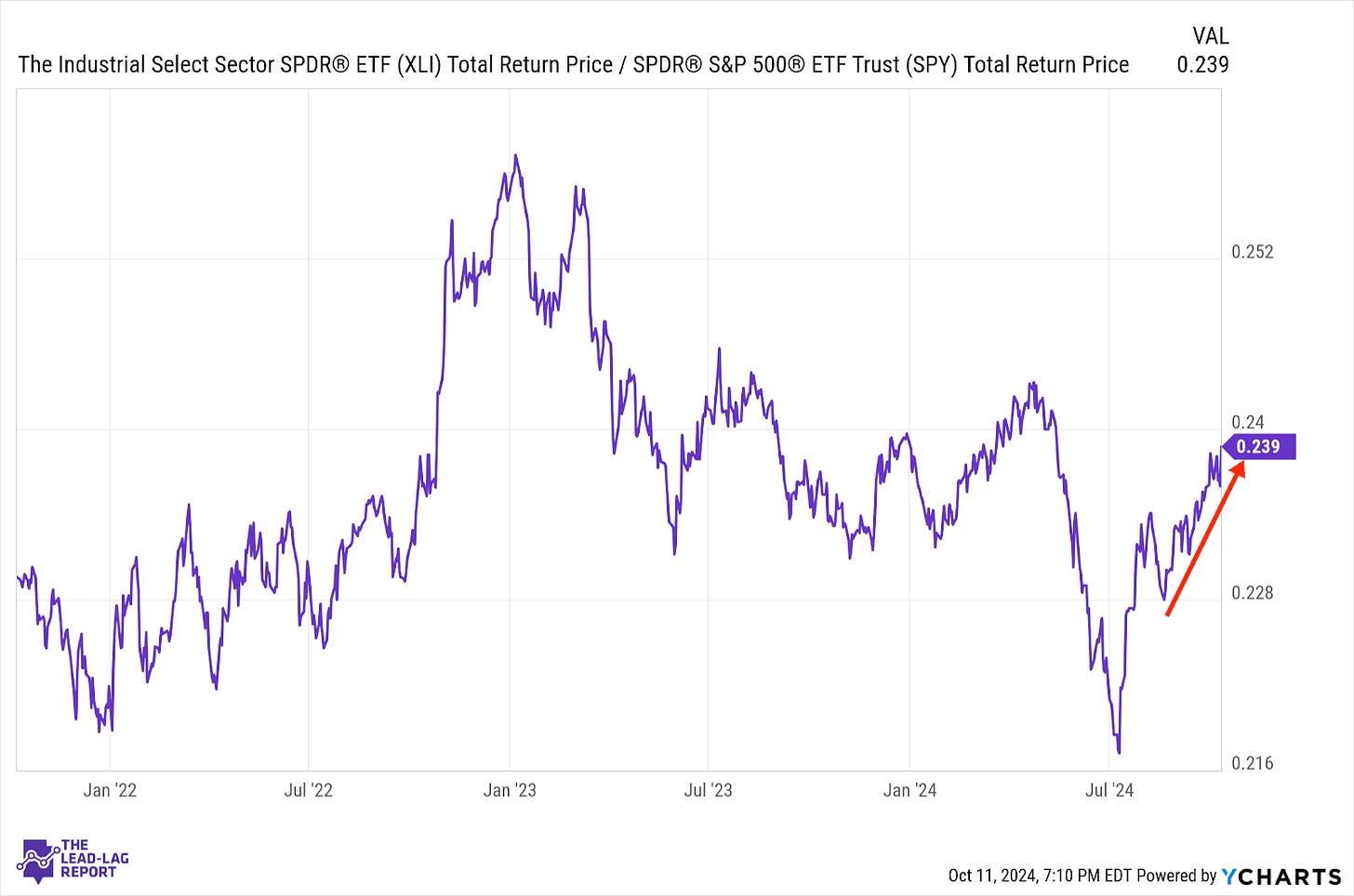

Industrials (XLI) – Leadership Continues

Perhaps no sector has benefited as much from the steady growth/Fed cutting narrative as industrials have. Economic conditions are looking favorable for a continued cyclical rebound and easing monetary conditions for the next several quarters should provide another tailwind. As long as inflation doesn’t start getting out of hand, there’s a roadmap for this sector to continue being a leader.

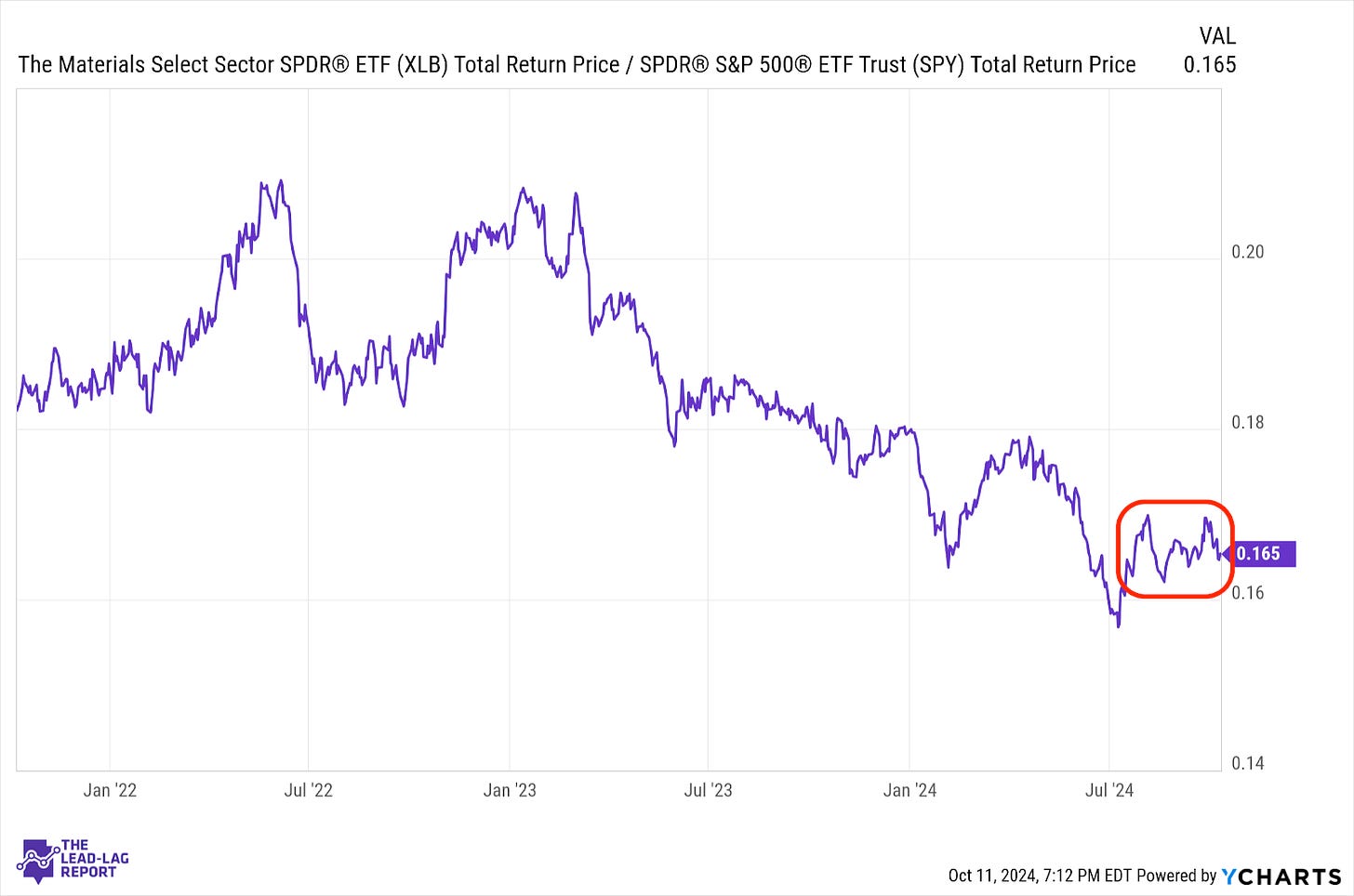

Materials (XLB) – China Vagueness Hurts

Even though conditions have looked generally positive for cyclically-sensitive areas of the market, this sector has produced mixed results. A lot of the demand anticipation is coming from China, which has yet to put any real details around big stimulus plans. As long as that uncertainty remains, this sector could have trouble building any significant momentum.

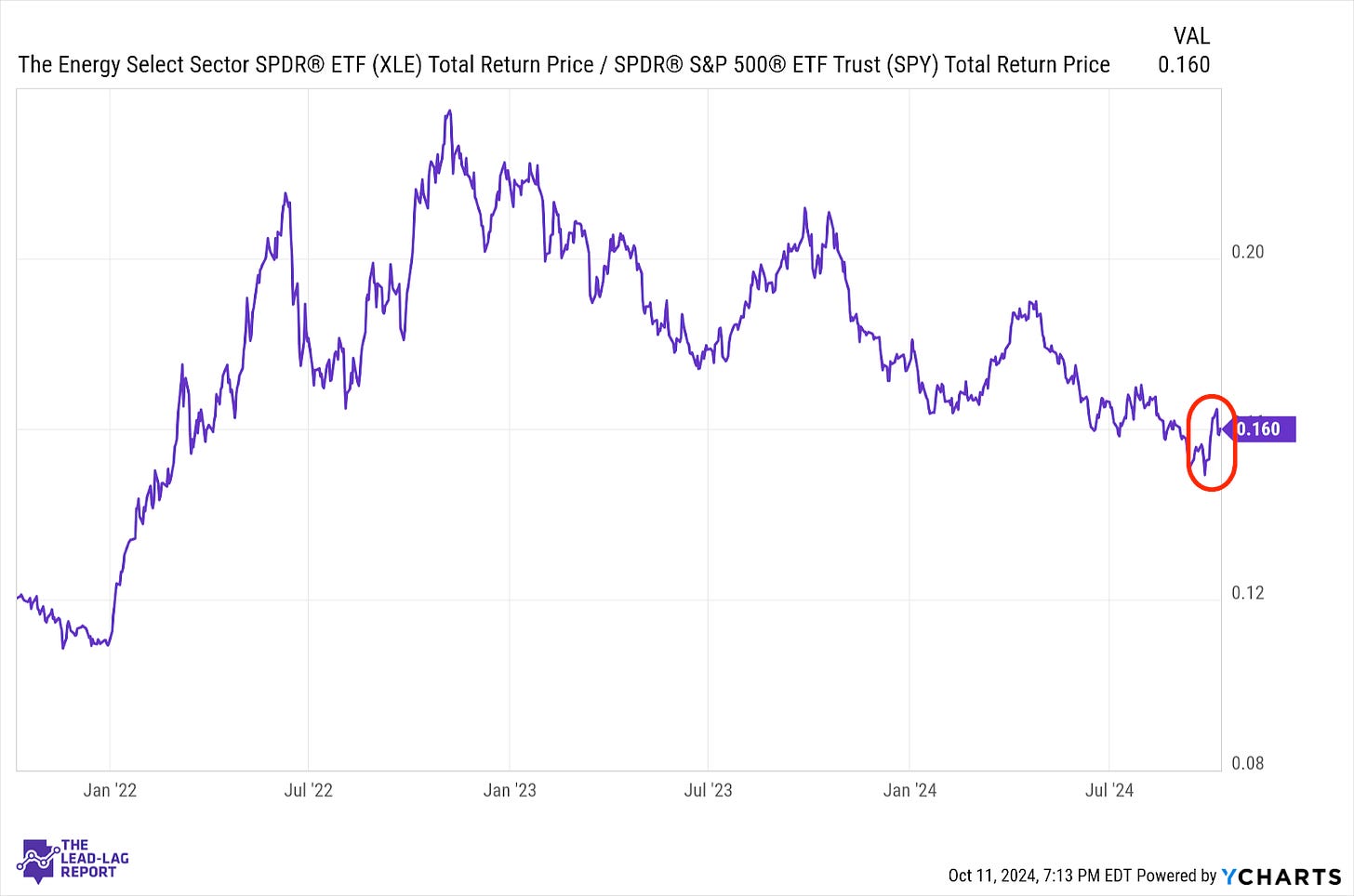

Energy (XLE) – Organic Demand Still Weak

Energy stocks have been heavily tied to geopolitical events lately, which explains the recent spike and subsequent pullback in this ratio. Organic demand expectations haven’t really improved much, but central bank liquidity could be the catalyst that ends up pushing demand higher. Depending on those kinds of non-organic factors can become dangerous because they often fail to happen.

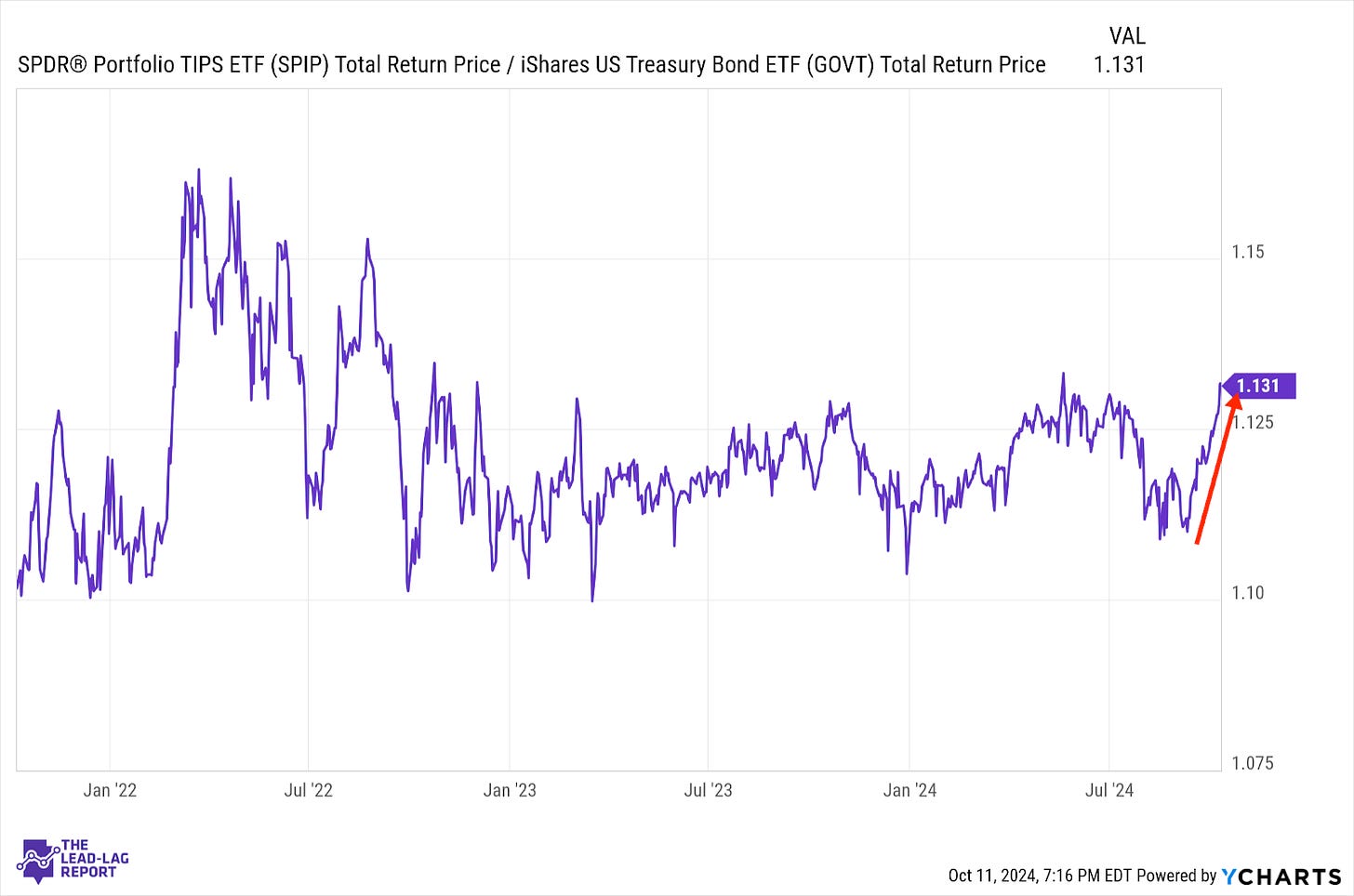

Treasury Inflation Protected Securities (SPIP) – Signaling Another Early Inflation Spike?

I don’t think we should ignore the fact that TIPS have been outperforming as strongly as they have over the past month. Healthy growth plus a resilient labor market plus easing monetary conditions create a scenario where inflation could easily spiral higher again and I think the bond market is definitely sensing some of that. This ratio turned higher well in advance of inflation rates soaring in 2021 and could be signaling something similar here again.

Junk Debt (JNK) – Spreads Likely To Remain Narrow