Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE RETURN OF TREASURIES SIGNALS A RETURN TO NORMALIZATION

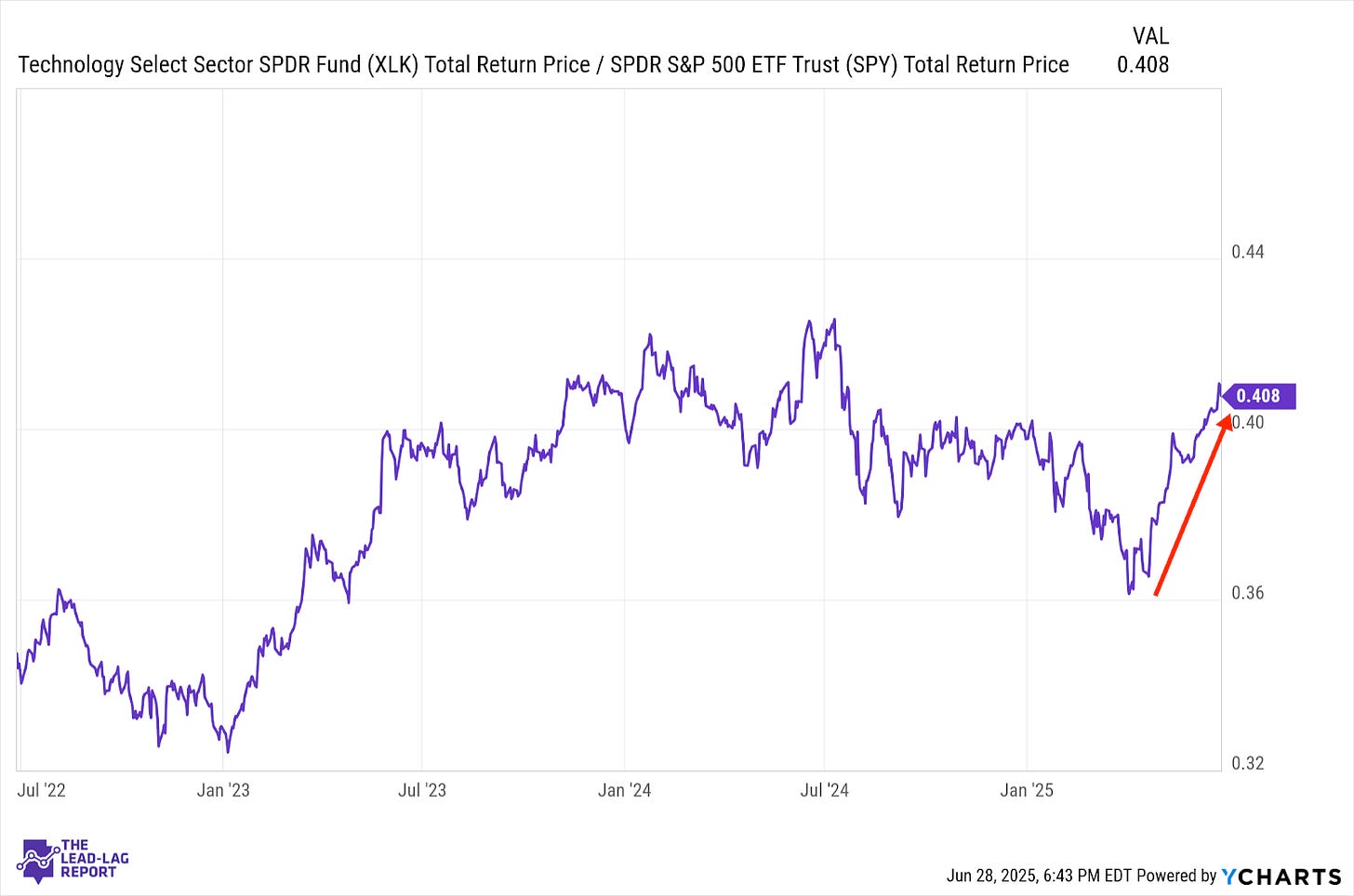

Technology (XLK) – Rate Cut Sentiment Shift

Clearly enthused by the idea that rate cuts might be near, investors remained in a risk-on mood, especially towards the growth stocks that had been leading following the 2022 bear market. This is again being driven by the magnificent 7 stocks. This doesn’t look so much like the AI trade as it is a rotation into the stocks that benefit most from a positive sentiment shift since tariff and geopolitical concerns have also calmed for the time being.

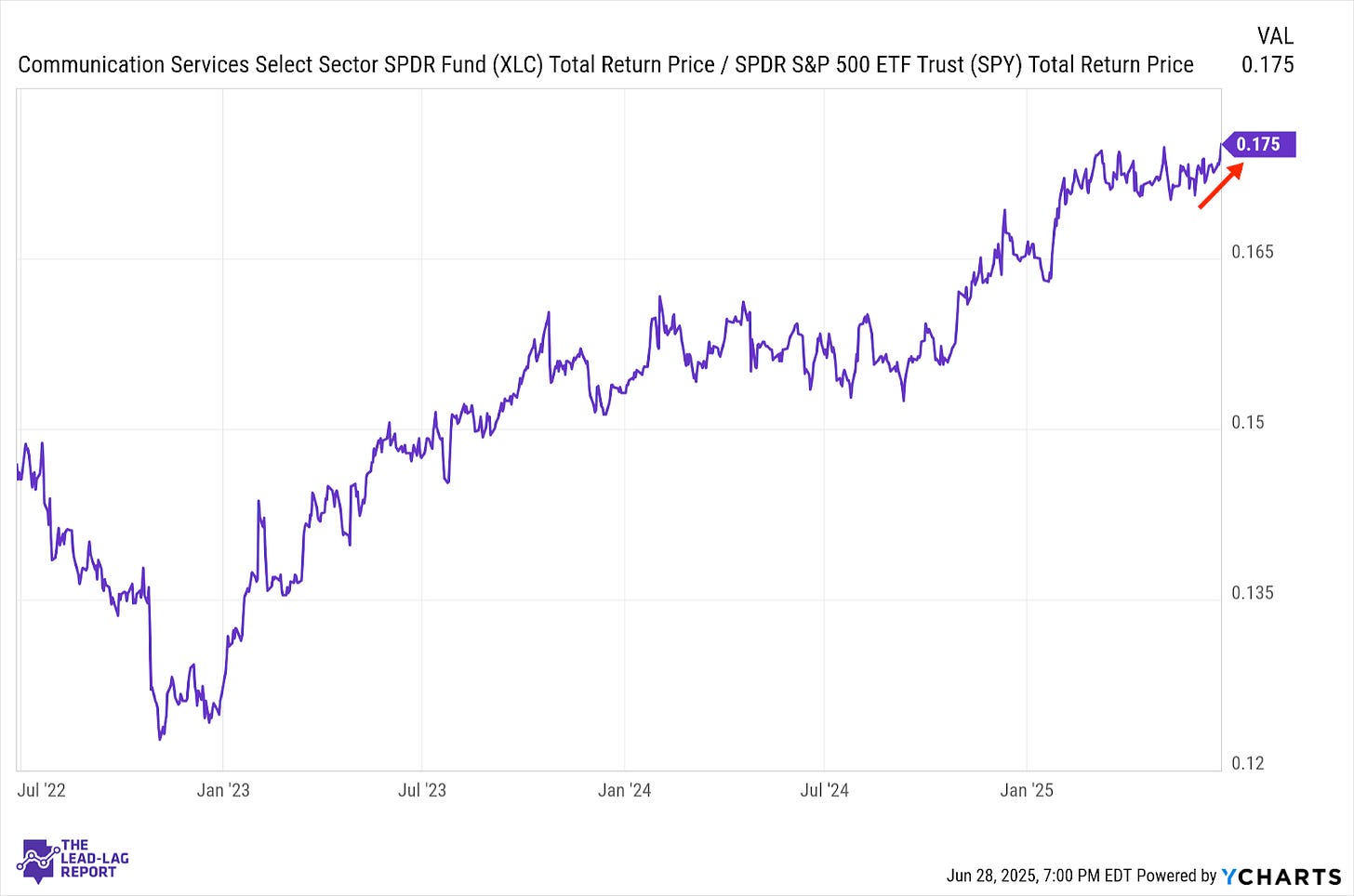

Communication Services (XLC) – Finally A Breakout?

I’ve been waiting for this ratio to break out in one direction or the other since February. It looks like we might finally be getting an answer. Thanks to the return of tech leadership, this sector has begun quietly outperforming again, although it still looks tenuous at this point. Communication services was the best-performing sector last week and, thanks to an early sprint out of the gate at the beginning of the year, the 2nd best-performing sector year-to-date.

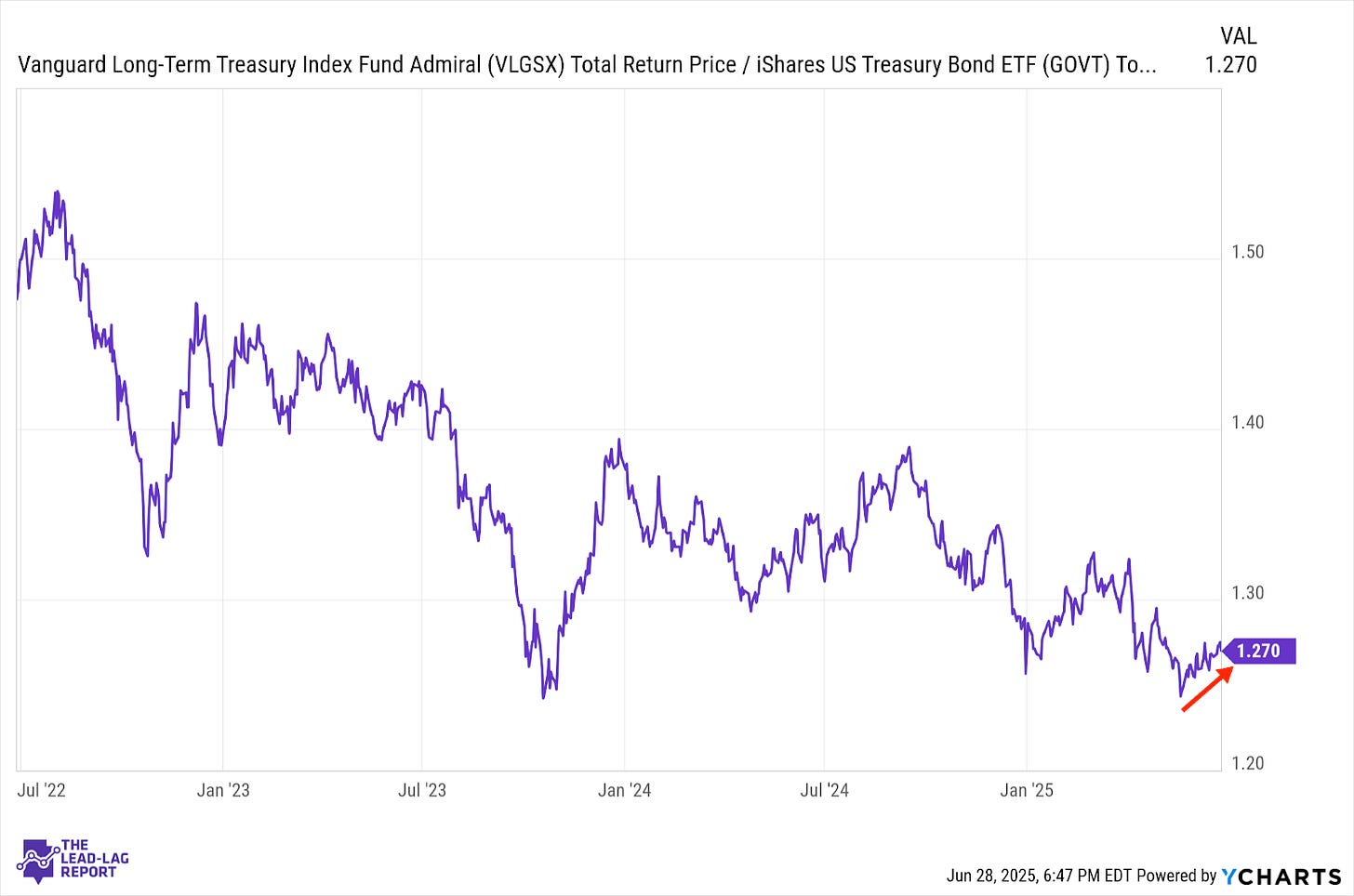

Long Bonds (VLGSX) – Here Comes The Fed

Even as U.S. stocks continue to test new all-time highs, Treasuries are quietly developing a little momentum of their own. While I believe there is some normalization occurring with some of the current tail risks, including trade and geopolitics subsiding, this group has clearly gotten a tailwind from the expectation of Fed rate cuts coming sooner than later.

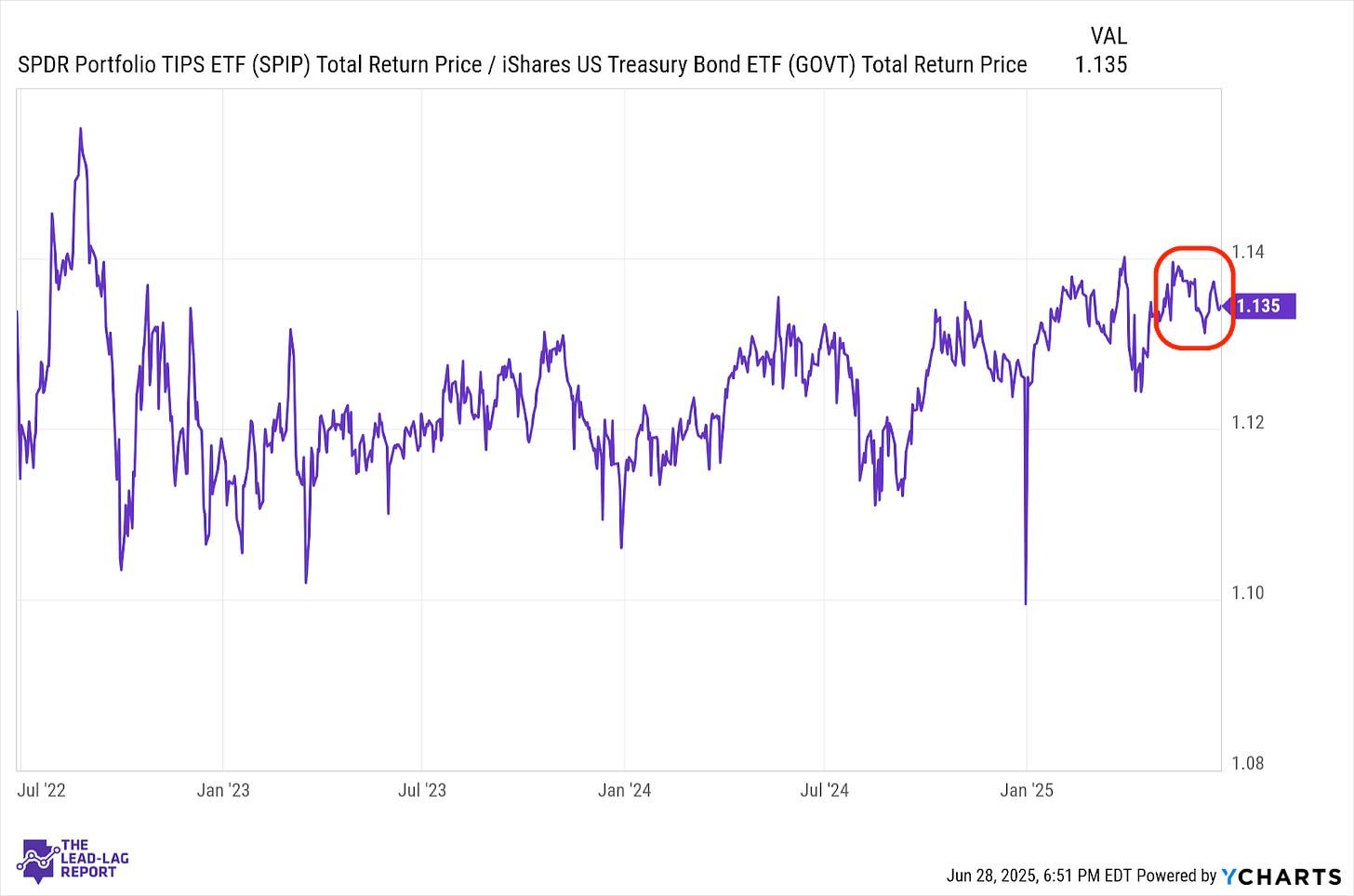

Treasury Inflation Protected Securities (SPIP) – The Fed Clears The Path

TIPS have kind of turned directionless at this point, largely following along with the behavior of Treasury bonds in general. The only thing really supporting the idea of TIPS outperformance was the fact that the Fed said it was still using inflation as the reasoning for not lowering rates. With the Fed now signaling that rate cuts are likely on the way, there may not be much need for inflation protection here.

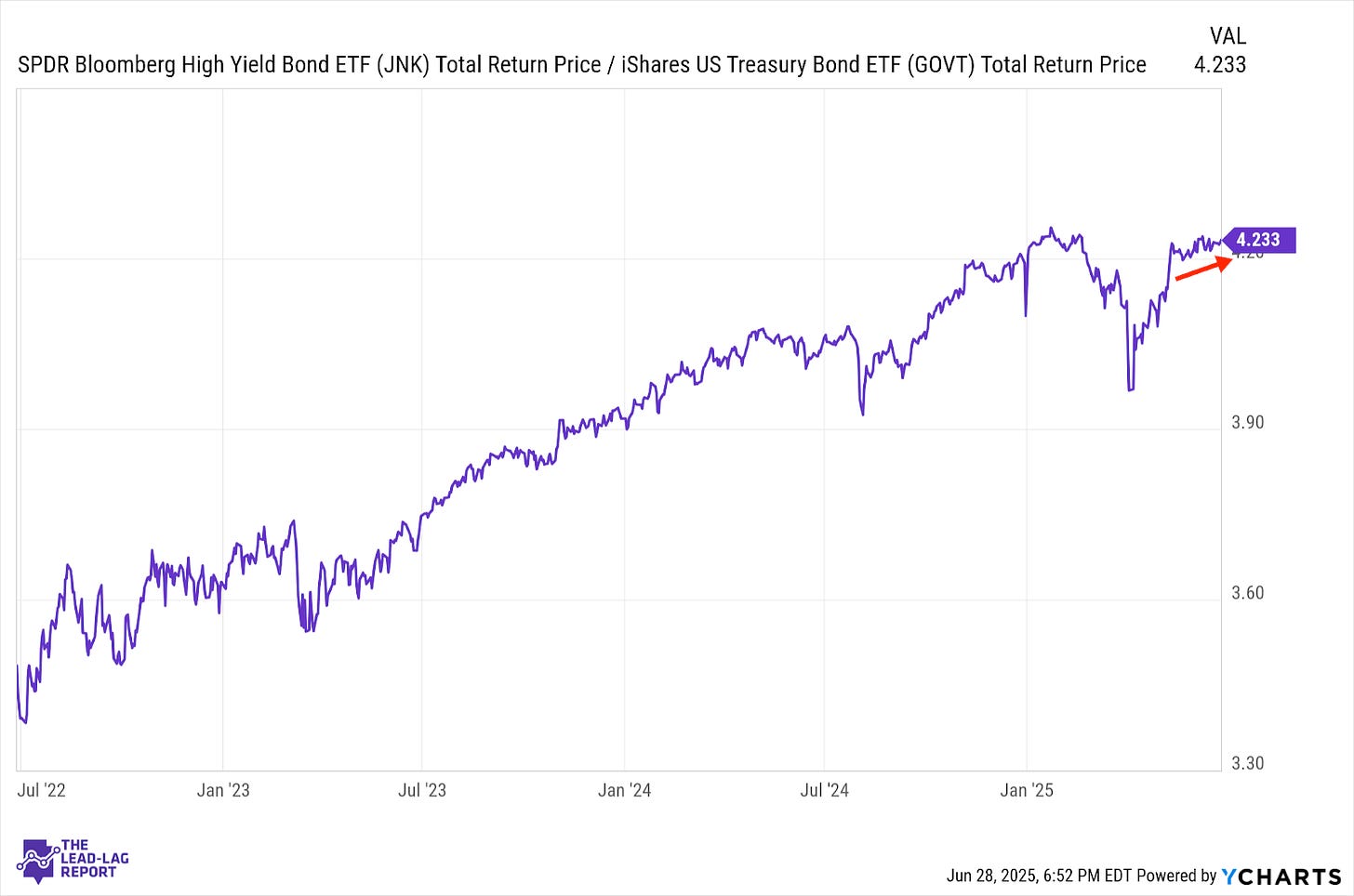

Junk Debt (JNK) – The Uptrend May Be Ending

Junk bonds have been rallying right alongside other risk assets, but the trend has been shallow. The difference this time around is that long bonds have been increasing in value too. The fall in gold prices recently suggests the uptrend in Treasuries isn’t necessarily due to risk-off sentiment, but due to the Fed’s likely rate cutting cycle ahead. That could mean an end to the long, steady uptrend of this ratio that’s been in place since early 2023.

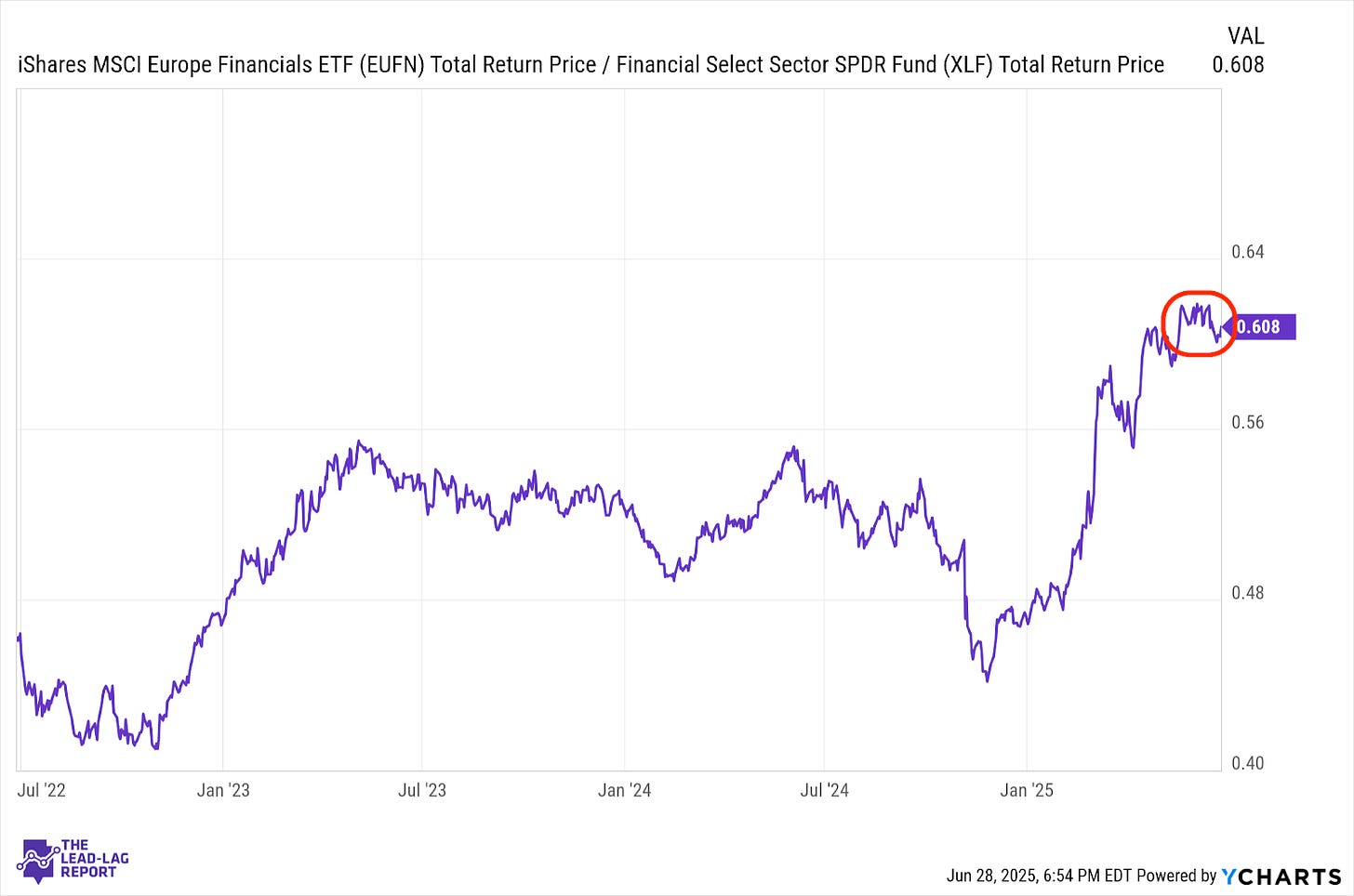

European Banks (EUFN) – Lower Rates Change The Calculus

After a strong start to 2025, the financial sector has cooled off over the past month, both in the U.S. and abroad. Banks do well when net interest margins are high (i.e. interest rates are high). With the Fed looking to join many other international central banks in lowering benchmark rates later this year, margins are likely to begin shrinking. That makes financial potentially less attractive over the next couple of quarters.

Emerging Markets Debt (EMB) – Reversal Possible