Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE RISK-OFF CONSENSUS IS NEARING COMPLETION

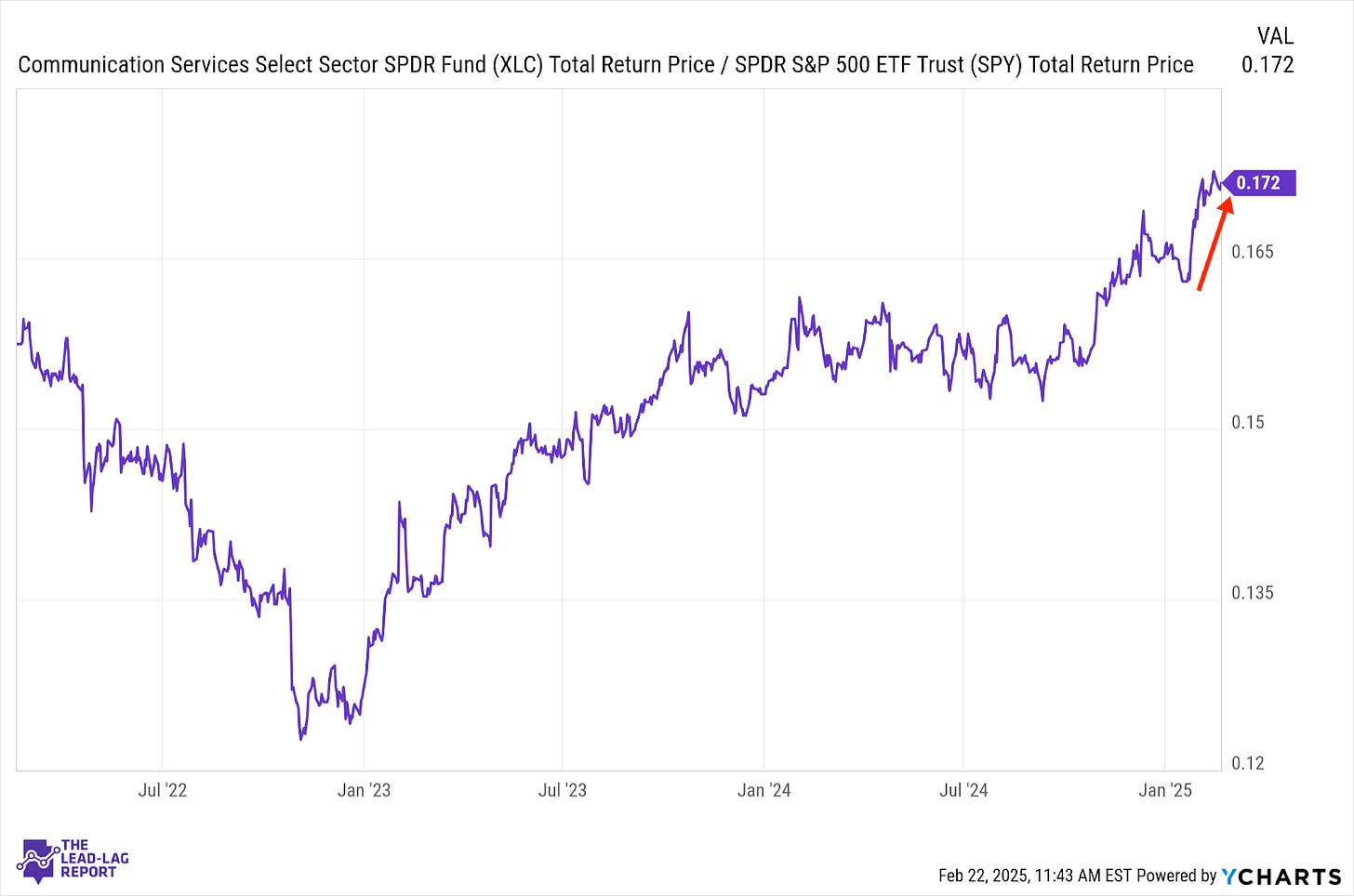

Communication Services (XLC) – Ability To Extend The Streak

The huge Facebook rally may be over, but this sector is still looking pretty healthy. That stock helped support the mag 7 sleeve of this portfolio, while the traditional telecom & media piece has seen a revival during the current defensive shift. The gains in recent weeks have been relatively, which gives me continued confidence that this sector has the ability to extend recent outperformance further.

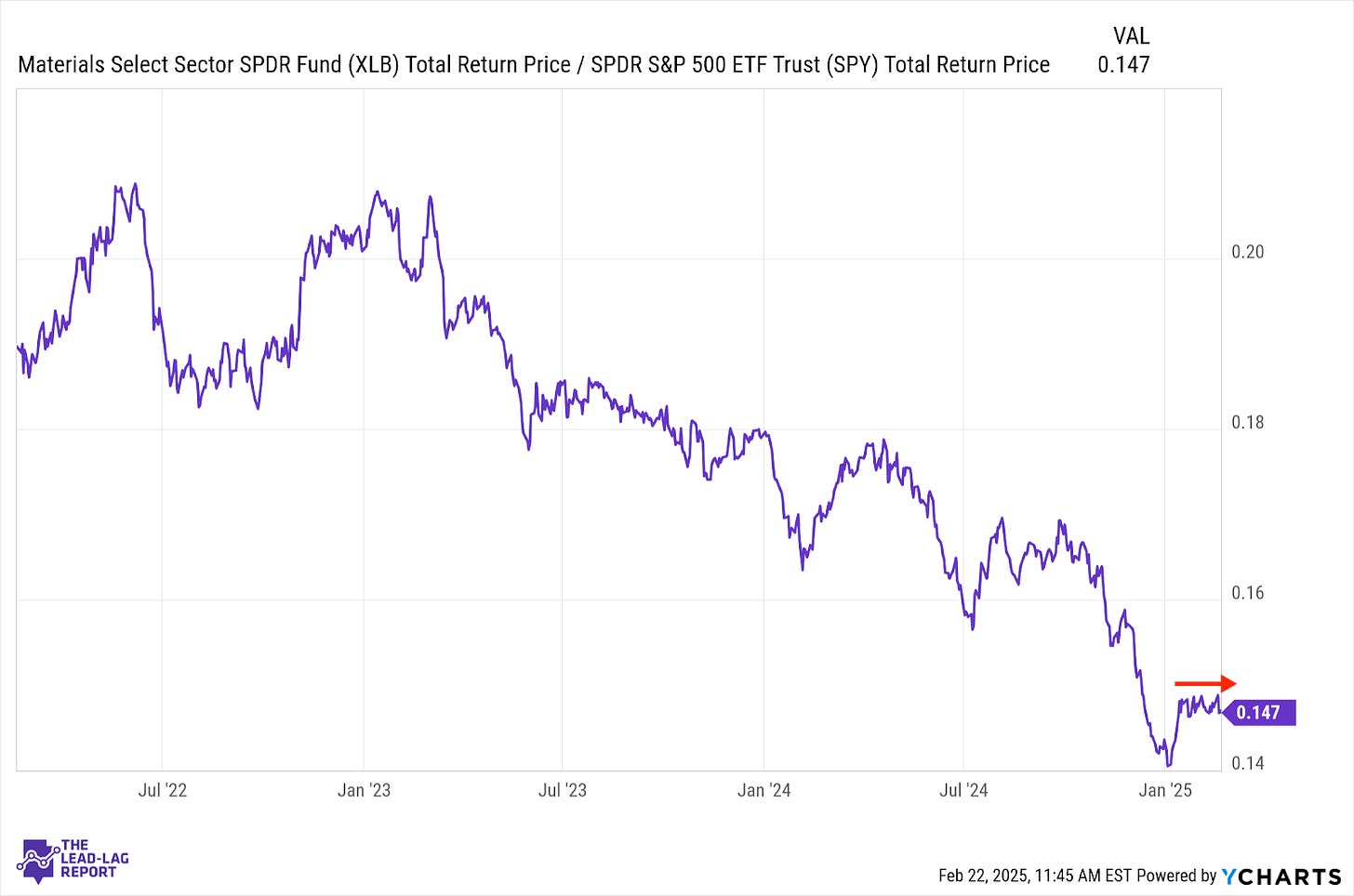

Materials (XLB) – Holding Up Well, But Few Tailwinds Ahead

The materials sector has been holding up relatively well here, even if it isn’t outperforming. It’s clearly getting some support from the underlying commodities space as well as outperformance from value stocks recently. If the economy is slowing, as last week’s PMI data strongly suggested, sensitive sectors, such as this one, are unlikely to find many tailwinds.

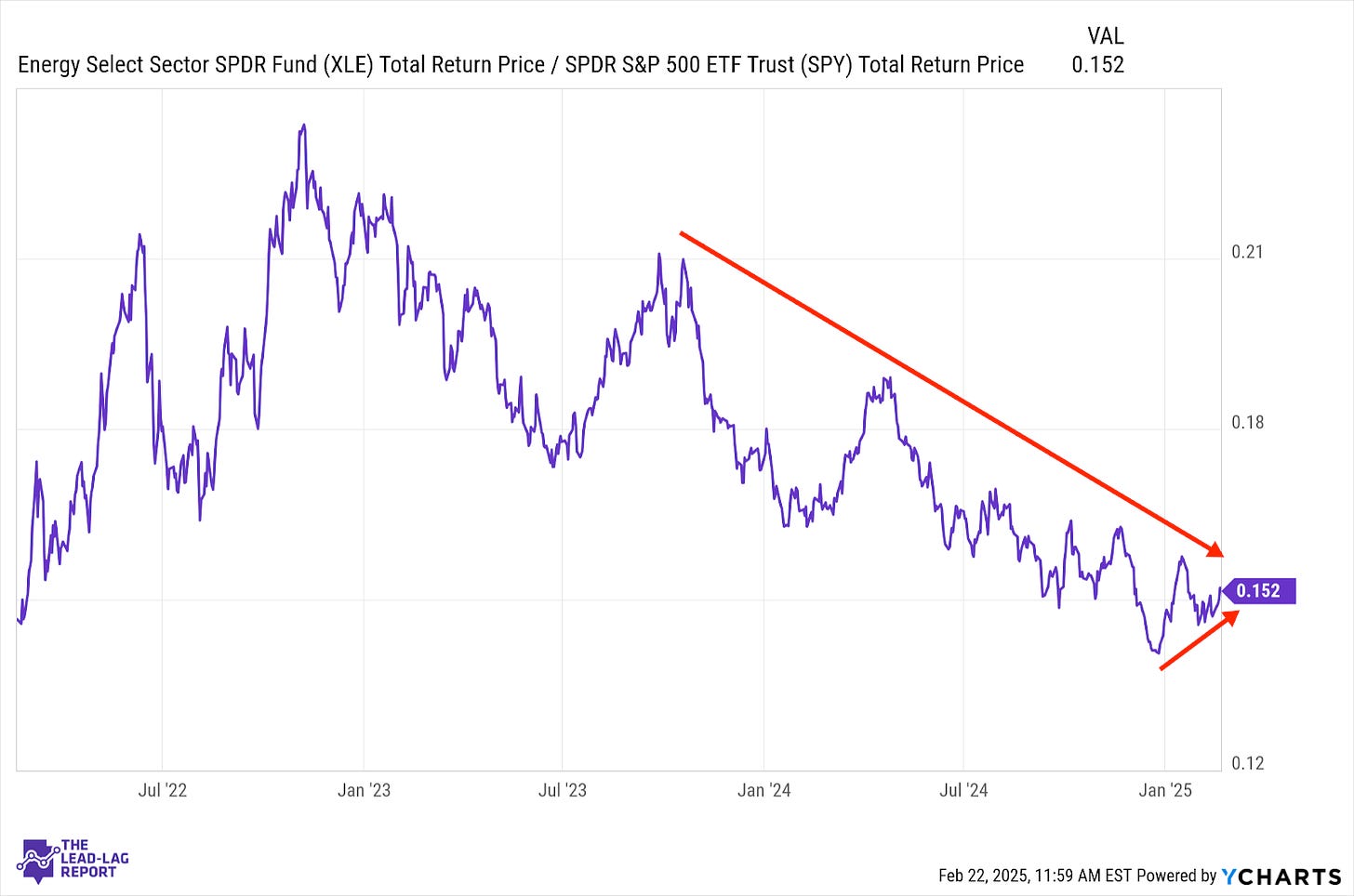

Energy (XLE) – China Driven

The recent uptick in this ratio might be China narrative driven considering that crude oil prices have largely remained range-bound. If the enthusiasm around the Chinese tech sector is justified and the country is preparing to invest in infrastructure and private sector growth, there could be a real positive story developing here.

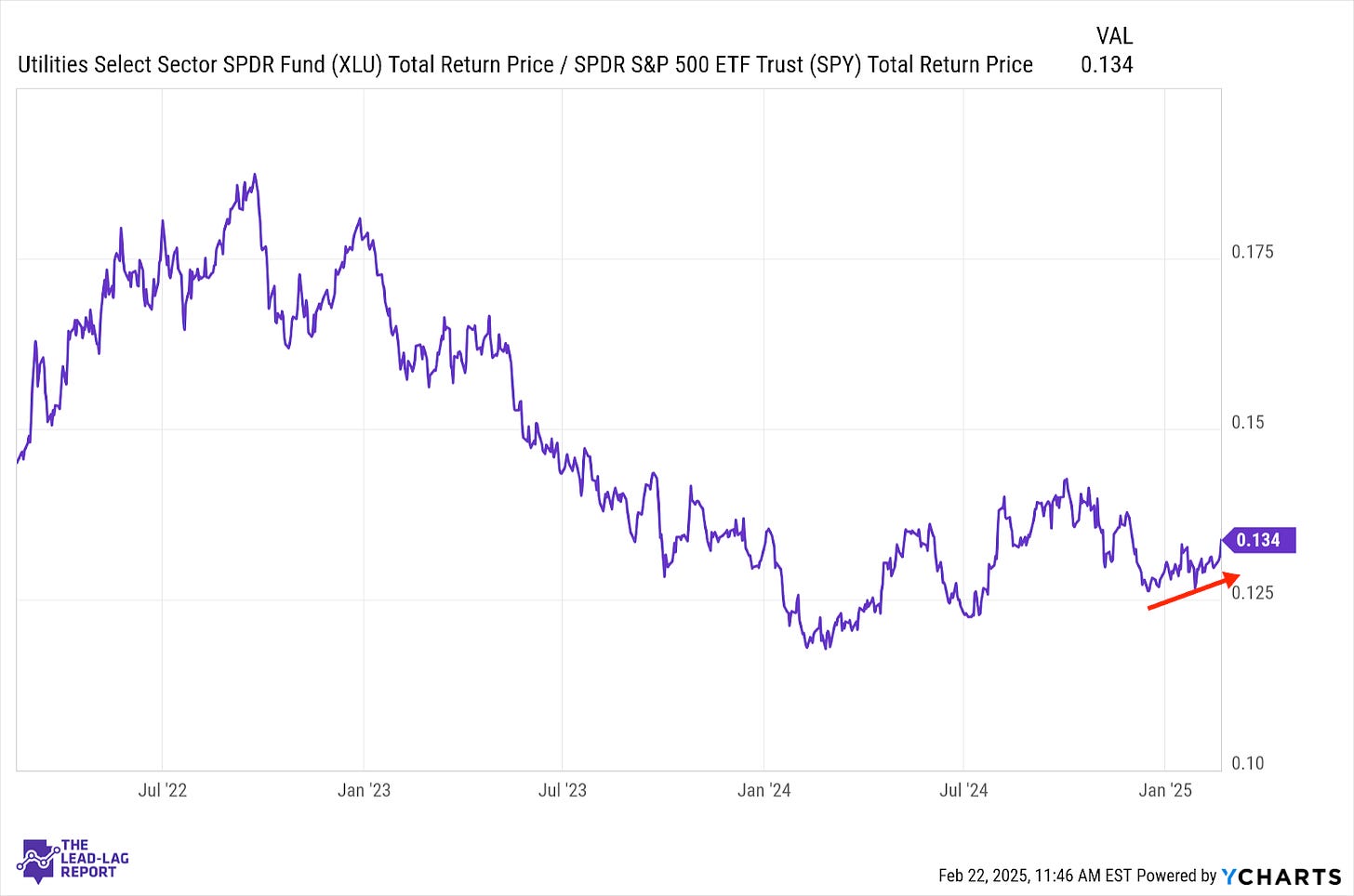

Utilities (XLU) – The Trend Has Legs

Utilities haven’t necessarily outperformed to the degree that healthcare has in 2025 or even consumer staples has recently. But the slow and steady ascension of this ratio is telling. Utilities, as they have historically, have started outperforming well before the data started to confirm macro conditions. Given that defensives are broadly participating now, I think there’s a chance that this trend has some legs.

Consumer Staples (XLP) – Textbook Risk-Off

Consumer staples was the one sector incredibly slow to respond to the defensive shift that was showing up in other areas of the market. Now that it’s going, it’s turning into one of the market’s best performers. We’ve heard a lot about the current troubles in the retail sector. The fact that it’s showing up so decisively in discretionary stocks but not here indicates that this is looking like a pretty textbook risk-off shift.

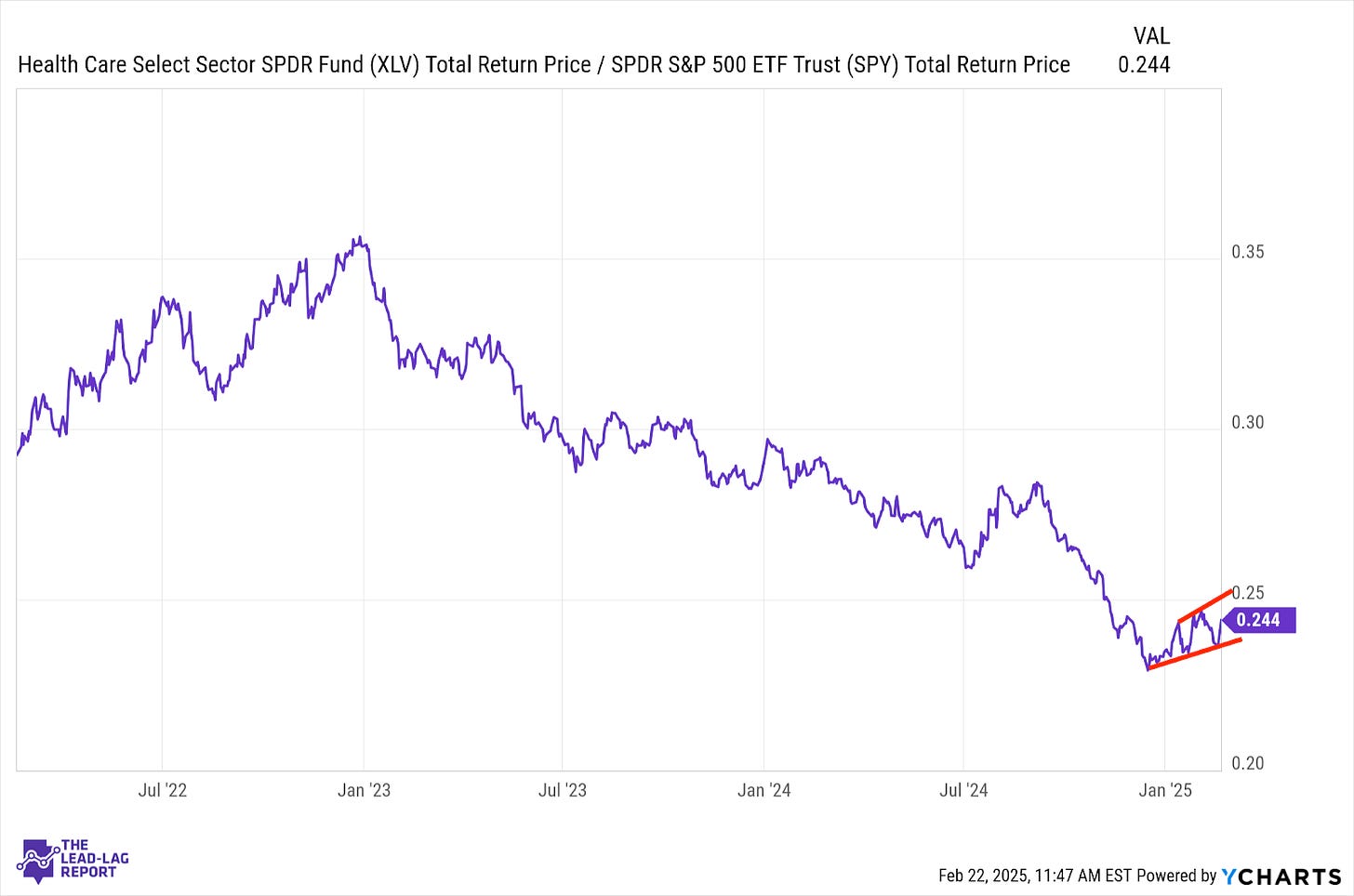

Health Care (XLV) – Risk-Off Is Winning

Healthcare remains one of the better sector performers year-to-date and its strong uptick last week relative to the S&P 500 demonstrates once again that this can be a big winner in a prolonged market downturn. There are still a lot of stops and starts in this trend and I do think that needs to be cleaned up a bit to feel better about sustainability, but the fact that this has extended for two months now confirms that risk-off is winning here.

Real Estate (XLRE) – Confirming The Risk-Off Tone