2025 has been a year filled with what one could charitably describe as “worry”.

Around Trump’s inauguration, he re-emphasized his America First agenda with a series of policy announcements centered around protectionist trade and economic policies. His trade war has blanketed most of the United States’ biggest global trade partners with high tariff rates in order to reshore American business and push other nations into making trade deals.

Tariff rates on Chinese imports at one point hit 145%, sparking fears of an inflationary surge and a screeching halt in global economic growth. That triggered the largest sustained spike in U.S. equity market volatility since the COVID pandemic.

While that volatility has since subsided, there’s still no shortage of catalysts keeping investors in a cautious mood.

Trump’s back and forth on tariff implementation means investors, businesses and the markets don’t really know what to expect on a day-to-day basis.

Trump's “One Big Beautiful Bill” has gotten a lot of criticism for potentially adding trillions of dollars of debt to the balance sheet and increasing annual budget deficits for the foreseeable future.

The Moody’s downgrade of U.S. government debt (which shouldn’t have been a surprise given that it was simply following what S&P and Fitch had already done) further eroded confidence in U.S. dollar denominated assets.

The markets keep waiting for rate cuts from the Fed, but Powell keeps saying no. They’re probably likely to cut the Fed Funds rate at least once before the end of the year, but the uncertain backdrop of tariffs and higher inflation makes it far from a sure thing.

Let’s not forget that Trump keeps threatening Powell and maybe (probably) wants to fire him.

In short, investors have no shortage of things to worry about. Even though the VIX has come down, volatility and uncertainty still reign. And when uncertainty abounds, strange things tend to happen in the markets that can serve as warning signs for the future.

One of the biggest right now is the relationship between the dollar and long-term Treasury yields. Spoiler alert: the relationship has broken.

Traditionally and over the long-term, Treasury yields and the dollar tend to be positively correlated. When the return on dollar-denominated assets goes up or the yield moves higher, it becomes more attractive in the eyes of investors. They generally need dollars in order to buy those higher-returning assets.

Lately, however, that correlation has broken down. Treasury yields are rising while the dollar is falling.

Short-term periods where correlations turn negative aren’t unusual, but they don’t usually happen quite this directly and with such conviction. If we start with the assumption that yields and the dollar should, in general, move together, there needs to be an explanation as to why we’re seeing the current divergence.

The answer would very likely be a loss of confidence in U.S. assets.

Let’s break down a few reasons why this could be happening.

The Eroding Confidence In U.S. Treasuries

When yields rise on the long end of the curve, it can be for a number of reasons, but one of the main ones is that investors perceive a security to be riskier, therefore they require a higher yield in order to compensate for that extra risk.

Special Announcement

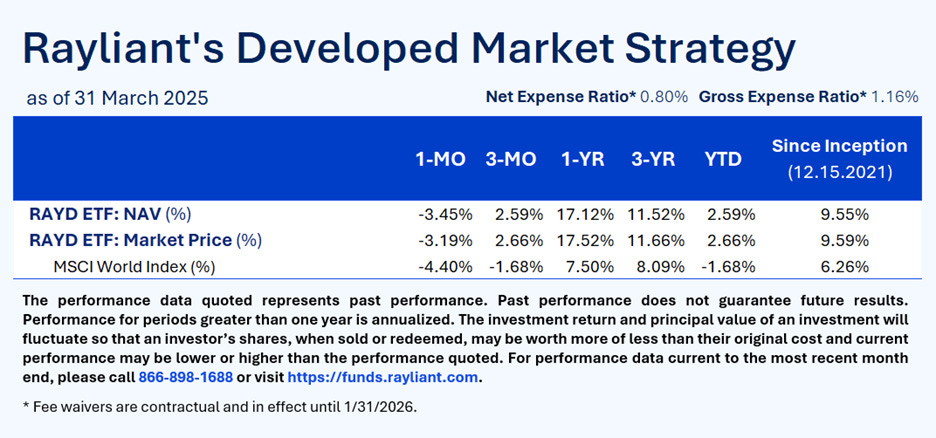

Exploring U.S. and international equities beyond the index?

Many developed market ETFs simply track benchmarks, which can result in concentrated exposures and overlooked risks.

The Rayliant Quantamental Developed Market Equity ETF (RAYD) takes a different approach.

RAYD is actively managed and combines quantitative tools with fundamental insights to select stocks across U.S. and developed international markets.

Explore the latest RAYD Fact Sheet (PDF)

Key features of RAYD:

· Active international exposure: Targets developed markets, with flexibility to respond to market conditions, fundamentals, and valuation signals.

· Quantamental investment process: Blends advanced quantitative modeling and fundamental stock analysis, mimicking the research process of traditional stock analysts while integrating behavioral finance insights to exploit investor biases.

· Portfolio diversification: Seeks to reduce exposure to common index biases, such as mega-cap concentration, while maintaining broad market access.

RAYD may suit investors seeking a more adaptive approach to developed market equities through an actively managed ETF.

For full fund details and disclosures, visit funds.rayliant.com/rayd

Important Information

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.

These Funds may trade securities actively, which could increase its transaction costs (thereby lowering its performance) and could increase the amount of taxes you owe by generating short-term gains, which may be taxed at a higher rate. Rayliant’s quantamental investment process includes incorporating models and machine learning (“ML”), or artificial intelligence (”AI”), to assist in the research process. The use of machine learning and AI involves risk such as poor data quality, lack of transparency, cybersecurity risk, changes to market risk, implementation risk and others that may not be identified herein.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Carefully consider the fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the fund’s summary or full prospectus, which may be obtained by visiting funds.rayliant.com. Please read the prospectus carefully before investing.

The funds are distributed by SEI Investments Distribution Co.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Rayliant. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Rayliant and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

When a ratings agency downgrades a credit issue, it’s because the risk profile has changed. Granted, the U.S. government may not actually default on its debt, but the uncertainty surrounding the direction of the debt and deficits would certainly be a justifiable reason for investors to want more yield for owning long-dated Treasuries.

This negative sentiment surrounding government debt could also be the reason that investors are abandoning the dollar - the general confidence in U.S. assets is diminishing. Even with the Fed keeping rates elevated for longer than the market originally expected, the higher yield hasn’t been enough to entice investors to invest in the United States.

One of the things factoring into dollar strength in most cases is the strength of the economy. Over the past several years, the U.S. economy has been among the best-performing in the world and the return on risk assets, particularly the S&P 500 and U.S. tech stocks, has reflected that.

Now, the situation may be changing. The economy had its first negative GDP growth print in three years during Q1. The Trump tariffs have thrown a wrench into the global economic engine and have resulted in higher costs for many goods, including food, electronics and car parts. Since those tariffs are paid by U.S. companies importing foreign goods, it makes sense that the U.S. economy would feel the brunt of this.

We’re entering a regime now where foreign and emerging markets may have a comparatively better outlook than the United States.

Also damaging sentiment is inflation expectations. The University of Michigan 1-year inflation expectation report came in at 6.5% in April. That’s the highest reading since 1981. While that number may never actually come true, it’s the perception of the negative impact of the Trump tariffs that is driving this number. When people feel that negatively about something like this, they respond with their money. They’ll look for better opportunities elsewhere.

The interesting thing is that what’s happened lately between the dollar and Treasury yields actually follows an unprecedentedly long period of positive correlation between the two.

The bottom line is that something looks wrong here. It feels like we’re looking at a real crisis of confidence in Treasuries and the dollar. It’s a big part of the reason why we’re seeing the yen approaching its highest levels against the dollar in roughly two years. And it’s a big part of the reason why gold has done so well lately. If Treasuries aren’t going to work, gold is the next safe haven in line.

Yet when it all comes crashing down, the flight to safety back into Treasuries probably returns.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.