REIT Leaders & Laggards: Rate Cuts, Trump 2.0, and the Real Estate Outlook

From Headwinds to Tailwinds: The Macro Reset for REITs

Key Highlights

After a prolonged period of underperformance driven by rising interest rates, several REIT subsectors appear positioned for a cyclical rebound as monetary policy shifts.

Anticipated Federal Reserve rate cuts in 2026 could meaningfully reduce financing costs, stabilize capitalization rates, and improve equity valuations across real estate.

A potential second Trump administration introduces policy variables that may favor deregulation, domestic investment, and infrastructure development, creating differentiated outcomes across REIT segments.

Selectivity remains critical, as structural headwinds persist for certain property types despite improving macro conditions.

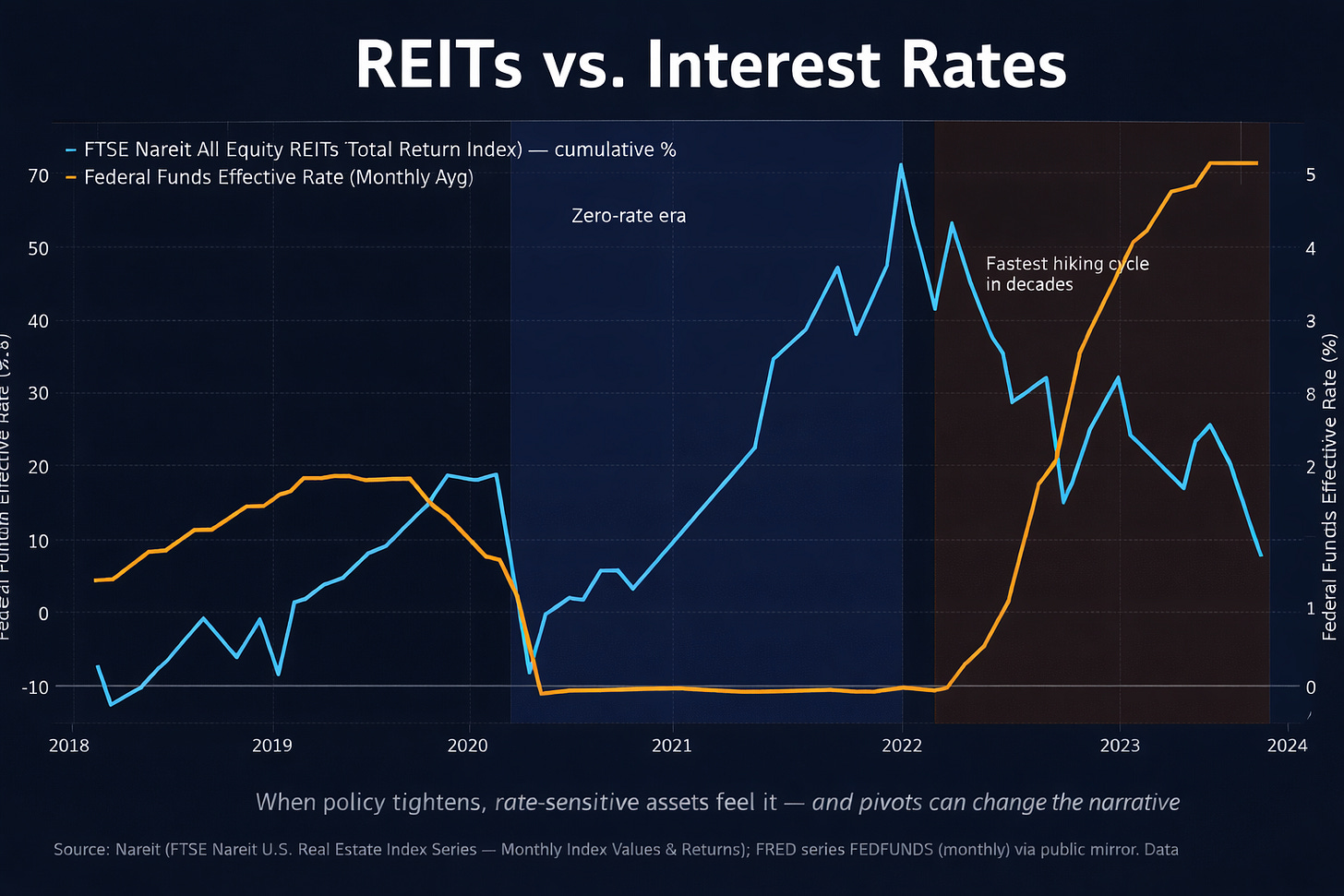

The U.S. REIT sector endured one of its most challenging stretches in decades between 2022 and 2024. Rapid Federal Reserve tightening pushed policy rates to restrictive levels, compressing equity valuations, increasing borrowing costs, and pressuring property values across nearly every real estate category. During this period, many REITs significantly underperformed broader equity benchmarks, reinforcing investor skepticism toward interest-rate-sensitive assets.¹

That backdrop is beginning to change. Forward-looking indicators increasingly suggest that the next major inflection point for real estate may arrive in 2026, as inflation moderates and the Federal Reserve pivots toward easing. Moody’s Analytics projects that the federal funds rate could decline from roughly 4.5 percent to the 2.5–3.0 percent range over the coming years, a shift that historically has been supportive for REIT performance.² Lower policy rates reduce debt service costs, improve refinancing conditions, and tend to stabilize capitalization rates, all of which are central to real estate valuation models.³

Layered onto this monetary shift is a potential political transition. A second Trump administration would likely prioritize deregulation, tax incentives, and policies aimed at accelerating domestic economic activity. During Trump’s first term, efforts to streamline environmental reviews and reduce regulatory friction altered the economics of development and capital deployment.⁴ A renewed emphasis on domestic manufacturing, energy production, and infrastructure investment could again reshape demand patterns across multiple real estate segments.⁵

However, the benefits of these changes are unlikely to be evenly distributed. Office properties continue to grapple with secular changes in work behavior, while certain retail formats remain exposed to structural e-commerce pressures. Against this backdrop, identifying relative leaders and laggards becomes more important than broad sector exposure.

Equity REITs Positioned for Recovery

Residential: Mid-America Apartment Communities (NYSE: MAA)

Mid-America Apartment Communities operates a portfolio concentrated in high-growth Sunbelt markets, an exposure that has proven resilient despite recent supply pressures. While new multifamily construction weighed on rent growth during 2024 and 2025, occupancy across the portfolio remained consistently above 95 percent, reflecting persistent housing demand and constrained affordability in single-family markets.⁶