Key Highlights

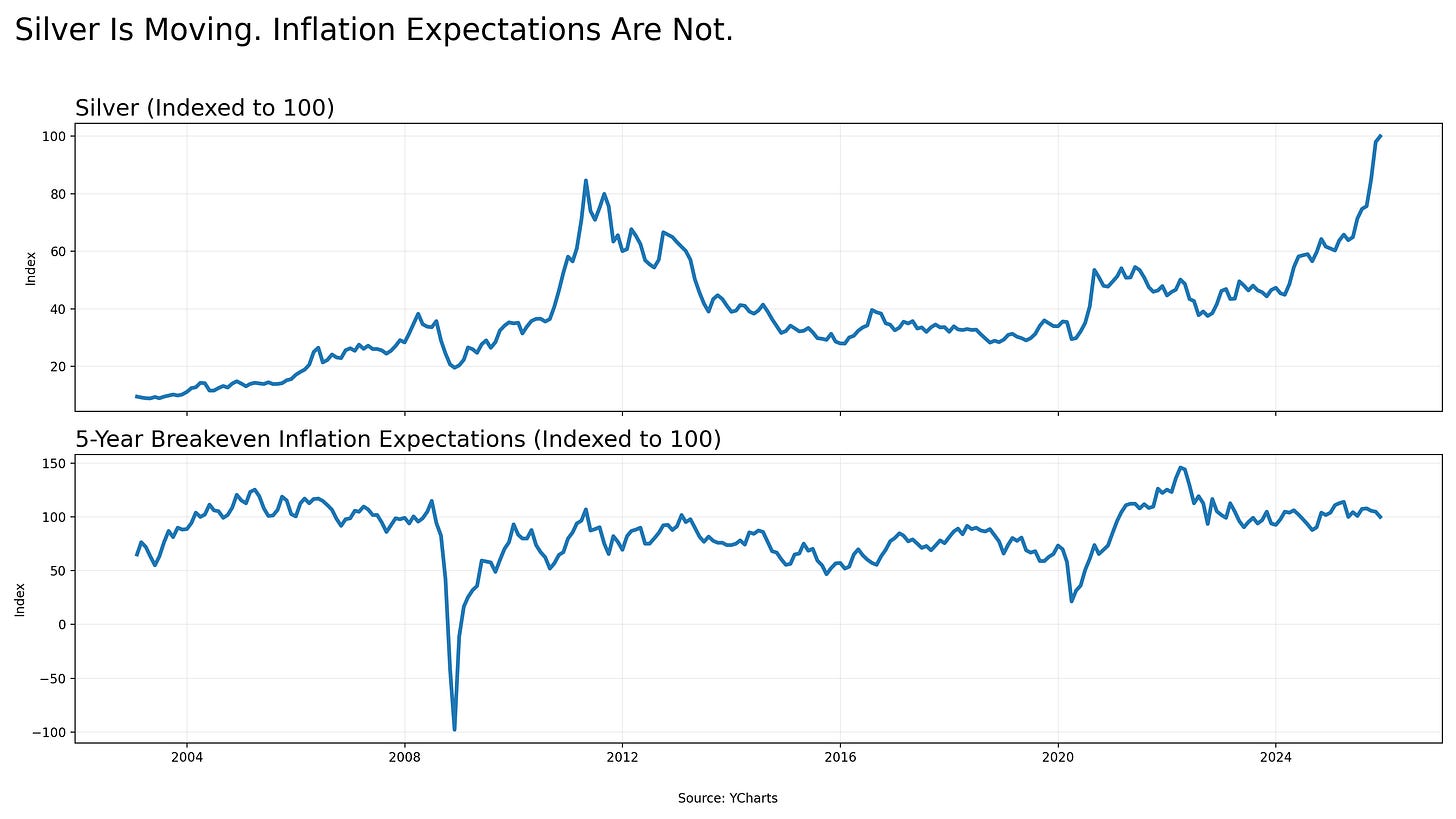

Silver’s recent surge is not corroborated by inflation expectations, which have remained range-bound. That disconnect suggests the move is driven by stress, not rising consumer prices.

Historically, silver outperforms gold and inflation hedges when confidence in growth and liquidity deteriorates, not when economies are overheating.

Persistent structural supply deficits in silver are amplifying the price response to fear-driven capital flows, turning macro anxiety into outsized moves.

Investor demand for silver has increased alongside weakening growth signals and falling real yields, consistent with late-cycle or stagflationary dynamics.

When silver rises sharply during periods of easing monetary policy and slowing growth, it has often preceded broader risk-off behavior across markets.

The current silver rally reflects distrust in policy outcomes, not optimism about economic expansion or reflation.

In past cycles, similar divergences between silver prices and inflation expectations have coincided with economic regime shifts, not soft landings.

Silver has been on a tear. In recent weeks, it has not just drifted higher. It has exploded to levels few expected, forcing investors to ask uncomfortable questions. Precious metals are usually treated as inflation barometers. When silver rises sharply, the default explanation is that inflation must be coming back. That interpretation misses what is actually happening.

Silver is not reacting to higher prices at the grocery store. It is reacting to stress in the system.

This move is not a vote of confidence in growth or policy. It is a hedge against dysfunction. The market is telling us that something beneath the surface is breaking down, and silver is where that anxiety is showing up first.

A Rally That Does Not Match the Inflation Story

Silver crossed major psychological thresholds in December, hitting record highs above levels never seen before in spot markets.¹ The move accelerated even as inflation data across developed markets continued to cool and central banks signaled a shift toward easier policy.² Under normal circumstances, falling inflation expectations would suppress demand for precious metals. That has not happened.

Gold has risen as well, but silver has dramatically outperformed. The gold-to-silver ratio collapsed in recent weeks, signaling that investors are rotating aggressively into silver rather than simply hedging currency debasement.³ This is unusual behavior if inflation is the primary concern. Gold is the traditional inflation hedge. Silver tends to outperform when fear broadens beyond prices and into growth, liquidity, and financial stability.

The timing matters. Silver’s surge has occurred alongside rate cuts, weakening economic indicators, and declining confidence in the durability of the expansion. The metal is rising as growth expectations deteriorate, not as inflation accelerates.

That distinction is critical.

Tight Supply Meets Nervous Capital

Part of silver’s move is rooted in fundamentals. The global silver market has been running persistent deficits for several years. According to industry data, supply has failed to keep pace with demand as mine production stagnates and industrial usage expands.⁴

Silver is not just a monetary metal. It is deeply embedded in industrial processes, particularly in solar panels, electronics, and electrification infrastructure. Industrial demand reached record levels this year, driven by energy transition investments that are largely insensitive to price in the short term.⁵

Unlike gold, silver supply cannot respond quickly to higher prices. Most silver is produced as a byproduct of other metals, limiting the ability of miners to increase output in response to rising demand. That structural rigidity creates conditions where relatively small shifts in investment demand can trigger large price moves.

But supply deficits alone do not explain the speed or magnitude of this rally. The real accelerant has been fear.

When Safe Haven Demand Turns Urgent

Investment flows into silver have surged as investors reassess macro risk. Exchange-traded products backed by physical silver saw heavy inflows in recent weeks, reflecting growing demand for assets outside the traditional stock and bond complex.⁶

Geopolitical uncertainty has added fuel. Ongoing tensions in the Middle East, unresolved conflicts in Eastern Europe, and rising trade frictions have increased demand for hard assets that sit outside the financial system.⁷ At the same time, currency weakness has made metals more attractive to global buyers, particularly in regions where confidence in domestic assets is eroding.

China offers a clear example. Chinese investors have poured into silver as real estate stagnates, equities remain volatile, and the currency weakens. Silver prices in Shanghai traded at significant premiums to global benchmarks, reflecting localized stress and capital flight into tangible assets.⁸ When authorities moved to cool speculation, prices whipsawed violently, underscoring how emotionally charged this market has become.

This is not inflation hedging. This is capital seeking shelter.

Silver and the Shadow of Stagflation

Silver’s behavior increasingly resembles periods when markets feared stagnation rather than overheating. Growth indicators have weakened across manufacturing, consumer spending, and credit formation. At the same time, inflation has proven sticky enough to constrain policymakers.

That combination points toward stagflation risk.

In a stagflationary environment, both stocks and bonds struggle. Growth slows, profits compress, and policy responses become constrained. Historically, precious metals perform well under those conditions because they are one of the few assets that benefit from falling confidence in paper claims.

Silver tends to amplify that signal. Its smaller market size and dual role as both industrial input and monetary asset make it particularly sensitive to shifts in sentiment. Analysts have repeatedly warned that silver moves faster and more violently than gold when fear enters the system.⁹

The comparison many investors are now drawing is to the late 1970s, when precious metals surged as growth faltered and inflation persisted. Gold’s strongest annual performance since that period has renewed those parallels.¹⁰ While today’s economy is different, the psychological backdrop is familiar. Confidence is thinning, and markets are preparing for policy mistakes.

What the Market Is Really Saying

Silver is not forecasting higher consumer prices. It is signaling distrust.

Distrust in growth projections that rely on fiscal expansion. Distrust in monetary policy that pivots too late or too early. Distrust in financial assets that depend on stable liquidity and steady earnings growth.

Central banks appear to understand this risk. Global official gold purchases remain elevated, reflecting a quiet shift toward reserve diversification and balance-sheet protection.¹¹ Silver is absorbing similar anxiety from private investors who lack access to central bank balance sheets but share the same concerns.

When silver rises this sharply during a period of cooling inflation, it is not celebrating economic resilience. It is preparing for economic disappointment.

What Investors Should Take Away

Silver’s surge should not be chased blindly, but it should not be ignored. Markets rarely send signals this loud without reason.

For investors, the message is about balance and preparedness. Portfolios built entirely around growth and liquidity assume a stable macro environment. Silver’s behavior suggests stability is no longer a safe assumption.

This does not require panic. It requires realism. Assets that protect against growth shocks, policy errors, and financial stress deserve consideration when confidence erodes. Silver is volatile and prone to sharp reversals, but its recent strength reflects something deeper than momentum trading.

The metal is acting as an early warning system.

If growth stabilizes and confidence returns, silver will likely retreat. If stagflation risks intensify or financial stress spreads, silver’s signal will become harder to ignore.

Either way, the takeaway is clear. This rally is not about inflation. It is about fragility.

Silver is not predicting higher prices. It is pricing in the possibility that the system itself is under strain.

Footnotes

Anjana Anil and Anmol Choubey, “Silver hits $60 an ounce for first time ever on supply deficit, demand surge,” Reuters, December 9, 2025.

Sherin Elizabeth Varghese and Ishaan Arora, “Silver scales record high above $75 as rate cut bets, tight supply lift prices,” Reuters, December 26, 2025.

Kavya Balaraman and Noel John, “Perfect storm of factors propels silver to record highs,” Reuters, December 17, 2025.

The Silver Institute, World Silver Survey 2025, April 2025.

Jennifer L., “Silver Price Hits Record High as Supply Deficit Enters Fifth Consecutive Year,” Carbon Credits, December 11, 2025.

Sherin Elizabeth Varghese, “Precious metals rally as dollar weakens and rate cuts loom,” Reuters, December 23, 2025.

Sherin Elizabeth Varghese, “Gold, silver gain on geopolitical tensions and safe-haven demand,” Reuters, December 24, 2025.

Bloomberg News, “China Silver Fund Plunges After Authorities Move to Quell Trading Frenzy,” Bloomberg, December 26, 2025.

Rhona O’Connell, quoted in Kavya Balaraman and Noel John, “Silver’s record run driven by speculation and tight supply,” Reuters, December 17, 2025.

John Kemp, “Gold heads for best annual gain since 1979 as central banks hoard bullion,” Reuters, December 27, 2025.

The Silver Institute, “Industrial Demand for Silver Reaches New High Amid Energy Transition,” press release, November 2025.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.

Thanks for this summary. Concerning fear and distrust, I would elaborate that the Vietnam war years were full of both, and silver rose from about $0.90 1n 1955 to about $5.60 in 1974-5. Similarly, Ukraine, Iran and Venezuela generate fear and distrust today.