Small Caps Back in Focus? ATACX’s Exposure Amid Rallying Cyclicals

Key Highlights

Small-cap stocks have begun to reassert leadership after years of trailing mega-cap technology.¹

Falling interest rates and improving cyclical conditions have historically favored smaller, domestically oriented companies.³⁴

Tactical allocation strategies such as ATACX are designed to participate in risk-on environments while actively managing downside risk.⁸

Market leadership has broadened beyond a narrow group of mega-cap stocks, increasing diversification opportunities within equities.¹

Flexible allocation approaches may help investors navigate small-cap volatility during periods of economic and policy transition.⁷⁸

For much of the past decade, equity market leadership has been narrowly concentrated. A handful of mega-cap technology stocks drove the majority of index returns, leaving thousands of smaller companies lagging quietly in the background. From late 2022 onward, small-cap stocks delivered respectable gains, posting mid-teens annualized returns by historical standards, yet they remained overshadowed by the explosive surge in large-cap technology shares.¹

This prolonged divergence gradually pushed small-cap valuations to historically discounted levels relative to large caps.²⁶ After trailing broader equity benchmarks for four consecutive years, smaller companies had become inexpensive not because their fundamentals collapsed, but because investor attention was elsewhere. That imbalance laid the groundwork for a potential shift once macroeconomic conditions changed.

By late 2025, that shift began to materialize. As expectations grew for easier monetary policy, investors rotated toward more economically sensitive segments of the market. In a matter of weeks, the Russell 2000 Index captured a disproportionate share of its annual gains, signaling renewed interest in the long-neglected small-cap universe.²³ The question now is whether this resurgence reflects a fleeting trade or the early stages of a more durable rotation.

Cyclical Forces Behind the Rally

Small-cap stocks tend to be more tightly linked to domestic economic conditions than their large-cap counterparts. Many rely more heavily on bank lending, carry higher interest sensitivity, and generate revenue primarily within the U.S. economy. These characteristics made them particularly vulnerable during the Federal Reserve’s aggressive tightening cycle. When rates rise quickly, financing costs climb and margins compress. When rates fall, the reverse is often true.

In 2025, the Federal Reserve shifted decisively from tightening to easing, cutting interest rates multiple times as inflation pressures moderated.³ This pivot provided immediate relief for smaller firms that had been disproportionately penalized by higher borrowing costs. Historically, small-cap equities have often outperformed in the early stages of rate-cut cycles, and market behavior in late 2025 followed that familiar pattern.⁴

The rally has also been notable for its breadth. During the middle quarters of 2025, all eleven sectors within the Russell 2000 posted positive returns, with cyclical areas such as Industrials, Technology, and Consumer Discretionary leading the advance.⁵ Unlike earlier phases of the bull market, performance was no longer dominated by a narrow group of mega-cap stocks. Instead, participation broadened across industries more closely tied to economic growth.¹

This broader leadership matters. When rallies expand beyond a small cluster of companies, they tend to reflect healthier underlying market dynamics. By the second and third quarters of 2025, small caps slightly outpaced large caps, reversing a trend that had defined much of the prior cycle.¹ Options markets echoed this optimism, with bullish positioning in small-cap ETFs reaching multi-month highs by early December.²

Valuations added further support. Even after the rally, the relative valuation gap between small and large caps remained near extremes not seen in decades.⁶ Combined with steady economic growth, easing financial conditions, and improving investor sentiment, the environment proved unusually favorable for smaller, cyclical companies.⁷

Still, risks remain. Small-cap stocks are inherently more volatile, and their sensitivity cuts both ways. A sharp economic slowdown or an unexpected resurgence in inflation could quickly undermine recent gains. While the performance gap has narrowed, small caps are only beginning to recover lost ground relative to large caps.² Sustained leadership will ultimately depend on earnings growth and macro stability extending into 2026.

Tactical Rotation and the Role of ATACX

Periods of leadership transition often reward flexibility. Rather than committing fully to a single market regime, some investors seek strategies capable of adapting as conditions evolve. The ATAC Rotation Fund (ATACX) is designed with precisely that objective in mind.

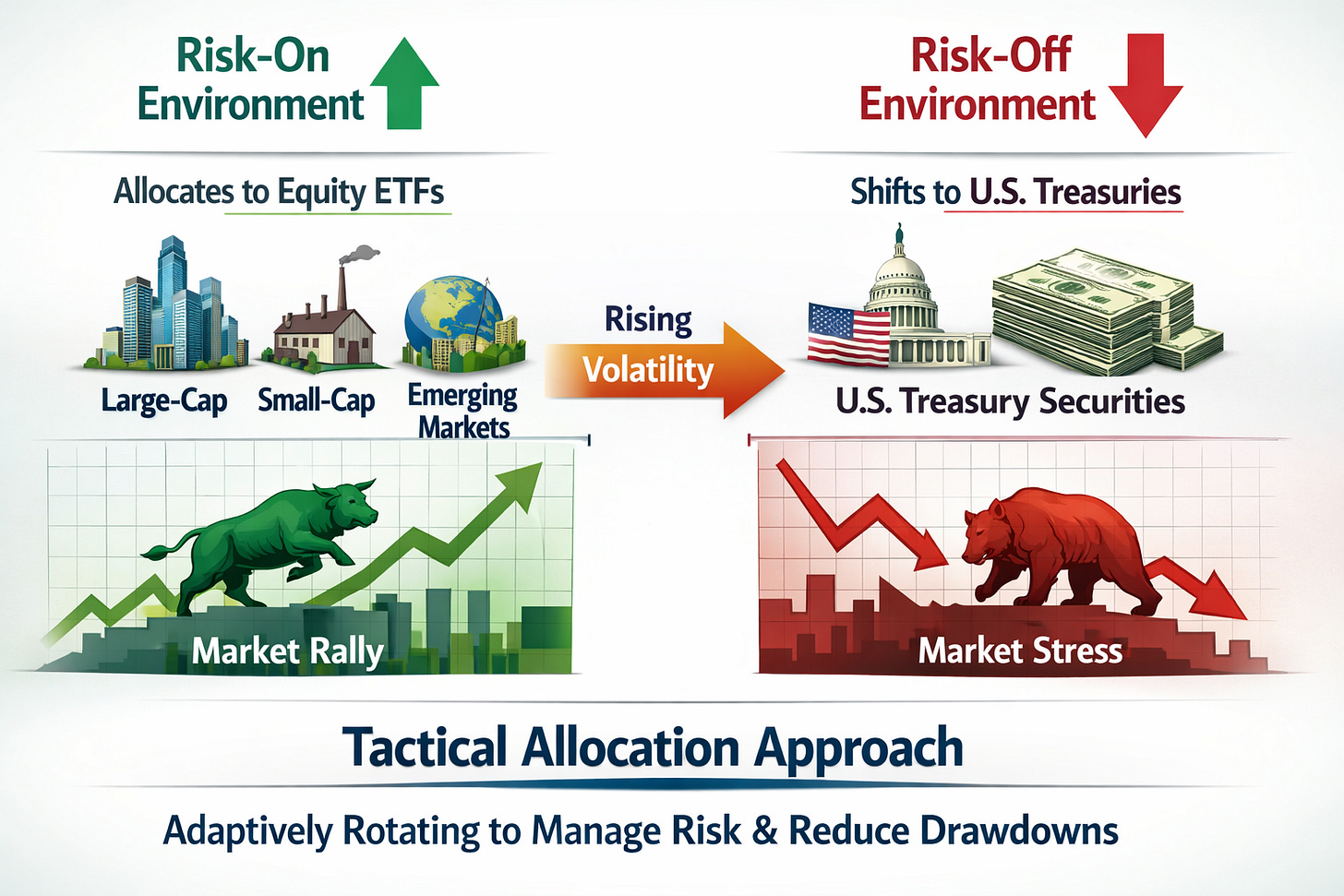

ATACX employs a tactical allocation approach that seeks to distinguish between risk-on and risk-off environments. When market conditions appear favorable, the fund allocates to equity ETFs, including small-cap, large-cap, and emerging market exposures. When stress indicators rise, it shifts defensively into U.S. Treasury securities.⁸ This rotation is intended to reduce exposure during periods of elevated volatility rather than attempting to endure full market drawdowns.

The strategy relies on monitoring market stress signals rather than discretionary forecasts. One such indicator is the relative performance of utility stocks versus the broader equity market. Utilities often act as a defensive haven, and sustained outperformance has historically preceded periods of rising volatility. When these warning signals emerge, ATACX reduces equity exposure.⁸

In the context of a small-cap resurgence, this approach carries particular relevance. If easing monetary policy and cyclical strength persist, ATACX can maintain equity exposure and participate in upside. If conditions deteriorate, the fund’s structure allows it to pivot quickly into Treasuries. This flexibility proved useful earlier in 2025, when bouts of volatility interrupted broader market momentum. During that period, the fund rotated defensively and later re-entered equities as conditions stabilized, helping mitigate downside relative to fully invested strategies.⁹

This does not eliminate risk. Tactical strategies can experience whipsaws, incur higher turnover, and face tax inefficiencies. Signals may occasionally misfire, leading the portfolio to exit or re-enter at inopportune times. ATACX is not designed as a passive allocation but as an active risk-management tool that may be most effective when market regimes shift.

Looking Ahead

After years in the shadows, small-cap stocks have reclaimed attention. The combination of easing interest rates, attractive relative valuations, and broadening market participation has created one of the most supportive backdrops for small caps in years.⁷ Whether this momentum evolves into a sustained cycle remains uncertain, but the structural ingredients are in place.

For investors, the challenge lies in balancing opportunity with risk. Tactical strategies such as ATACX offer one approach to navigating that balance, providing exposure when conditions favor growth while seeking protection when volatility rises. There are no guarantees in investing, and past performance offers no assurance of future results.¹⁰ Still, as market leadership continues to evolve, staying flexible may prove just as important as staying invested.

Consider ATACX. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Interactive Advisors, Small Caps Step Up in Broadening US Equity Rally, November 21, 2025.

TradeAlgo, Traders See More Upside Ahead for the Risky Small-Cap Rally, November 25, 2025.

MarketMinute, The Great Rotation: Why the Russell 2000 Is Finally Outpacing the Giants, December 18, 2025.

Janus Henderson Investors, A U.S. Small-Cap Awakening: Positive Momentum for 2025, January 10, 2025.

Royce Investment Partners, 3Q25 Small-Cap Recap, October 15, 2025.

Franklin Templeton, U.S. Small Caps Are Finally on Top, September 30, 2025.

Interactive Brokers, Large Caps Stall but Small Caps Rally on Looser Policy and Solid Economy, December 4, 2025.

ATAC Funds, Overview, August 1, 2025.

ATAC Funds, ATACX Factsheet, July 31, 2025.

ATAC Funds, ATACX Fund Disclosure, January 1, 2025.

The Russell 2000 Index is a stock market index that tracks the performance of 2,000 small-cap US companies, serving as a key benchmark for small-cap stocks and a barometer for the US economy

The Nasdaq 100 is a stock market index comprising the 100 largest non-financial companies listed on the Nasdaq stock exchange, weighted by modified market capitalization

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Fund Risks: An investment in the Fund is subject to numerous risks including the possible loss of principal. There can be no assurance that the Fund will achieve its investment objective. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV. Please see the prospectus and summary prospectus for a complete description of principal risks.

The Fund’s investments will be concentrated in an industry or group of industries to the extent the portfolio manager deems it appropriate to be so concentrated. In such event, the value of Shares may rise and fall more than the value of shares that invest in securities of companies in a broader range of industries.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

ATACX is distributed by Quasar Distributors, LLC.