Tactical vs. Strategic Fixed Income: When to Choose $JOJO Over a Plain-Vanilla Bond ETF

For decades, bonds occupied a familiar role in portfolios. A broad, plain-vanilla bond ETF offered diversification, income, and ballast against equity volatility. Investors could buy a core bond fund, reinvest interest, and largely ignore day-to-day market noise. That framework worked well when inflation was subdued and interest rates moved gradually. In recent years, however, even bonds have tested investor patience. Persistent inflation shocks, aggressive central-bank tightening, and episodic credit stress have challenged the assumption that fixed income should always be static.¹

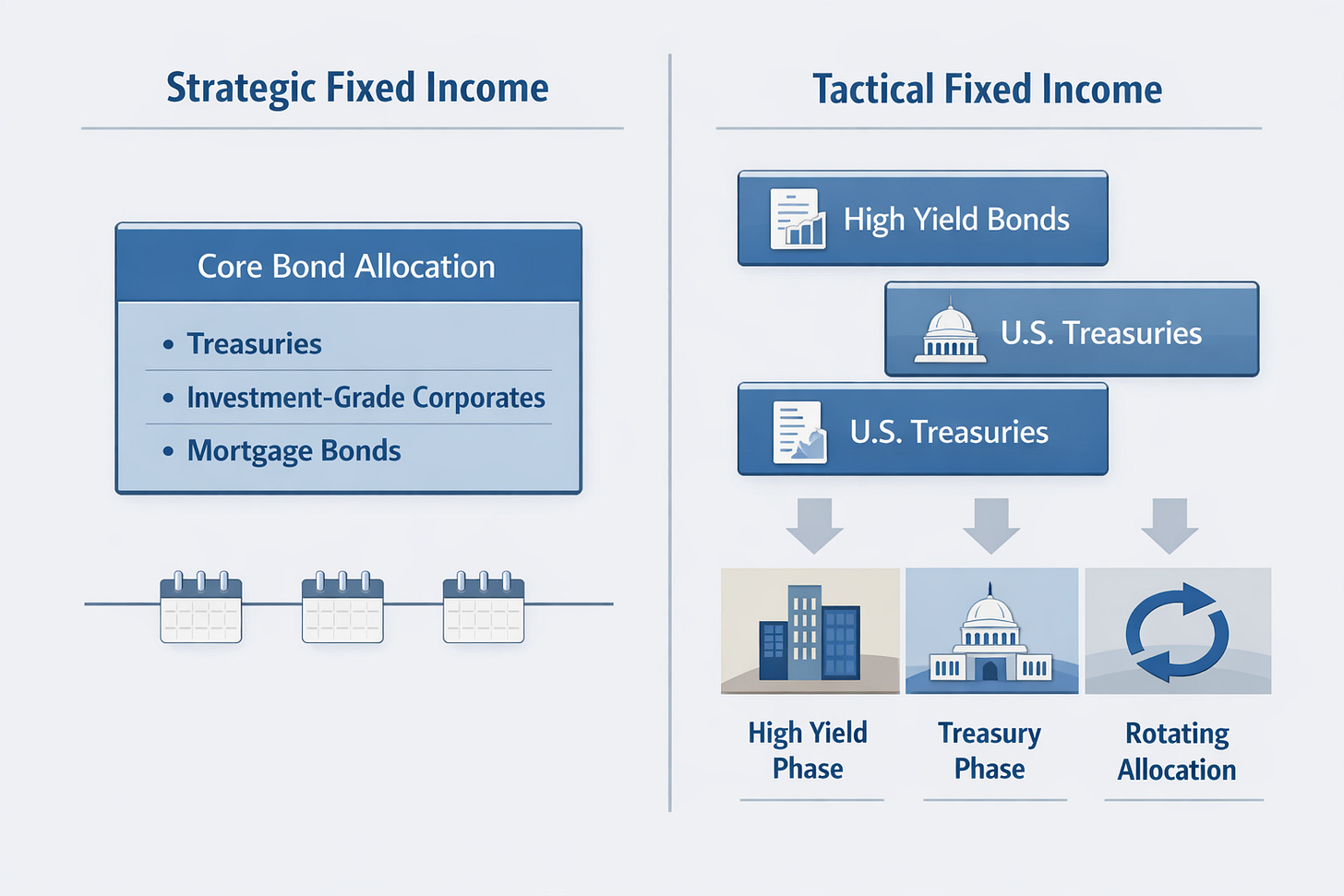

At the heart of this debate is the distinction between strategic and tactical fixed income. Strategic strategies maintain stable allocations over time, while tactical approaches seek to adjust exposure as market conditions evolve. Academic research consistently shows that long-term asset allocation explains most portfolio outcomes, making market timing difficult.² Yet within fixed income, where returns are shaped by interest-rate movements, credit cycles, and shifting risk appetites, rotation across bond sectors can meaningfully affect outcomes.¹

Strategic (Buy-and-Hold) Fixed Income

Strategic bond ETFs are designed to mirror broad market indexes. These funds typically hold diversified baskets of Treasuries, agency securities, mortgage-backed bonds, and investment-grade corporates. The appeal is simplicity. Investors gain diversified exposure and operational efficiency without the need to analyze individual securities.¹ Portfolios are rebalanced periodically to maintain index alignment, but otherwise remain largely unchanged.

This approach has clear strengths. A diversified bond ETF can provide income, help to reduce overall portfolio volatility, and serve as a structural counterbalance to equities. Over long horizons, these characteristics have made core bond funds a foundational allocation. Yet strategic fixed income also has structural limitations. Most bond ETFs do not mature and continuously roll holdings, leaving investors permanently exposed to interest-rate risk.¹ When rates rise sharply, prices decline, and there is no mechanism to shorten duration or step aside.

Strategic bond funds are also slow to respond to credit stress. Because allocations are driven by index composition, exposure to corporate credit often remains intact even as spreads widen. Adjustments occur gradually, frequently after market conditions have already shifted. As a result, buy-and-hold bond ETFs can feel static during periods of rapid macroeconomic change.¹

Tactical Fixed Income Strategies

Tactical fixed income strategies attempt to address these limitations by adjusting exposures as conditions evolve. Instead of maintaining static allocations, these strategies rotate across bond sectors using signals tied to inflation trends, economic momentum, or market risk appetite.¹ A tactical framework may reduce duration during inflationary periods, extend duration when easing cycles emerge, or shift between credit and Treasuries as recession risks rise or fall.

The expansion of the bond ETF market has made tactical implementation more practical. ETFs provide daily liquidity, transparency, and efficient access to distinct segments of fixed income.¹ Rather than trading individual securities, tactical strategies can reposition portfolios quickly using liquid instruments. Vanguard and other research providers caution, however, that market timing is difficult and can detract from returns if executed inconsistently.²

The ATAC Credit Rotation ETF (JOJO)

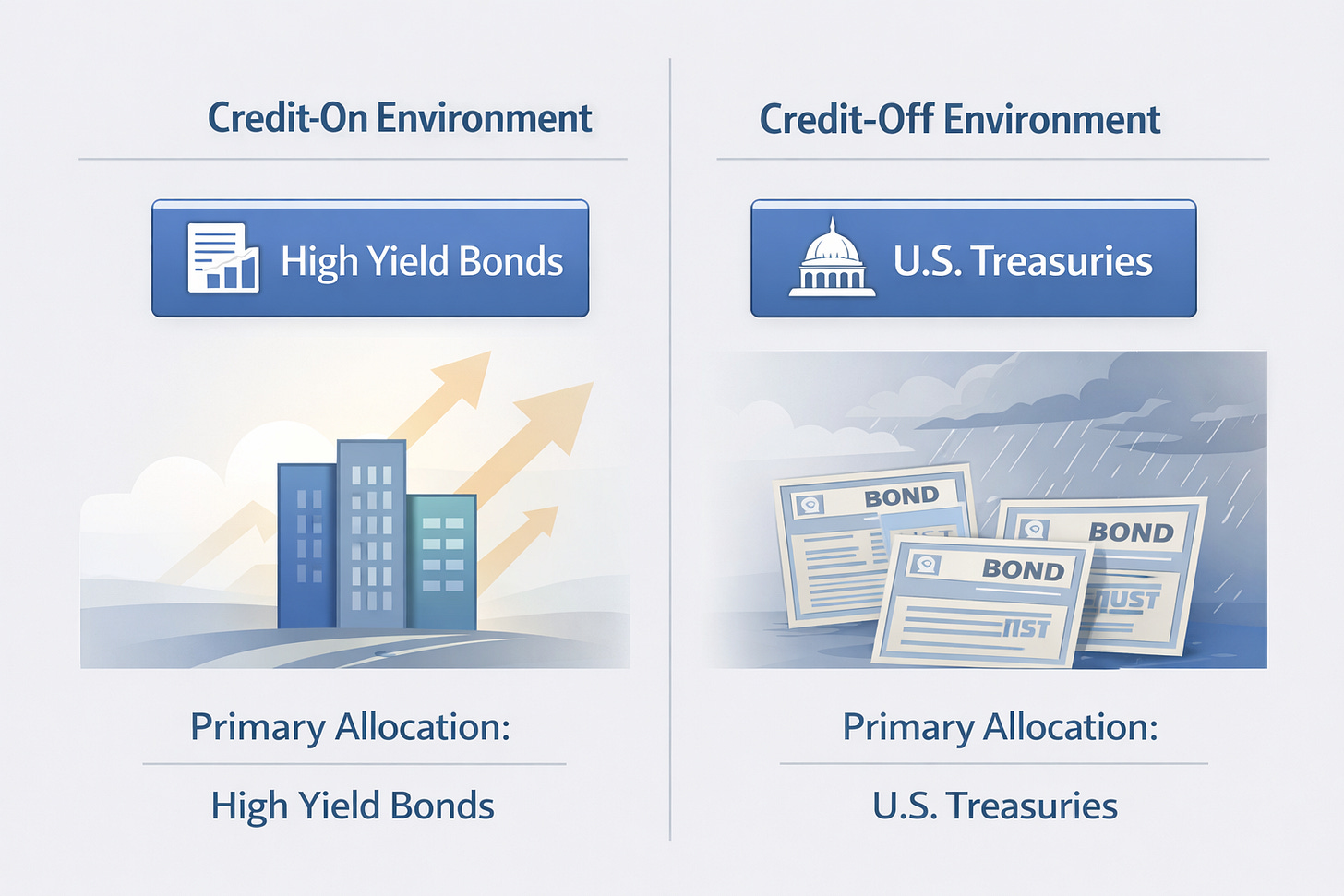

The ATAC Credit Rotation ETF provides a rules-based example of tactical fixed income in practice. JOJO follows a binary allocation model that rotates between high-yield corporate bonds and long-duration U.S. Treasuries based on market signals.³ Rather than maintaining constant exposure to both, the strategy seeks to be fully allocated to one side of the credit spectrum at a time.

The model relies on relative performance signals derived from the U.S. utilities sector compared with the broader equity market. Utilities have historically exhibited defensive characteristics, often outperforming during periods of rising economic uncertainty. When utilities underperform, the model interprets this as a risk-on environment and allocates toward high-yield bond ETFs. When utilities outperform, the signal turns defensive, prompting a shift into long-duration Treasury ETFs.⁴

JOJO evaluates this signal on a regular schedule and rebalances accordingly. The fund typically gains exposure through U.S.-listed bond ETFs rather than individual securities, supporting liquidity and transparency. The strategy is actively managed within a systematic framework and carries a higher expense ratio than passive bond ETFs, reflecting its tactical design.³

When to Consider JOJO Versus a Core Bond ETF

Choosing between a tactical strategy like JOJO and a traditional bond ETF depends on investment objectives, risk tolerance, and views on the economic environment. A plain-vanilla bond ETF may remain appropriate for investors prioritizing simplicity, steady income, and long-term diversification.

JOJO may appeal in environments characterized by greater dispersion between risk-on and risk-off assets. Periods marked by uncertain growth, shifting inflation expectations, or elevated market volatility can favor strategies that adapt rather than remain static. While many economists do not currently forecast an imminent recession, uncertainty surrounding the economic outlook remains elevated.⁵

Bond yields also remain elevated relative to long-term history, reinforcing the continued relevance of fixed income as a portfolio diversifier.⁶ Fidelity research highlights that bonds can still play a stabilizing role during periods of equity market stress, even as correlations fluctuate.⁶ A tactical approach like JOJO seeks to engage this dynamic by emphasizing either safety or income depending on prevailing signals.

Investors should remain mindful of trade-offs. Tactical strategies can underperform if signals prove mistimed or if markets move abruptly. As fund disclosures emphasize, past performance does not guarantee future results, and active strategies involve additional risks.⁷ For this reason, some advisors use JOJO as a complement rather than a replacement, positioning it as a tactical sleeve alongside core bond exposure.

Final Thoughts

Strategic and tactical fixed income approaches are not mutually exclusive. Plain-vanilla bond ETFs continue to offer diversification and simplicity, while tactical strategies introduce adaptability in uncertain environments. The ATAC Credit Rotation ETF represents one systematic attempt to navigate credit cycles by rotating decisively between risk and safety. For investors comfortable with active management and rule-based rotation, JOJO offers an alternative way to think about bonds in a changing market landscape. For others, a traditional bond ETF may remain sufficient. In either case, fixed income remains a foundational component of diversified portfolios.⁶

Consider $JOJO. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Beacon Capital Management, Fixed Income ETFs: Strategic Advantages and Tactical Implementation, March 2024.

Vanguard, Tactical vs. Strategic Asset Allocation, August 2023.

Roic AI, ATAC Credit Rotation ETF (JOJO) Overview, January 2025.

MutualFunds.com, JOJO: ATAC Credit Rotation ETF, February 2025.

Money, “Will We Have a Recession in 2026? Most Economists Say No,” December 2025.

Fidelity, Bond Market Outlook, November 2025.

ATAC Funds, JOJO Fund Overview and Disclosures, October 2025.

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

Duration measures a bond’s sensitivity to interest rate changes, representing the weighted average time it takes to receive all cash flows from the bond.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

Because the Fund invests in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, equity securities, growth stocks, large and small capitalization companies, non-diversification, fixed income investments, derivatives and leverage. The prices of fixed income securities may be affected by changes in interest rates, the creditworthiness and financial strength of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Because the Fund expects to change its exposure as frequently as each week based on short-term price performance information, (i) the Fund’s exposure may be affected by significant market movements at or near the end of such short-term periods that are not predictive of such asset’s performance for subsequent periods and (ii) changes to the Fund’s exposure may lag a significant change in an asset’s direction (up or down) if such changes first take effect at or near a weekend. Such lags between an asset’s performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market. Because the Adviser determines the exposure for the Fund based on the price movements of gold and lumber, the Fund is exposed to the risk that such assets or their relative price movements fail to accurately predict future performance.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

Learn more about $JOJO at https://atacfunds.com/jojo/ Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso or ACA/Foreside.