Record Leverage, Record Calls, Zero Fear — Volatility Could Explode At Any Moment

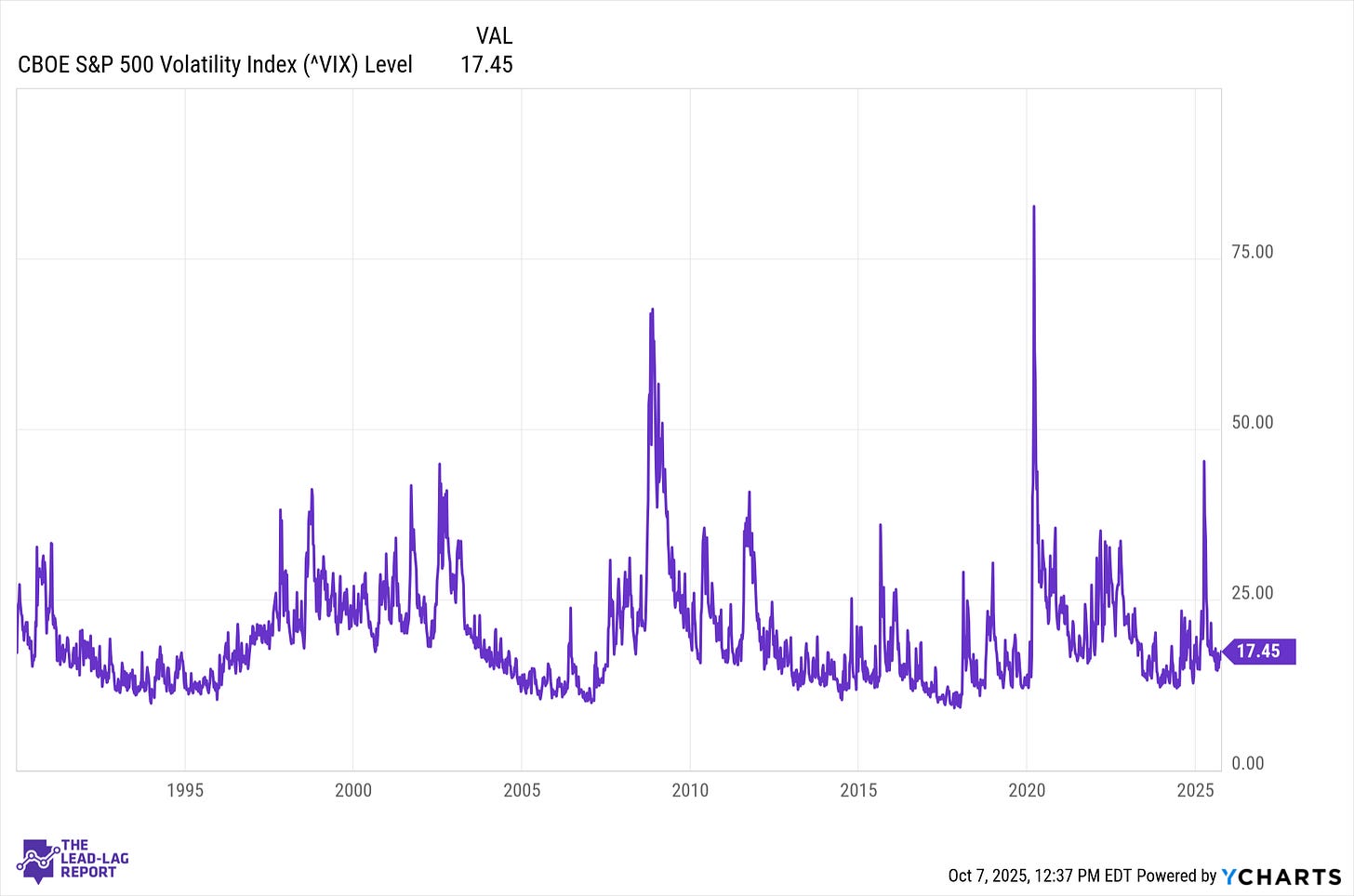

The CBOE Volatility Index (VIX) has stayed relatively tranquil in the mid-teens over the past month, dipping below 14-15 in mid-September and just settling around 16 as October started.¹ This sort of quiet is staggeringly complacent. Yet less volatility leads investors to take on more leverage and risk. This is exact type of condition under which accidents occur.

In the past, periods of reduced volatility have often taken place right before violent spikes. Investors take it for granted that stability is eternal, but one shock — geopolitical, macroeconomic or credit-related — can spark an increasingly big move. All it takes is a spark.

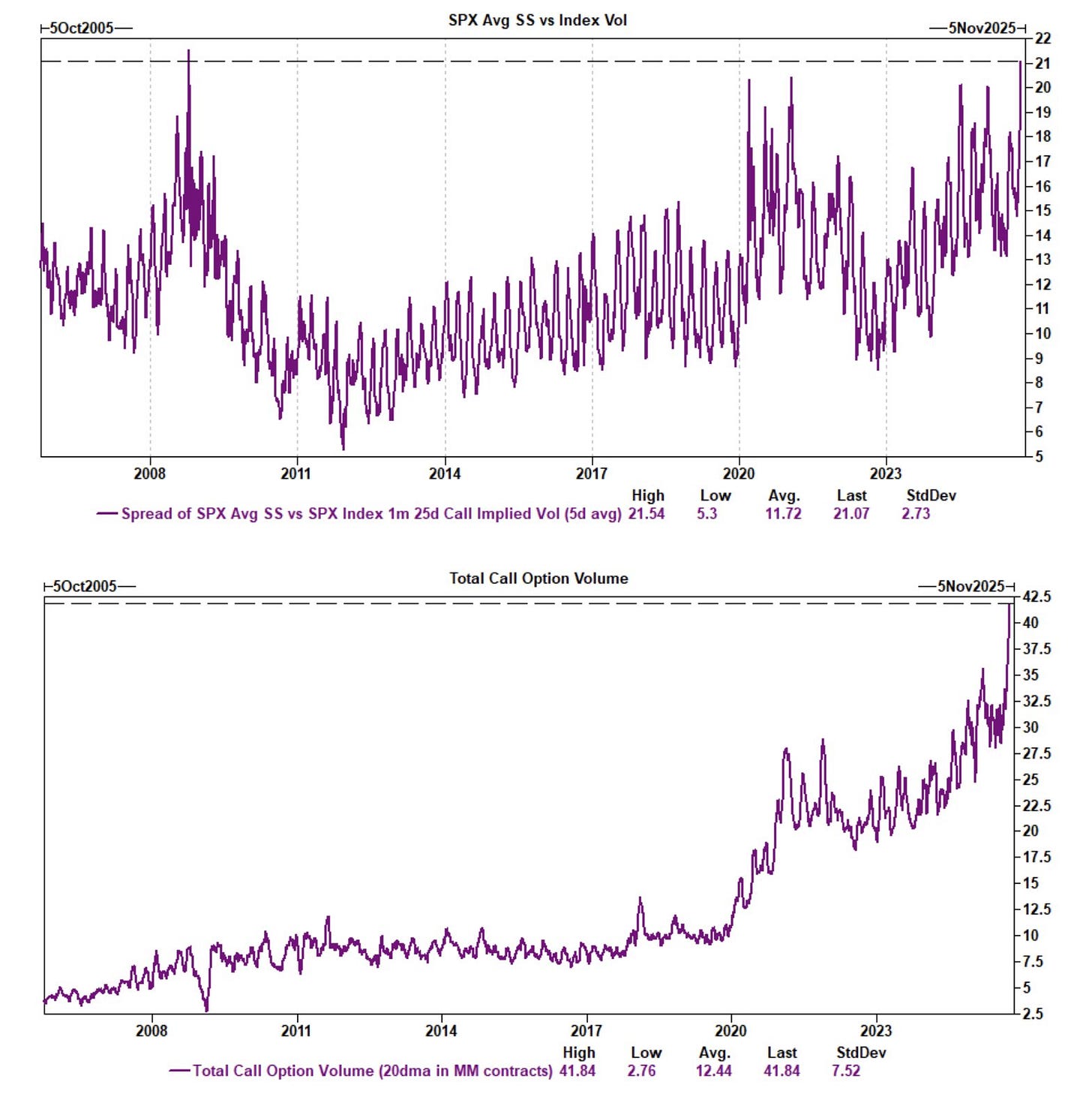

It’s Call Option Mania: A Warning Sign for the Stock Market

The signs of excess are now evident: record call-option activity. U.S. call option volumes have recently jumped to record levels in the past four weeks. ² This isn’t optimism — it’s speculation. When call volume spikes, dealers typically hedge their bets by buying stocks, a move that artificially extends upside momentum. When that changes, the feedback loop goes into reverse, magnifying declines.

We’ve seen this movie before — the dot-com blowoff of 1999 also involved surging call activity. Too much buying of calls is a contrarian indicator because it shows not simple confidence, but overconfidence. And the kind of speculative options exposure we see now leaves the market structurally fragile. When volatility returns, those positions can unravel in a matter of hours.

October’s Seasonal Trap

October has so often been the most volatile month for stocks. The S&P 500 has seen more than its average of 1 percent daily swings in October every month since 1950.³ There was the month of the panic of 1907, the crash in 1929 and Black Monday 1987. In tranquil cycles like this, October almost invariably provides at least one volatility spike as institutions rebalance into the end of year.

The VIX has increased an average 4 percent in October each year since 1990.⁴ This year, that is being compounded by an especially serene summer — markets mostly shrugged off soft data and geopolitical risks through September. When calm lasts this long, it rarely ends in a whisper.

Leverage Builds the Bomb

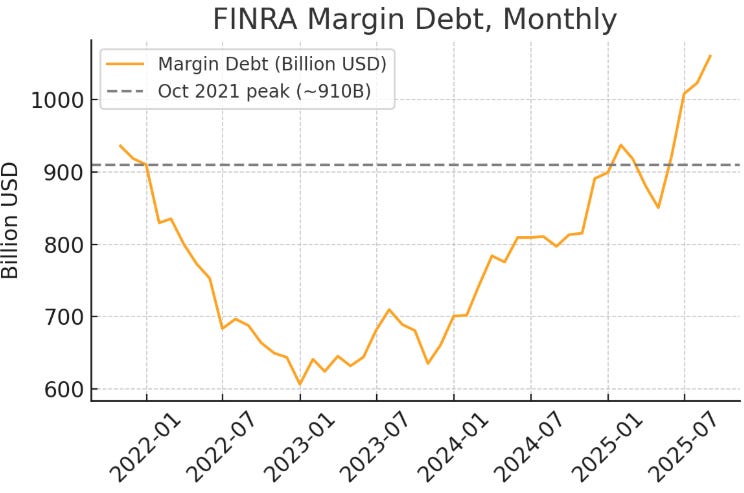

As for options, margin debt — money borrowed to buy stocks — has recently risen to about $1 trillion, close to its peak. ⁵ Leverage doesn’t cause crashes, but makes them worse. As prices decline, margin calls lead to forced selling that amplifies the slide.

The risk this time around is that leverage and complacency are feeding off each other. When a trader’s exposure is high they must borrow it and the closing of low-return trades that exist primarily if not solely to fulfill leverage requirements increases demand for borrowing. Retail margin balances have spiked, hedge-fund leverage is near a decade high, and derivative exposure has never been greater. To be sure, similar setups like this occurred prior to the 2007 credit unwind and drawdown in tech stocks earlier this year. When repricing takes place, leverage turns a correction into contagion.

Small-caps Are Signaling Trouble Underneath the Surface

The Russell 2000 — a barometer of small-cap performance — has quietly taken a turn for the worse. Following a decent third quarter that for a time was better than large-caps, small stocks rolled over again in early October.⁶ That reversal is meaningful. Small-caps are higher-beta, more sensitive to credit spreads and liquidity moves; when they lag large-caps even as the latter continue to edge higher, it is a sign of shrinking breadth and fading confidence.

These divergences lead, historically speaking to market pullbacks. In both 2018 and 2021, weakness in small caps preceded larger declines. All told, when investors start fleeing out of higher-beta equities it’s usually an early sign that risk appetite is running out of gas.

Sentiment at a Dangerous Extreme

Market psychology has turned toxic. This is confirmed by social-media sentiment—all bearish commentary has become a breeding ground for ridicule at best and personal attacks at worst.

That aversion to skepticism is classic late-stage bull market. Bearish analysts were derided in 1999; in 2021, they were called “doomers.” When markets do this to dissidents, they are near-burned out. Everyone’s bullish, which means there isn’t a marginal buyer around. The exit will be crowded when expectations change.

Defensive Assets Are Telling The Real Story

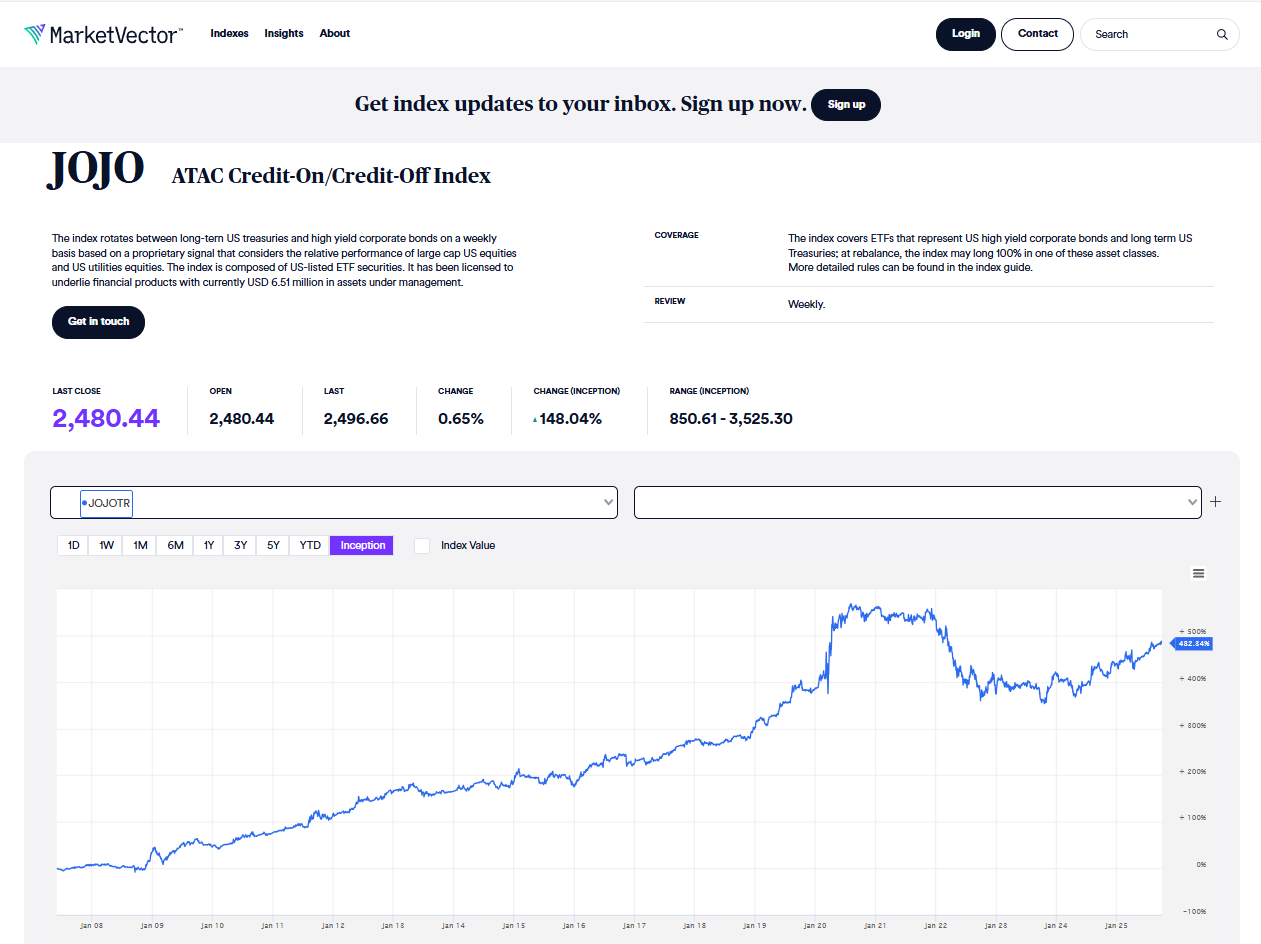

Defensive stocks quietly gather strength as the bulls party. One traditional safe-haven group, utilities, is now showing relative strength against Technology. Meanwhile, Treasury prices are coming off, and yields on the 10-year note look like they could surprise on the downside as more classic risk-off behavior re-appears. The ATAC Credit-On/Credit-Off Index flipped to “junk-off” mode two week ago, going from high yield junk debt into long-duration Treasuries.

And that combination — utilities outperforming while Treasuries rally — is not one often seen during bull runs. It’s a sign perhaps that old-fashioned institutional money is positioning for risk under the table. Defensive rotation such as this is frequently a precursor to spikes in market volatility. In 2000, 2007 and 2021 such divergences appeared just ahead of more widespread weakness.

When bonds and defensives do well together, money is moving toward safety, no matter what the collective says. Beneath the surface, the market is hedging against precisely what most believe cannot happen.

A Setup Few Believe

The consensus now is volatility is over, the economy is soft-landing and liquidity is unlimited. But underneath that story are unmistakable cautionary signals:

Record call options speculation and crowded leverage.

Record margin debt magnifying fragility.

Small-cap weakness and narrowing breadth.

Defensive rallies in utilities and Treasuries.

An unfriendly attitude to any opposing opinion.

This is a pure contrarian trade. Bears are jeered, VIX disdained and leverage applied. Absent a force of sufficient magnitude, all that is required for an excessive response is some small jolt — an earnings miss, a credit default, a pattern interrupt — to catalyze it.

The Inevitable Repricing

Nobody can predict the specific day when volatility returns, but the asymmetry of risk is evident. With the VIX close at these levels, even a move from 15 to 25 would be a huge percentage spike in implied volatility taking place so rapidly that systematic and volatility-targeting funds would have to de-risk at an alarming pace.

Put the October seasonality on top, combine that with some of this leverage and all of this record speculation, and you do have a situation where they could get a burst of volatility here in the near-term. Markets do not require a new crisis — simply a belief that perpetual calm might be ending.

Maybe I’m wrong. I don’t care. What I care about is being authentic in what I am seeing. What I care about is pointing out the obvious to me, which to others will only be obvious with hindsight.

And then I’ll scream melt-up.

Notes

CBOE, VIX Index Historical Data, accessed October 2025.

Bloomberg, “Call Option Volumes Hit Record Levels,” September 2025.

LPL Financial Research, “October: The Most Volatile Month,” October 2024.

CBOE Market Statistics, “Average Monthly VIX Changes,” 1990–2024.

FINRA, Margin Statistics Monthly Report, August 2025.

Bloomberg, “Russell 2000 Turns Lower After Q3 Outperformance,” October 2025.

AAII Sentiment Survey; CNN Fear & Greed Index, October 2025.

FactSet S&P 500 Sector Performance, October 2025.

U.S. Treasury Department, Daily Yield Curve Rates, October 2025.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

I have entered the frenzy and trading lifestyle late, myself, 40 years after my stepdad's Uniform Gift to Minors of 25 shares of GTE in the mid-80's (before I joined the USAF).

I would like to say your article was specifically helpful to my understanding why my future son-in-law keeps telling me how important it is for me to pay close attention to the VIX as I place my trades with part of my VA disability income. Thank you for the clarity.

Feel free to send me any links to your other writings and musings. MaryvilleVet@gmail.com in East Tennessee.