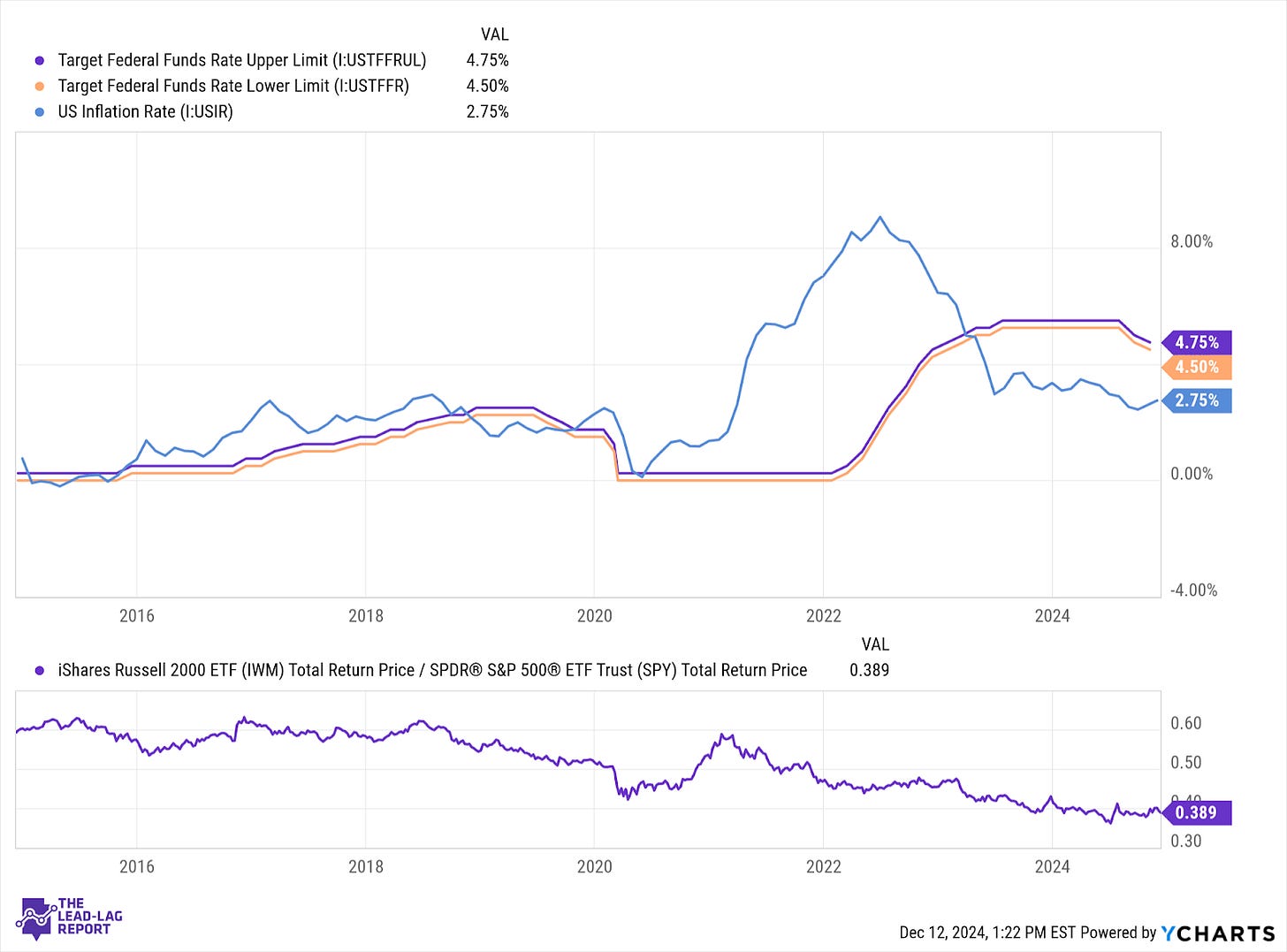

We’ve always been taught that when the market is rising, small-caps should outperform large-caps. After all, small-caps are, in theory, riskier than large-caps and that risk premium needs to be rewarded.

Over the past four years (and really long before that), that hasn’t been the case. Save for the COVID recession, the U.S. economy has been steadily growing. Financial conditions have been very accommodating. Liquidity has been strong. Everything should have lined up for a strong run for small-caps.

Except it hasn’t. Instead of rallying because of risk-on conditions, they’ve given us a reminder of why you need to look beyond just GDP growth to see if conditions really are favoring everybody the same.

Coming out of the COVID recession, small-caps enjoyed nearly a year-long stretch of outperforming large-caps. Why? Financial conditions were ultra-favorable. Rates dropped to zero. The government was throwing money at every consumer, small business and anyone else willing to catch it in order to support a recovery. That kind of bazooka stimulus package did, in fact, result in small-caps leading large-caps as you might expect.

But then everything changed with the arrival of inflation.

The Russell 2000 began lagging the S&P 500 at almost the exact moment when inflation cleared the Fed’s 2% target and was obviously going to go much, much higher from there. That was the first major headwind for small-caps. Even after pricing pressures peaked and started heading lower, high inflation was replaced with high interest rates from the Fed. When one headwind stepped back, the next one took its place. That combination of factors has led to small-cap underperformance for four straight years even though the economy has been healthy and the labor market has been tight.

Why has this happened? Small companies tend to be disproportionately negatively impacted by high costs and high rates than larger ones. Small companies are much more reliant on debt and can’t get the favorable terms big companies can. It’s much easier for small-caps to get crushed under the weight of debt than large-caps, which can usually obtain debt more easily or can complete a bond issue to raise more capital.

We’re seeing that play out today and it’s getting worse.

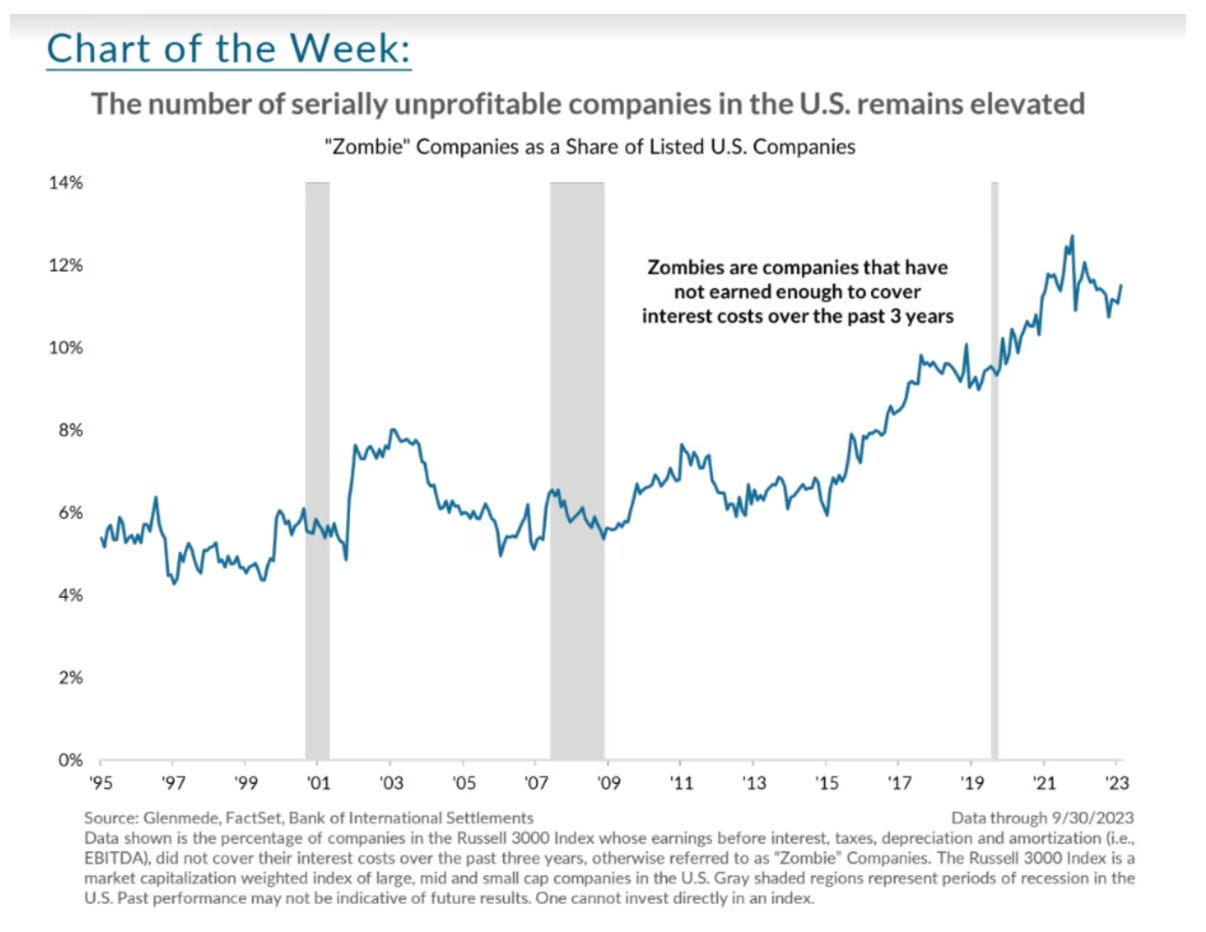

You’ve probably heard the term “zombie companies” many times. The general definition of a zombie company is one that has been unable to generate the profits necessary to cover the costs of servicing their existing debt. If they can’t pay the interest on debt through normal business operations, they need to do it through additional debt or refinancing. As we saw recently, a stimulus package works nicely in that sense. Unfortunately, these are usually just temporary fixes. If they can’t become profitable enough to pay their bills, these companies are merely existing, not growing. Hence the name “zombie”.

In the United States, the number of zombie companies is rising. This is actually a trend that’s been building for the past decade, but has gotten more attention recently. The zombie situation got a little better recently, but it’s back on the rise. Roughly one in 10 companies within the Russell 3000 index qualify as zombies.

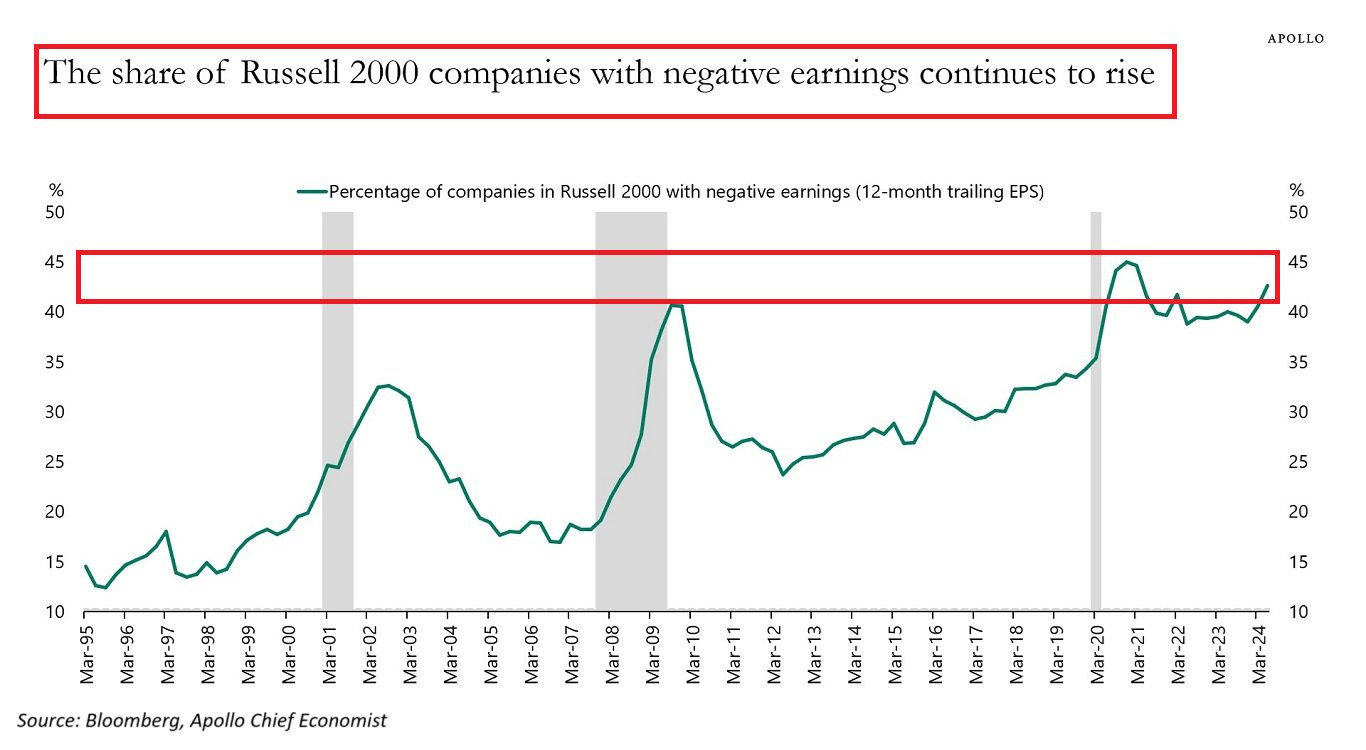

As you can imagine, the situation gets worse when you look only at small-caps.

This chart doesn’t necessarily look for zombie companies, just unprofitable ones (but you can assume the two are highly correlated). More than 40% of Russell 2000 companies have lost money over the past 12 months. It doesn’t necessarily mean that all of them are on their deathbed. Some emerging companies take on a lot of debt to grow and lose money during this period. There’s a lot of them, however, that are losing money simply because they can’t keep their heads above water.

With high inflation and high interest rates, there’s almost no room for error with these companies. If they need more debt to survive, it’s probably going to be prohibitively costly. With inflation already back on the rise and the Fed potentially limited in its ability to ease conditions, these unprofitable/zombie companies may not find relief anytime soon.

So how many companies within the small-cap index have actually reached zombie status? You might not be surprised to learn that this number has been steadily on the rise too.