Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: ONE OF THE BIGGER WARNING SIGNS IS COMING FROM HEALTHCARE

Communication Services (XLC) – Temporary Support From The AI Trade

This sector is beginning to tail off a bit as growth struggles to get out of the gate in 2025. Magnificent 7 leadership, however, hasn’t waned and that’s keeping this top-heavy sector afloat for the time being. Even though the market as a whole seems to be tilting in a risk-off direction, the AI trade has still been largely getting a pass thus far and that could provide some temporary support.

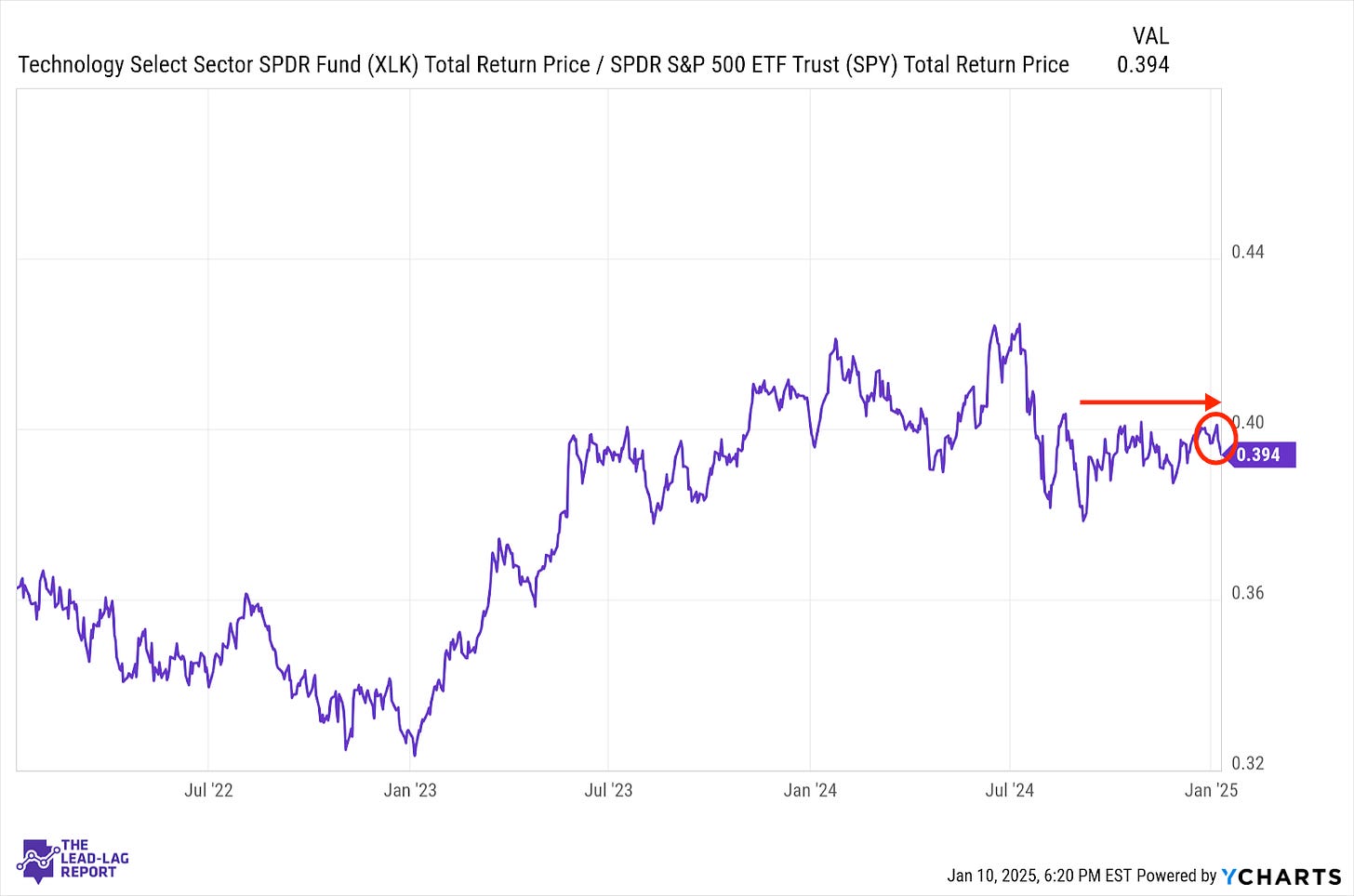

Technology (XLK) – Unlikely To Make Progress Here

Tech continues to be stuck in a middle ground as it has for the past six months or so. The uptick in inflation combined with a likely lack of support from the Fed is acting as a downward force, although it’s being offset by some continued relative strength in the mag 7 trade. As macro conditions act as a headwind heading into 2025, valuations are probably going to get a little more attention. That could prevent this sector from making significant progress.

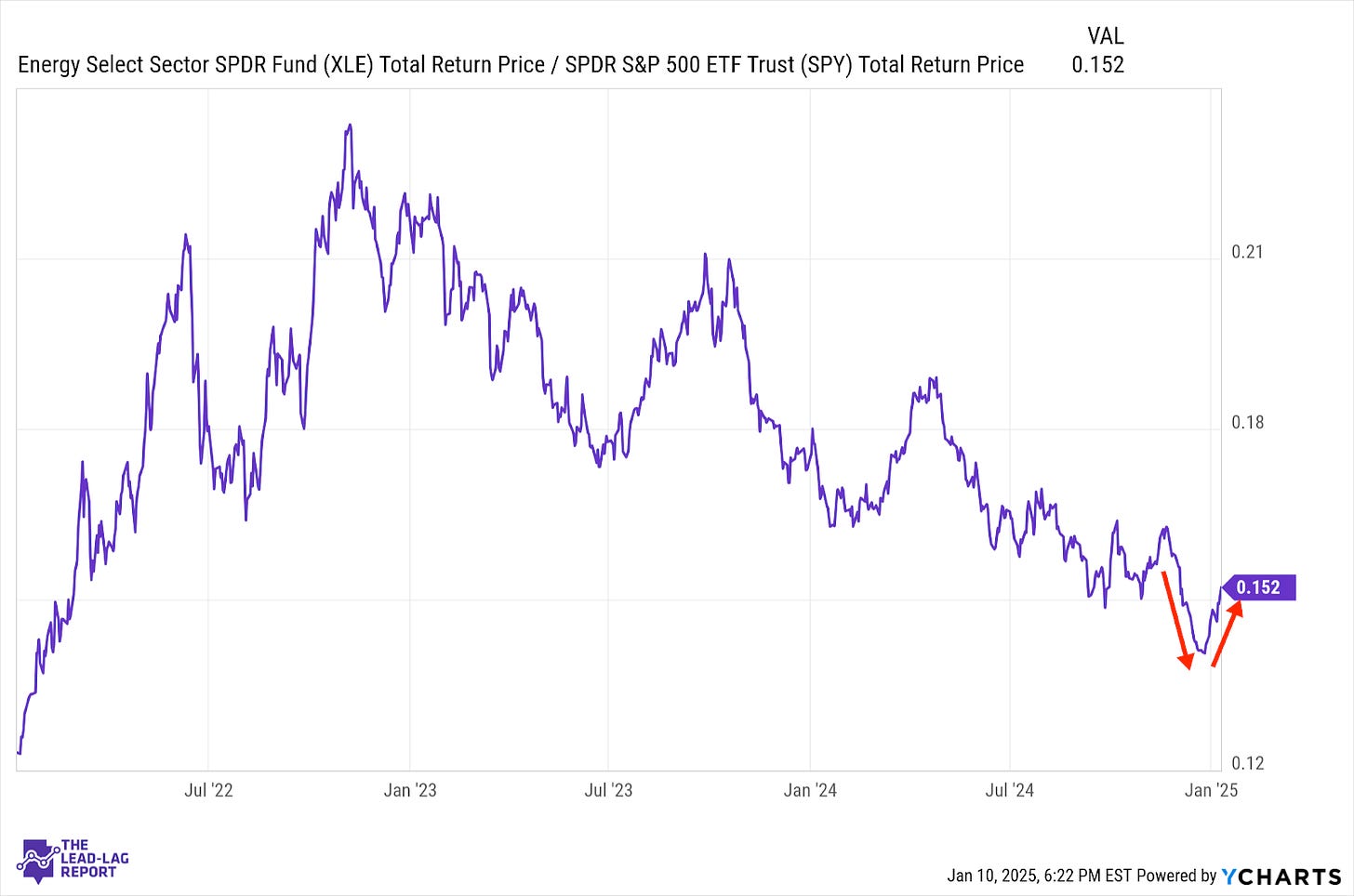

Energy (XLE) – Russia Sanctions A Net Positive

Late last week, the U.S. applied significant sanctions to Russia’s oil infrastructure and industry. The announcement moved the price of crude from $74 to around $78 by Monday’s open. While this would be considered a net negative for consumers, inflation and the economy in general, it’s generally good for energy stocks, which can take advantage of higher prices more directly.

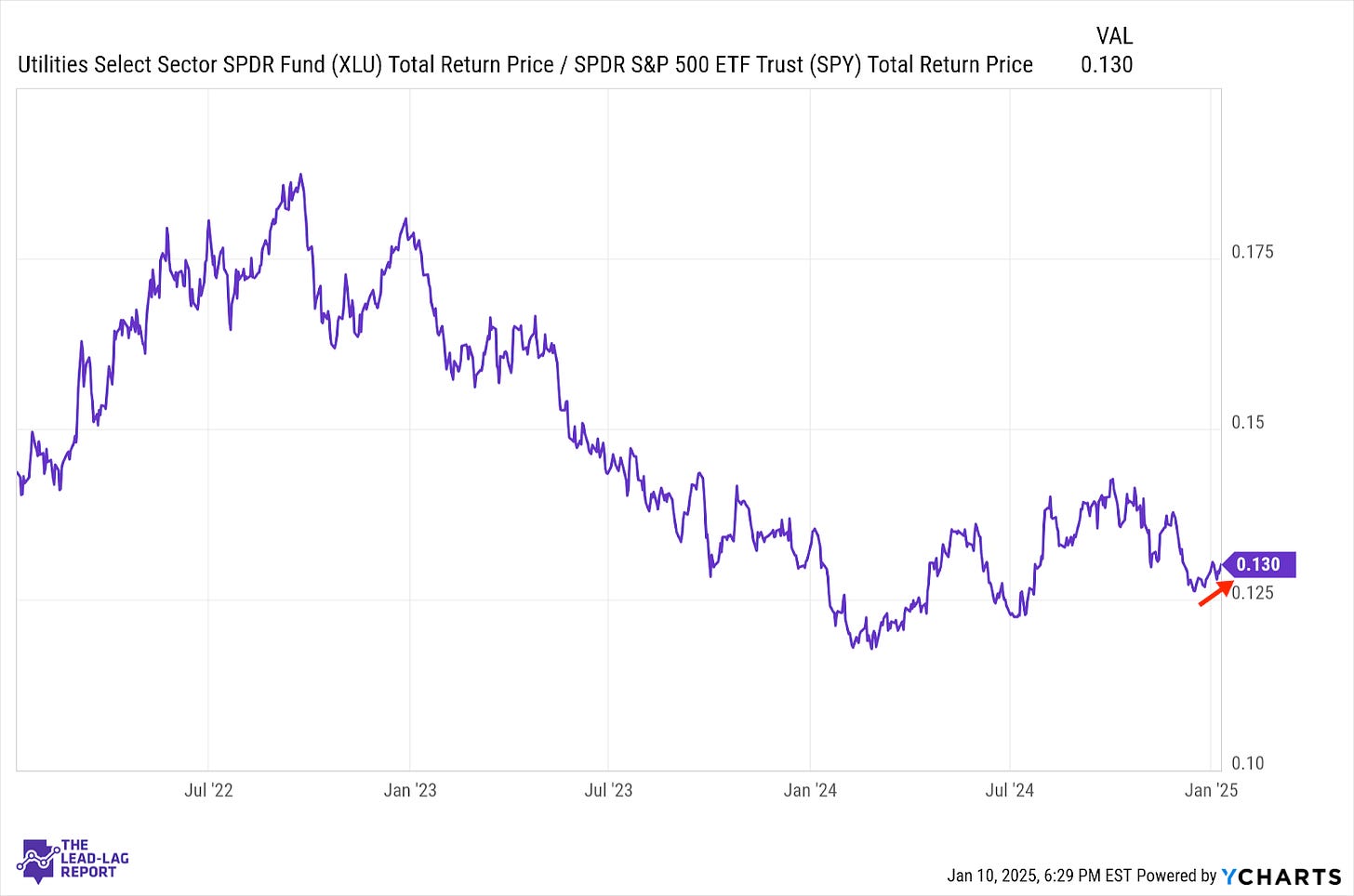

Utilities (XLU) – A Modest Move, But One That’s Stretching Out

Utilities are starting to outperform again relative to the S&P 500 and that’s generally one of the better signs for risk-off behavior. It’s still only a modest move higher, but the fact that it’s stretched for more than three weeks suggests there could be some legs to this move. I do, however, wish that it was getting confirmed by other risk-off groups, including consumer staples and low volatility stocks.

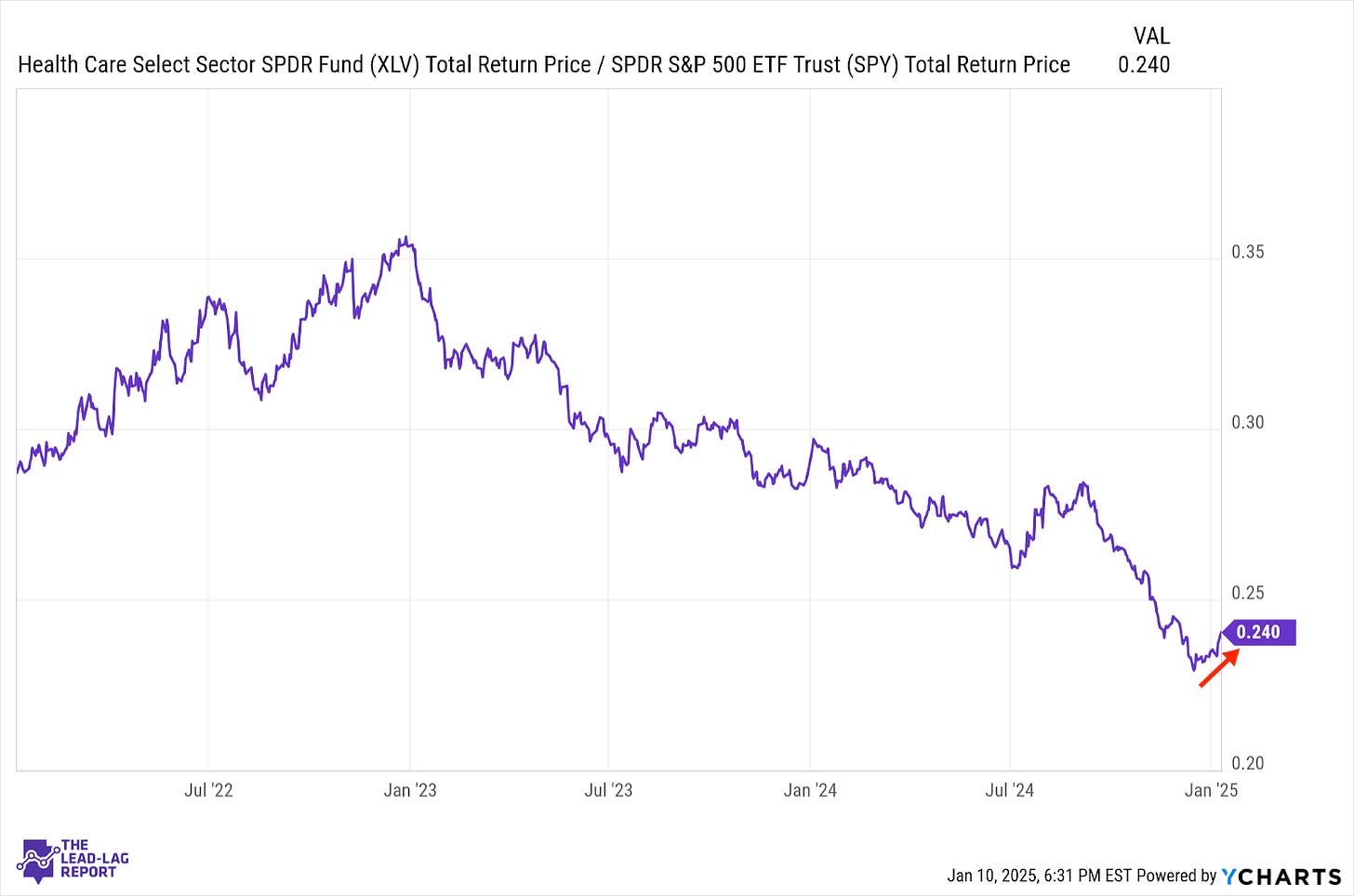

Health Care (XLV) – A Lengthening Uptrend Suggests Trouble

The rebound in healthcare is particularly notable for me. This sector is one of the few that behaves in a traditionally defensive manner independent of short-term pressures from rates or other specific factors. While still relatively brief, it’s the sector’s best stretch since August and one of the few extended uptrends of the past couple years. If this sector continues to outperform, it should be considered one of the stronger risk-off signals.

Junk Debt (JNK) – The Top Is In

Junk bonds may still be outperforming relative to Treasuries, but absolute performance peaked about a month ago. Any declines to this point have been almost entirely due to shifts in the yield curve. Credit spreads, while still at historically low levels, have been rising slowly and could soon become a bigger factor here if bond market conditions begin deteriorating.

European Banks (EUFN) – High Yields Create Similar Risks

European banks are showing a little more relative strength here, although the global financial sector in general is in a questionable spot. Long-term bond yields in Europe are on the rise just as they are in the United States and that’s going to put some of the same pressures on the financial sector there as well.

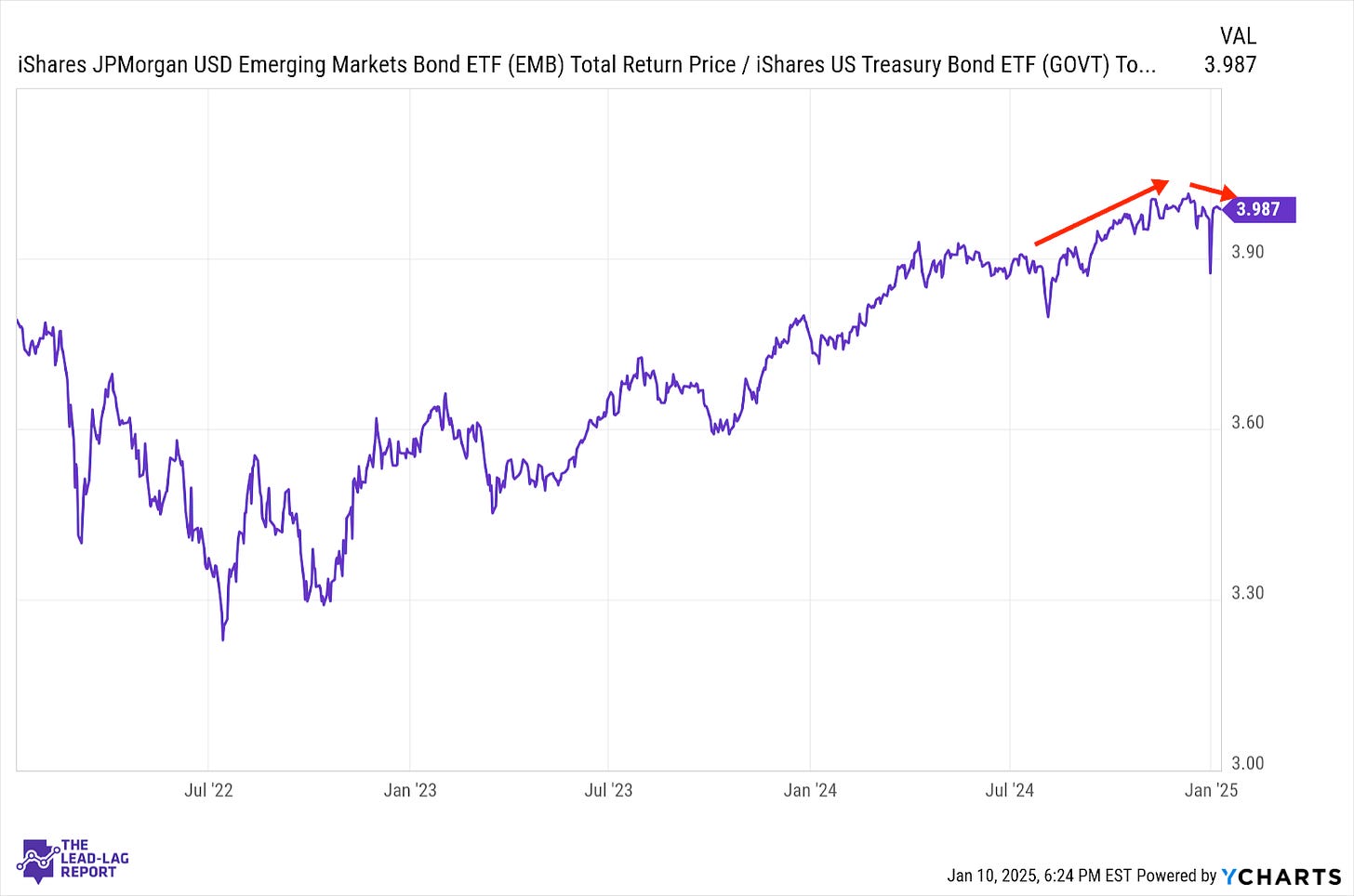

Emerging Markets Debt (EMB) – Bond Market Risk Aversion Building

As we’re seeing with other lower grade debt, emerging market bonds are showing signs of reversing lower relative to Treasuries. Dollar-denominated bonds, such as these, have been able to avoid much of the negative impact of the dollar rally, but I do think the general risk aversion that’s beginning to build beyond just long-dated Treasuries could have a longer-term impact.

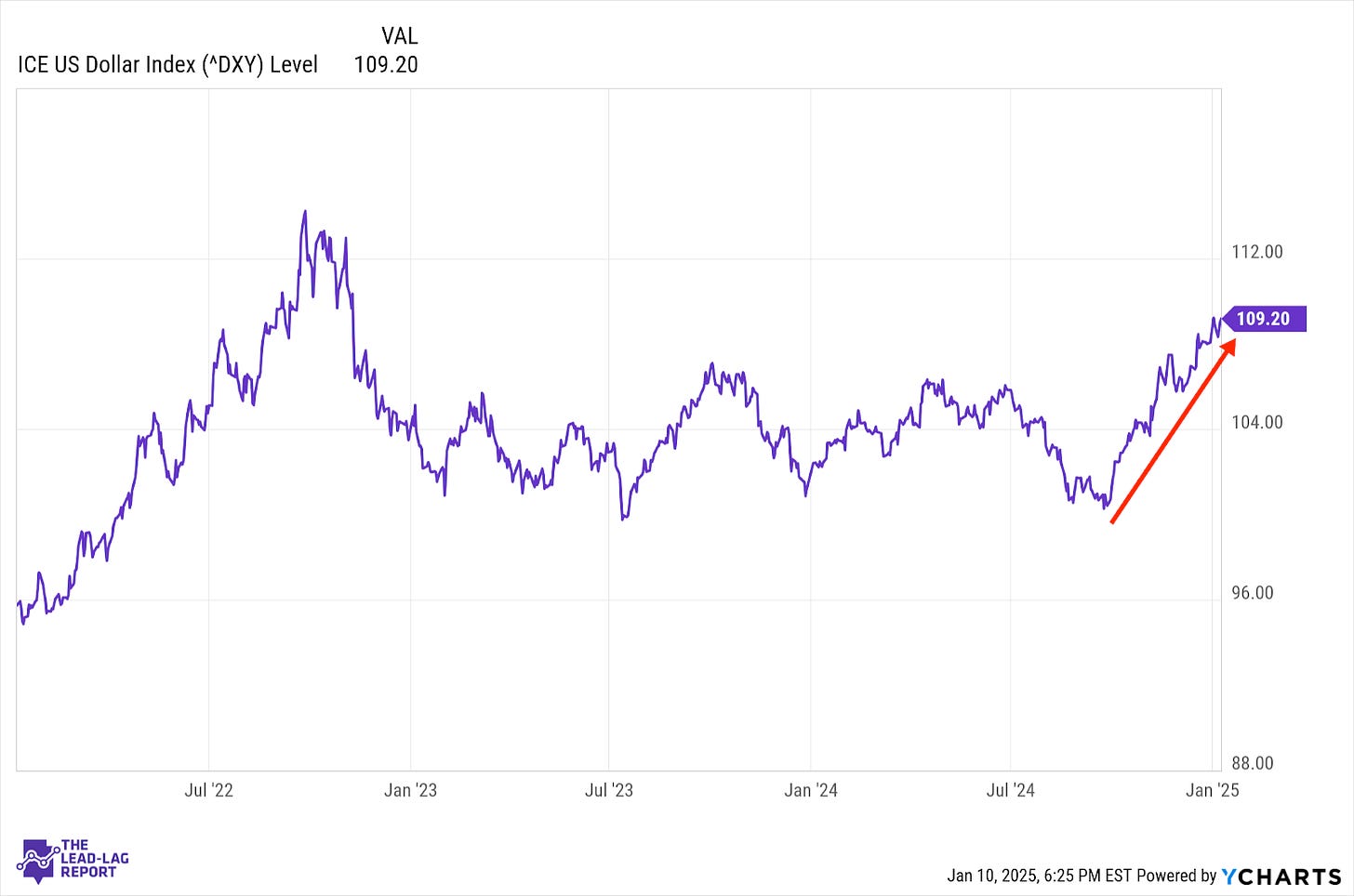

U.S Dollar ($USD) – Yet Another Inflationary Catalyst

The dollar is showing little sign of weakening and the recent sanctions against the Russian oil industry will help fuel a continuation. A lot of the critical macro data that’s come in over the past month or two has fed into the re-inflation narrative to push yields and the dollar higher. An unexpected geopolitical rally in the energy market adds to the list and could lead to a challenge of the 2022 high.

LAGGARDS: TIME FOR BOND MARKET RISK TO GET PRICED IN

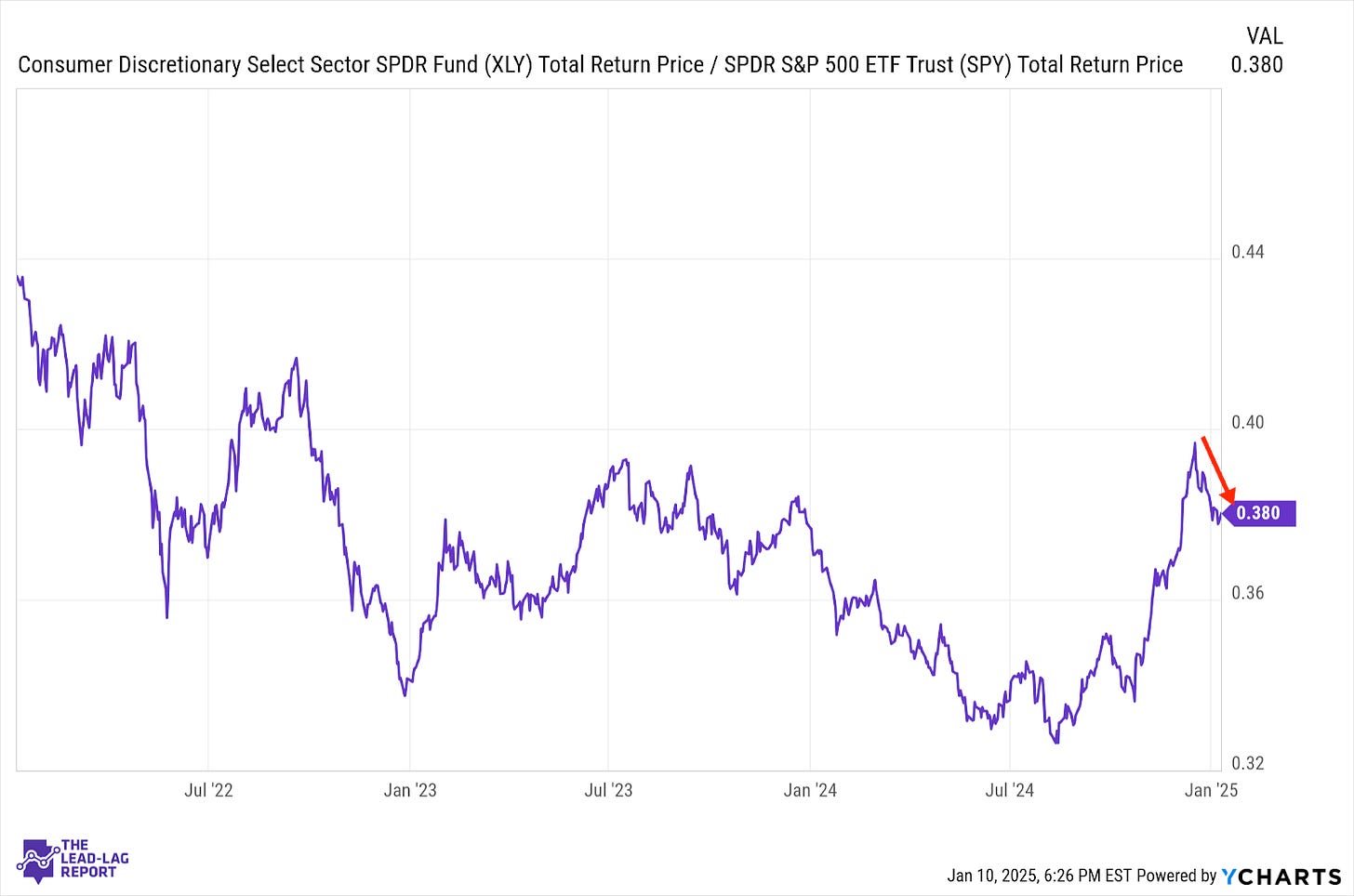

Consumer Discretionary (XLY) – Conditions For Consumers Are Worsening

Investors are continuing to move away from retail stocks as the Fed looks to keep conditions tighter for longer. This week’s U.S. retail sales report isn’t likely to show any major slowdown in activity, but higher interest rates and higher inflation are perhaps the two things that could do the most damage to consumer sentiment in the near future.

Industrials (XLI) – Fed Help Off The Table