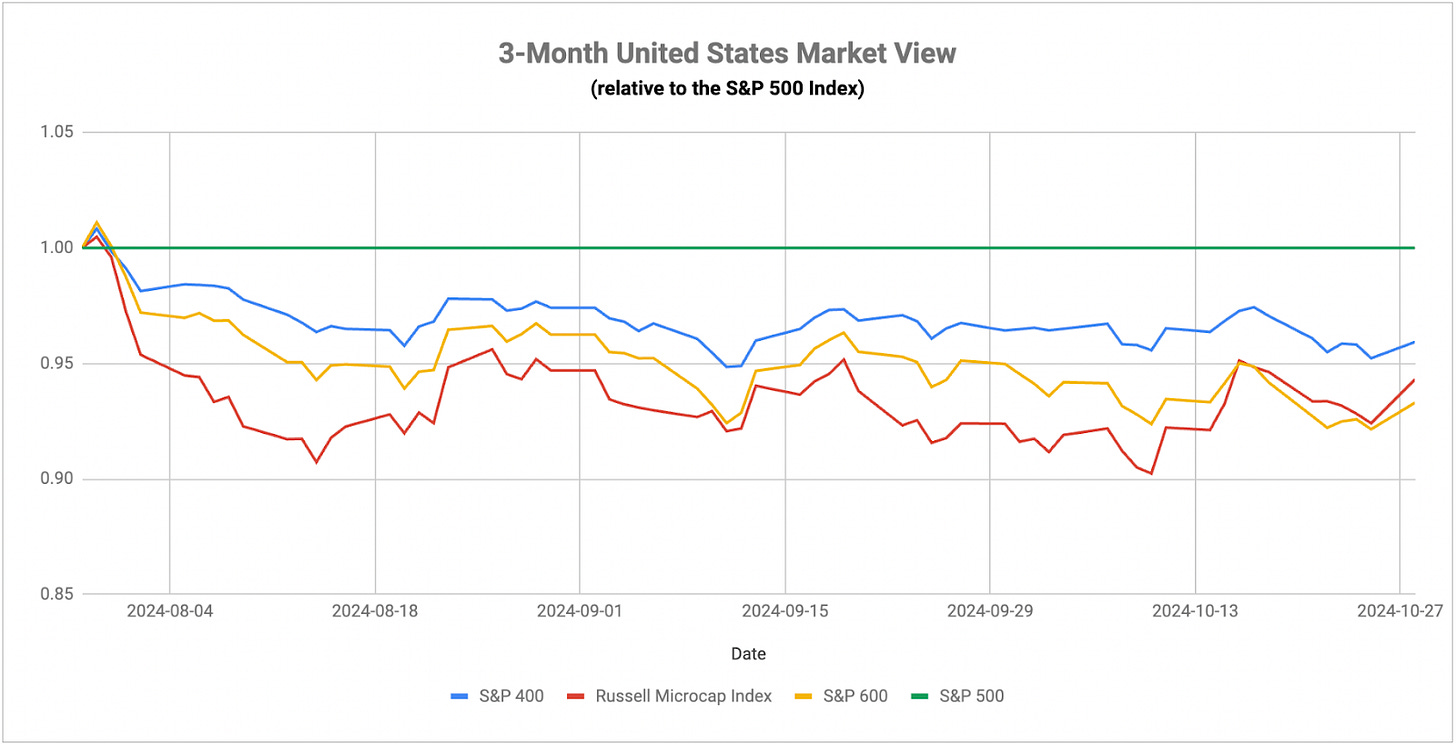

U.S. large-, mid- and small-cap stocks have all been performing at roughly the same pace since mid-August, offering no real signs that any one of these groups is aiming to take the lead, but the real action might be in the Treasury market. The 10-year Treasury yield is only back to the level it was in July, but that’s an increase of 65 basis points off of the September low. The bond market seems to be getting increasingly concerned about the latest election rhetoric being thrown around, which includes tax cuts, heavy government spending, possible tariffs and a general disregard for current debt loads and deficits. Regardless of who wins, the question isn’t “if”, but “how much”. Bond market volatility, as measured by the MOVE index, is at its highest level in a year and there is growing worry that inflation could be primed to make a comeback.

As evidence, gold is continuing its relentless rally and may even have the $3000 level in its sights before too long and TIPS have been sharply outperforming the broader Treasury market for several weeks. There could be a “buy the rumor, sell the news” element to all of this where investors worry about the unknown now, but settle down once we know who the president-elect will be. The other part could be the impact of the next liquidity bomb. The Treasury announced earlier this week that it plans on borrowing another half trillion dollars just in Q4. Recent auctions haven’t quite been met with high demand, so there’s some fear that yields may need to push even higher in order to pull buyers into the market. If we don’t get any significant downside surprises from the jobs report at the end of the week, there may not be an immediate catalyst that would help soften inflation concerns.

The most important week of the Q3 earnings season is upon us, which will see five of the magnificent 7 names deliver their latest numbers and guidance. Those companies will likely deliver impressive results again, but they’ll be closely watching to see how growth rates are moderating and what they offer in terms of forward guidance. Tech sector performance is once again outpacing that of the S&P 500 and the magnificent 7 stocks have been helping lead the way. Tesla provided a big boost last week, but there’s still some trepidation that investors may still be overestimating growth potential in the mega-caps. In the last quarter, NVIDIA saw the markets deem its excellent quarterly results not excellent enough and sent the stock lower. The fact that the big banks generally had a strong Q3 gives me hope that some of the earnings growth from the S&P 500 companies can broaden beyond just the tech sector.

The narrative may be changing in Japan. Following this past weekend’s election, which saw Japan’s ruling LDP lose its majority for the first time in 15 years, the monetary and fiscal policy of the country may be changing. While the current government hadn’t necessarily been supportive of the monetary tightening measures favored by BoJ Governor Ueda, it had seemed at least amenable to those being enacted. The head of the opposition’s DPP went on the record and said that the BoJ should hold off on making any changes to the current ultra-accommodative policies. This could lead to some in-fighting as coalitions are reformed, but it potentially lowers the chances of a rate hike before year-end. The yen weakened further on the news, but not significantly, suggesting that the calculus, at least in the market’s view, hasn’t changed much. The BoJ meets Wednesday to reset policy conditions and the market will now undoubtedly be listening closely for any signals of what they might do in December.

Eurozone GDP readings for Q3 came in surprisingly strongly on Wednesday. While I don’t think it will do a lot to change the narrative that the region still has plenty of work to do, it could quell fears for the time being that it’s headed towards recession. GDP growth for the quarter came in at 0.4%, above consensus expectations of 0.2%, and pushing the annualized growth rate to 0.9%. More importantly, there was growth all across the region, including Germany, which has struggled mightily to keep itself out of recession. It managed to deliver 0.2% growth in the quarter, continuing the ping-pong pattern of expansion & contraction over the past two years. France and Spain also beat estimates, while Italy was the only major economy to miss. We’ll see if this changes the outlook for the ECB, but it seems unlikely. With the region still growing at less than 1% and multiple economies still struggling with stagnant growth, the central bank still has room to keep lowering rates and normalizing policy conditions. That, of course, is as long as inflation doesn’t pick up, which doesn’t seem to be an issue at the moment at least.

If the rumors are to be believed, the massive stimulus package that China has been talking about for weeks could finally come to fruition in November. The country is apparently considering a $1.4 trillion debt package aimed at shoring up local economies and buying up distressed and empty properties. What’s interesting is the market’s reaction. When China first floated this idea in September, it ignited a rally that added 40% to Chinese stock prices, about half of which has since been given back. Upon this announcement, a reaction was almost non-existent. Chinese stock prices held steady. Chinese bond yields held steady. The yuan dipped a little bit, but nothing significant. Maybe investors are in wait & see mode or they’re simply not buying that it will be enough or it’s already fully priced in. Either way, the markets seem much less impressed this time around.