Shockwaves Through the Strait: How a U.S.–Iran Clash Could Detonate the Yen Carry Trade

From oil spikes to currency convulsions, the hidden chain reaction that could tighten global liquidity in days—not months.

Key Highlights

A U.S.–Iran escalation does not need to close the Strait of Hormuz to disrupt markets.

Even a temporary oil risk premium can lift FX volatility and pressure yen-funded positioning.

The yen carry trade behaves like a short-volatility strategy and can unwind abruptly.

Japan’s massive overseas asset base means currency shocks can translate into global liquidity tightening.

Investors should monitor oil persistence, USD/JPY volatility, and Japanese cross-border flows for early warning signals.

The Strait Is a Price Signal, Not Just a Shipping Lane

Investors often reduce geopolitics to a simple formula: tension rises, oil spikes, energy stocks rally. That framing misses the deeper transmission channel. Markets do not require a worst-case outcome to reprice risk. They require only a shift in perceived probabilities.

In early February, U.S. officials issued fresh guidance for commercial vessels transiting the Strait of Hormuz, advising ships to maintain distance from Iranian waters. Separate reporting described Iranian boats approaching a U.S.-flagged tanker before it continued under escort.¹ These developments did not halt shipping. They altered the tone.

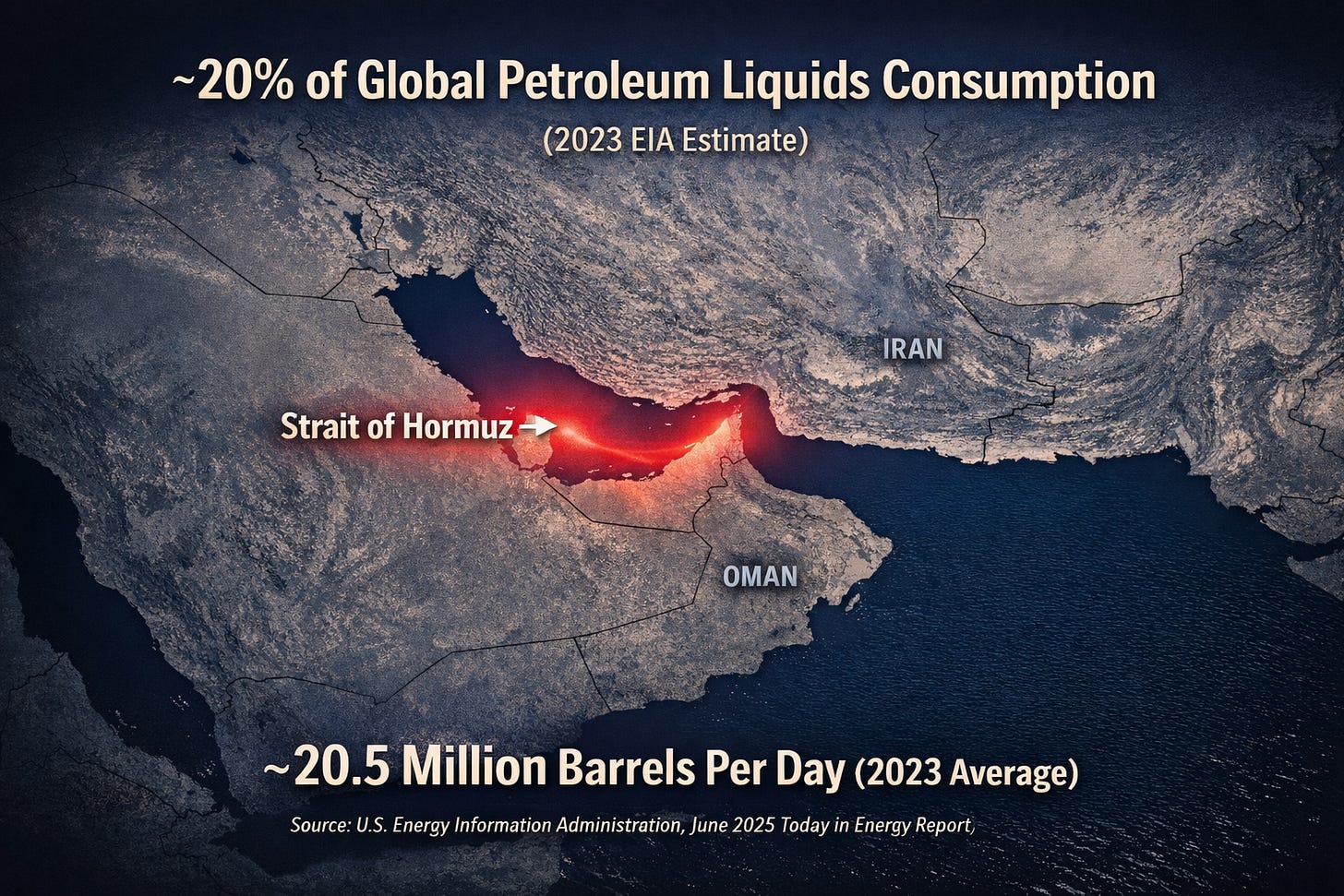

The Strait of Hormuz remains one of the most consequential energy chokepoints in the world. A substantial share of global seaborne crude flows through the passage, with limited alternative routing capacity relative to normal transit volumes.² ³ That lack of redundancy means even incremental tension can push traders to demand a higher risk premium.

Oil markets embed that premium quickly. Brent crude functions as a global reference benchmark, influencing both physical cargo pricing and derivatives markets.⁴ When headlines raise the perceived odds of disruption, Brent often reacts first. In early February, oil prices moved higher alongside renewed shipping caution.⁵

The key point is structural. Oil does not need to disappear from the market to influence asset prices. It simply needs to become less certain. That uncertainty transmits outward.

Oil, Volatility, and the Yen Carry Machine

Crude oil is not just an energy input. It feeds into inflation expectations, consumer purchasing power, and central bank reaction functions. Higher prices can behave like a tax on import-dependent economies. Policymakers may face renewed inflation pressures precisely when growth is fragile. The macro conversation shifts quickly.

Foreign exchange markets often respond faster than equities. Research from the International Monetary Fund shows that periods of heightened uncertainty tend to coincide with yen appreciation, particularly when leveraged positions unwind.⁶ The yen frequently strengthens in risk-off episodes, even when Japan is not the source of stress.

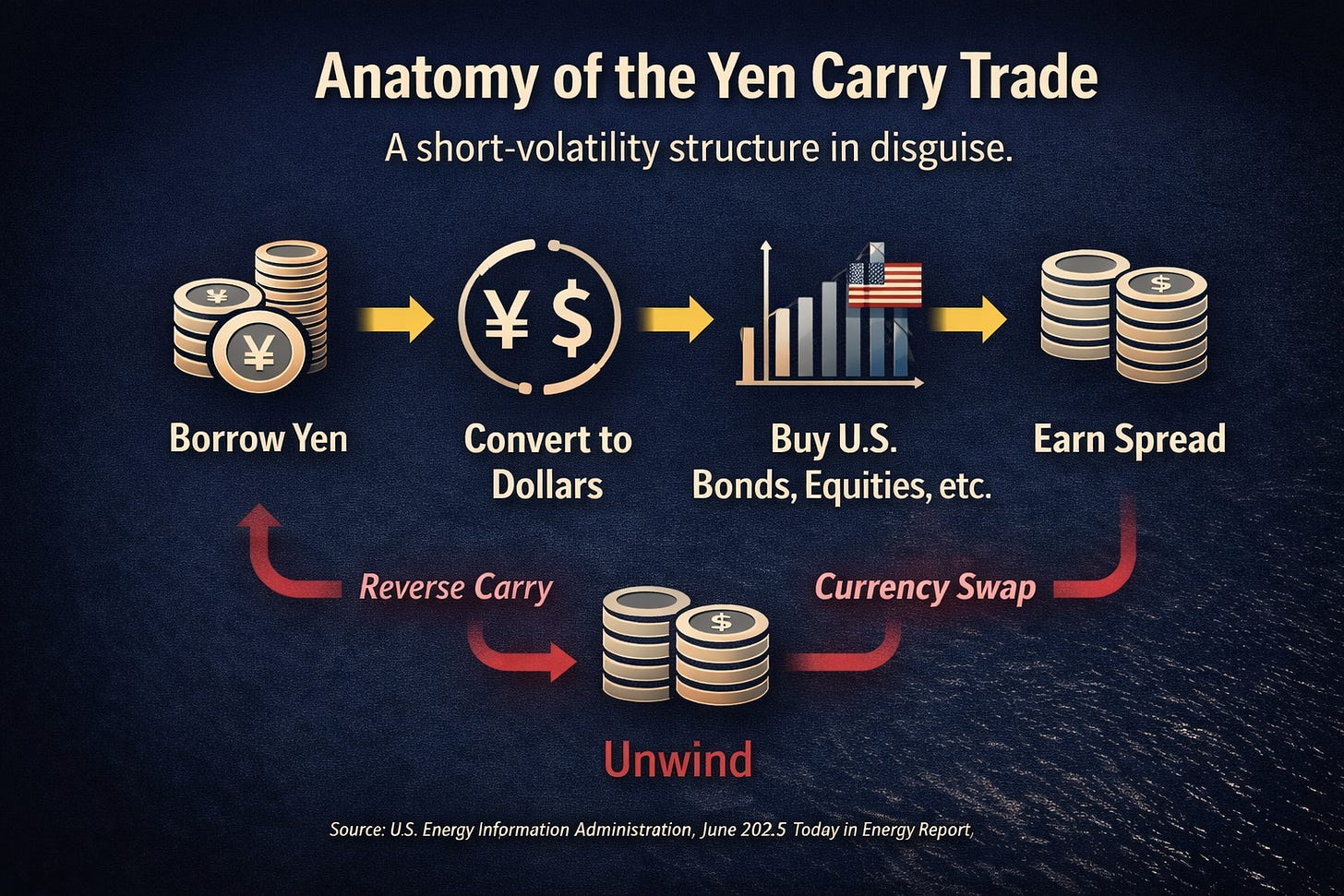

The yen carry trade helps explain why.

In its simplest form, investors borrow in yen, a historically low-rate currency, and invest in higher-yielding assets abroad. The strategy works best in calm environments where volatility remains subdued and the yen stays stable or weak.⁷

Two structural features make carry trades systemically relevant.

First, they frequently operate through derivatives such as FX forwards and swaps, linking them directly to funding markets. The Bank for International Settlements has documented how these instruments can obscure the scale of positions while tightening the connection between currency moves and liquidity conditions.⁷

Second, carry trades behave like short-volatility positions. Gains accumulate gradually in quiet periods. Losses can emerge rapidly when volatility spikes. The BIS review of the August 2024 turbulence described how yen appreciation amplified broader stress as leveraged trades unwound.⁷

Oil-driven uncertainty can act as the catalyst. If Brent rises and FX implied volatility increases, the economics of yen funding deteriorate. Higher USD/JPY volatility raises hedging costs. Margin requirements tighten. Risk managers reassess leverage. The move feeds on itself.⁶ ¹¹

Currency volatility does not merely reflect stress. It can generate stress when portfolios depend on exchange-rate stability.

Japan’s Balance Sheet and the Global Liquidity Channel

Japan remains one of the world’s largest net external creditors, holding more foreign assets than foreigners hold Japanese assets.⁸ ⁹ The scale reflects decades of outbound investment and a weaker yen that boosted the domestic-currency value of overseas holdings.