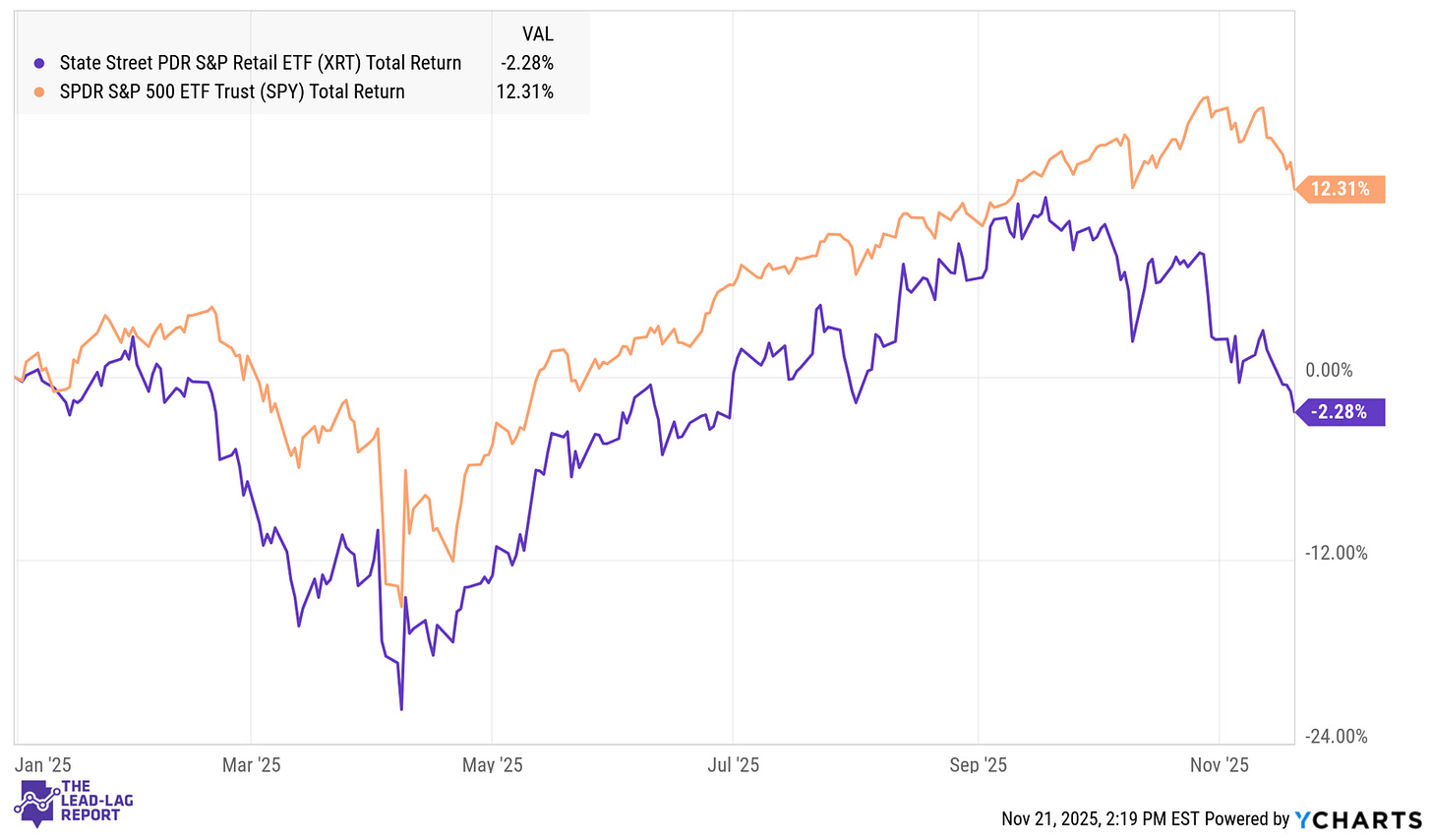

Retail stocks have spent most of 2025 on their back foot. The equal-weighted SPDR S&P Retail ETF (XRT) is down for the year, badly trailing the S&P 500’s gain.¹ A rotation away from consumer cyclicals has hardened into a broader risk-off stance, and XRT recently broke key technical support on heavy distribution selling — a classic signal that institutions are stepping aside as consumer cracks widen.²

The Valuation Reset

Valuations across the retail landscape have compressed meaningfully. The S&P Retail Select Industry Index now trades near 15× forward earnings, a steep discount to the broader market.³ Schwab’s sector models place consumer discretionary among the weakest corners of the market in 2025, reflecting skepticism about earnings durability.⁴

High interest rates amplify those concerns. Consumer discretionary carries the highest debt-to-equity ratio of any major sector, which makes rising borrowing costs disproportionately painful.⁵ Higher financing expenses squeeze retailers, while household budgets are increasingly strained by elevated credit costs.

Inflation in necessities — food, fuel, and shelter — continues to erode discretionary budgets. Retail analysts noted a wave of negative Q4 pre-announcements as demand softened and shoppers became more price-sensitive.⁶ Many households are prioritizing essentials, driving a wedge between resilient value retailers and struggling apparel or department-store chains. Falling conversion rates and shrinking basket sizes tell the same story.⁶

Consumer confidence fell to multi-year lows heading into the second half of the year, while student-loan payments, rising delinquencies, and higher living costs weighed on household resilience.² Retailers themselves face higher wage bills, elevated inventory-carrying costs, and persistent shrink — all of which limit their ability to pass costs on to consumers.

With so many pressures converging, it is no surprise that many retail stocks trade as if a recession is already underway.

Macy’s: Luxury Strength in a Difficult Backdrop

Despite gloomy sentiment, Macy’s has shown early signs of stabilizing. In Q2, the company posted a 1.9 percent comp-sales increase, led by solid results at Bloomingdale’s and Bluemercury.⁷ Macy’s beat earnings expectations and raised its full-year outlook — a notable contrast with much of the sector.⁷

CEO Tony Spring is reshaping the company with disciplined cost control and targeted investment. Macy’s closed dozens of underperforming stores in 2025 and plans 150 closures by 2026.⁷ At the same time, it is modernizing its digital infrastructure and leaning into its higher-margin luxury categories, which generate merchandise margins north of 45 percent.⁷ With a mid-single-digit forward P/E, strong liquidity, and active buybacks, Macy’s valuation reflects deep skepticism that may prove too harsh.

Kohl’s: A Deep-Value Contrarian Setup

Kohl’s has been among the sector’s biggest casualties. By late summer, shares traded near half of book value — an extreme discount relative to history.⁸ Years of strategic missteps had weighed on confidence, but recent quarters point to emerging traction.

Kohl’s beat sales and earnings estimates for the second consecutive quarter in Q2.⁹ Adjusted EPS nearly doubled expectations, aided by a roughly 4 percent reduction in SG&A.⁹ Management lifted its full-year profit outlook and emphasized tighter merchandising discipline and cost control.⁹

Interim CEO Michael Bender has refocused the retailer on value-conscious shoppers through sharper pricing, stronger private-label brands, and the full rollout of the successful Sephora shop-in-shop partnership.⁹ Leaner inventories and improving traffic in categories such as activewear and back-to-school merchandise add support. While challenges remain — comps are still negative — extremely low expectations and distressed valuation levels position Kohl’s as a compelling mean-reversion candidate if stabilization continues.

Foot Locker: A Reset and a Potential Catalyst

No retailer has undergone a more sweeping overhaul than Foot Locker. The company has closed more than 400 stores since 2020 as part of its “Lace Up” restructuring plan.¹⁰ These moves created near-term pain, including large impairment charges, but early signs of recovery are visible. In Q2, North American comps rose 1.4 percent even as Europe lagged.¹¹