Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE BROADENING EQUITY RALLY EXPANDS TO INCLUDE TREASURIES

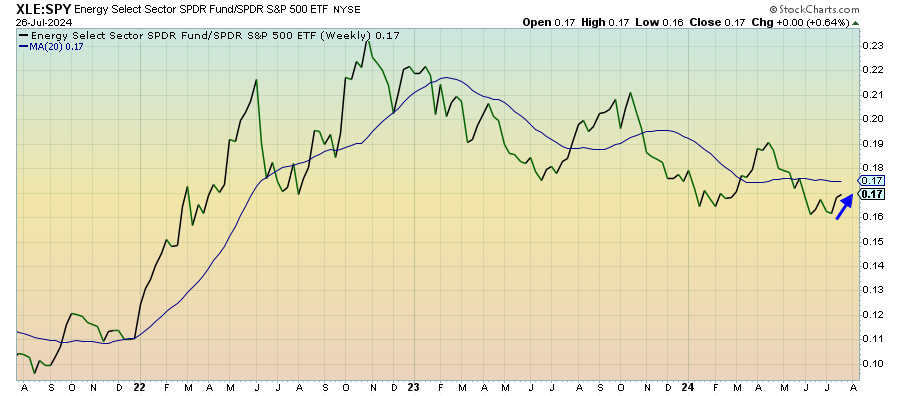

Energy (XLE) – A Muddled Picture

Energy has been cautiously participating in this market rotation, but there are still some concerns of where the demand might come from. The cartels seem committed to limiting production in order to keep prices elevated, which should support prices to some degree. The global picture is still very muddled.

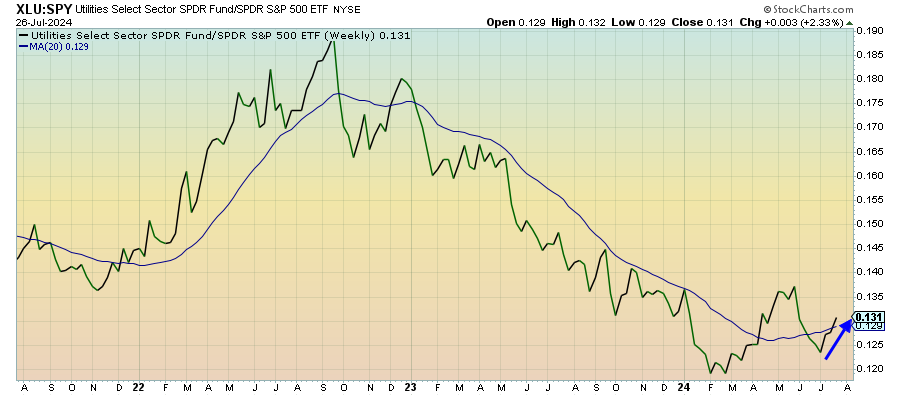

Utilities (XLU) – An Unclear Sign

As market breadth expands, defensive issues are picking up some momentum again. The signals are still mixed overall, so it’s unclear if there’s some broader risk-off behavior at play, but utility outperformance is usually a stronger sign. The fact that healthcare and staples are outperforming alongside this sector could be a tell.

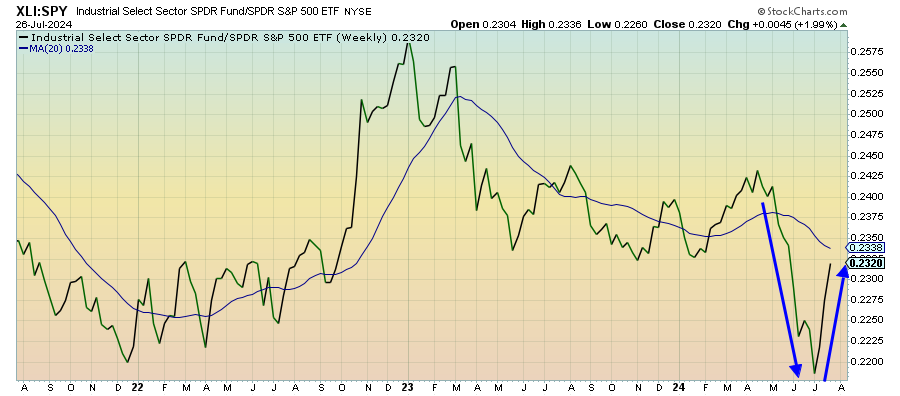

Industrials (XLI) – Still More Potential

Industrials continue to claw back two months of steep underperformance. Investors remain optimistic that the combination of resilient U.S. growth and falling interest rates will make conditions more favorable for a lackluster manufacturing sector. The group is likely short-term overbought, but there’s potential here in a sustained rotation away from big tech.

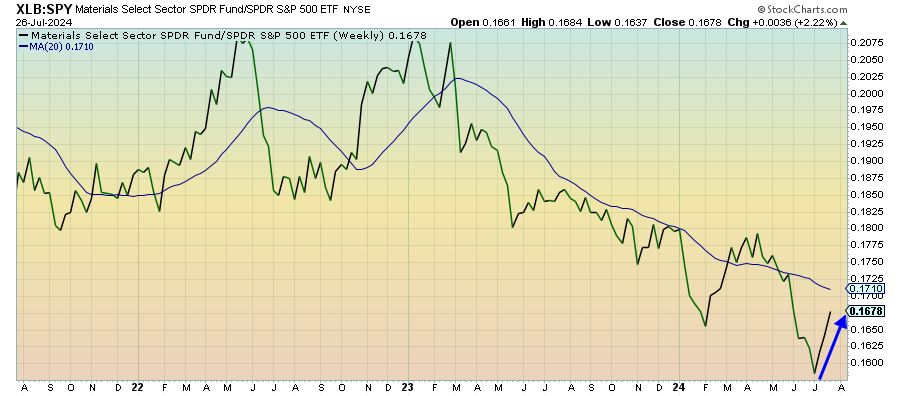

Materials (XLB) – Conditions Are Still Struggling

Commodity prices are still declining, especially industrial metals, but lumber seems to be hanging on to recent gains. This is a sector that has long struggled with a deteriorating manufacturing cycle and unfavorable operating conditions. That’s likely still going to be the case for a while yet, but stocks are still benefiting from the cyclical rally.

Financials (XLF) – Staging A Comeback