U.S. stocks did well in September. The S&P 500, Dow, and Nasdaq all went up in value, and the Dow even set a new record. But the background doesn’t look as convincing. Markets may be ahead of fundamentals given weak jobs growth, manufacturing weakness, and stubborn inflation. People are happy that the Fed is easing, sure, but this optimism comes with some risk.

Jobs, inflation, and the Fed in the United States

The job market is getting cooler. The unemployment rate is 4.3%, which is the highest it has been since 2021. People are still spending money, but the slowdown in jobs suggests that the economy is losing steam.

Core PCE is at 2.9% year-over-year, and the Fed cutting cycle has begun. Powell hinted that there might be more cuts, but he stressed that the data will determine the speed.

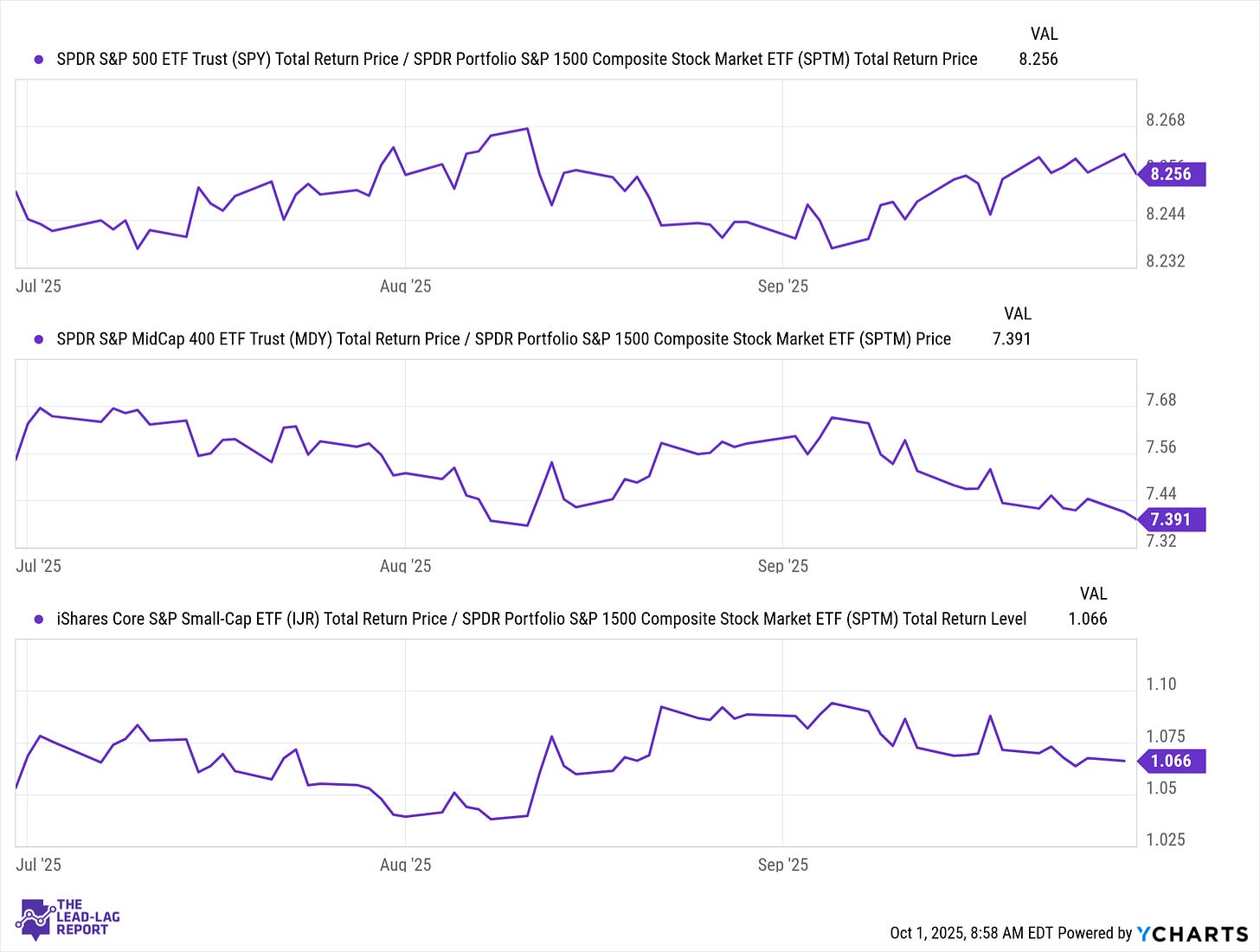

The curve got steeper as two-year Treasury yields fell to 3.65% and 10-year yields stayed near 4.15%. Small-cap stocks showed some signs of strength on rate cut optimism. Megacap tech stocks rose, and leadership is spreading to more cyclical stocks. Equity investors are betting that the Fed can continue to ease. This bet could be tested quickly if growth slows down even more.

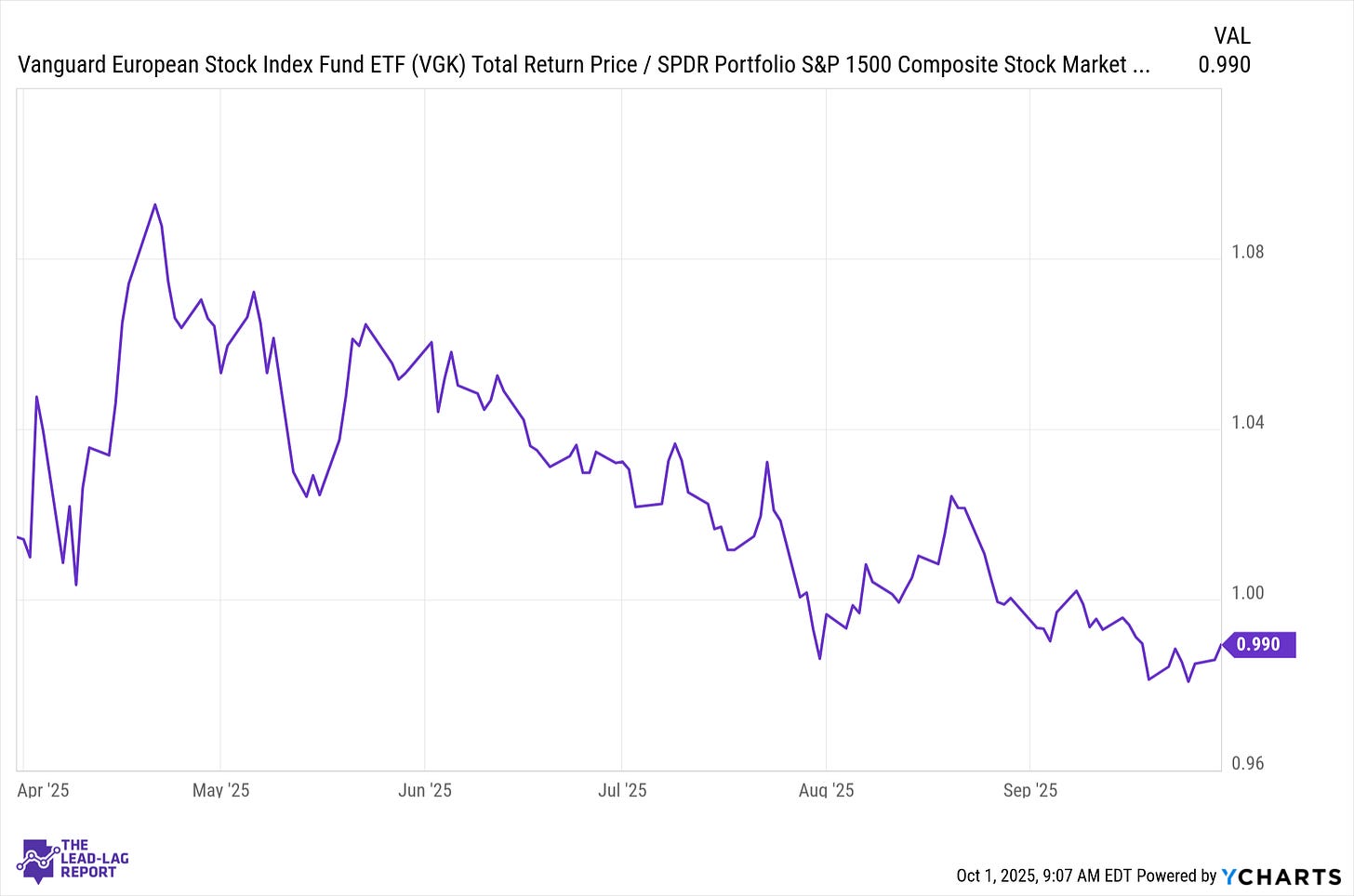

International Developed Markets: Slower Growth as Policies Change

Europe is still stuck between rising prices and weak growth. The ECB can now take a break because inflation in the Eurozone is about 2%. But manufacturing is still shrinking, and Germany is on the verge of going into a recession. Inflation in the UK is getting worse, and it’s stuck at about 3.8%. The Bank of England is stuck between weak growth and rising prices.

Japan is different. The Bank of Japan is still keeping its ultra-loose stance, even though inflation is above 2%. Tariffs and weak Chinese demand are still hurting exports, but the cheap yen has helped businesses make more money and brought in money from abroad. The Nikkei is trading near its highest level in decades, which is very different from Europe’s slow markets.

Emerging Markets: Different Fortunes