Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE FED PULLS THE RUG ON THE MARKETS

Consumer Discretionary (XLY) – Inflation Could Be A Killer

Retail sales and personal spending came in a little light in November, but nothing significant enough to change the narrative. If inflation becomes a larger problem in 2025, as the Fed seems to be indicating that it could be, it’s easy to see this sector quickly become an underperformer. Consumer debt levels are still suggesting there’s a lot of stress in the system and another round of inflation could push many over the edge.

Communication Services (XLC) – Uptrend Not Finished

Last week’s risk-off pulse reversed the recent progress in this sector, but it doesn’t look like the uptrend is necessarily. The heavy influence of AI development by the sector’s two mega-caps will almost certainly be a major factor in the upcoming year and should be a tailwind as long as economic sentiment doesn’t sharply reverse. The anti-tech regulatory headwind could also be a bigger theme in the new administration.

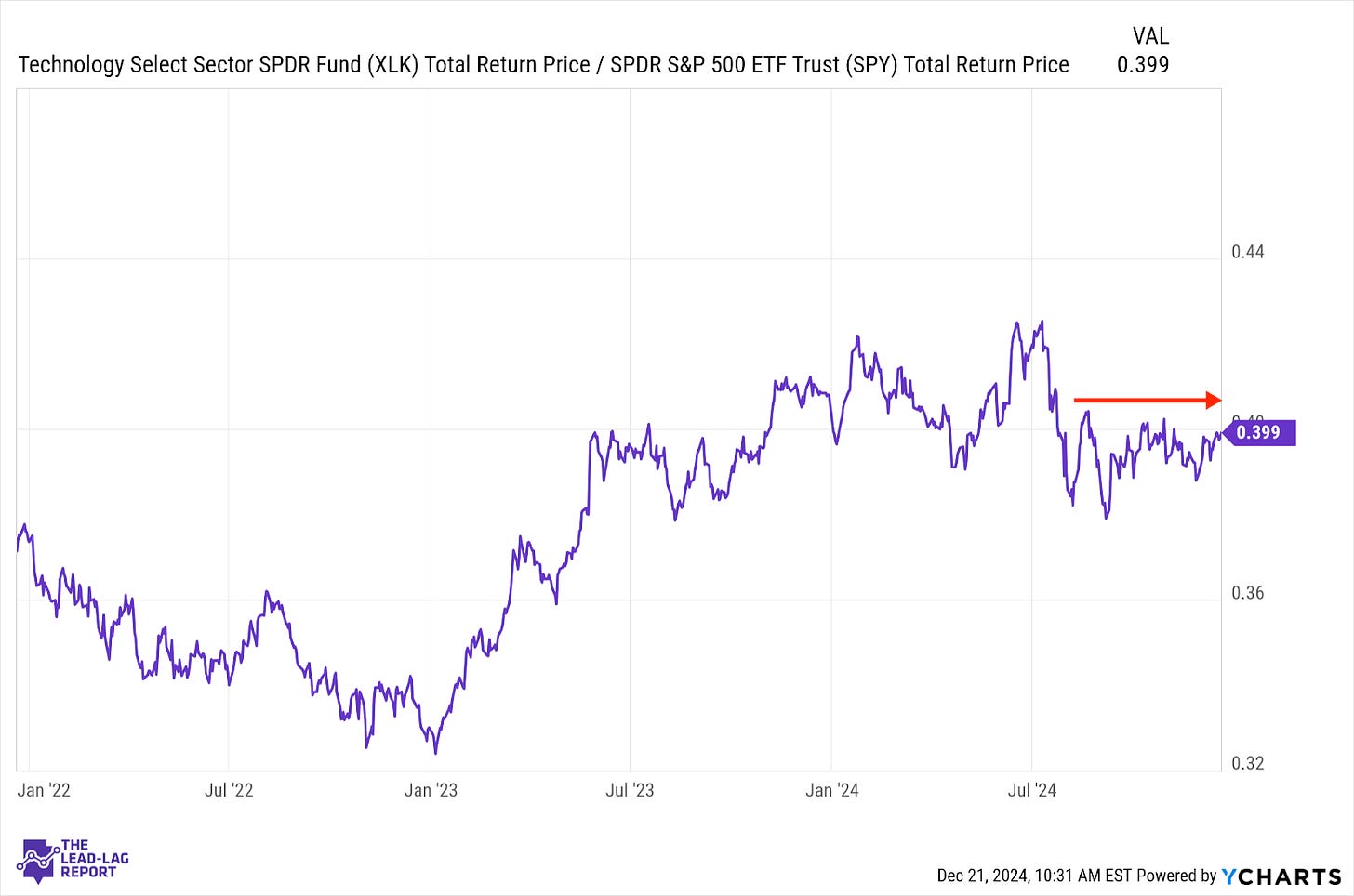

Technology (XLK) – Economic Growth vs. Inflation

Even as growth has recaptured leadership from cyclicals over the past several weeks and the magnificent 7 continue outperforming, the tech sector more broadly has been stuck in neutral for most of the past year relative to the S&P 500. Valuations may be playing a small role, but I think volatility is becoming a bigger risk. The resilient economy narrative should provide some support, but inflation in 2022 resulted in massive underperformance.

Junk Debt (JNK) – Spreads Start Moving Higher

It looks like we might finally be seeing the end of the junk bond rally. Credit spreads widened significantly after the Fed meeting and the group has only been matching Treasury performance over the past month (which has been struggling itself). Even with high yield spreads expanding by 25 basis points over the past week, there’s still plenty of room for them to get wider in the coming weeks and months.

Emerging Markets Debt (EMB) – The Time For Junk Bonds Is Ending