Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE BOND MARKET IS GETTING IT RIGHT AGAIN

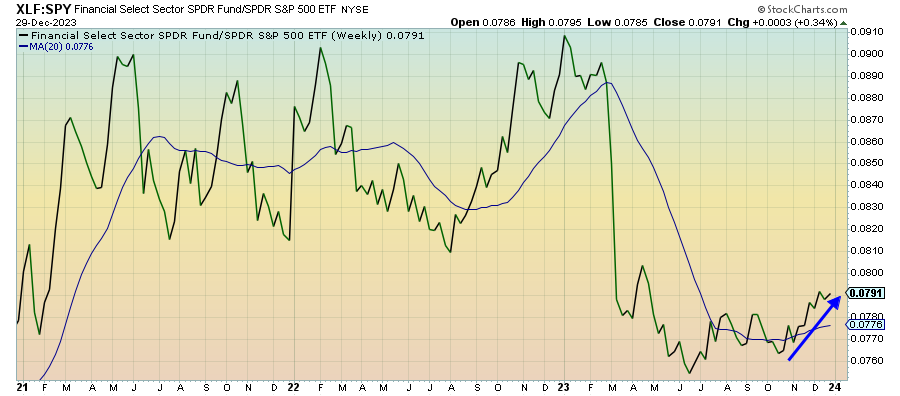

Financials (XLF) – Hurdles Coming This Week

Bank stocks continue to ride the momentum of falling interest rates, but there are going to be some hurdles to overcome this week. The markets are already pricing in 6-7 rate cuts in 2024, leaving very little room for error when it comes to news that disrupts this narrative. If Friday’s labor market report shows above average job growth again, it could send yields heading sharply in the other direction, a likely negative for financial stocks.

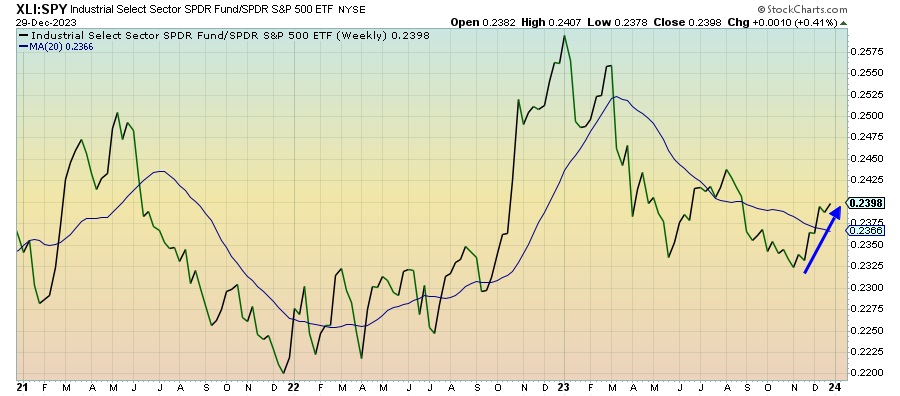

Industrials (XLI) – Time To Back It Up

Cyclicals continue to be in control of the equity markets heading into 2024. Industrials have been the steadiest outperformer over the past two months, but we’re rapidly approaching the point where stocks can no longer rise based solely on sentiment. They need data to back up the story. They’ll get their chance this week with new PMI readings, but the current rally may use it as an opportunity to take a rest.

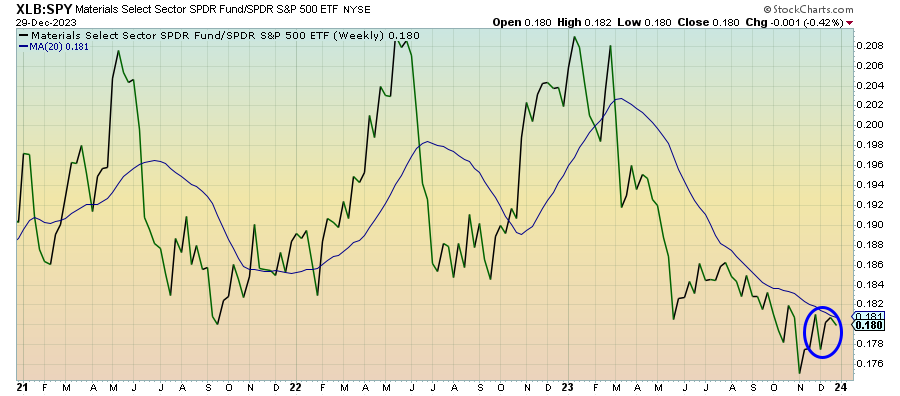

Materials (XLB) – Volatility Is A Concern

While base metal prices were largely unchanged on the year, chemicals, which make up a big component of this sector, did relatively well. The volatility of materials stocks relative to the broader market, however, indicates a fair amount of uncertainty surrounding both the global economic outlook and the geopolitical background, both of which could present demand challenges.

Real Estate (XLRE) – Declining Rates Masking Underlying Issues

REITs are still riding the momentum of falling interest rates, but, as always, it’s the sector’s structural deficiencies that are the biggest issue. The vulnerabilities in the commercial real estate market have been largely masked by declining yields and the everything rally, but they’re still there. Once the labor market starts to soften, that’s probably the point where you’ll finally see the supply/demand dynamics of the residential market shift and not in a good way.

Dividend Stocks (SDY) – Recovery Hinges On Two Things