Risk-Off Isn’t Dead: The Resurgence of Classic Defensive Asset Correlations

How Utilities and Long-Duration Treasuries Are Quietly Signaling That Growth Fears—Not Inflation—Are Back in Control

Key Highlights

Utilities and long-duration Treasuries have recently moved in tandem, signaling a revival of classic risk-off behavior.

The recoupling suggests growth concerns are outweighing inflation fears at the margin.

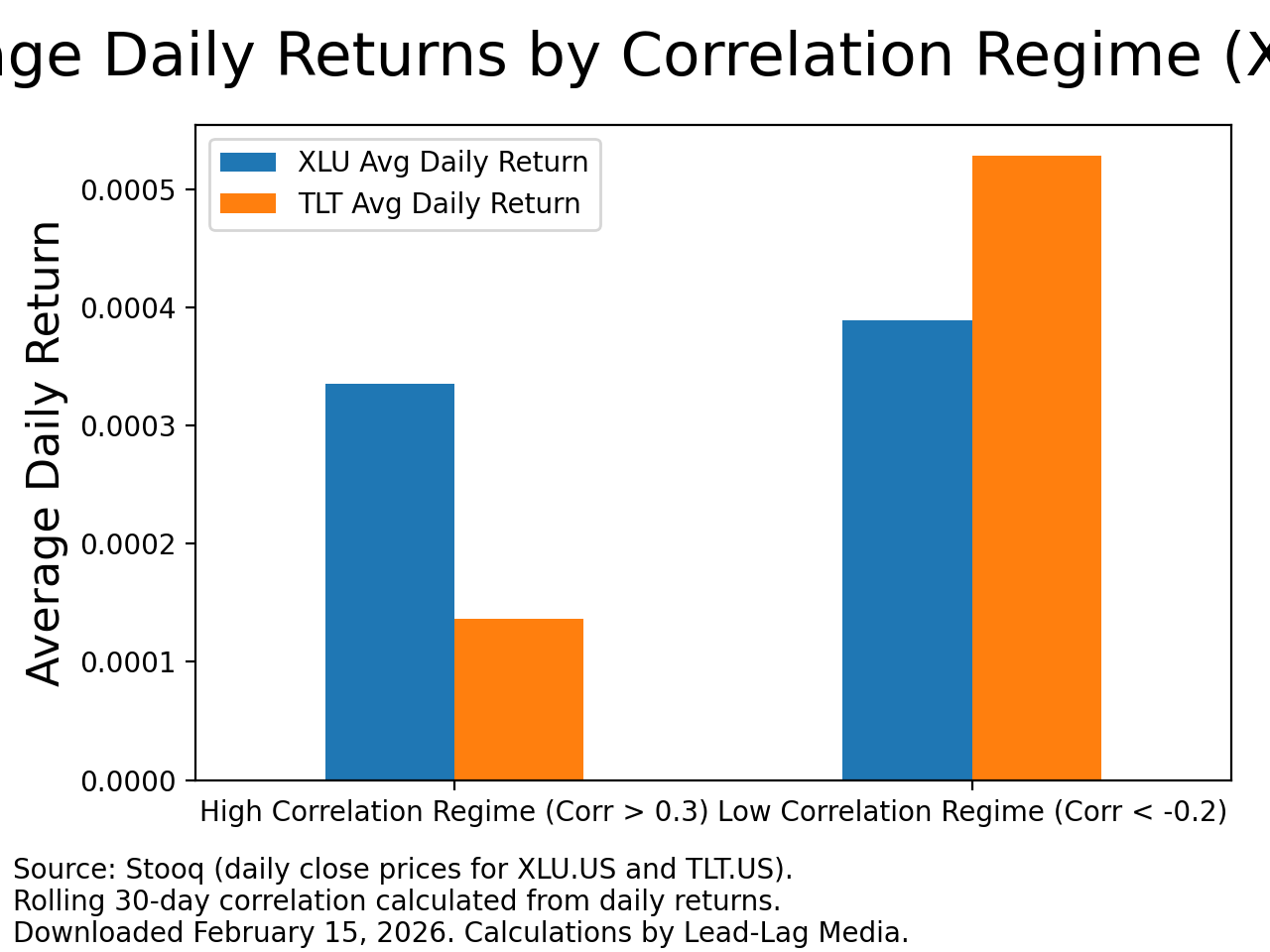

Correlation regimes shift depending on whether markets are dominated by inflation shocks or growth shocks.

Defensive sectors like utilities remain sensitive to rates, but structural AI-driven electricity demand complicates the traditional narrative.

The XLU + TLT relationship can serve as a practical weekly risk barometer.

The Return of a Familiar Pattern

A funny thing happens when markets get uneasy. The same “boring” corners of the market begin to show relative strength. Utilities. Long-term Treasuries. The quiet assets that rarely trend on social media.

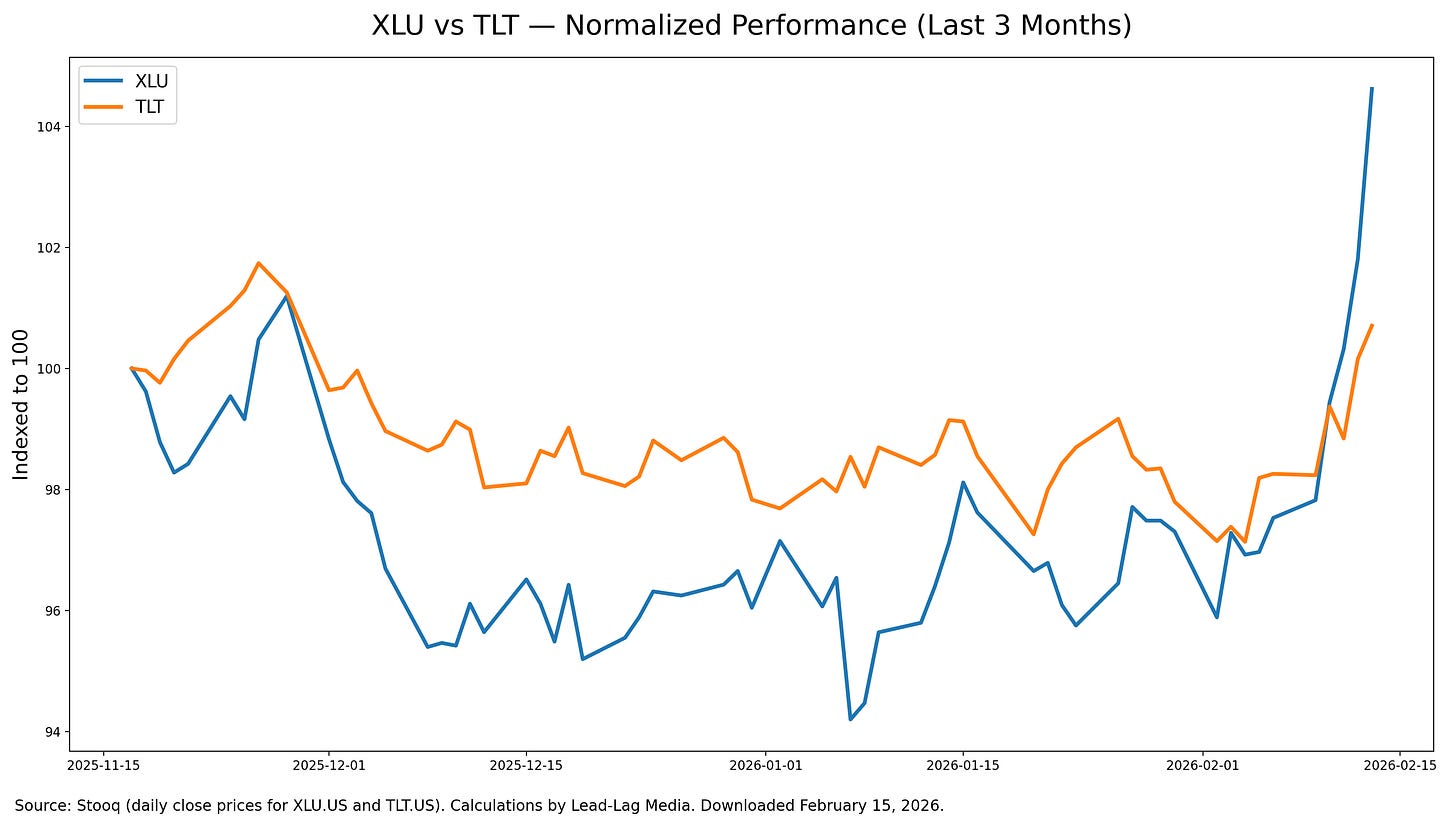

That pattern has reemerged in recent weeks. The Utilities Select Sector SPDR ETF (XLU) and the iShares 20+ Year Treasury Bond ETF (TLT) have frequently moved in the same direction across multiple sessions.¹ ² The pairing matters because it reflects a classic defensive alignment that many investors had written off during years when diversification seemed unreliable.

This is not merely about two ETFs rising together. It is about what that co-movement signals. Utilities represent defensive equity exposure. Long-duration Treasuries represent high-quality duration. When both attract capital simultaneously, the market is revealing its macro preference.

The key distinction lies between growth fear and inflation fear. When inflation dominates, bonds and equities can decline together. When growth concerns dominate, bonds often resume their traditional role as ballast.³ ⁴ The recent recoupling suggests investors are leaning toward the latter.

Utilities and long Treasuries belong in the same conversation for structural reasons.

Utilities are defensive because electricity demand is relatively inelastic. Consumers may delay discretionary purchases, but they continue paying utility bills. Charles Schwab’s sector outlook notes that utilities historically hold up better during slowdowns due to the essential nature of their services.⁵

At the same time, utilities behave like bond proxies. Their capital-intensive balance sheets and steady cash flows make them sensitive to interest rate movements. Rising rates can pressure valuations while increasing financing costs.⁶

Long-duration Treasuries operate differently but respond to similar macro impulses. The U.S. Securities and Exchange Commission explains that bond prices and interest rates generally move in opposite directions.⁷ When investors anticipate slower growth and lower future rates, long bonds often benefit.

BlackRock states that TLT tracks U.S. Treasury bonds with maturities greater than twenty years, emphasizing that interest-rate risk remains central to its behavior.⁸ Fixed income carries duration risk, but in growth scares, duration can become protection.

Put together, utilities and long Treasuries tend to align when investors prioritize stability, income consistency, and rate sensitivity. That alignment appears to be resurfacing.

When the Hedge “Broke”

The resurgence of this relationship feels notable because it follows a period when traditional diversification seemed unreliable.

Inflation shocks, aggressive rate hikes, and uncertainty surrounding central bank policy created stretches where stocks and bonds declined simultaneously. The familiar negative stock-bond correlation weakened or even reversed.

The Bank for International Settlements provides a useful framework. When inflation is low and stable, growth shocks tend to dominate. In that environment, weak economic news pushes equities lower while boosting bonds through expectations of easier policy.⁹

When inflation is high and volatile, the dynamic changes. Inflation surprises can pressure both bonds and equities at the same time because both are sensitive to discount-rate adjustments.⁹

Vanguard reaches a similar conclusion. Its research shows that inflation shocks increase stock-bond correlation, while growth and volatility shocks tend to restore diversification benefits.¹⁰

That explains the frustration many investors experienced. During inflation-dominated regimes, bonds failed to cushion equity drawdowns. Utilities also struggled, as rising rates weighed on valuations and financing costs simultaneously.⁶

Recent headlines help contextualize the shift.

Market commentary during the latest volatility described a renewed flight-to-quality tone, with defensive sectors strengthening alongside government bonds.¹¹ ¹² Meanwhile, Reuters reported episodes of geopolitical and tariff uncertainty that pressured multiple asset classes at once, creating the kind of “sell America” move that challenges diversification assumptions.¹³

MSCI refers to these episodes as “triple-red” scenarios, when U.S. equities, Treasuries, and the dollar decline together.¹⁴ Such environments undermine confidence in traditional asset allocation.

The recent utilities-plus-Treasuries rally does not resemble that pattern. Instead, it resembles the older template: cyclicals soften, defensives hold up, duration firms. That implies growth sensitivity has reemerged as the dominant concern.

Correlation regimes do not disappear. They rotate.

What the Recoupling Signals Now

When utilities and long Treasuries strengthen together, the market often implies three underlying beliefs.