Software Is Not Dead. It’s Being Mispriced.

AI disruption fears, multiple compression, and why embedded platforms may be the real beneficiaries of automation.

Key Highlights

The current software selloff is being driven more by narrative than confirmed structural deterioration in enterprise demand.¹

Markets are rapidly pricing a “software is dead” scenario under the assumption that AI will commoditize SaaS.¹

The Federal Reserve is no longer tightening at the margin, and futures markets have begun pricing renewed easing in 2026.² ³

Forward valuations for software have compressed toward multi-year lows even as revenue growth remains positive across large platforms.⁴

Large, embedded systems-of-record platforms with recurring revenue and net liquidity may offer asymmetric upside if the narrative shifts from replacement to integration.

The Macro Backdrop: AI Panic Meets Policy Inflection

The software drawdown is increasingly framed as existential. The dominant narrative argues that “agentic AI” will compress subscription pricing, erode moats, and replace large portions of the SaaS stack. That view has gained traction following earnings reactions and headlines emphasizing AI’s ability to generate code and applications at lower cost.¹

Yet markets are discounting a clean substitution effect in a business that historically behaves more like a toll system than a commodity. AI may alter interfaces and workflows, but enterprises still require governance, permissioning, audit trails, compliance, uptime, and data orchestration. Those needs do not disappear when automation improves. In many cases, they intensify.

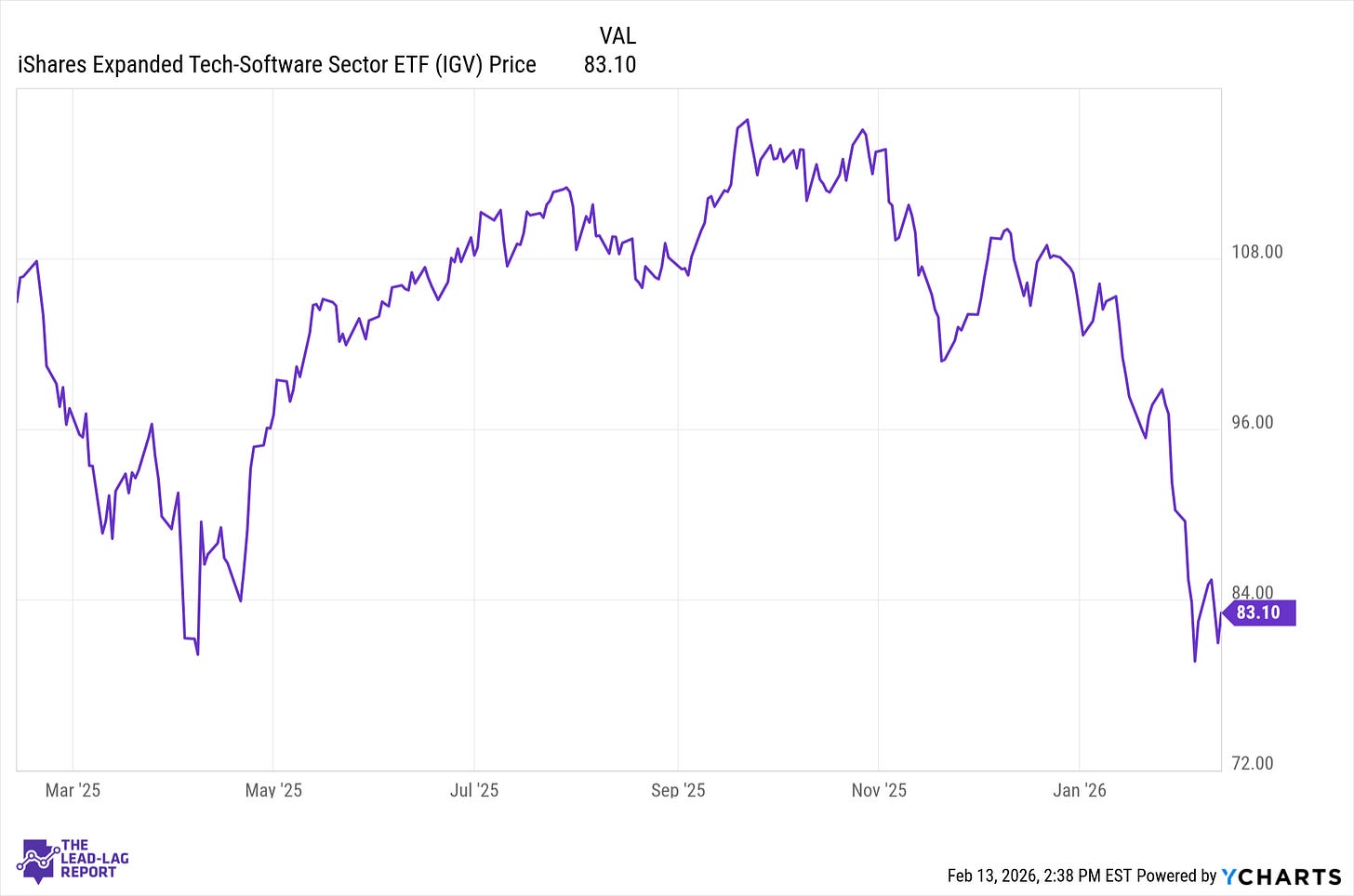

The repricing is visible in the iShares Expanded Tech-Software Sector ETF (IGV), which showed a materially negative year-to-date return as of mid-February 2026.⁵ That move reflects aggressive de-risking rather than confirmed collapse in enterprise software spending. Reuters reporting in late January described broad declines across software names as investors leaned into a “worst-case” AI disruption scenario.¹

The macro overlay amplifies the volatility. The Federal Reserve’s January 28, 2026 statement maintained the federal funds target range at 3.50% to 3.75%.² The effective federal funds rate has remained in the mid-3% area.³ At the same time, futures markets lifted the implied odds of a mid-year rate cut following softer inflation data.⁴

For long-duration equities such as software, that shift from tightening to optional easing alters valuation math. The sector’s forward valuation has fallen toward levels not seen in roughly three years.⁶ Historically, when multiples compress under narrative pressure while policy risk moderates, the setup for contrarian re-rating improves.

This is not about dismissing AI risk. It is about recognizing that policy is no longer tightening at the margin, and that price action may be overshooting fundamentals.

Leaders: Platforms Being Priced Like Commodities

Using IGV as the software universe provides a practical framework. The fund’s fact sheet highlights heavy exposure to large enterprise platforms including Salesforce, Adobe, ServiceNow, Intuit, and Atlassian.⁷ All five were referenced in recent reporting on the AI-driven selloff.¹

Across these names, a consistent pattern emerges: steep year-to-date drawdowns alongside continued revenue growth and, in several cases, strong liquidity positions.

Salesforce (CRM)

Salesforce remains a central system-of-record for enterprise customer workflows. Revenue continues to grow, according to trailing data compiled by StockAnalysis.⁸ The company reported substantial cash and marketable securities relative to debt in its most recent Form 10-K.⁹

The market is treating Salesforce as a front-end interface vulnerable to AI replacement. That assumption overlooks data gravity, workflow entrenchment, and integration complexity. If AI increases automation inside customer systems, the governance layer embedded within Salesforce may become more—not less—critical.

Adobe (ADBE)

Adobe’s distribution across creative and document ecosystems remains difficult to replicate at scale. Trailing revenue growth has remained positive despite sharp multiple compression.¹⁰