As 2026 begins, equity market leadership looks notably different from what investors have grown accustomed to over the past several years. Instead of mega-cap technology stocks dictating the market’s direction, small-cap equities have emerged as the primary drivers of performance. For investors conditioned to measure risk appetite through the lens of a handful of technology giants, this shift may feel unfamiliar. Yet the market’s early-year message is unambiguous: risk appetite remains intact, even as leadership migrates away from Silicon Valley and toward Main Street.¹

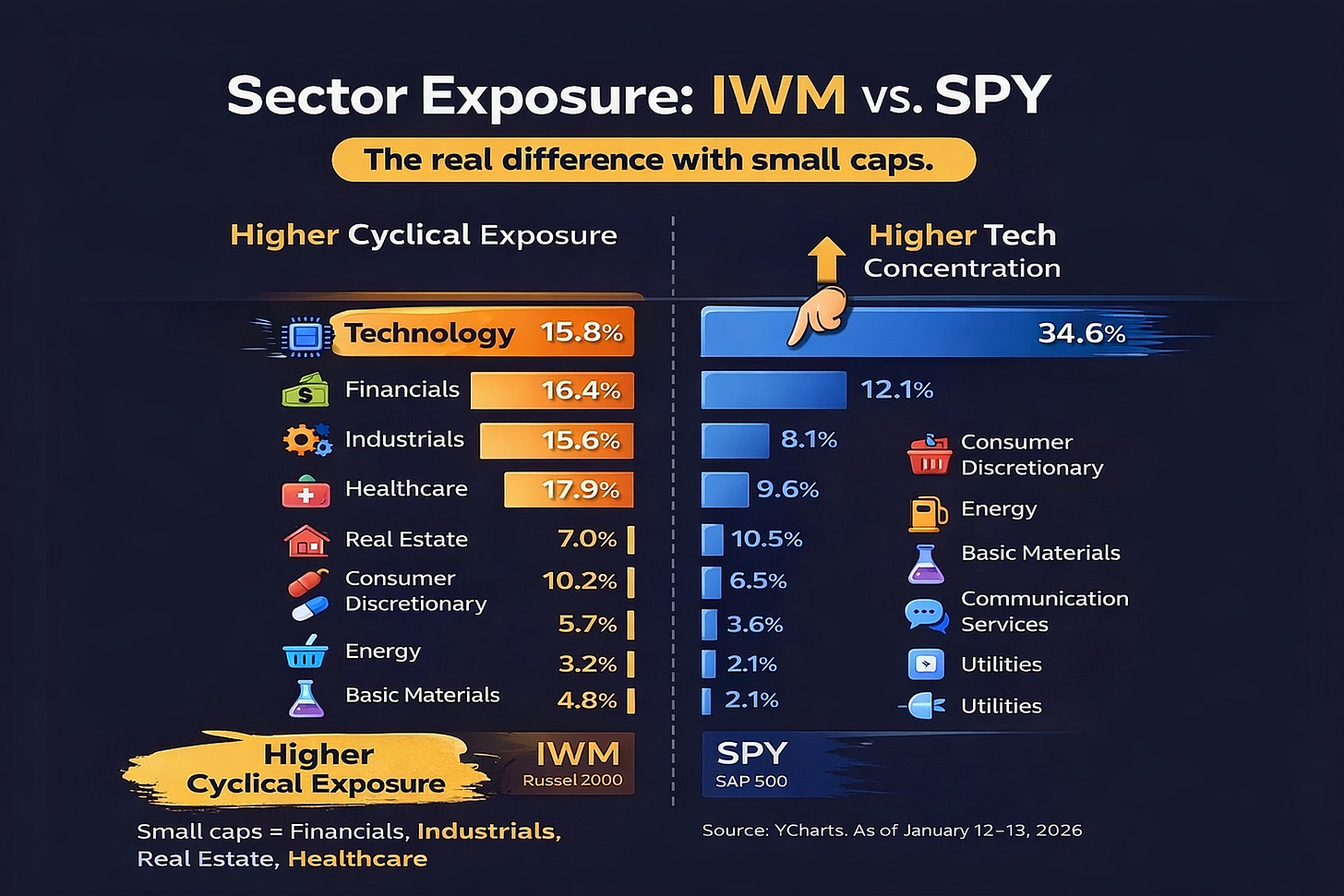

This distinction matters because leadership regimes influence how investors express optimism. A tech-led market often reflects a search for growth scarcity and long-duration earnings. A small-cap led market signals confidence in the broader economy, domestic demand, and cyclical momentum. Early 2026 price action suggests that investors are increasingly comfortable embracing that latter narrative.²

Small-Cap Leadership and the Return of Market Breadth

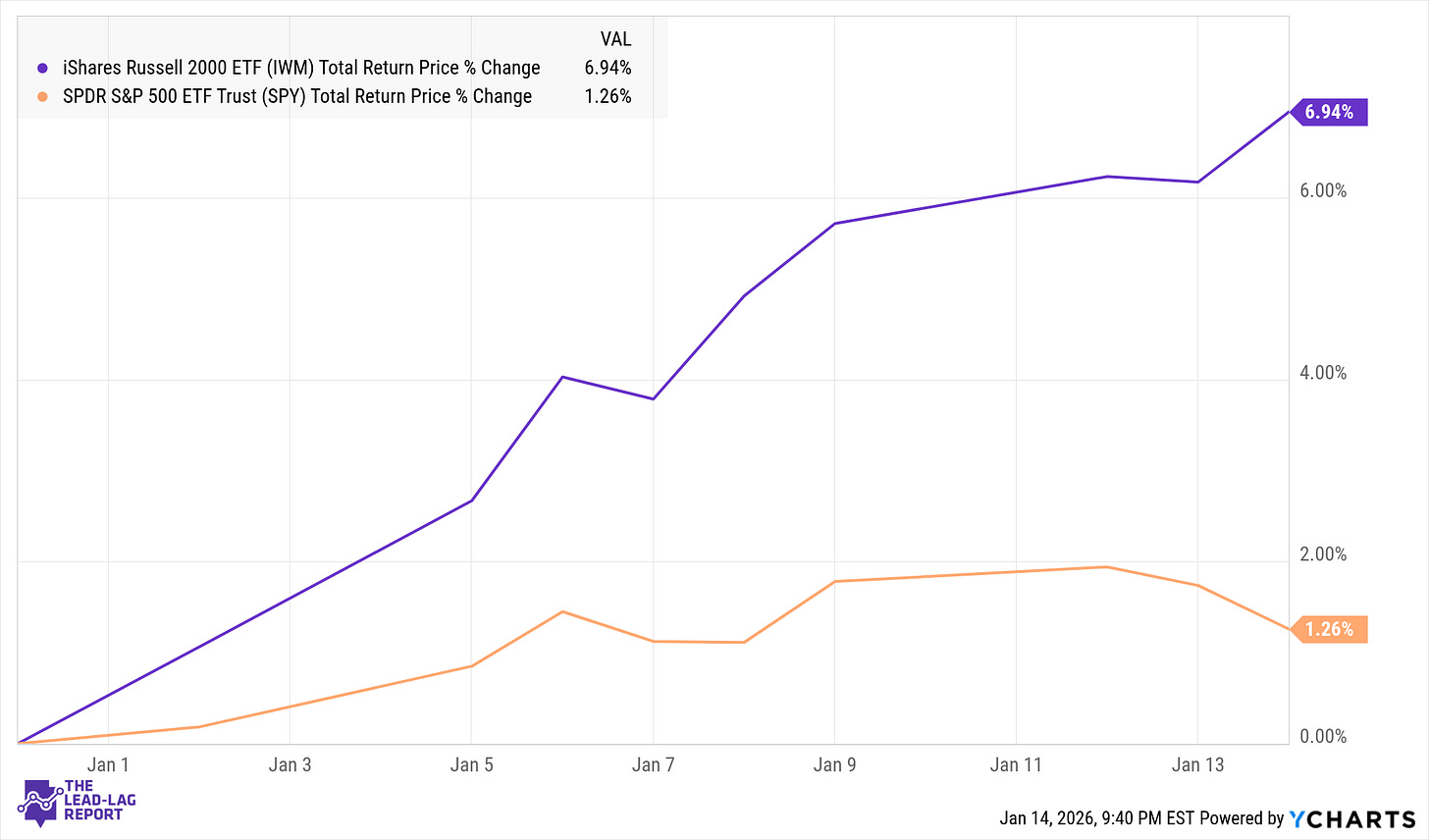

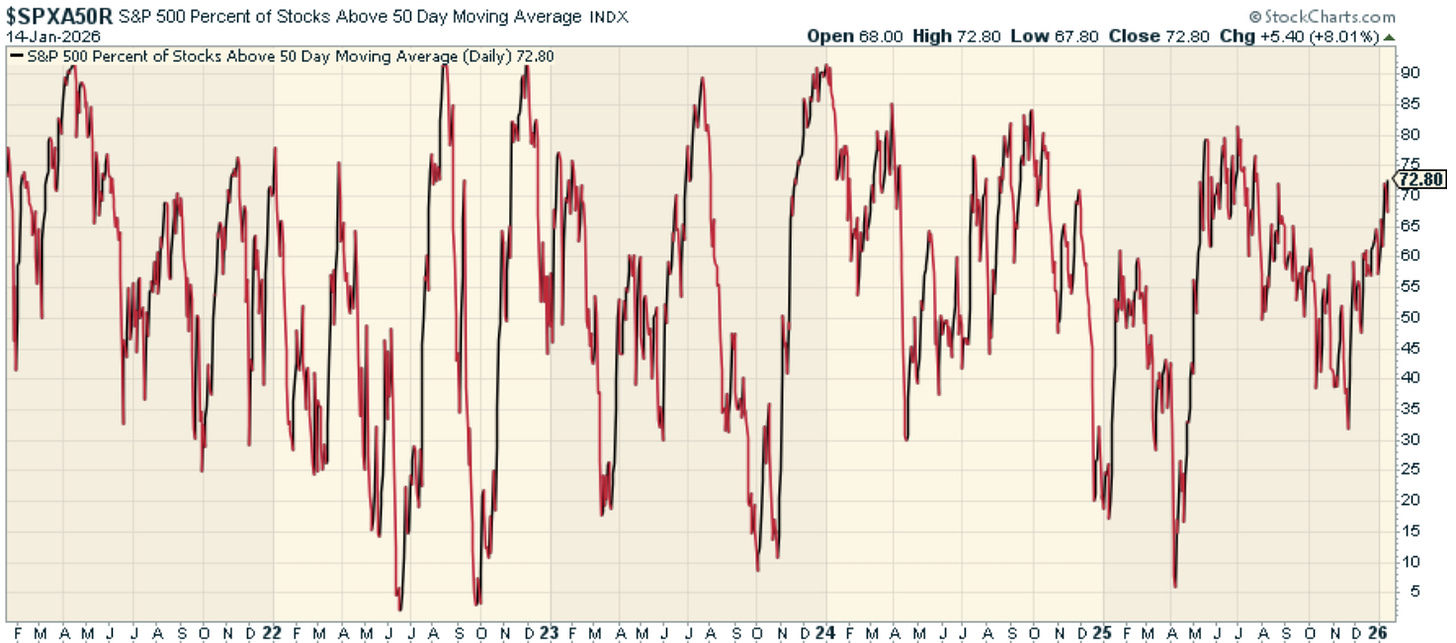

One of the most important features of the current rally is its breadth. Unlike prior advances driven by a narrow set of stocks, participation has expanded meaningfully. Small- and mid-cap equities have outperformed, while gains have spread across a wider range of industries.³ This broadening is significant because rallies supported by many stocks tend to be more durable than those dependent on a few dominant names.

The macroeconomic backdrop helps explain why this shift is occurring. By late 2025, inflation pressures had moderated and monetary policy had clearly pivoted away from restriction. The Federal Reserve signaled greater comfort with easing financial conditions, reducing fears of an imminent recession.⁴ As uncertainty around rates diminished, investors became more willing to reallocate capital toward economically sensitive areas of the market.

Small-cap companies are particularly responsive to this environment. They tend to rely more heavily on external financing and domestic economic activity, making them natural beneficiaries of stabilizing credit conditions. As borrowing costs ease and confidence improves, earnings expectations across this segment tend to rise more quickly. The resulting rotation has improved overall market breadth, reinforcing the perception that the rally is grounded in broader economic participation rather than narrow speculation.⁵

At the same time, mega-cap technology stocks have paused after years of outsized gains. This moderation has been orderly rather than disruptive, reflecting valuation digestion rather than structural weakness.⁶ The leadership transition does not suggest technology has lost relevance. It suggests investors are redistributing risk across the market as opportunities widen beyond the most crowded trades.

Sector Rotation in a Small-Cap Led Environment

When small-caps lead, sector performance tends to follow well-established historical patterns. Cyclical and value-oriented sectors usually outperform, while defensive areas lag. That pattern has reasserted itself as 2026 gets underway.

Financials, industrials, and energy stocks have been among the primary beneficiaries of renewed risk appetite.⁷ These sectors are closely tied to economic activity, credit availability, and capital investment. As growth expectations stabilize, banks benefit from improved lending conditions, industrial companies gain from rising infrastructure and manufacturing demand, and energy firms see stronger support from firming consumption trends.