If you have a copy of Benjamin Graham’s “The Intelligent Investor” on your bookshelf or religiously follow Berkshire Hathaway’s annual shareholder meetings, you might want to sit down.

That’s because all notion of fundamental investing is being thrown out the window as we speak.

Gone, apparently, is the need to examine balance sheets or cash flow statements or competitive advantages or, you know, anything that has to do with the actual health of a business.

Today, we’re in an environment where this guy…

can post this…

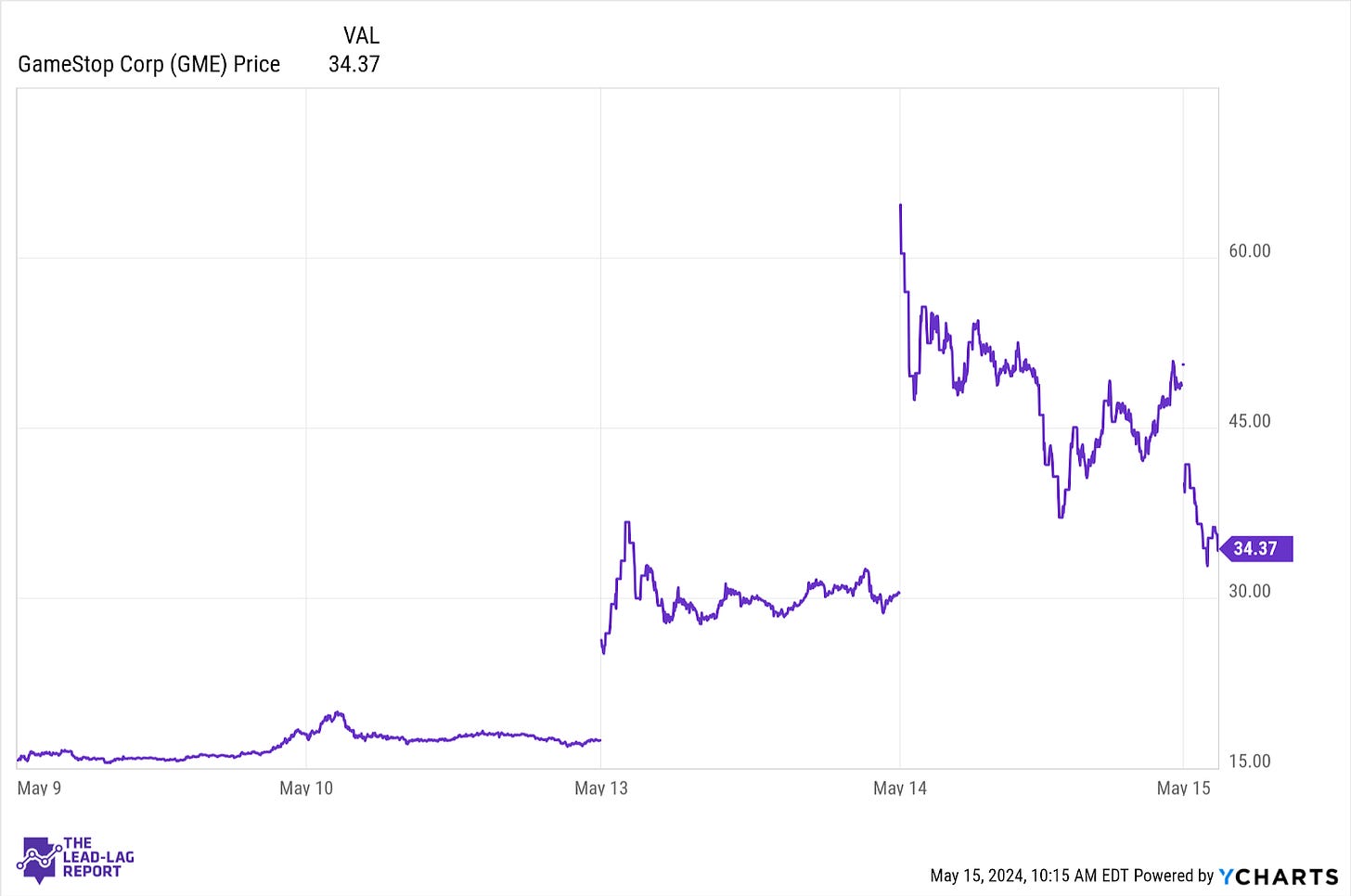

and cause this…

In reality, this environment isn’t new. It really started during the COVID pandemic when people stuck at home who were bored, had nothing to do and were sitting on thousands of dollars of stimulus cash decided to turn the stock market into their own personal casino. Looking for a target to take their frustrations out on, they settled on ultra-wealthy hedge fund operators, who were clearly having a much easier time making it through the pandemic than they were (financially speaking at least).

So they coordinated on a Reddit message board and identified the companies with the largest short positions out there. The plan: buy as much of these stocks as they could, drive the share price higher and inflict millions of dollars of damage on these funds, if not bankrupt them altogether.

And it worked for a little while, but by the end of 2021, the biggest meme stocks, including GameStop and AMC, were down more than 60% from their peaks. The bear market of 2022 took care of destroying most of what was left of their remaining value and meme stock mania quietly fizzled out.

Up until the past week.

The Biggest Current Market Inefficiency

I think it’s important to distinguish the difference between what might be considered a “bubble” and an “inefficiency”.