The yield curve finally works in favor of smaller banks again.

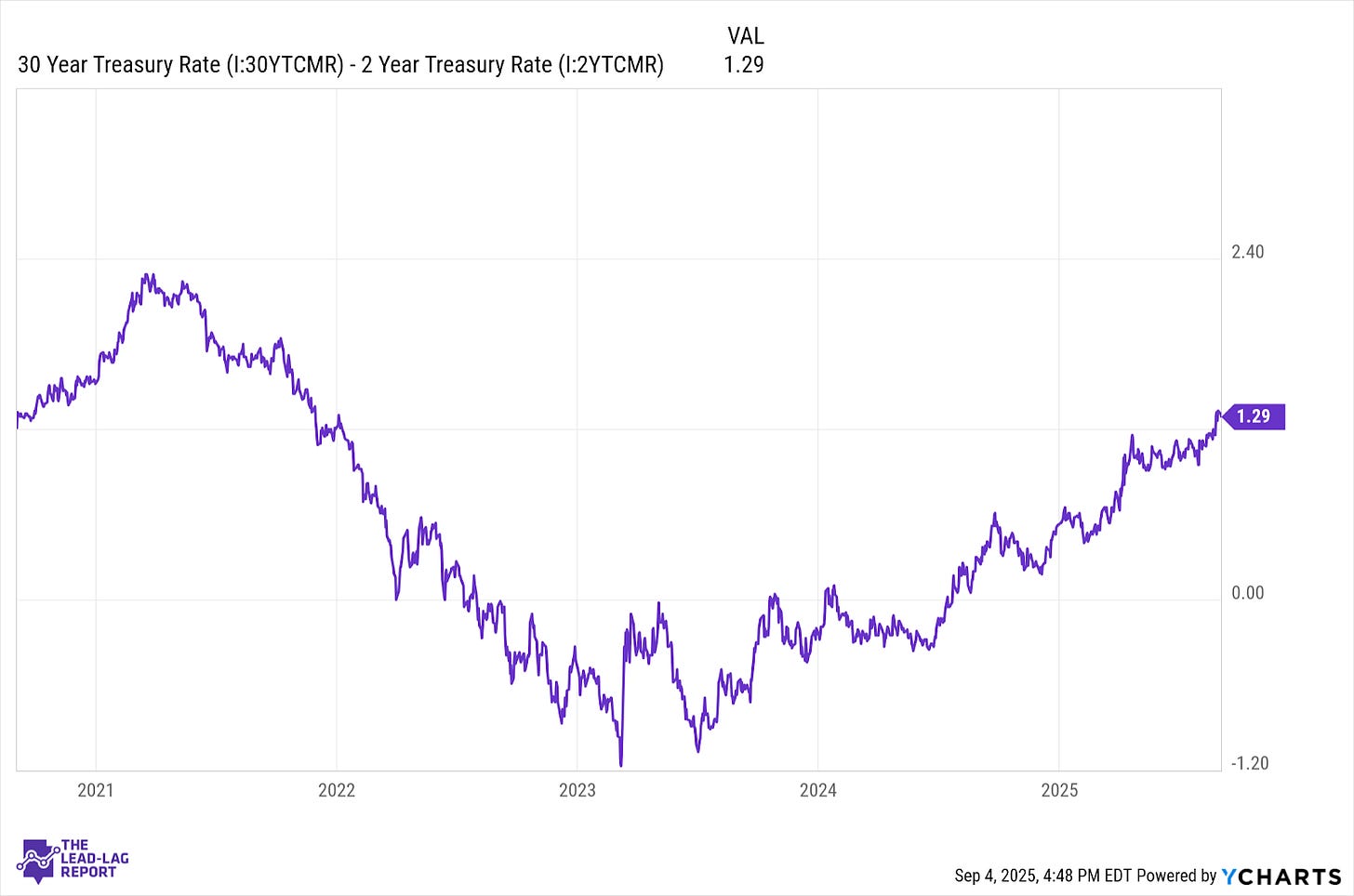

The 30Y-2Y Treasury yield spread currently sits at 129 basis points. This marks the highest level for this spread since the beginning of 2022.

This steepening creates a fundamental advantage for regional banks. They borrow short and lend long. When short-term rates stay lower than long-term rates, their net interest margins expand. More spread equals more profit.

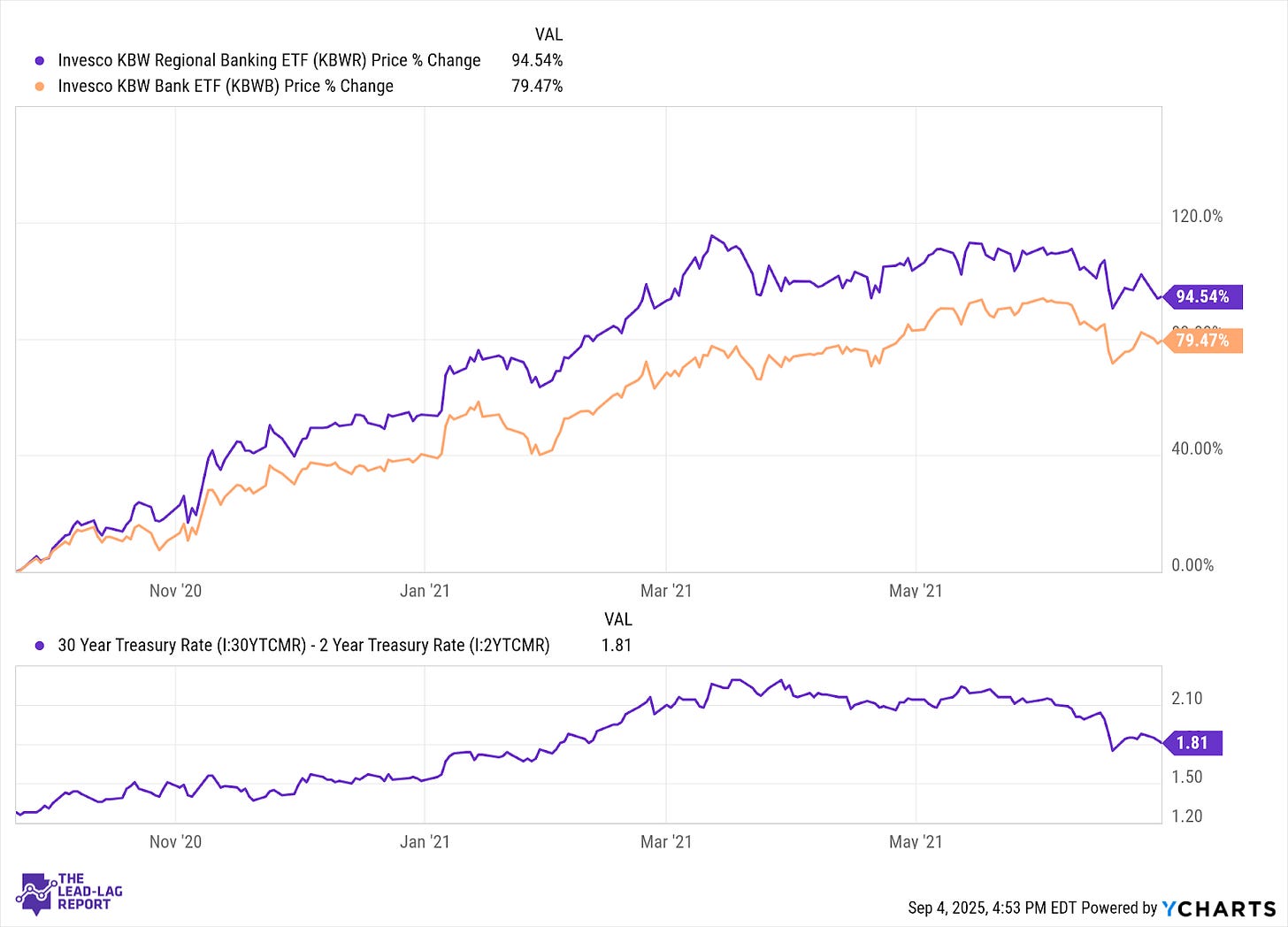

The 2021 steepening cycle offers a compelling precedent. The Invesco KBW Regional Banking ETF (KBWR) doubled from late September 2021 to early March 2022 as yield spreads widened. The broader Invesco KBW Bank ETF (KBWB) surged more than 70% during that same period. Regional banks outperformed because they remain more sensitive to yield curve movements than larger counterparts. A higher percentage of their revenue comes from traditional lending activities.

Why the Yield Curve Is Steepening in 2025

Three distinct forces reshape the Treasury market, each creating specific advantages for regional banks.

Shift from recession fears to inflation expectations

Market sentiment has fundamentally changed over the past year. What analysts call a "bear steepener" is underway, both short- and long-term rates rise, but long-term yields climb faster. This reflects a shift from recession worries to concerns about persistent inflation and potentially stronger economic growth.

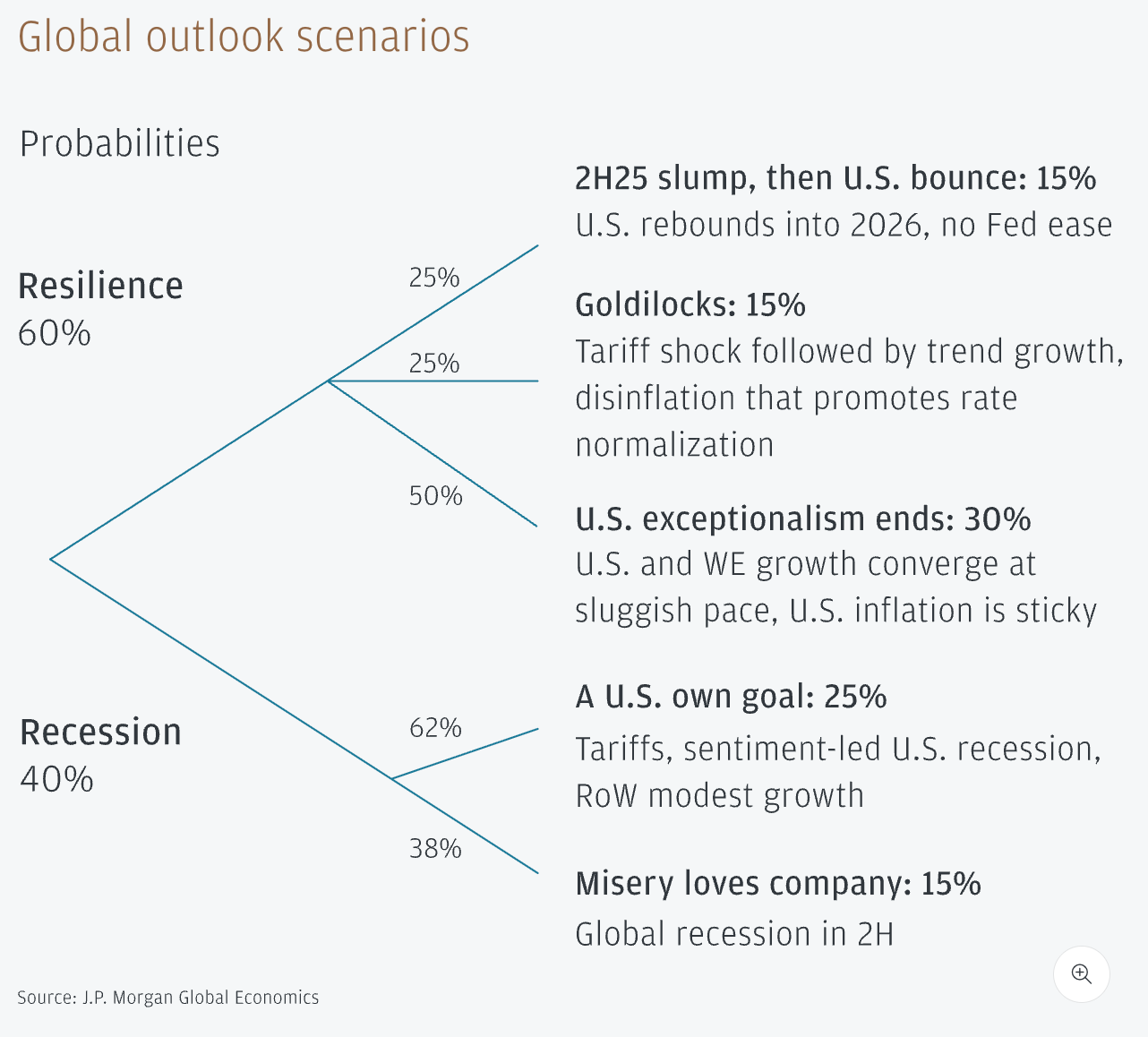

The recession probability estimates tell the story. J.P. Morgan recently cut their U.S. recession odds from 60% to 40%. They put the odds of a severely adverse scenario (“Misery Loves Company”) at just 15%.

10-year vs 2-year Treasury spread reversal

As mentioned above, some yield spreads are at their widest in roughly three years. Current yields show how the situation has changed in just 12 months: