Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: SMALL-CAPS AND GOLD SPRING BACK TO LIFE

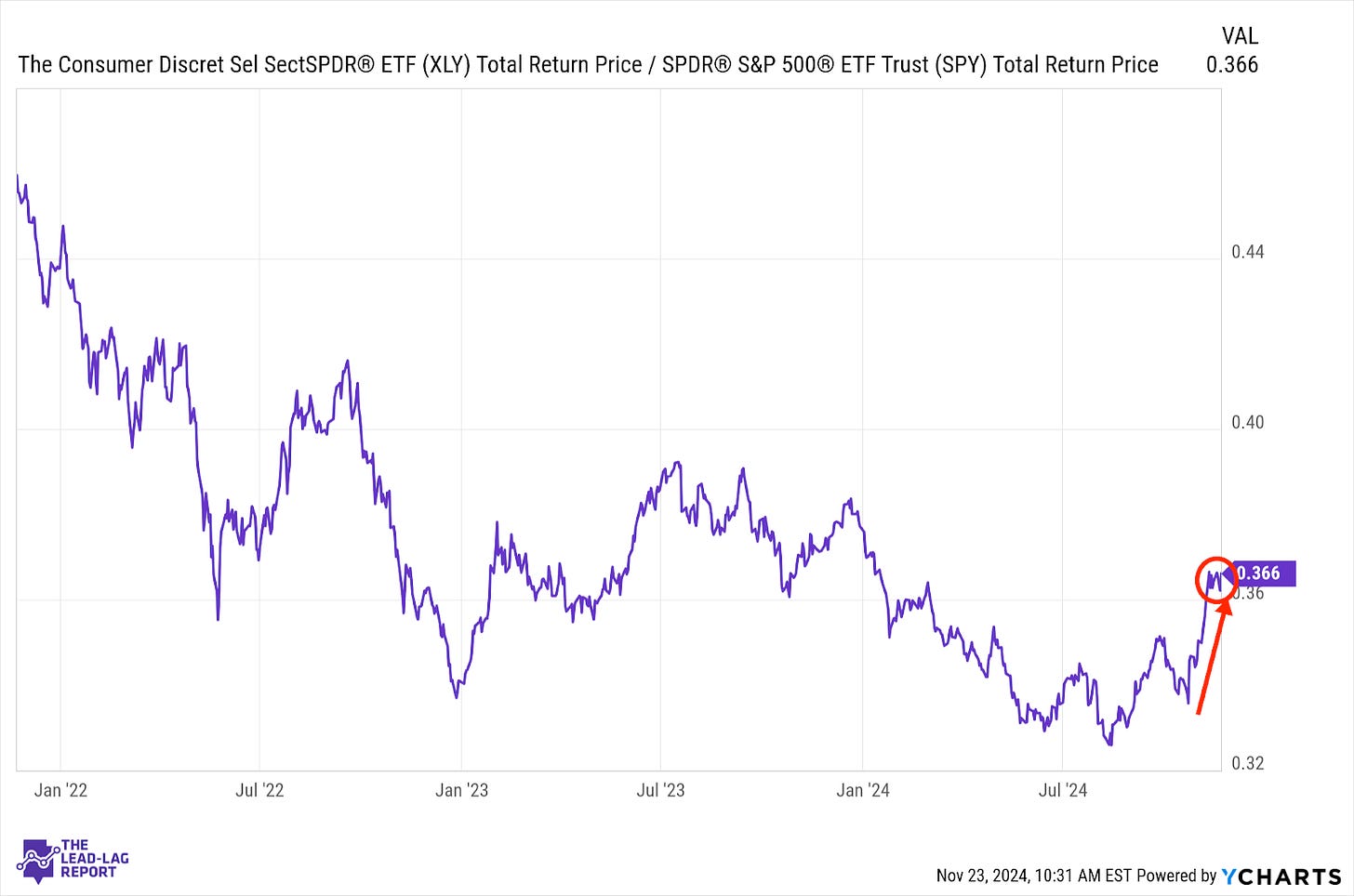

Consumer Discretionary (XLY) – Headwinds Are Still Blowing

Discretionary stocks are holding on to recent outperformance, although the rally may be taking a pause. We’re likely to get a new set of numbers this week suggesting that consumer behavior is still healthy, but the Walmart/Target earnings dichotomy is interesting. I think a best case scenario is that it’s showing consumers are being more discerning in their spending and looking for lower cost alternatives, a sign that the macro headwinds are still blowing.

Communication Services (XLC) – A Potential Landing Spot

The breakout in this sector continues and it continues to happen outside the margins of just Facebook and Alphabet. Traditional telecoms and names, such as Netflix, are trying to follow the lead of utilities in providing leadership in a market where tech is falling behind and cyclicals are turning mixed. If inflation is going to become a future concern, this might end up being a nice landing spot for more conservative investors.

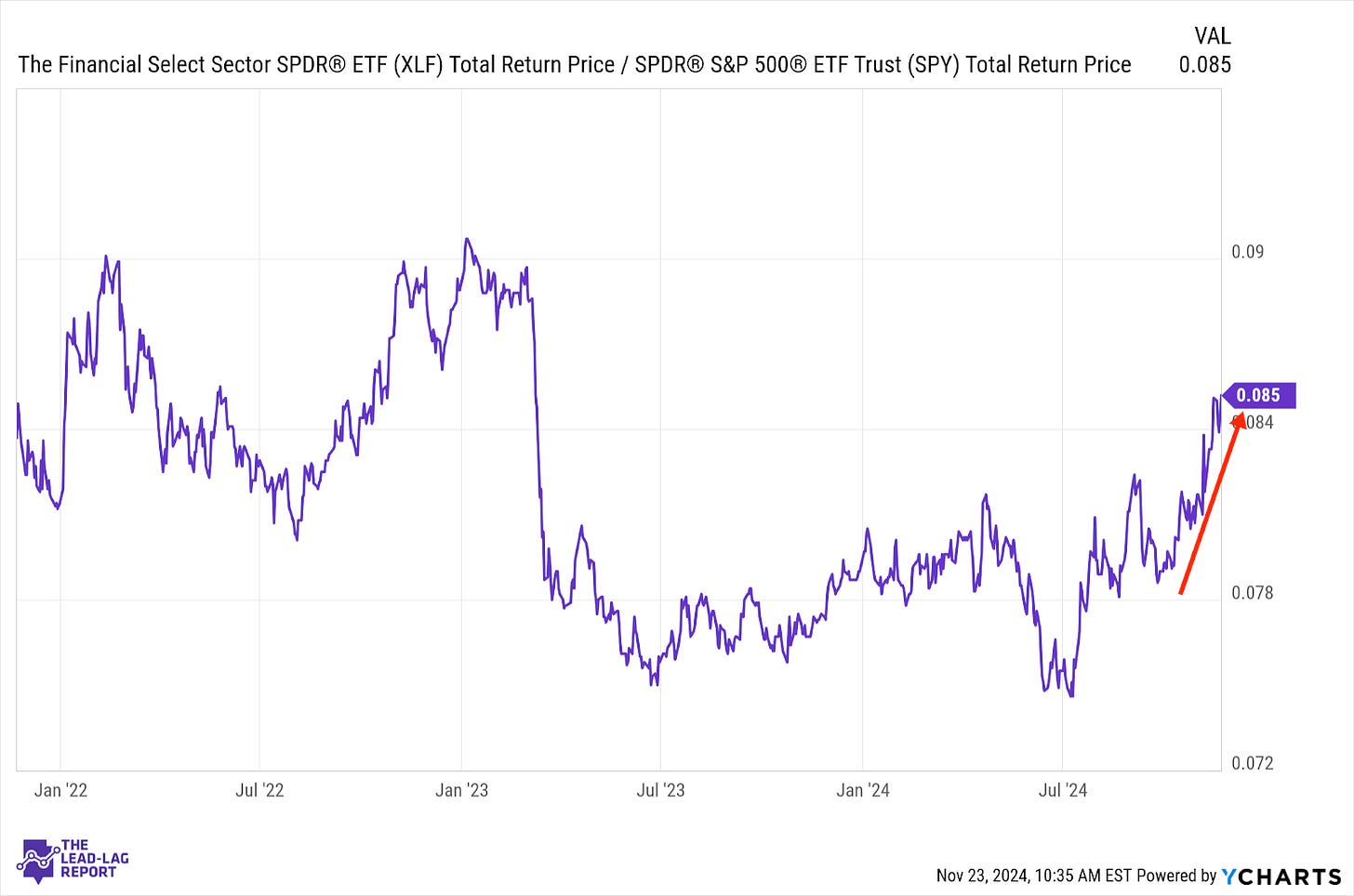

Financials (XLF) – Optimism Giving Way To Inflation Concerns

Financials continue to be the standard bearer among the S&P 500 sectors, but the action is starting to turn a little more choppy. Improving lending conditions, an uptick in M&A and the deregulation theme have all worked in this sector’s favor. However, I believe the possibility of higher inflation in 2025 is starting to weigh on that optimism. Higher for longer interest rates and the threat of higher costs will weigh on consumers and that will spill over to this sector as well.

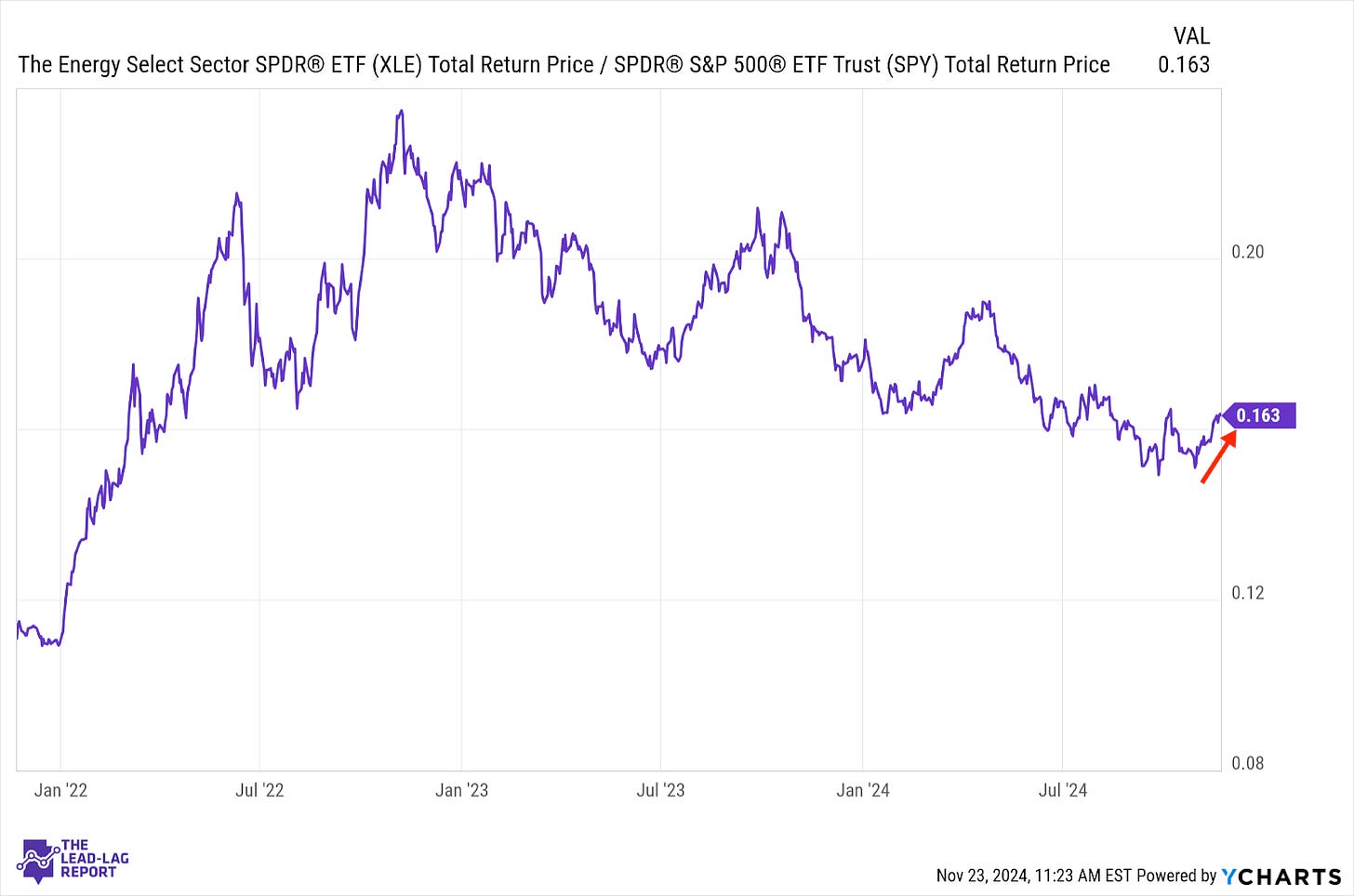

Energy (XLE) – Geopolitics Take Center Stage

Energy sector stocks are always a balance between global demand and supply/demand dynamics. Currently, however, geopolitical risks are pushing this ratio higher. These often tend to be temporary in nature (and could this time as well), but there are so many daily flare-ups happening in so many different locations that this could keep crude oil prices elevated for longer.

Industrials (XLI) – Uncertain Future