Key Highlights

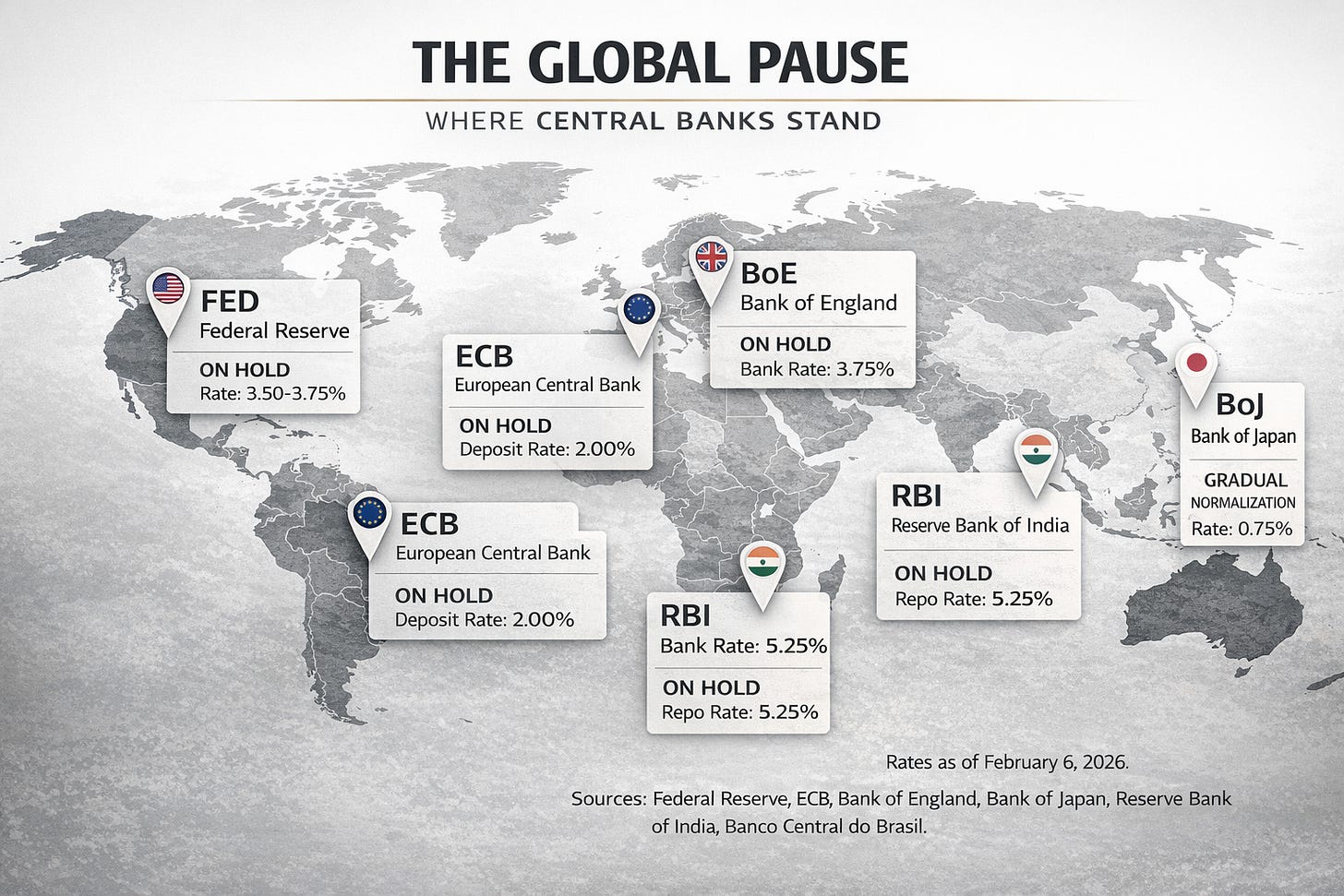

Central banks are pausing in unison, but policy pivots remain conditional and uneven.

Labor markets are cooling just enough to sustain rate-cut expectations without confirming recession.

Equity leadership is rotating toward value, cyclicals, and smaller caps beneath stable index levels.

A weaker dollar, record gold prices, and emerging-market strength suggest global capital reallocation rather than outright risk-on behavior.

A Pause Before the Pivot

The first week of February delivered a familiar but still consequential outcome: patience. In the United States, the Federal Reserve held interest rates steady, acknowledging gradual softening in labor conditions while emphasizing that progress on inflation remains incomplete. Chair Jerome Powell characterized the economy as “solid,” reinforcing policymakers’ preference to wait for clearer confirmation before shifting course.¹

With the policy decision widely anticipated, attention quickly turned to labor data. A partial government shutdown delayed the official January employment report, leaving markets to rely on alternative indicators. The ADP private payrolls report showed job gains of just 22,000, a sharp undershoot relative to expectations and a sign that hiring momentum is fading more rapidly than forecast.² While unemployment remains historically low and is expected to hold in the mid-4% range, the direction of travel has become increasingly difficult to ignore.³

Bond markets reacted accordingly. Short-dated Treasury yields declined as investors increased bets on eventual rate cuts, while longer-dated yields remained relatively anchored. The result was a persistently inverted yield curve, reflecting confidence that inflation pressures are easing alongside lingering concern about medium-term growth prospects.⁴

Equities extended January’s gains but with noticeably higher volatility. Earnings season exposed investor sensitivity to guidance rather than headline results. Several mega-cap technology companies reported strong quarterly numbers only to see their share prices fall sharply, as markets reassessed valuation and growth durability.⁵ At the same time, select consumer and hardware companies delivered upside surprises that helped stabilize broader indices.

One asset class stood apart. Gold surged to record highs above $5,500 per ounce, supported by a weaker dollar, declining real yields, and elevated geopolitical risk.⁶ The rally signaled not panic, but growing demand for insurance as markets transition away from peak-tightening conditions.

Rotation Beneath the Surface

Beneath relatively calm index levels, leadership continued to rotate. Value stocks extended their outperformance over Growth for a third consecutive month, driven by investor preference for cash-flow durability and valuation discipline.⁷ Cyclical sectors such as Energy, Materials, and Industrials again led the market, supported by higher commodity prices and supply-side uncertainty.⁸

Energy equities benefited from oil’s rebound toward the upper-$60s per barrel, its highest level since late 2025. While global demand growth remains modest, geopolitical risks and tighter inventories have sustained a risk premium in energy markets. Defensive sectors also held firm. Consumer Staples and Utilities attracted steady inflows as investors balanced optimism about easing policy with caution around slowing growth.

Market-capitalization dynamics reinforced the theme of rotation rather than speculation. Small-cap equities, which surged in January, continued to outperform large caps. The Russell 2000’s relative strength reflects easing financial conditions and domestic economic resilience rather than excess risk-taking.⁹ Importantly, leadership within small and mid-cap indices skewed toward profitable firms with improving fundamentals.

Financials lagged, weighed down by compressed yield spreads and uncertainty surrounding loan growth.¹⁰ Within technology, dispersion widened further. Profitable, established companies and AI-linked infrastructure providers continued to attract capital, while higher-valuation speculative growth names struggled to maintain momentum.

Overall, market behavior suggests broadening participation accompanied by selectivity. Investors appear willing to embrace opportunity, but only where quality and downside resilience remain evident.