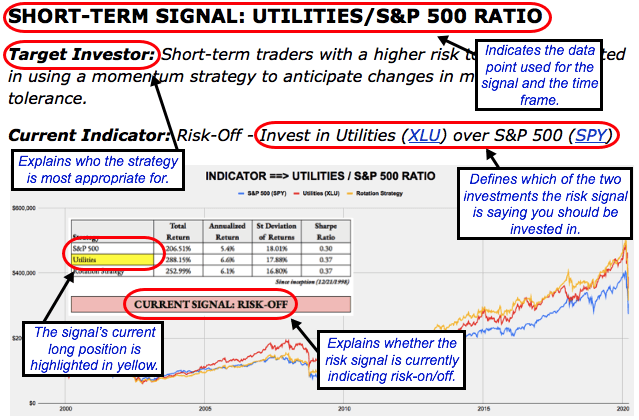

How To Interpret the Signals: Within each strategy, there is a risk-on and risk-off investment recommendation, with the risk-off option being the more conservative of the two. When a particular signal indicates that investors should be risk-off, for example, subscribers should consider investing in the risk-off option and avoiding the risk-on option. The opposite, therefore, would be true when the signal flips to risk-on. In each strategy, you’d always be invested in one option or the other.

Here’s how to read the scorecard for each strategy:

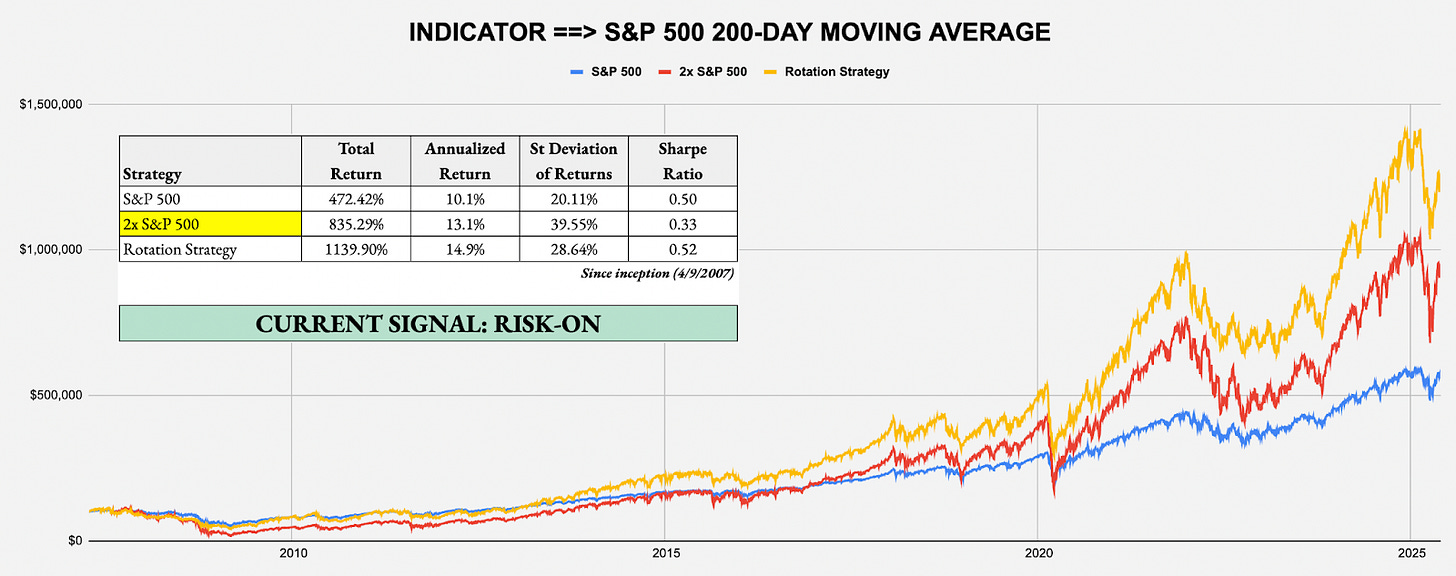

Some of the strategies will be more aggressive than others. The “Leverage For The Long Run” strategy, for example, uses the S&P 500 and 2x-leveraged S&P 500. The more conservative “Lumber/Gold Bond” strategy, however, uses intermediate-term Treasuries and the S&P 500. In every case, a risk-off signal indicates that you should be invested in the more conservative of the two options, while a risk-on signal indicates you should be invested in the more aggressive one.

For a full user's guide on how to interpret each of the signals and how to put them to work in your portfolio, please click HERE.

SHORT-TERM SIGNAL: UTILITIES/S&P 500 RATIO

Target Investor: Short-term traders with a higher risk tolerance interested in using an equity momentum strategy to anticipate changes in market risk tolerance.

Current Indicator: Risk-On

Strategy: Beta Rotation - Example: Invest in S&P 500 (SPY) over Utilities (XLU)

SHORT-TERM SIGNAL: LONG DURATION/INTERMEDIATE DURATION TREASURIES RATIO

Target Investor: Short-term traders with a higher risk tolerance who want to use the activity in the U.S. Treasury market to judge overall risk levels.

Current Indicator: Risk-On

Strategy: Tactical Risk Rotation - Example: Invest in S&P 500 (SPY) over Long-Duration Treasuries (VLGSX)

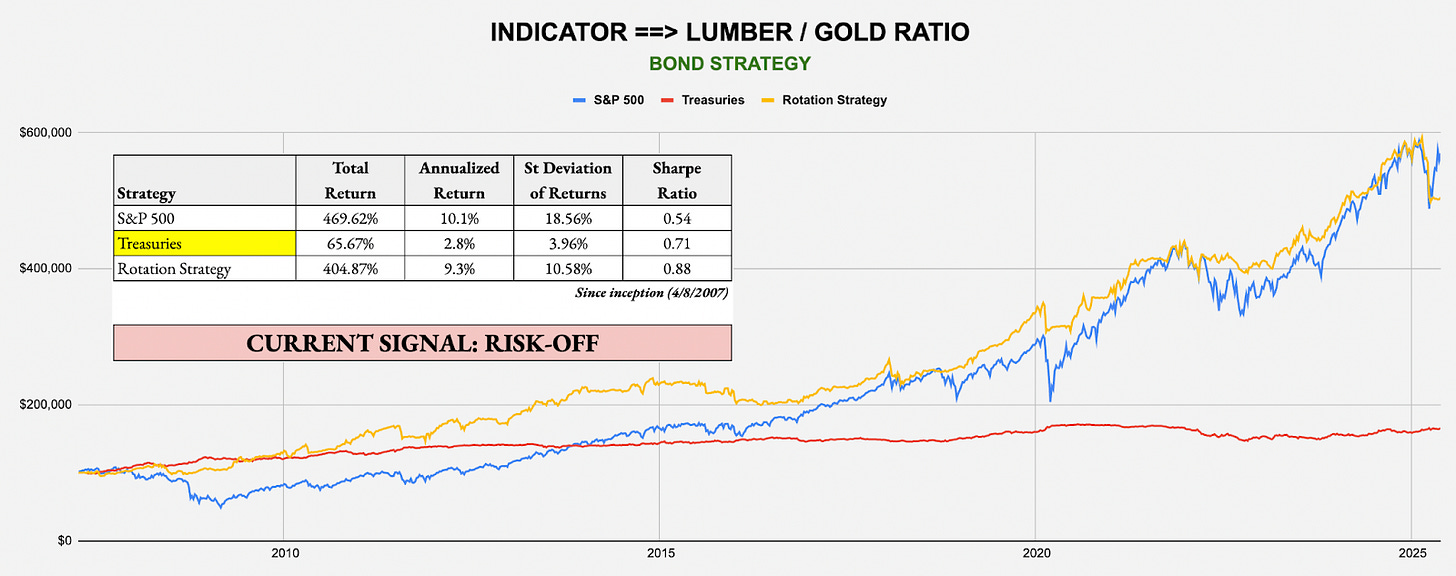

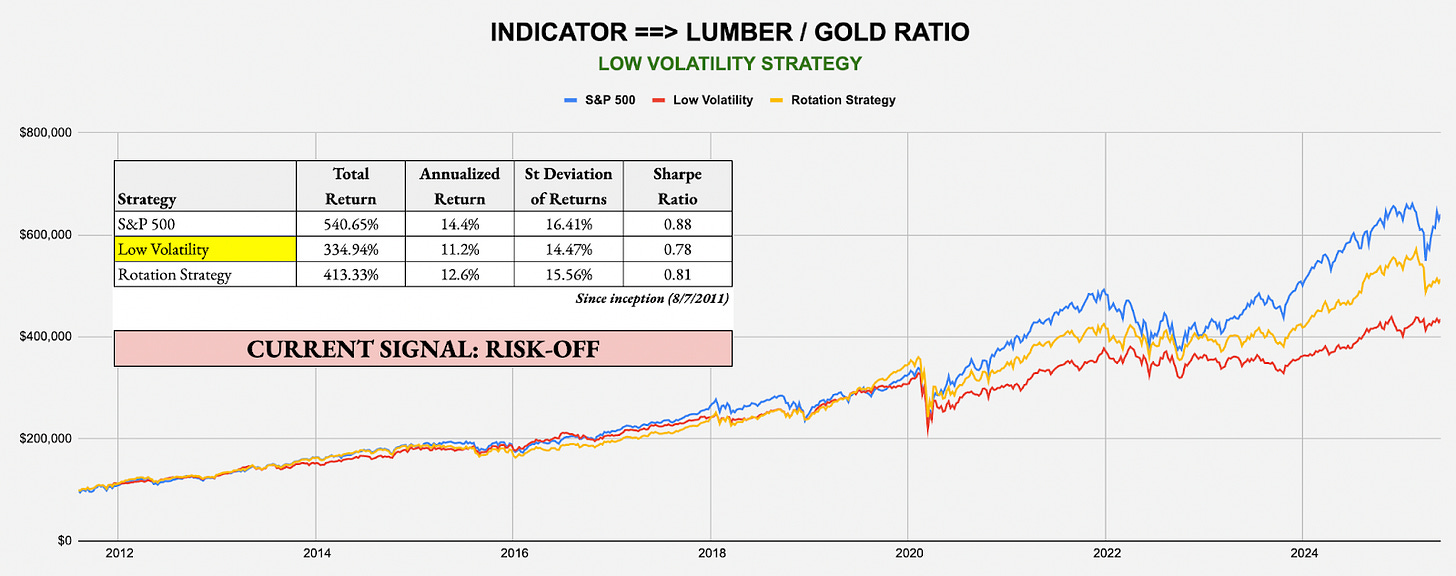

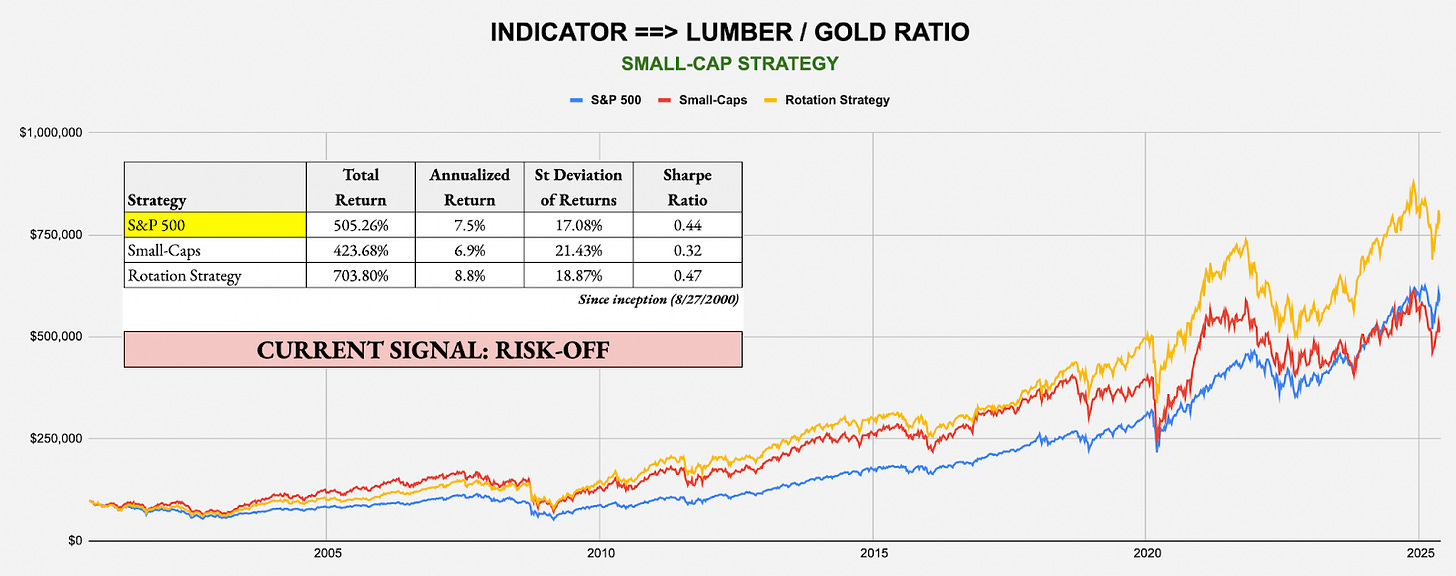

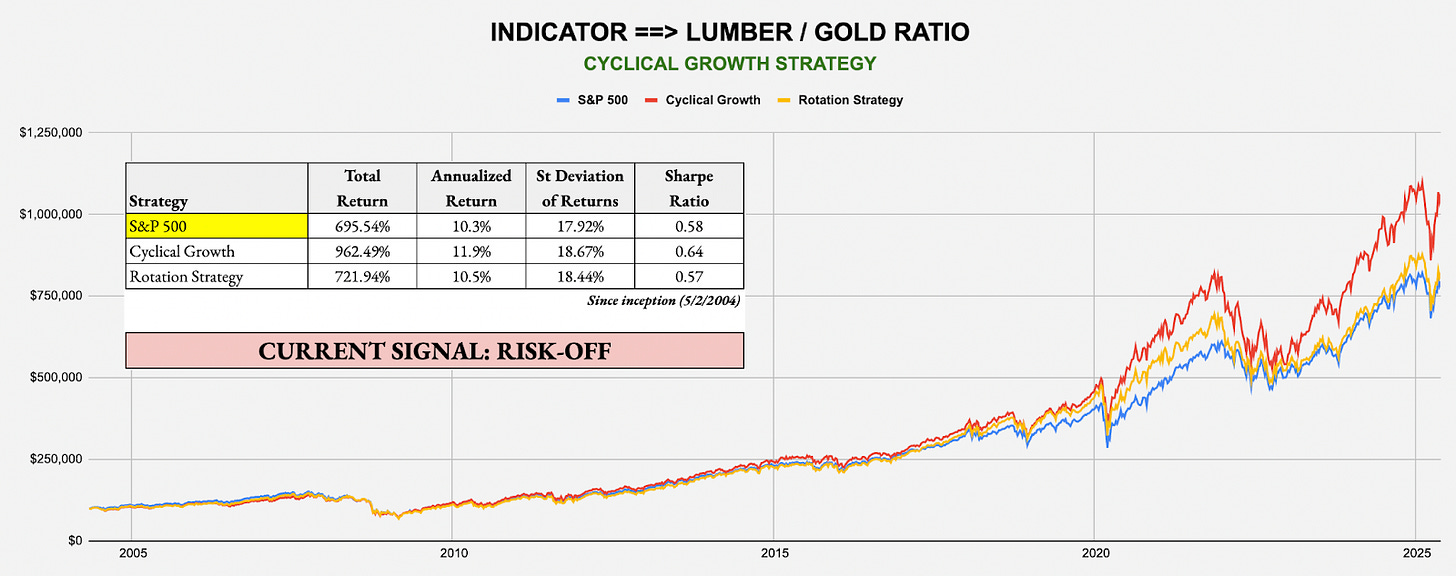

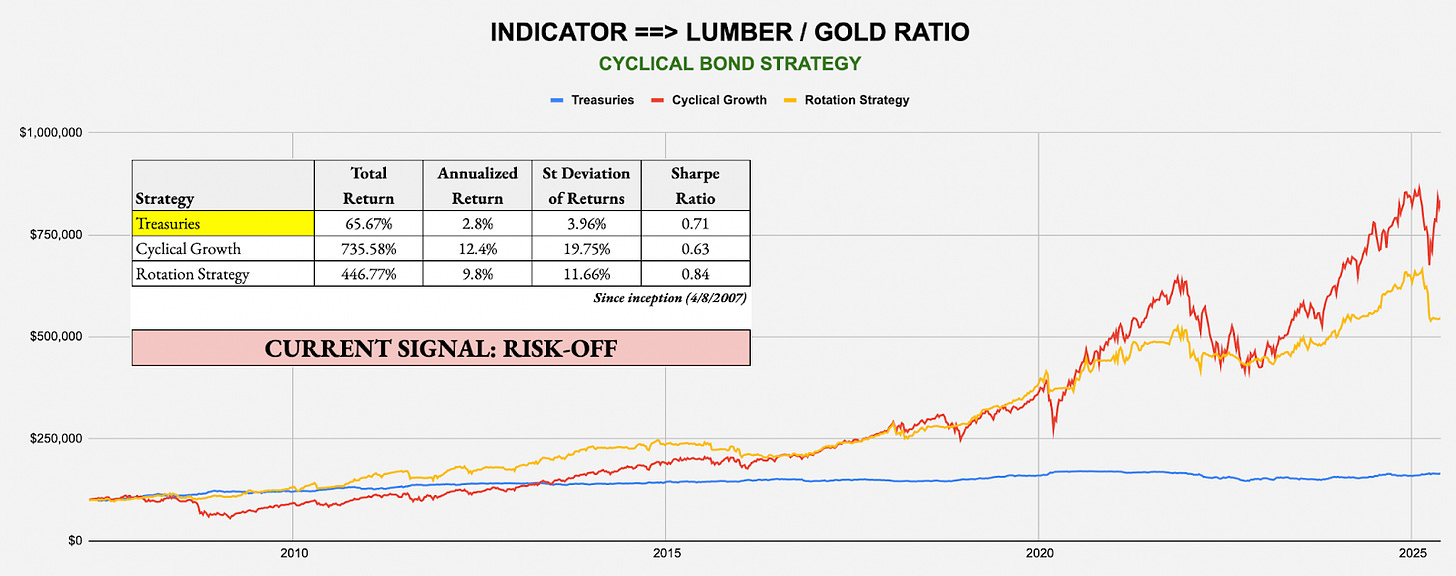

INTERMEDIATE-TERM SIGNAL: LUMBER/GOLD RATIO

Target Investor: Short- and long-term investors willing to trade more frequently using the classic cyclical vs. defensive asset comparison.

Current Indicator: Risk-Off

Strategy: Lumber/Gold Bond - Example: Invest in Treasuries (GOVT) over S&P 500 (SPY)

Special Announcement

The future is highly uncertain, with potential challenges in growth, inflation, and geopolitics, making diversification crucial.

Most investors are unknowingly underdiversified. A traditional 60/40 portfolio is 98% correlated to the stock market, potentially exposing investors to more risk than they realize. The S&P 500 historically experienced extended periods of underperformance, including:

1. Underperforming cash from 1966 to 1982 during inflationary times

2. A 0% average return from 1929 to 1949

3. A lost decade prior to the recent 15-year bull market

Historical bear markets often started with high valuations. Given current high valuations, we may be on the verge of another challenging period for U.S. equities.

Risk parity seeks to offer a more diversified allocation than conventional mixes. By spreading risk across global equities, Treasuries, TIPS, and commodity producers and gold, investors can maintain a low-cost, tax-efficient passive mix seeking:

1. Equity-like long-term expected returns

2. Lower risk than stocks

3. Reduced risk of a lost decade

To learn more about the RPAR Risk Parity ETF, visit rparetf.com.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

Investing involves risk. Principal loss is possible.

Distributed by Foreside Fund Services, LLC.

Data source: Bloomberg.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Evoke Advisors. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Evoke Advisors and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

Strategy: Lumber/Gold Buy-Write - Example: Invest in Buy-Write (PBP) over S&P 500 (SPY)

Strategy: Lumber/Gold Low Volatility - Example: Invest in Low Volatility (SPLV) over S&P 500 (SPY)

Strategy: Lumber/Gold Small-Cap - Example: Invest in Large-Caps (SPY) over Small-Caps (VSMAX)

Strategy: Lumber/Gold High Beta - Example: Invest in S&P 500 (SPY) over High Beta (SPHB)

Strategy: Lumber/Gold Cyclical Growth - Example: Invest in S&P 500 (SPY) over Growth (VUG)

Strategy: Lumber/Gold Cyclical Bond - Example: Invest in Treasuries (GOVT) over Growth (VUG)

LONG-TERM SIGNAL: S&P 500 200-DAY MOVING AVERAGE

Target Investor: Long-term investors with a higher risk tolerance willing to move to an aggressive strategy when the signal flips to risk-on.

Current Indicator: Risk-On

Strategy: Leverage For The Long Run - Example: Invest in 2x-Leveraged S&P 500 (SSO) over S&P 500 (SPY)

About the Signals: The above trade signals and allocations are taken directly from each of the four award winning white papers I authored, which can be individually read at https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=2224980. The underlying commonality across all risk-on/off signals and backtested strategies from these papers is the same: what matters isn’t being up more, but rather being down less. Each strategy historically has significantly outperformed through the avoidance of major drawdowns and volatile periods. The signals can change often from week to week, so it’s important to keep checking The Lead-Lag Report for updates. While not every trade and not every signal will be right, cumulatively over time, the identification of conditions that favor an accident in the stock market can help you slow down entering the storm, even if no one knows the exact mile marker where a crash might occur.

CONCLUSION

The one takeaway from last week might be how in stride the market took recent trade developments. From having the Trump tariffs blocked to having them reinstated to claiming that China violated any current trade agreements to raising steel tariffs from 25% to 50% (although that last one happened after Friday’s close, so we’ll see how the market reacts), the VIX remained subdued and U.S. stocks traded within a relatively tight range.

It seems that this could mean the market’s trade-related whipsaws over the past two months could be a thing of the past. Investors seem unwilling to overreact to short-term developments knowing that they probably won’t be in place for long. Lower volatility generally means better opportunities for stocks and this could be one of those instances.

The slow drift lower in Treasury yields last week could mark the return to some sense of normalcy. Between the Moody’s downgrade and the Trump tax cut bill, the market has been trying to reassess credit risk and the impact of a further bloated federal debt. For now, it looks like investors may be trying to digest what’s been a lot of new information over the past couple weeks before moving forward again. Short-term signals remain bullish, but the lumber/gold ratio has been consistently risk-off throughout the past two months.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.