The Fed cut interest rates a quarter-point this week, as expected. Looking at the Fed Funds futures market right now, the market currently expects about 4-5 more by this time next year. However, economic data presents a more complex picture that raises questions about the necessity of these cuts.

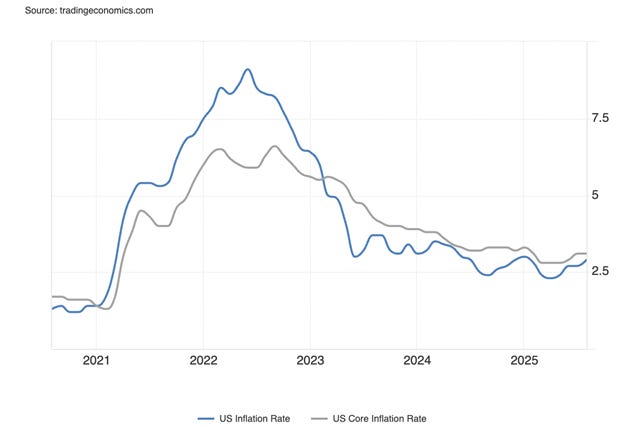

Recent economic indicators paint a mixed landscape. The U.S. economy added only 22,000 jobs in August, while unemployment rose to 4.3%, its highest since October 2021. Consumer prices increased slightly to 2.9% in August, with core inflation remaining at 3.1%. These inflation figures still exceed the Federal Reserve’s 2% target by a full percentage point, even as labor markets show weakness.

This contradiction creates a fascinating economic puzzle. Markets anticipate interest rate reductions, yet core CPI inflation remains stuck at 3.1%. The current federal funds rate sits at the 4.00-4.25% band, which appears reasonable given persistent inflation. The August unemployment rate and recent GDP growth numbers, however, don’t indicate an economy desperately needing intervention. This gap between market expectations and economic reality raises important questions about the Fed’s true motivations.

What Is The Fed Trying To Solve?

The Federal Reserve operates under a dual mandate from Congress: maximizing employment while maintaining price stability. This distinguishes the Fed from other central banks that focus solely on inflation control.

Maximum employment represents the highest level of jobs the economy can sustain without triggering excessive inflation. The Fed examines various labor market indicators rather than targeting a specific unemployment number. For price stability, the Fed aims for a 2% inflation rate based on the Personal Consumption Expenditures (PCE) index. Research indicates this level supports business operations while preserving purchasing power.

These goals typically complement each other. Stable, low inflation creates an environment conducive to planning, saving and investing, which drives economic growth and job creation. However, sometimes these objectives conflict, creating difficult policy choices. Currently, the Fed faces precisely this dilemma, with “risks to inflation tilted to the upside and risks to employment to the downside.”

How Interest Rates Affect Economic Activity

The federal funds rate serves as the Fed’s primary policy tool, influencing all other interest rates throughout the economy. When the Fed cuts rates, borrowing costs generally decrease across the board but usually not evenly. This can produce several effects:

Lower borrowing expenses encourage consumer and business spending

Home purchases increase as mortgage rates decline

Businesses expand by acquiring equipment and hiring workers

Consumer spending on major purchases like vehicles rises

These changes stimulate economic activity and job creation. Companies hire more workers as demand for their products and services grows, supporting the Fed’s employment objective.

Rate cuts also indirectly impact inflation by increasing money supply and encouraging spending, which typically raises demand for goods and services. This can push prices higher, requiring the Fed to balance its goals carefully. Rate cuts might boost employment, but could fuel inflation if the economy overheats.

Why Sticky Inflation Complicates The Decision

The Federal Reserve faces a significant challenge with sticky inflation as it considers rate cuts. Economists distinguish between headline inflation (covering all goods and services) and core inflation (excluding volatile food and energy prices). The Federal Reserve closely monitors core Personal Consumption Expenditure (PCE) inflation. The Fed doesn’t ignore food and energy costs, but core measures provide a clearer picture of long-term inflation trends.