Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THROUGH ALL OF THE TURMOIL, UTILITIES HAVE SUSTAINED

Utilities (XLU) – Safe Haven Momentum Building

Even as rate sensitive sectors got hammered last week, utility stocks are still holding up fairly well here. Even though investors returned to tech & growth amid last week’s selling, traditionally defensive equities also held their own, suggesting that there is some modest safe haven momentum building here. This sector has done a good job of signaling the risk-off pivot from earlier on this year and will likely remain this way through at least the end of this month.

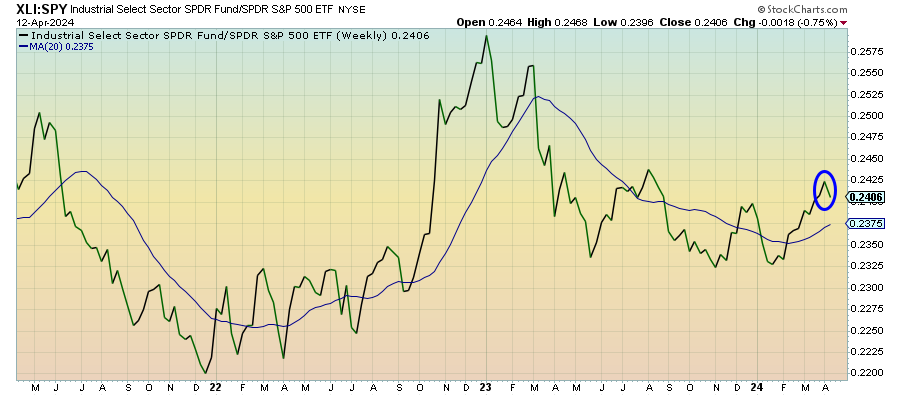

Industrials (XLI) – Investors Suddenly Shaken

Another hotter than expected inflation report, a little geopolitical unrest and the realization that the Fed won’t be able to come to the rescue made quick work of the recent cyclical rally. The underlying macro fundamentals of strong domestic growth and full employment are still in place, but the prospect of soaring oil prices and high interest rates throttling the recent uptrend seems to have shaken investors.

Materials (XLB) – Confirming That Inflation Is A Real Problem

Commodity prices continue to soar in what’s starting to look a little 2022-ish. Higher prices could signal that demand for these inputs is still robust, but it’s also confirming why the threat of higher inflation is very real. Service-side inflation has been the real problem recently. If goods inflation starts picking up again as well, the next action by the Fed might be a hike, not a cut.

Energy (XLE) – Is An Escalation Coming?

Crude oil prices have remained mostly flat for the first two weeks of April, but the Israel/Iran conflict has the potential to send them much higher very quickly should the two sides begin trading attacks. We know the macro backdrop, but the short-term really all depends on whether all sides involved can negotiate a de-escalation and remove a black cloud from the marketplace.

Communication Services (XLC) – In Reality, An Underperformer