Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: SMALL-CAPS NOW HOLD THE KEY

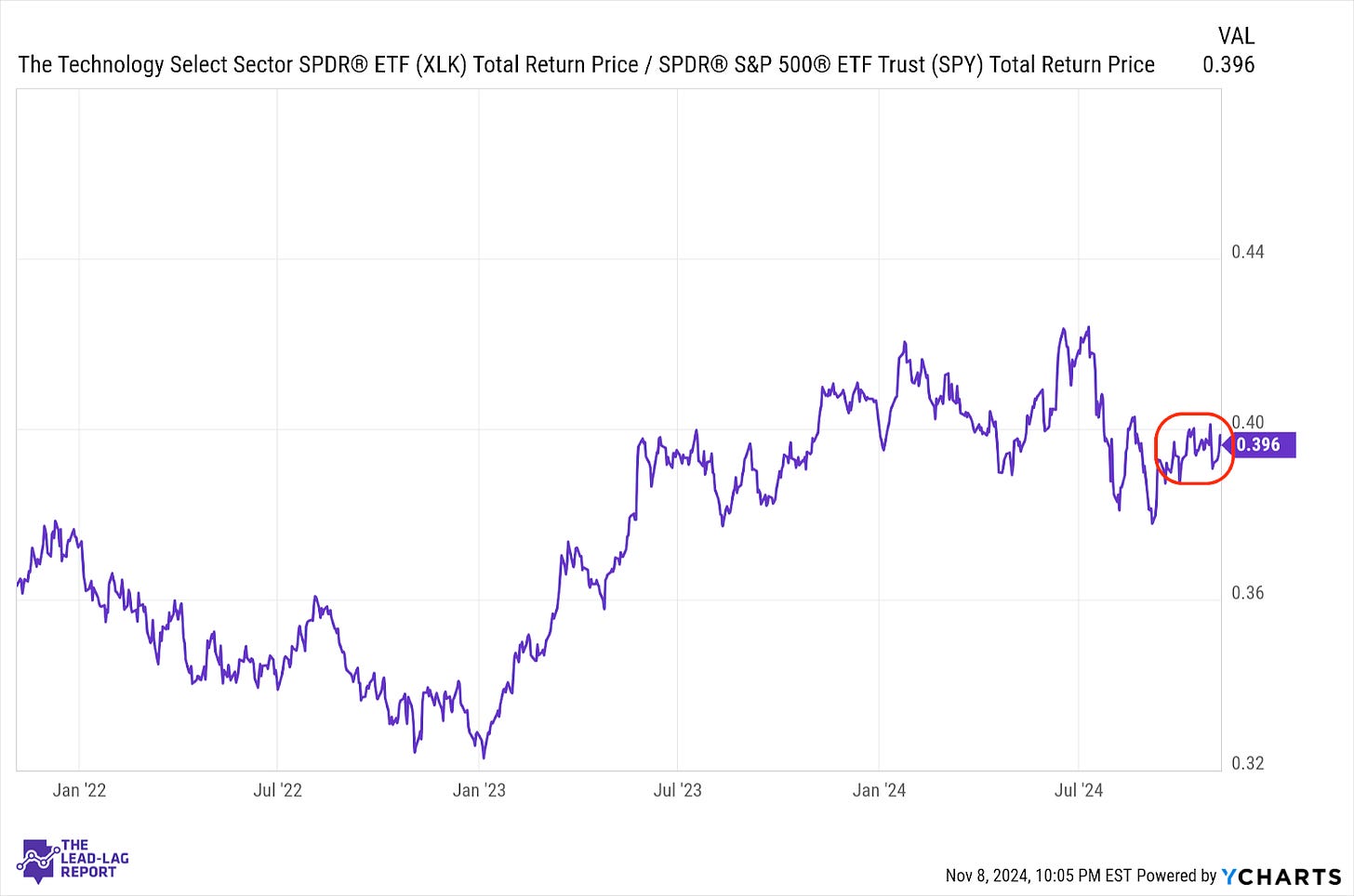

Technology (XLK) – Leadership Pause?

Even though tech didn’t really outperform to a major degree last week, it did get a big boost from the chip stocks, which figure to benefit significantly from a tariff protectionist policy. The AI trade will likely keep tech from drifting too far from market leadership for the time being, but the Trump policies could make other sectors look comparatively more attractive.

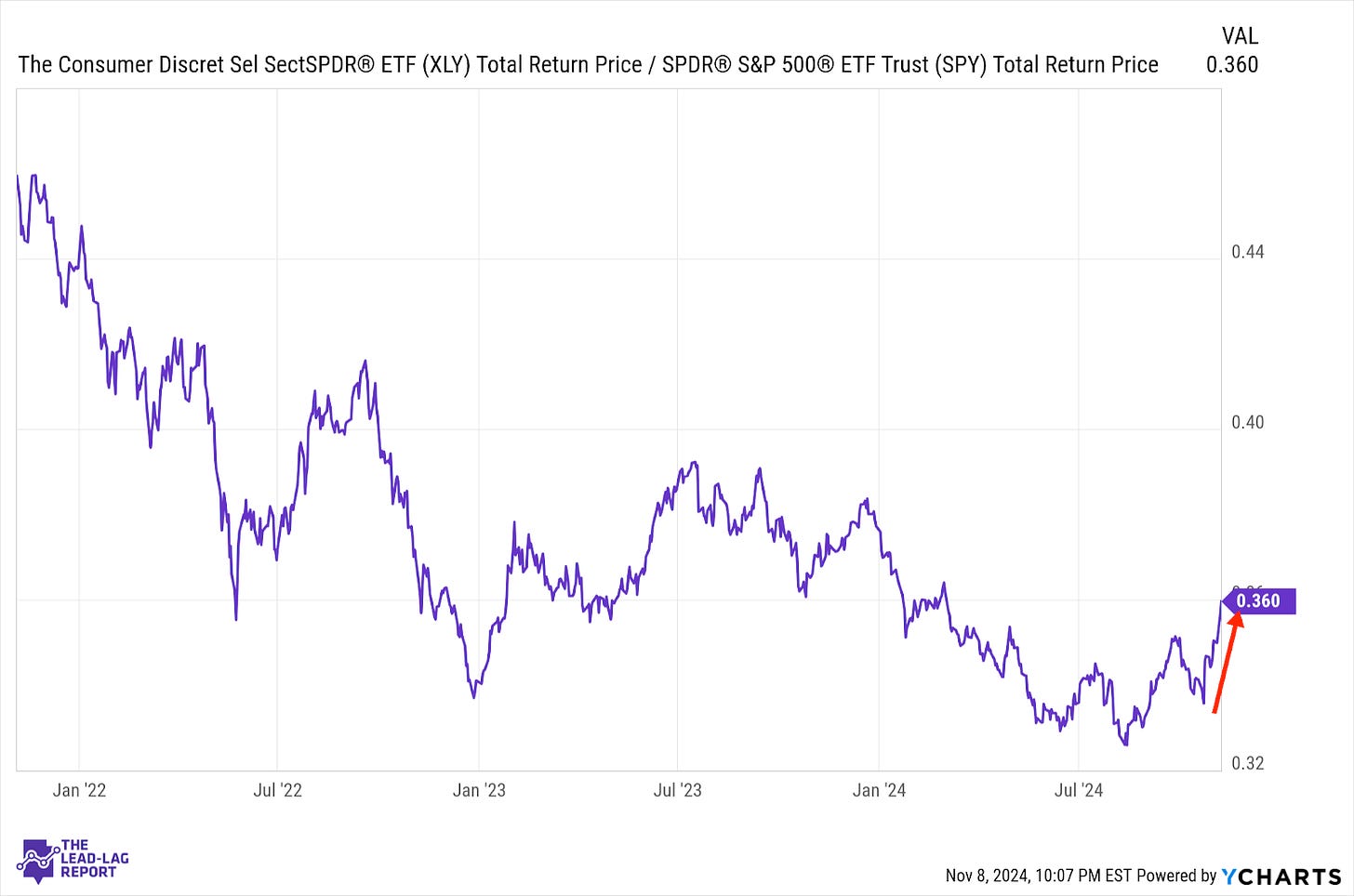

Consumer Discretionary (XLY) – Not A Positive Outlook For Retailers

It’s a little curious that consumer stocks are performing so well here considering that they may be some of the most adversely impacted by protectionist policies. Many major retailers outsource from China and could see their costs go way up. Dollar stores could be in trouble. Perhaps this is more of a macro reaction from the belief that consumers could have more money in their pockets, but the retailer outlook doesn’t seem particularly positive.

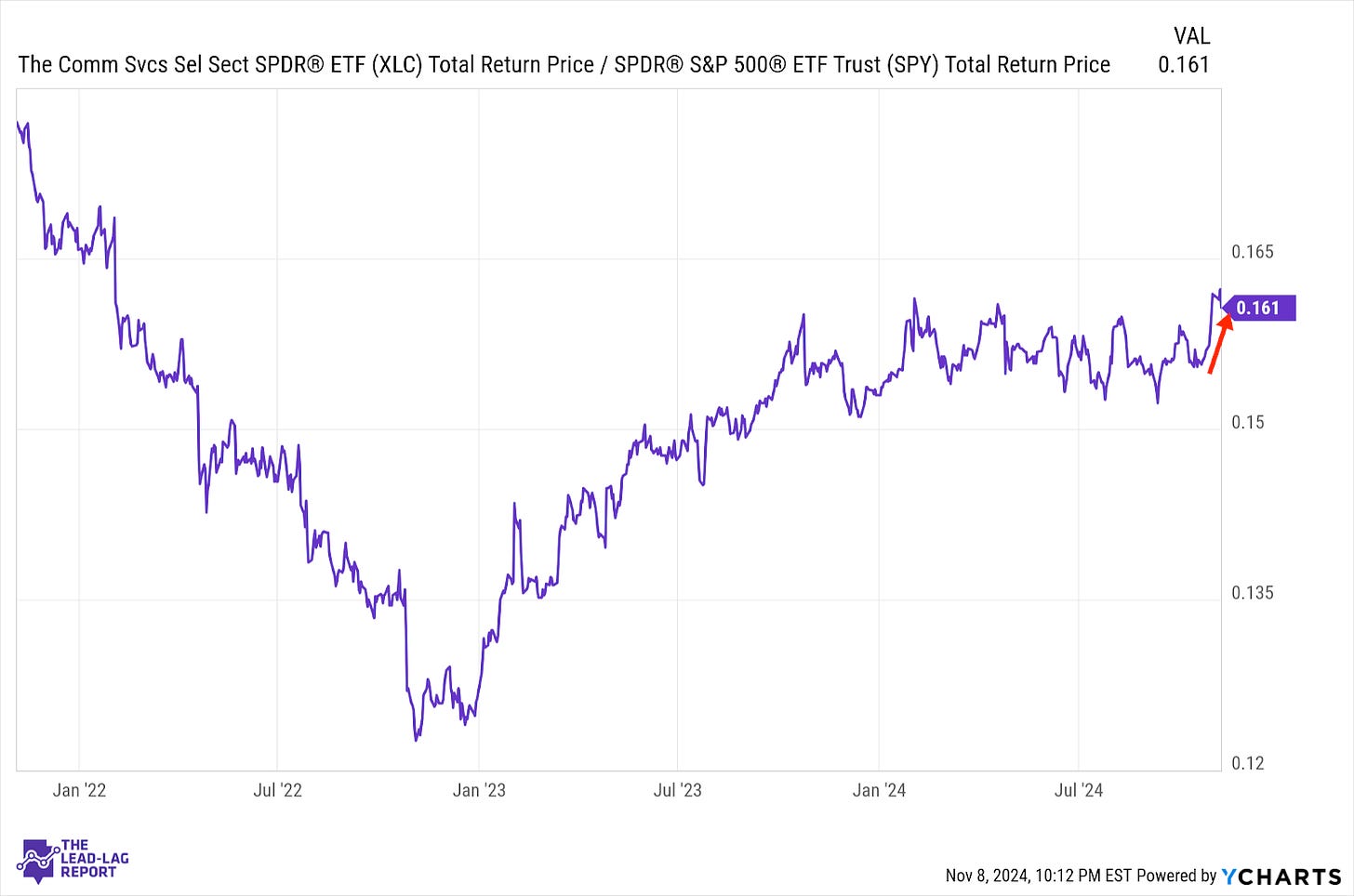

Communication Services (XLC) – Breaking Out Of Its Range

This sector may finally be breaking out of its range relative to the S&P 500. AI remains the big story here and even though Facebook worried some folks with its intent to ramp up infrastructure spending, Alphabet appears to be on the right track and these two companies figure to be leaders. The overall outlook still looks relatively positive here.

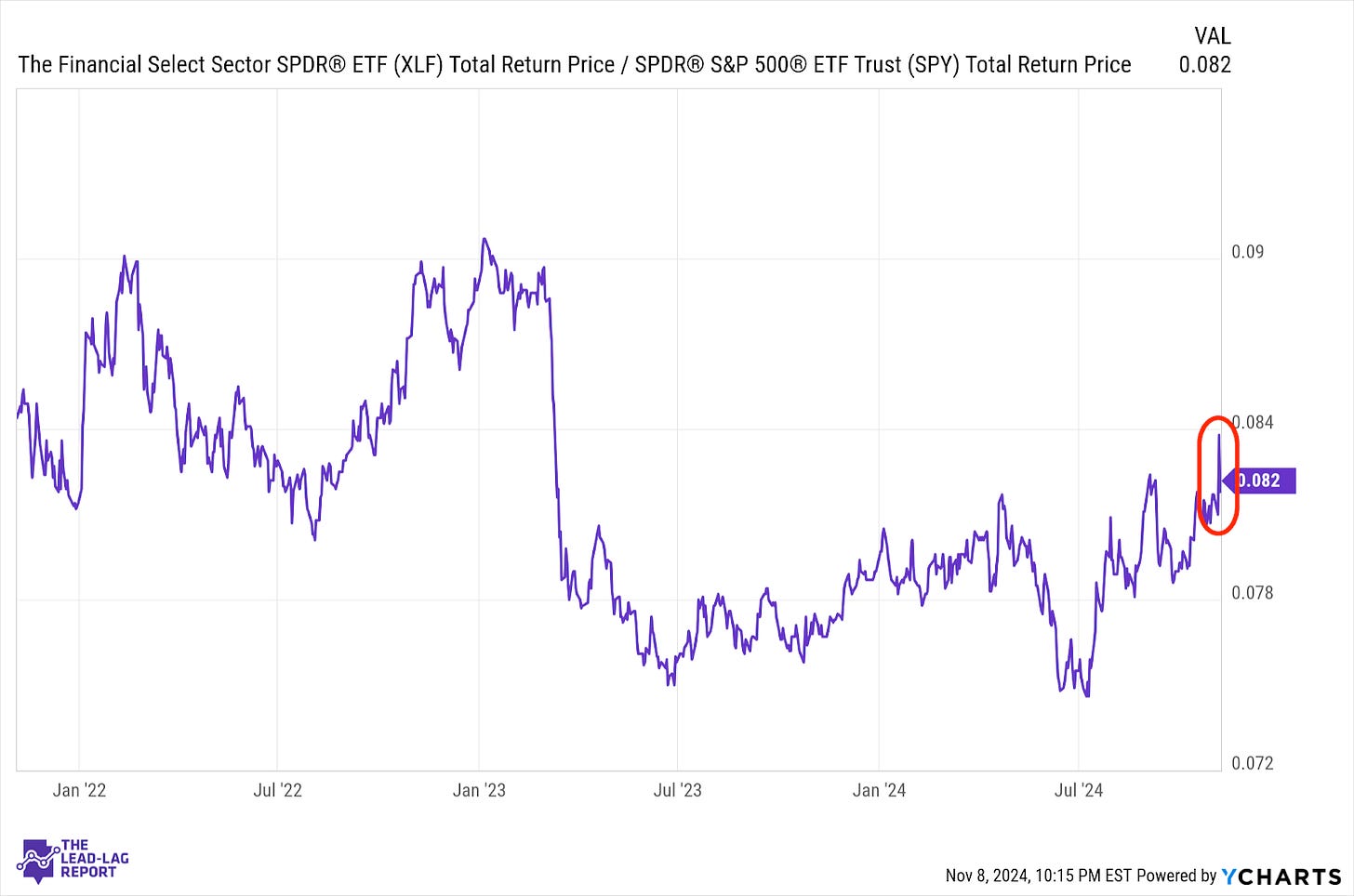

Financials (XLF) – In A Good Place

Banks could have one of the highest ceilings in this economy, even after becoming the 2nd best-performing sector this year. Lower interest rates, improved lending prospects and a pickup in M&A activity were already positive catalysts, but a focus on deregulation in a Trump presidency could add fuel to the fire. If the soft landing narrative is intact, this sector is in a good place.

Industrials (XLI) – Upward Trajectory, But Some Complications